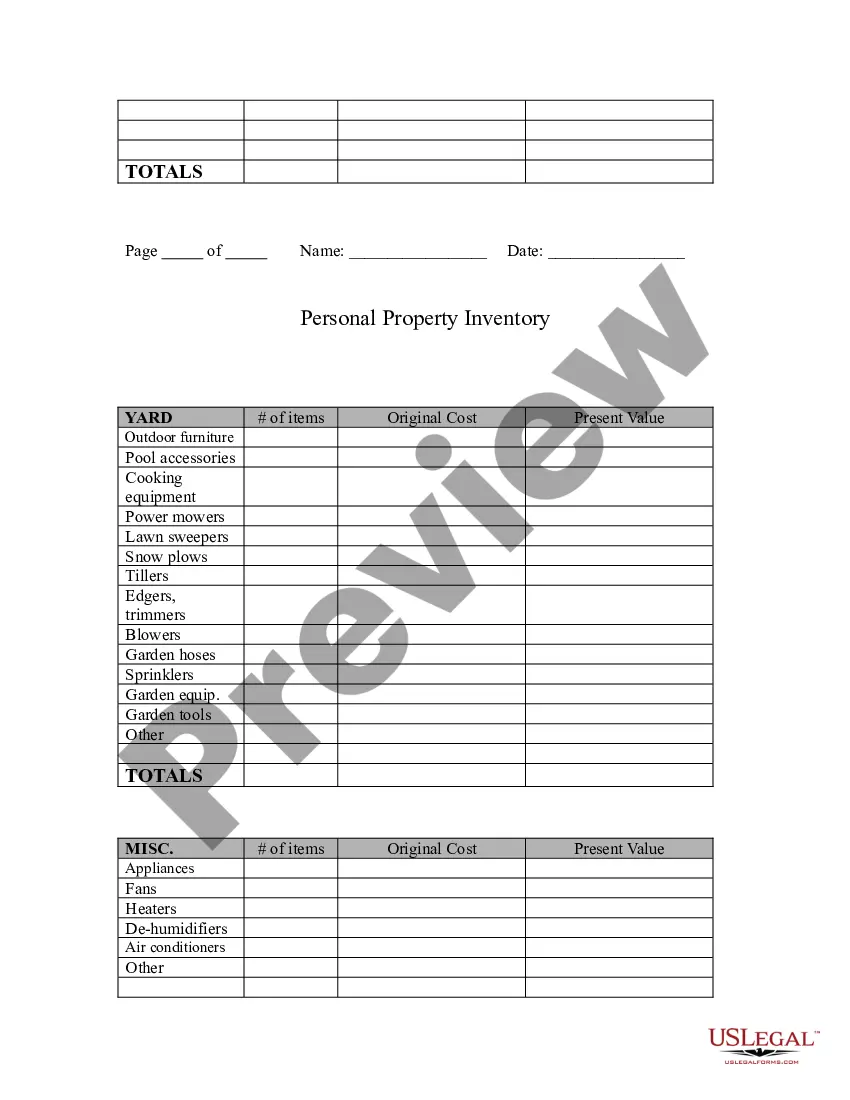

Massachusetts Personal Property Inventory

Description

How to fill out Personal Property Inventory?

US Legal Forms - one of the most important collections of legal documents in the United States - provides a vast selection of legal templates that you can download or print.

By utilizing the site, you will access thousands of documents for professional and personal purposes, organized by categories, states, or keywords. You can find the latest versions of documents like the Massachusetts Personal Property Inventory within moments.

If you already possess a membership, Log In and download the Massachusetts Personal Property Inventory from the US Legal Forms library. The Acquire button will appear on every form you view. You can access all previously obtained documents from the My documents tab of your account.

Complete the transaction. Use your credit card or PayPal account to finalize the purchase.

Choose the format and download the document to your device. Make edits. Fill out, modify, and print or sign the downloaded Massachusetts Personal Property Inventory. Each template you added to your account does not have an expiration date and it is yours permanently. Therefore, if you wish to download or print another copy, just navigate to the My documents section and click on the form you need. Access the Massachusetts Personal Property Inventory with US Legal Forms, one of the most extensive collections of legal document templates. Utilize thousands of professional and state-specific templates that fulfill your business or personal needs.

- Ensure you have selected the appropriate form for your city/state.

- Click the Preview button to review the form’s details.

- Check the form description to confirm you have picked the correct document.

- If the form does not meet your requirements, use the Lookup field at the top of the screen to find the suitable one.

- If you are satisfied with the form, confirm your choice by clicking the Get now button.

