Massachusetts Revocable Trust for Estate Planning

Description

How to fill out Revocable Trust For Estate Planning?

Locating the appropriate legal document template can be a challenge.

Certainly, there are numerous templates accessible online, but how do you find the legal form you need.

Utilize the US Legal Forms website. This service offers a vast array of templates, including the Massachusetts Revocable Trust for Estate Planning, suitable for both business and personal needs.

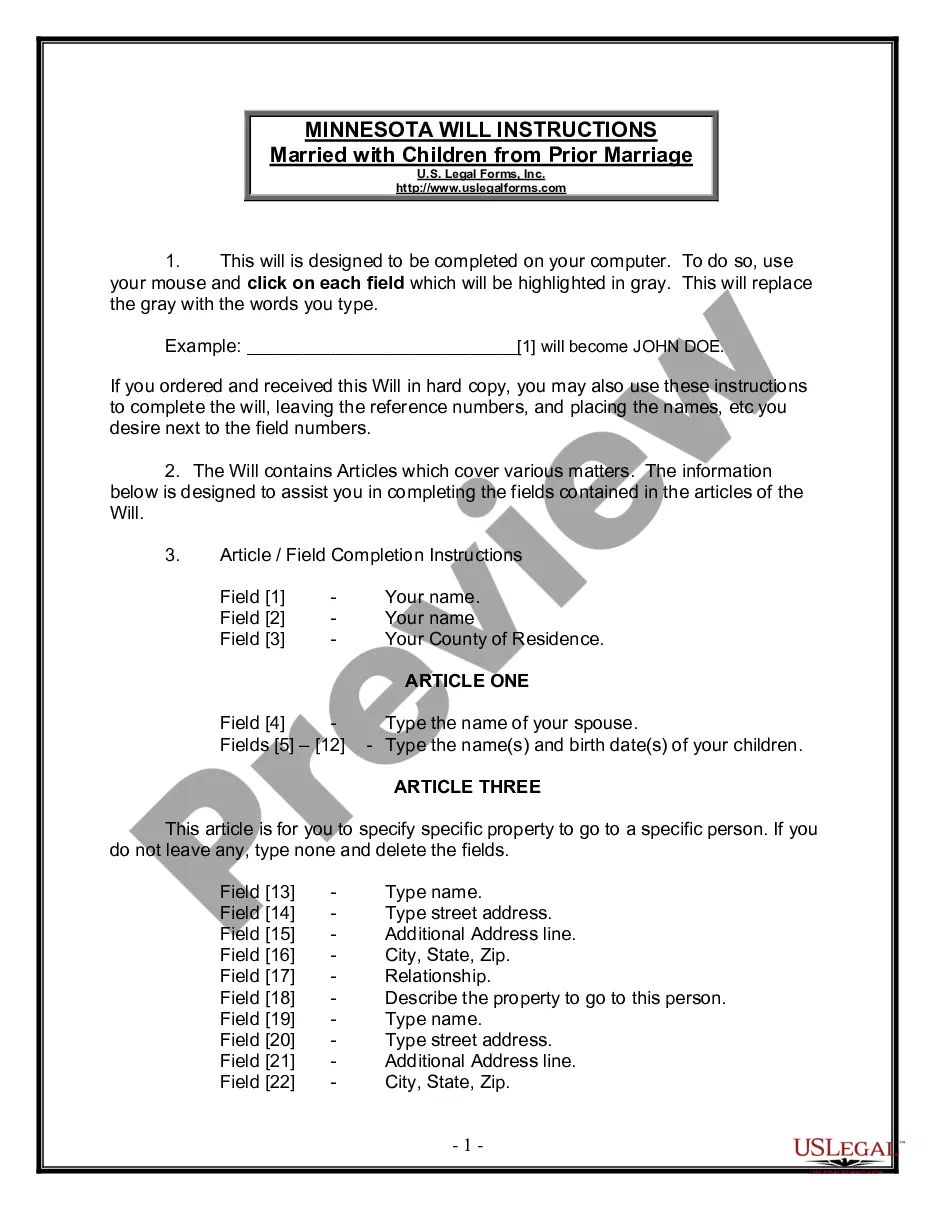

Start by ensuring you have selected the correct form for your area. You can review the document with the Preview button and check the document description to confirm it is suitable for you.

- All forms are reviewed by experts and meet federal and state regulations.

- If you are already registered, Log In to your account and click the Download button to access the Massachusetts Revocable Trust for Estate Planning.

- Use your account to browse through the legal forms you may have previously purchased.

- Go to the My documents section of your account to obtain another copy of the document you require.

- If you are a new user of US Legal Forms, here are some simple steps to follow.

Form popularity

FAQ

A trust does not inherently avoid Massachusetts estate tax. A Massachusetts Revocable Trust for Estate Planning keeps your assets out of the probate process but does not shield them from taxes owed upon your death. To minimize tax implications and maximize your estate's value, it may be beneficial to explore other estate planning strategies and consult with an expert.

Yes, a Massachusetts Revocable Trust for Estate Planning can help avoid probate. When properly established and funded, the trust allows your assets to transfer directly to your beneficiaries without court involvement. This process not only saves time but also maintains your family's privacy during a potentially stressful period.

Trusts do not necessarily bypass estate tax, especially a Massachusetts Revocable Trust for Estate Planning. The assets within the trust are still part of your federal and state estate for tax purposes. It’s important to work with an estate planning professional to navigate the tax landscape effectively and determine the best strategy for your situation.

Putting your house in a Massachusetts Revocable Trust for Estate Planning can simplify the transfer process after your passing. By doing so, your home can pass to your beneficiaries without going through probate, which saves time and reduces complications. It's advisable to evaluate your specific situation and consider legal guidance to ensure it aligns with your estate planning goals.

A Massachusetts Revocable Trust for Estate Planning does not directly avoid estate tax. While the trust can offer various benefits, such as avoiding probate, the assets in the trust are still counted toward your estate when determining tax liability. Understanding the tax implications is essential, so consulting with a professional can be beneficial.

One of the biggest mistakes parents often make when setting up a Massachusetts Revocable Trust for Estate Planning is failing to fund the trust properly. Many assume that just creating the trust is sufficient, but without transferring assets into it, the trust cannot serve its purpose. It's crucial to list all desired assets, including bank accounts and property, to ensure smooth management and distribution for your heirs.

While a Massachusetts Revocable Trust for Estate Planning offers many benefits, it does have some disadvantages. One notable concern is the potential costs involved in setting up and managing the trust. Additionally, it does not provide protection from creditors, meaning your assets can still be vulnerable in certain legal situations. Furthermore, a living trust does not eliminate estate taxes, so planning for those obligations remains vital.