The Fair Credit Reporting Act also provides that a consumer reporting agency that furnishes a consumer report for employment purposes and which, for that purpose, compiles and reports items of information on consumers that are matters of public record and are likely to have an adverse effect on a consumer's ability to obtain employment must: (1) at the time the public record information is reported to the user of the consumer report, notify the consumer of the fact that public record information is being reported by the consumer reporting agency, together with the name and address of the person to whom the information is being reported; or (2) maintain strict procedures designed to insure that whenever public record information likely to have an adverse effect on a consumer's ability to obtain employment is reported, it is complete and up to date.

Massachusetts Notice to Consumer of Report of Public Record Information Likely to Have Adverse Effect

Description

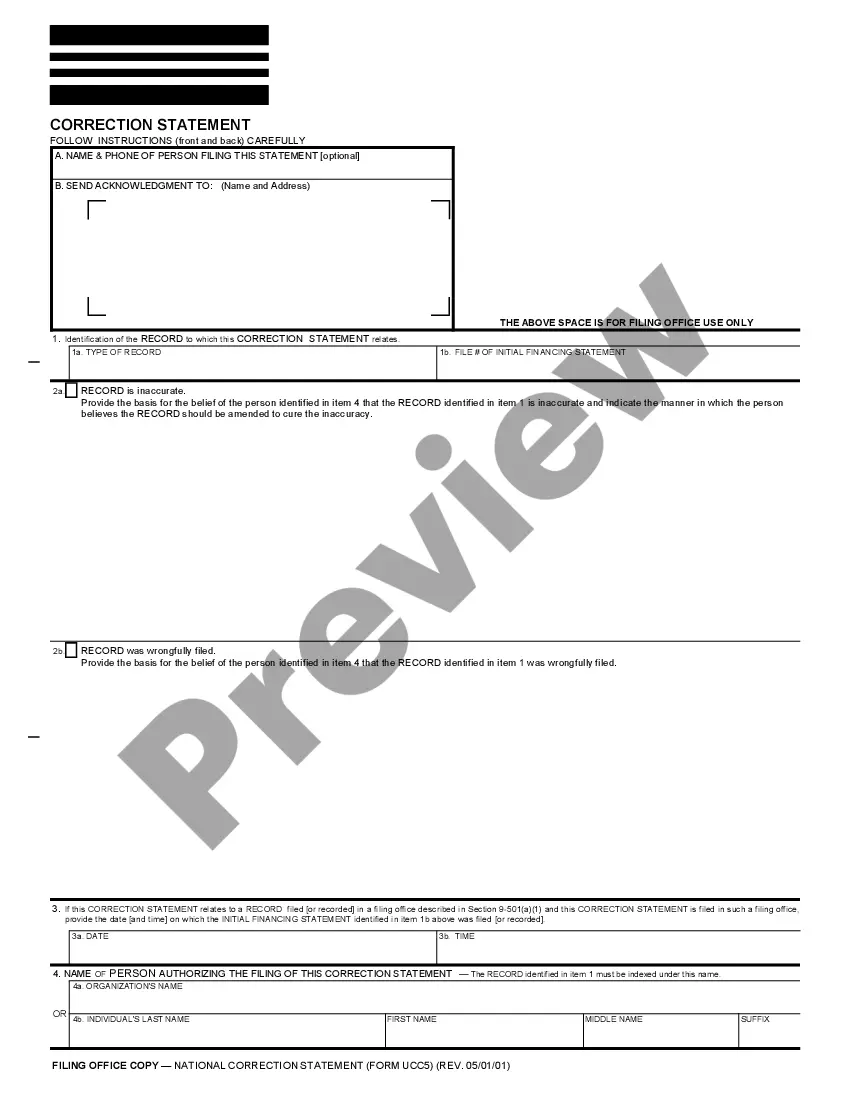

How to fill out Notice To Consumer Of Report Of Public Record Information Likely To Have Adverse Effect?

You can commit several hours on-line looking for the lawful papers web template that meets the federal and state specifications you will need. US Legal Forms gives 1000s of lawful forms which are examined by professionals. It is possible to download or print the Massachusetts Notice to Consumer of Report of Public Record Information Likely to Have Adverse Effect from our assistance.

If you currently have a US Legal Forms profile, you are able to log in and click on the Download button. Following that, you are able to full, revise, print, or sign the Massachusetts Notice to Consumer of Report of Public Record Information Likely to Have Adverse Effect. Every single lawful papers web template you purchase is your own property for a long time. To acquire an additional copy of the acquired form, visit the My Forms tab and click on the related button.

If you use the US Legal Forms site the very first time, keep to the basic recommendations listed below:

- Very first, ensure that you have selected the right papers web template for your county/city that you pick. Read the form explanation to ensure you have chosen the appropriate form. If available, use the Preview button to look through the papers web template at the same time.

- If you would like get an additional model of your form, use the Lookup discipline to obtain the web template that suits you and specifications.

- After you have identified the web template you desire, just click Buy now to continue.

- Pick the rates plan you desire, type your accreditations, and sign up for a merchant account on US Legal Forms.

- Complete the financial transaction. You may use your charge card or PayPal profile to fund the lawful form.

- Pick the file format of your papers and download it for your gadget.

- Make modifications for your papers if necessary. You can full, revise and sign and print Massachusetts Notice to Consumer of Report of Public Record Information Likely to Have Adverse Effect.

Download and print 1000s of papers themes making use of the US Legal Forms website, which provides the most important assortment of lawful forms. Use expert and status-specific themes to tackle your organization or individual requirements.

Form popularity

FAQ

A consumer report can contain a wide variety of information including credit history, past bankruptcy, judicial records, employment records, and even online activity. This information can only be accessed with approval from the individual and is highly regulated by the Fair Credit Reporting Act (FCRA).

Information excluded from consumer reports further include: Arrest records more than 7 years old. Items of adverse information, except criminal convictions older than 7 years. Negative credit data, civil judgments, paid tax liens, and/or collections accounts older than 7 years.

As we have seen in previous posts, background checks/consumer reports can include a variety of information from different sources, including credit reports and criminal records at the county, state, or federal level.

A Consumer Credit Report is an "Employment" credit report that provides information about a candidate's financial history. It may reveal indicators of finical irresponsibility that could affect your organization.

When you apply for a job, your prospective employer may use a consumer report to evaluate you as a potential employee. A consumer report is a collection of documents that may include credit reports, criminal and other public records such as bankruptcy filings, and records of civil court procedures and judgments.

(f) The term ?consumer reporting agency? means any person which, for monetary fees, dues, or on a cooperative nonprofit basis, regularly engages in whole or in part in the practice of assembling or evaluating consumer credit information or other information on consumers for the purpose of furnishing consumer reports to ...