- Then, choose your preferred pricing plan and provide your credentials to register for an account.

Form popularity

FAQ

Seniors do not have a designated age at which they stop paying taxes altogether in Massachusetts. Nonetheless, individuals aged 65 and older can apply for specific tax exemptions and deferrals that can alleviate their financial obligations. A well-organized Massachusetts Personal Property Inventory can be crucial in identifying qualifying assets and applying for available relief. Engaging with resources like uslegalforms can guide you through the process effectively.

For residents over age 65 in Massachusetts, property taxes may decrease through various exemptions and programs designed for seniors. While property taxes do not automatically lower with age, you may qualify for special reductions that lessen your financial responsibility. By keeping an updated Massachusetts Personal Property Inventory, you can better navigate these options and take full advantage of any applicable tax relief. Always consult local regulations to understand your benefits.

Certain individuals may be exempt from paying property taxes in Massachusetts, including veterans, the elderly, and individuals with disabilities. Each local government sets specific criteria for these exemptions, which often includes age, income, and asset levels. Ensuring your Massachusetts Personal Property Inventory is accurate can help you apply for these exemptions effectively. It's essential to check local regulations and work with resources like uslegalforms for comprehensive details.

In Massachusetts, there is no specific age at which you automatically stop paying property taxes. However, seniors aged 65 and older can access tax exemptions and deferrals that may significantly reduce their property tax burden. For instance, many municipalities offer programs that provide relief for those who qualify. Utilizing a Massachusetts Personal Property Inventory can help you assess your assets and determine your eligibility for these benefits.

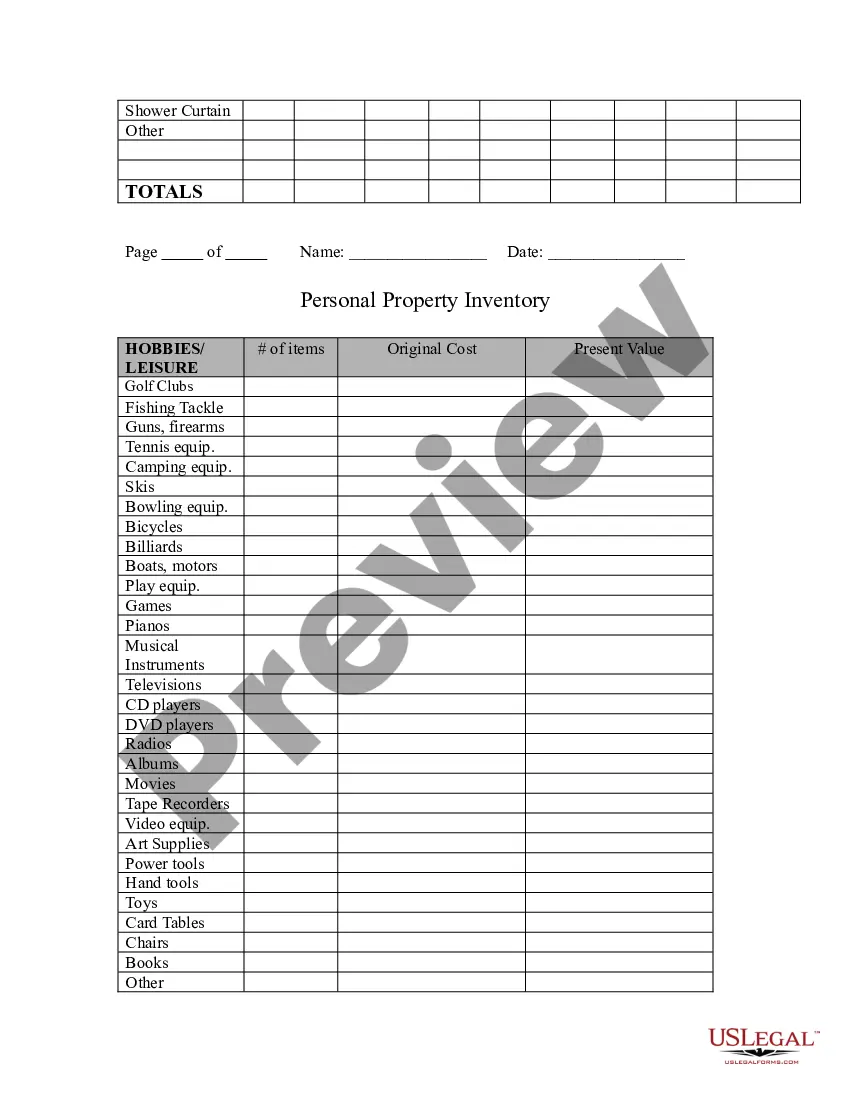

An example of tangible personal property is a car, which you can both see and touch. Other examples include household items like televisions and electronics. When you create your Massachusetts Personal Property Inventory, remember to include these visible assets to avoid any oversight.

