Massachusetts Notice of Default under Security Agreement in Purchase of Mobile Home

Description

A secured transaction involves a sale on credit or lending money where a creditor is unwilling to accept the promise of a debtor to pay an obligation without some sort of collateral. The creditor (the secured party) requires the debtor to secure the obligation with collateral so that if the debtor does not pay as promised, the creditor can take the collateral, sell it, and apply the proceeds against the unpaid obligation of the debtor. A security interest is an interest in personal property or fixtures that secures payment or performance of an obligation. Personal property is basically anything that is not real property.

How to fill out Notice Of Default Under Security Agreement In Purchase Of Mobile Home?

If you want to thorough, acquire, or generate valid document templates, utilize US Legal Forms, the largest array of valid forms, that is accessible online.

Take advantage of the site’s straightforward and convenient search to locate the documents you require.

Various templates for business and personal purposes are categorized by types and jurisdictions, or keywords.

Step 4. After you have found the form you need, click on the Get now button. Choose the pricing plan you prefer and enter your details to register for the account.

Step 6. Process the payment. You can use your credit card or PayPal account to complete the transaction. Step 7. Download the format of the legal form and save it on your device.

- Employ US Legal Forms to retrieve the Massachusetts Notice of Default under Security Agreement in Purchase of Mobile Home in just a few clicks.

- If you are already a US Legal Forms user, Log In to your account and click on the Obtain button to get the Massachusetts Notice of Default under Security Agreement in Purchase of Mobile Home.

- You can also access forms you previously stored in the My documents tab of your account.

- If you are using US Legal Forms for the first time, refer to the instructions below.

- Step 1. Ensure you have selected the form for the appropriate city/state.

- Step 2. Use the Preview option to review the form’s contents. Be sure to read the description.

- Step 3. If you are not satisfied with the form, use the Search field at the top of the screen to find alternate versions of the legal form template.

Form popularity

FAQ

Security agreements and financing statements are often confused with one another. The primary difference is that the financing statement largely serves as notice that a creditor possesses security interest in the debtor's assets or property. The financing statement is not a contract.

A secured creditor is any creditor or lender associated with an issuance of a credit product that is backed by collateral. Secured credit products are backed by collateral. In the case of a secured loan, collateral refers to assets that are pledged as security for the repayment of that loan.

Security interest is an enforceable legal claim or lien on collateral that has been pledged, usually to obtain a loan. The borrower provides the lender with a security interest in certain assets, which gives the lender the right to repossess all or part of the property if the borrower stops making loan payments.

To become a secured party, the creditor must obtain a security interest in the collateral of the debtor.

Under a security deed, the lender is automatically able to foreclose or sell the property when the borrower defaults. Foreclosing on a mortgage, on the other hand, involves additional paperwork and legal requirements, thus extending the process.

The term purchase money security interest (PMSI) refers to a legal claim that allows a lender to either repossess property financed with its loan or to demand repayment in cash if the borrower defaults. It gives the lender priority over claims made by other creditors.

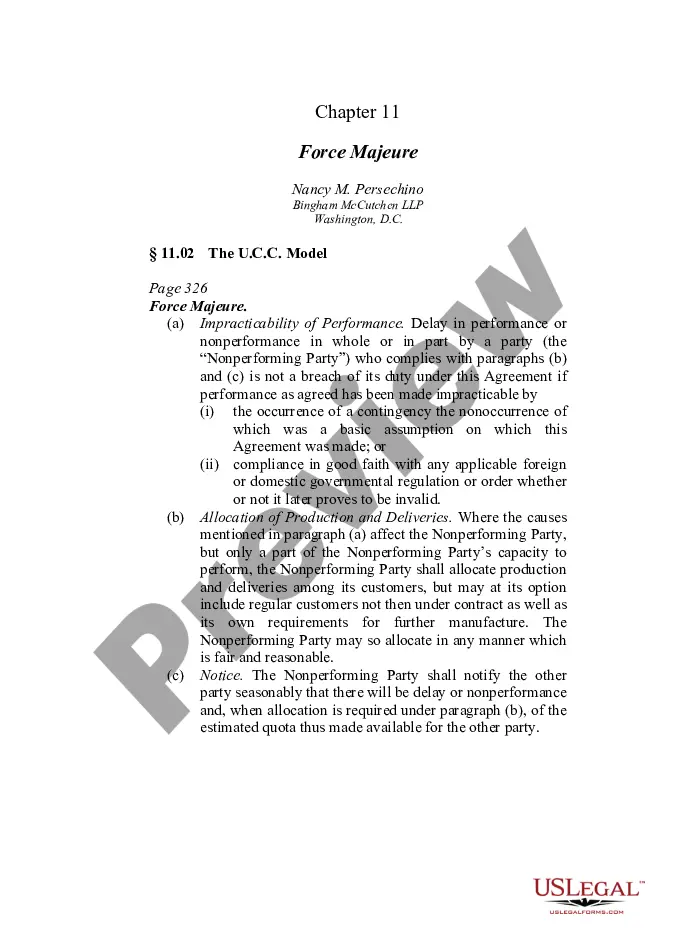

A security agreement is a document that provides a lender a security interest in a specified asset or property that is pledged as collateral. Security agreements often contain covenants that outline provisions for the advancement of funds, a repayment schedule, or insurance requirements.

A chattel mortgage is a loan used to purchase an item of movable personal property, such as a manufactured home or a piece of construction equipment. The property, or chattel, secures the loan, and the lender holds an ownership interest in it.

Often, secured parties use UCC-1 financing statement forms to achieve perfection of security interest outlined in a security agreement. Prepared and signed by both parties, this form includes the following information: The debtor's name (either the name of an organization or an individual taking on debt).

Certain specific requirements are required for the security agreement to form the foundation for a valid security interest, namely 1) it must be signed, 2) it must clearly state that a security interest is intended, and 3) it must contain a sufficient description of the collateral subject to the security interest.