Massachusetts Agreement for Assignment and Sale of Partnership Interest and Reorganization with Purchaser as New Partner including Assignment

Description

How to fill out Agreement For Assignment And Sale Of Partnership Interest And Reorganization With Purchaser As New Partner Including Assignment?

US Legal Forms - one of the largest collections of legal documents in the USA - provides a range of legal form templates you can download or print.

By using the website, you will access a vast array of forms for both business and personal use, categorized by types, states, or keywords. You can receive the latest versions of forms such as the Massachusetts Agreement for Assignment and Sale of Partnership Interest and Reorganization with Purchaser as New Partner including Assignment in an instant.

If you already possess a monthly subscription, Log In and acquire the Massachusetts Agreement for Assignment and Sale of Partnership Interest and Reorganization with Purchaser as New Partner including Assignment from the US Legal Forms library. The Download button will be visible on each form you view. You can access all previously saved forms in the My documents section of your account.

Process the transaction. Use your credit card or PayPal account to complete the transaction.

Select the file format and download the form to your device. Edit. Complete, modify, print, and sign the saved Massachusetts Agreement for Assignment and Sale of Partnership Interest and Reorganization with Purchaser as New Partner including Assignment. Each template you added to your account has no expiration date and is yours forever. So, if you want to download or print another copy, just go to the My documents section and click on the form you need. Access the Massachusetts Agreement for Assignment and Sale of Partnership Interest and Reorganization with Purchaser as New Partner including Assignment with US Legal Forms, the most extensive library of legal form templates. Utilize a vast range of professional and state-specific templates that fulfill your business or personal needs and requirements.

- If you are using US Legal Forms for the first time, here are essential tips to help you get started.

- Verify you have selected the correct form for the city/county.

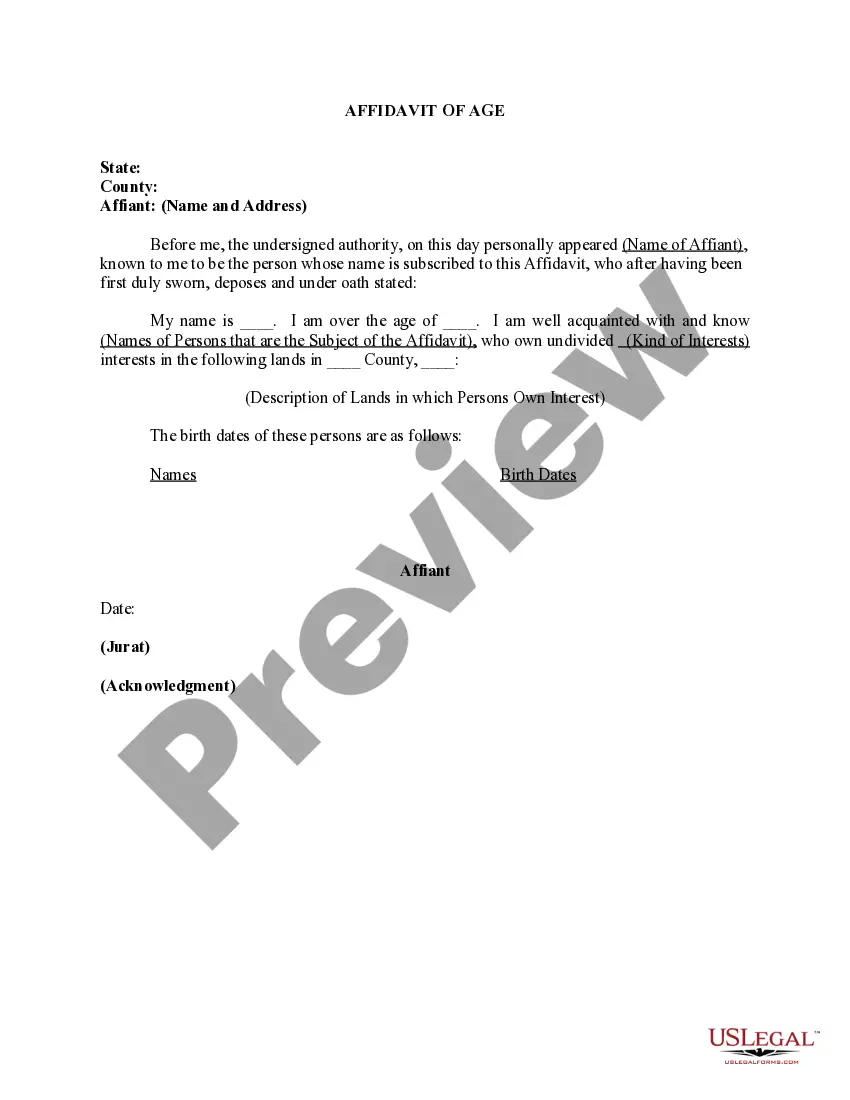

- Click the Preview button to review the form’s content.

