Massachusetts General Form for Bill of Sale of Personal Property

Description

How to fill out General Form For Bill Of Sale Of Personal Property?

Finding the appropriate legal document template can be challenging. Certainly, there are numerous templates available online, but how can you locate the legal form you need? Utilize the US Legal Forms website. The service offers a vast collection of templates, including the Massachusetts General Form for Bill of Sale of Personal Property, suitable for both business and personal purposes. All documents are vetted by professionals and meet federal and state regulations.

If you are already registered, Log In to your account and click the Download button to obtain the Massachusetts General Form for Bill of Sale of Personal Property. Use your account to browse the legal forms you have previously purchased. Navigate to the My documents section of your account and retrieve another copy of the document you need.

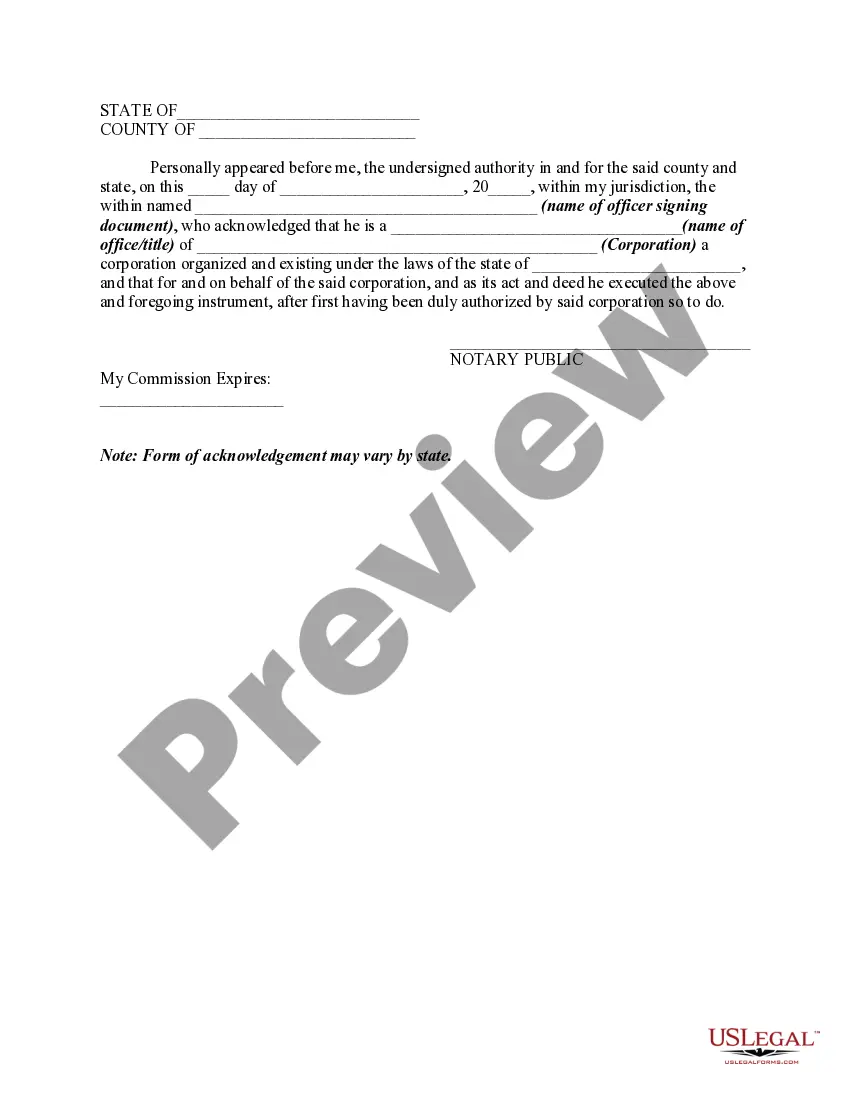

If you are a new user of US Legal Forms, here are simple instructions for you to follow: First, ensure that you have selected the correct form for your city/state. You can preview the form using the Review button and read the form details to confirm it’s suitable for you. If the form does not meet your requirements, use the Search field to find the right document. Once you are sure that the form is appropriate, click the Get now button to download the form. Choose the pricing plan you want and enter the necessary information. Create your account and pay for the order using your PayPal account or credit card. Choose the document format and download the legal document template to your device.

- Complete, edit and print the acquired Massachusetts General Form for Bill of Sale of Personal Property.

- US Legal Forms is the largest repository of legal forms where you can find various document templates.

- Utilize the service to obtain well-crafted paperwork that complies with state regulations.

Form popularity

FAQ

While Massachusetts does not legally mandate a bill of sale for all personal property transactions, using one is highly recommended. It serves as evidence of the transfer of ownership and can prevent disputes. The Massachusetts General Form for Bill of Sale of Personal Property provides a standardized format that simplifies this process. Employing this form can protect your rights and clarify the terms of the sale for both parties.

You can register a car in Massachusetts using a bill of sale, provided it includes detailed information about the vehicle and the transaction. However, you will also need other documents, such as proof of insurance and a completed application. The Massachusetts General Form for Bill of Sale of Personal Property can simplify this process, ensuring all necessary information is included.

To avoid paying sales tax on a used car in Massachusetts, you must ensure that the transaction qualifies under specific exemptions, such as a gift or transfer between family members. Proper documentation is essential, and a well-crafted bill of sale will help justify your tax position. The Massachusetts General Form for Bill of Sale of Personal Property can provide clarity in these transactions.

Yes, a car can be sold 'as is' in Massachusetts. This means the seller does not have to make repairs or provide warranties about the car's condition. It is advisable to document this in the bill of sale, and the Massachusetts General Form for Bill of Sale of Personal Property can assist in articulating this agreement clearly.

A bill of sale 'as is' in Massachusetts indicates that the buyer accepts the item in its current condition, without any warranties or guarantees from the seller. This means that the buyer assumes any risks associated with the property after the sale is completed. Using the Massachusetts General Form for Bill of Sale of Personal Property can clearly state the 'as is' condition for better legal protection.

In Massachusetts, a bill of sale does not need to be notarized unless the transaction involves a vehicle or certain higher-value items. For those situations, notarization may help to protect both buyers and sellers. Utilizing the Massachusetts General Form for Bill of Sale of Personal Property can streamline the process, ensuring you know what is required.

Yes, Massachusetts imposes a personal property tax on cars, which is a major source of revenue for local municipalities. Vehicle owners must report their cars annually, and the tax is assessed based on the car's value. To simplify the process of managing your vehicle's record, consider using the Massachusetts General Form for Bill of Sale of Personal Property when buying or selling.

In Massachusetts, personal property generally includes items such as vehicles, appliances, furniture, and business equipment. It does not include real estate or fixtures that are attached to the land. Using a Massachusetts General Form for Bill of Sale of Personal Property can clarify ownership and facilitate the transfer of such items seamlessly.

A Massachusetts personal exemption reduces the income tax you owe, based on your unique situation, including age and disability status. Eligible taxpayers may claim this exemption on their state income tax returns, which helps lower their overall tax burden. Familiarizing yourself with these exemptions alongside the Massachusetts General Form for Bill of Sale of Personal Property can optimize your financial planning.

In Massachusetts, there is no specific age at which you cease paying property taxes. However, the state does offer programs, such as the Senior Property Tax Work-Off Program, that can help seniors with tax relief. Also, knowing how to manage your personal property through documentation like the Massachusetts General Form for Bill of Sale of Personal Property can benefit you in keeping accurate records.