Massachusetts Miller Trust Forms for Assisted Living

Description

How to fill out Miller Trust Forms For Assisted Living?

Are you currently in a situation where you require documents for both business or personal reasons almost all the time.

There are numerous legal document templates accessible online, but finding ones you can trust is challenging.

US Legal Forms offers thousands of form templates, including the Massachusetts Miller Trust Forms for Assisted Living, which are designed to comply with state and federal regulations.

Select a convenient document format and download your copy.

Access all the document templates you have purchased in the My documents section. You can obtain an additional copy of the Massachusetts Miller Trust Forms for Assisted Living at any time if needed. Just click the required form to download or print the document template.

- If you are already familiar with the US Legal Forms website and have an account, just Log In.

- Then, you can download the Massachusetts Miller Trust Forms for Assisted Living template.

- If you do not have an account and wish to start using US Legal Forms, follow these steps.

- Select the form you require and ensure it is for the correct city/state.

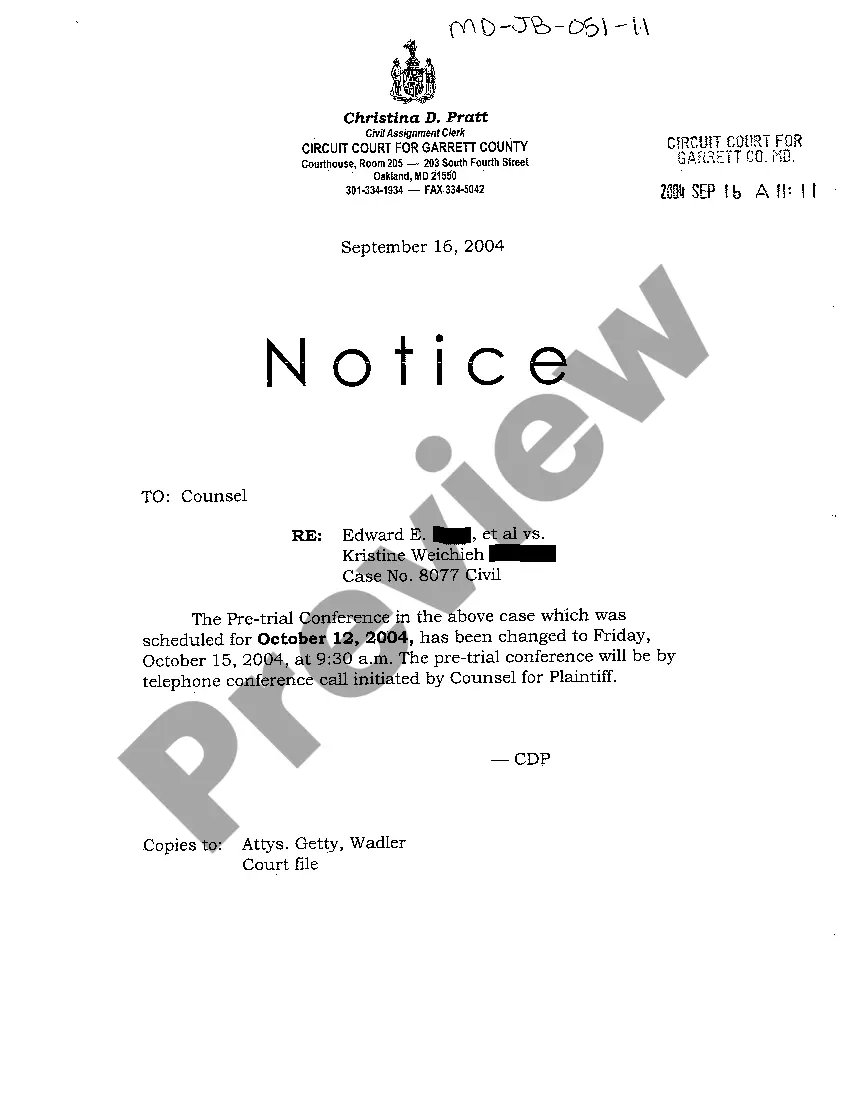

- Utilize the Preview button to review the form.