- Review the form description to ensure you have selected the appropriate form.

- If the form does not meet your needs, use the Search box at the top of the screen to find one that does.

- If you are satisfied with the form, confirm your selection by clicking on the Get now button.

- Then, choose the payment plan you prefer and provide your credentials to sign up for an account.

Form popularity

FAQ

The transfer of interest in a partnership refers to the legal process of assigning one partner's rights and obligations to another party. This transfer can occur through sale, gifting, or other means, and it must be documented to maintain the partnership's integrity. In Massachusetts, utilizing the Massachusetts Agreement for Assignment and Sale of Partnership Interest is essential for clarity and legality in such transactions.

The form for the transfer of interest in a partnership is a legal document that formalizes the change in ownership among partners. This form must include essential details such as the identities of the transferring and receiving partners, the value of the interest, and the terms of the transfer. Using the Massachusetts Agreement for Assignment and Sale of Partnership Interest streamlines this process, ensuring all critical information is captured accurately.

When accounting for the sale of partnership interest, it is crucial to recognize the financial implications for both parties involved. The partner selling their interest must record any gains or losses on the transaction, while the purchasing partner must adjust their capital account accordingly. To ensure accurate accounting, the Massachusetts Agreement for Assignment and Sale of Partnership Interest should detail the sale's terms and implications.

Yes, you can exchange a partnership interest, which typically involves trading one partner's ownership share for another asset or interest. Such exchanges must adhere to state laws and the partnership agreement. Leveraging a Massachusetts Agreement for Assignment and Sale of Partnership Interest can facilitate this process, helping to avoid misunderstandings among partners.

A 351 transfer of partnership interest refers to a tax provision under Section 351 of the Internal Revenue Code. It allows partners to exchange property for partnership interests without recognizing immediate income tax liabilities. In Massachusetts, applying this provision requires careful structuring, making a thorough understanding of the Massachusetts Agreement for Assignment and Sale of Partnership Interest vital for effective tax planning.

The transfer of partnership interest from one partner to another involves the legal process of moving ownership rights from one individual to another within the partnership. This process ensures that the partnership's operations remain uninterrupted while allowing new partners to participate. Documenting this transfer with a Massachusetts Agreement for Assignment and Sale of Partnership Interest is vital for compliance and future reference.

A transfer of partnership interest to another partner is the process where one partner sells or gives their ownership share to another existing partner. This transfer often occurs in response to changing business dynamics or personal circumstances. In Massachusetts, utilizing the Agreement for Assignment and Sale of Partnership Interest can simplify this transaction while establishing clear terms.

The assignment of partnership interest agreement is a legal document that outlines the transfer of a partner's share in a partnership to another party. This agreement allows for the reallocation of rights and responsibilities among partners. In Massachusetts, this agreement is essential for ensuring a smooth transition and maintaining clarity in the partnership structure.

The right to assign agreement refers to the contractual provision that allows a partner to transfer their ownership interest to another party. This is typically detailed in the Massachusetts Agreement for Assignment and Sale of Partnership Interest and Reorganization with Purchaser as New Partner including Assignment. Having this agreement in place clarifies the terms under which ownership can be transferred, minimizing potential conflicts. Consulting legal experts or using platforms like uslegalforms can facilitate creating these agreements.

The sale of a partnership interest is generally treated as a transfer of ownership, which can have tax implications for both the selling and purchasing partners. The terms outlined in the Massachusetts Agreement for Assignment and Sale of Partnership Interest and Reorganization with Purchaser as New Partner including Assignment will dictate how profits, losses, and liabilities are addressed. Consulting a tax professional can provide insight into any consequences from the sale. Proper documentation ensures that all legal aspects are complied with during this process.