- Check the description to ensure you have chosen the correct form.

- If the form is not what you're looking for, use the Search field to find the form that suits your needs.

- Once you find the correct form, click Acquire now.

Form popularity

FAQ

A Miller trust is categorized as an irrevocable trust specifically designed for Medicaid eligibility. This means that once established, it cannot be changed or revoked easily. By employing a Miller trust, individuals can effectively manage income to comply with Medicaid rules. When looking for guidance on this matter, Massachusetts Miller Trust Forms for Assisted Living are essential tools.

Special needs trusts may also be referred to as supplemental needs trusts or disability trusts. Each name emphasizes the trust's purpose: to provide for individuals with disabilities while preserving their eligibility for government benefits. These trusts are tailored to enhance the quality of life for beneficiaries. When considering Massachusetts Miller Trust Forms for Assisted Living, knowing the correct terminology can be beneficial.

You might need a Miller trust if your income exceeds the Medicaid limits, yet you require long-term care services. This trust helps you allocate your income appropriately, ensuring you qualify for Medicaid while receiving necessary assistance. By establishing a Miller trust, you can secure your future and address your care needs. To navigate this process, Massachusetts Miller Trust Forms for Assisted Living can be an invaluable resource.

A Medicaid income trust, commonly known as a Miller trust, allows individuals to set aside their income to meet eligibility requirements for Medicaid. Funds placed in this trust do not count as income, allowing you to maintain access to valuable services. This mechanism is instrumental in assisting with the costs associated with assisted living. To get started, exploring Massachusetts Miller Trust Forms for Assisted Living is vital.

Yes, a Miller trust qualifies as a type of special needs trust. It is specifically designed to allow individuals to qualify for Medicaid while protecting excess income. Using a Miller trust can help you manage your finances effectively and ensure you receive essential care. This is especially important when navigating Massachusetts Miller Trust Forms for Assisted Living.

There are two main types of special needs trusts: first-party trusts and third-party trusts. First-party trusts use the disabled individual's own assets, while third-party trusts are funded by family or friends. Both types aim to help individuals maintain their eligibility for government benefits while providing necessary financial support. Understanding the differences is crucial when considering Massachusetts Miller Trust Forms for Assisted Living.

A Miller trust, or an income-only trust, generally needs to file a tax return for any income it generates. When using Massachusetts Miller Trust Forms for Assisted Living, it is essential to understand that the trust must comply with IRS regulations. This means any income produced within the trust could be subject to taxes, depending on your specific situation. Therefore, consulting a tax professional while managing your Miller trust can ensure compliant and informed decisions.

Qualifying for assisted living in Massachusetts involves meeting specific income and asset limits set by Medicaid. Using the Massachusetts Miller Trust Forms for Assisted Living can help you meet these requirements when your income exceeds the limits. In addition, you will need to provide documentation of your medical condition and proof of your financial situation. Through careful preparation and the right forms, you can facilitate your path to receiving the necessary care.

A Qualified Income Trust (QIT) form is a necessary document used in Massachusetts for individuals applying for Medicaid, particularly when seeking assisted living services. The Massachusetts Miller Trust Forms for Assisted Living help you manage income above the Medicaid limit, enabling you to qualify for financial assistance. By using a QIT, you can set aside excess income, which can then be used for your care expenses. Understanding how to fill out and submit this form is crucial for obtaining the financial support you need.

To establish a Miller trust, you must begin by gathering necessary documents including financial records and personal identification. Next, you will need to complete the Massachusetts Miller Trust Forms for Assisted Living accurately. Utilizing resources from platforms like US Legal Forms can help you with step-by-step guidance through the creation of your trust, ensuring compliance with Massachusetts laws.