Tangible personal property refers to physical items that can be touched or moved, including furniture and equipment. In Massachusetts, these items must be reported to assessors for tax purposes. An accurate Massachusetts Personal Property Inventory captures these essentials, ensuring compliance with state regulations.

Tangible personal property excludes intangible assets like stocks, bonds, and intellectual property rights. These types of assets do not have a physical presence and, therefore, do not appear in a Massachusetts Personal Property Inventory. Identifying these differences can streamline your inventory process.

In Massachusetts, personal property tax is generally based on the assessed value of the property. Local assessors determine the value, which is then used to calculate the tax owed. Keeping an updated Massachusetts Personal Property Inventory assists you in understanding and anticipating your tax obligations.

In Massachusetts, personal property includes movable items that are owned by individuals or businesses. This can range from furniture and electronics to inventory for a business. Understanding what qualifies as personal property is essential for maintaining an accurate Massachusetts Personal Property Inventory.

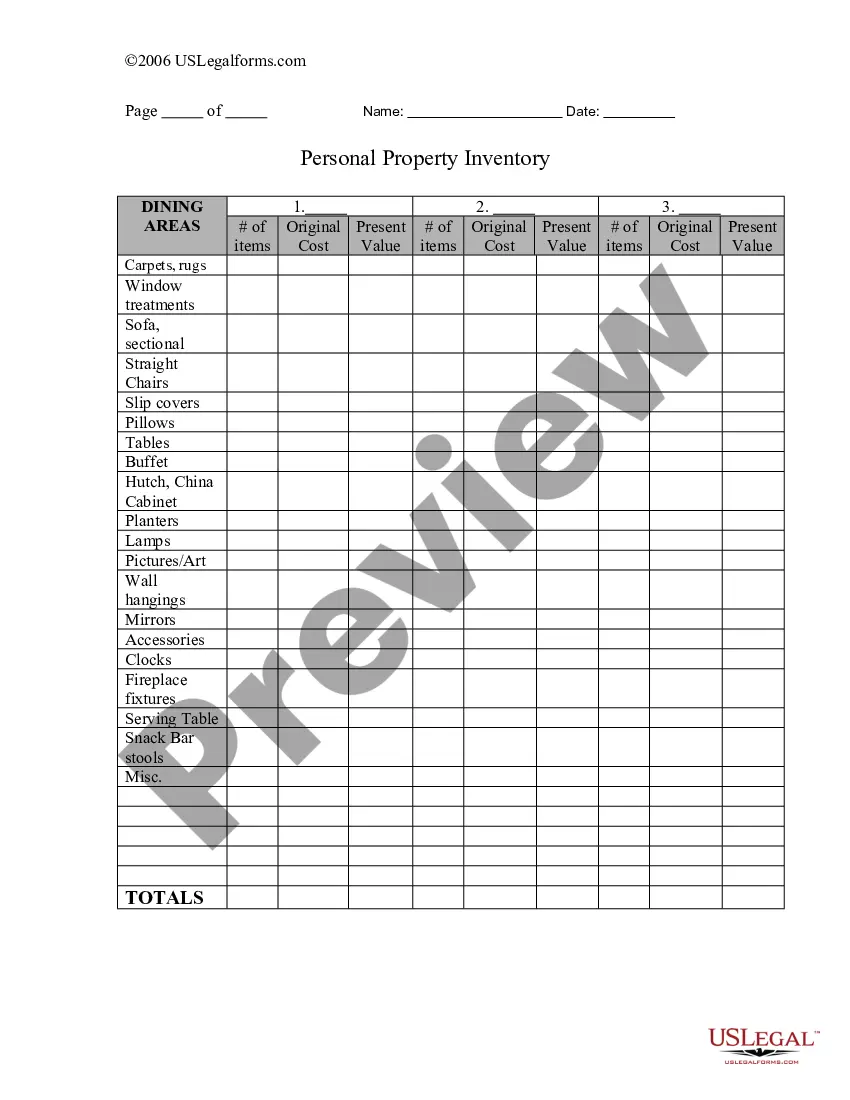

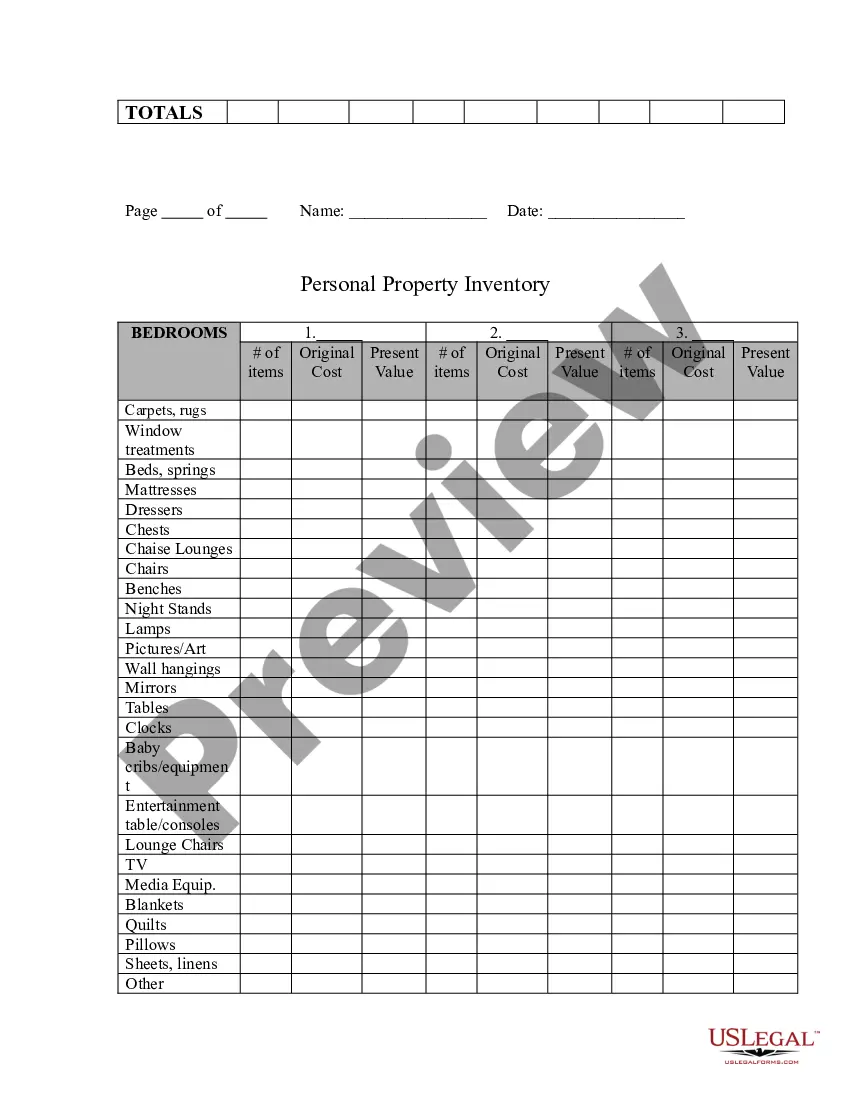

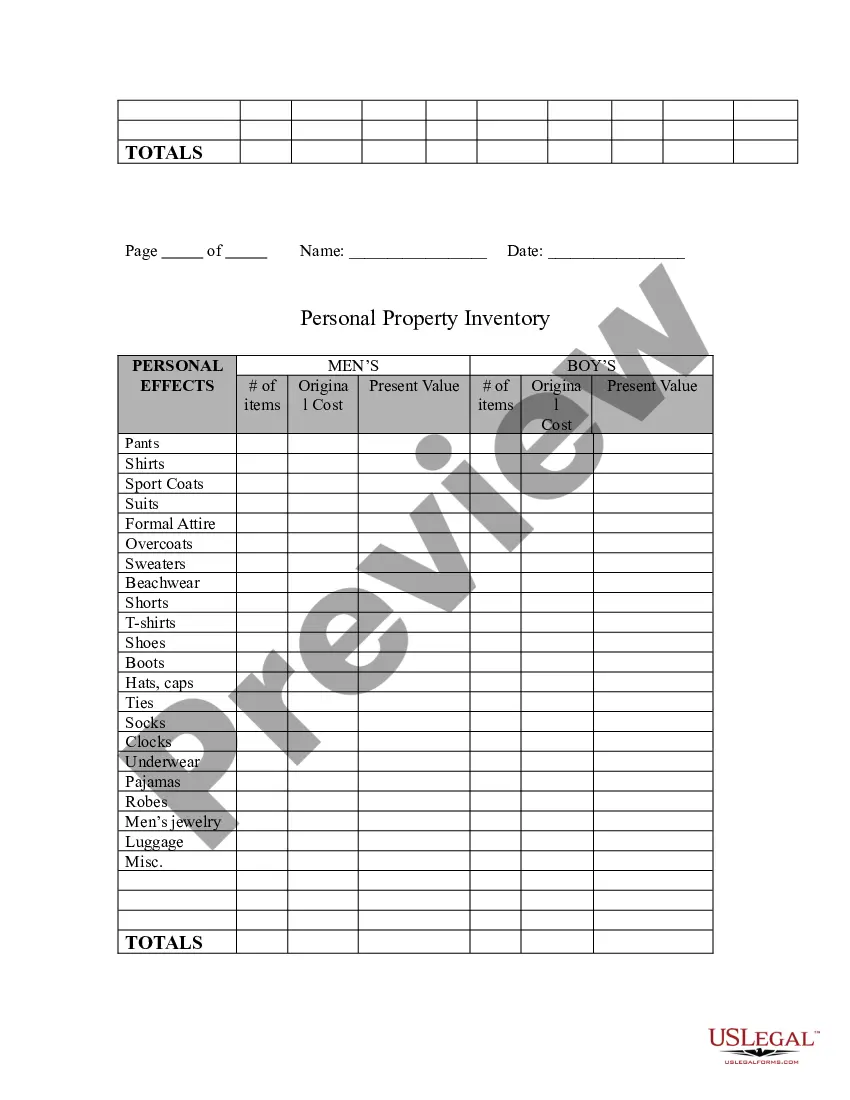

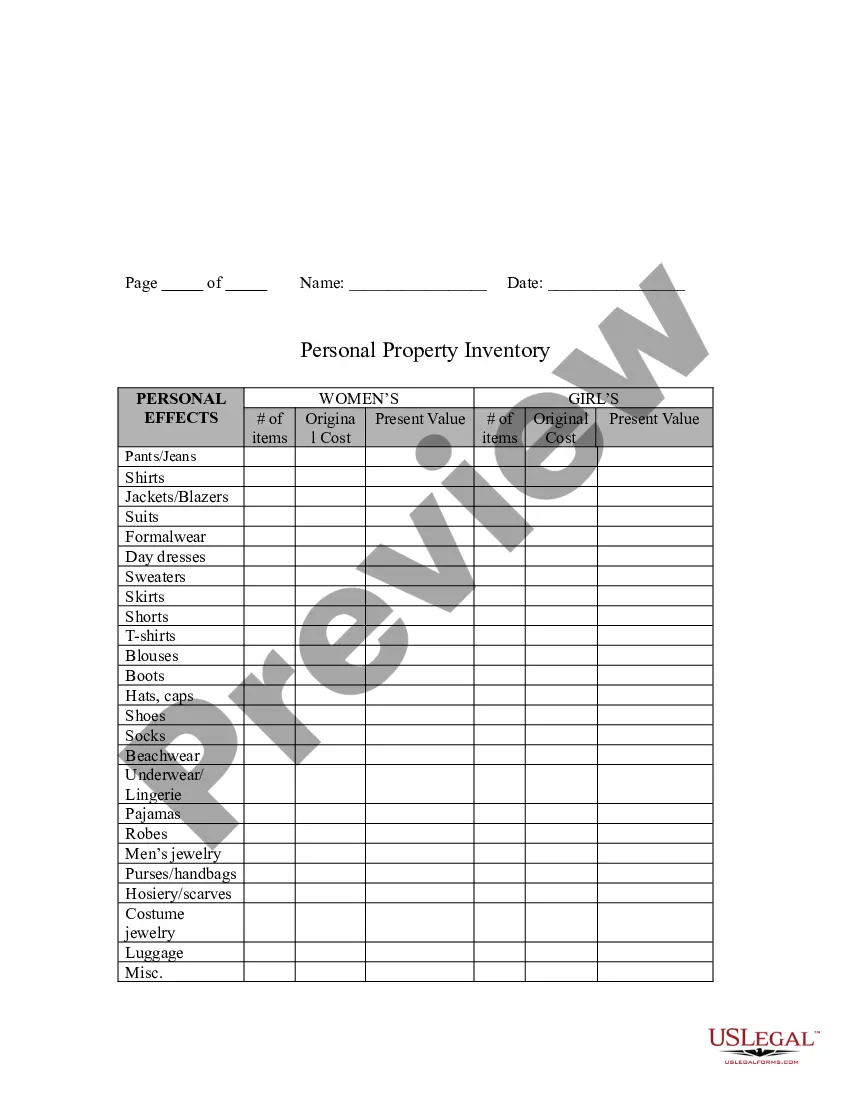

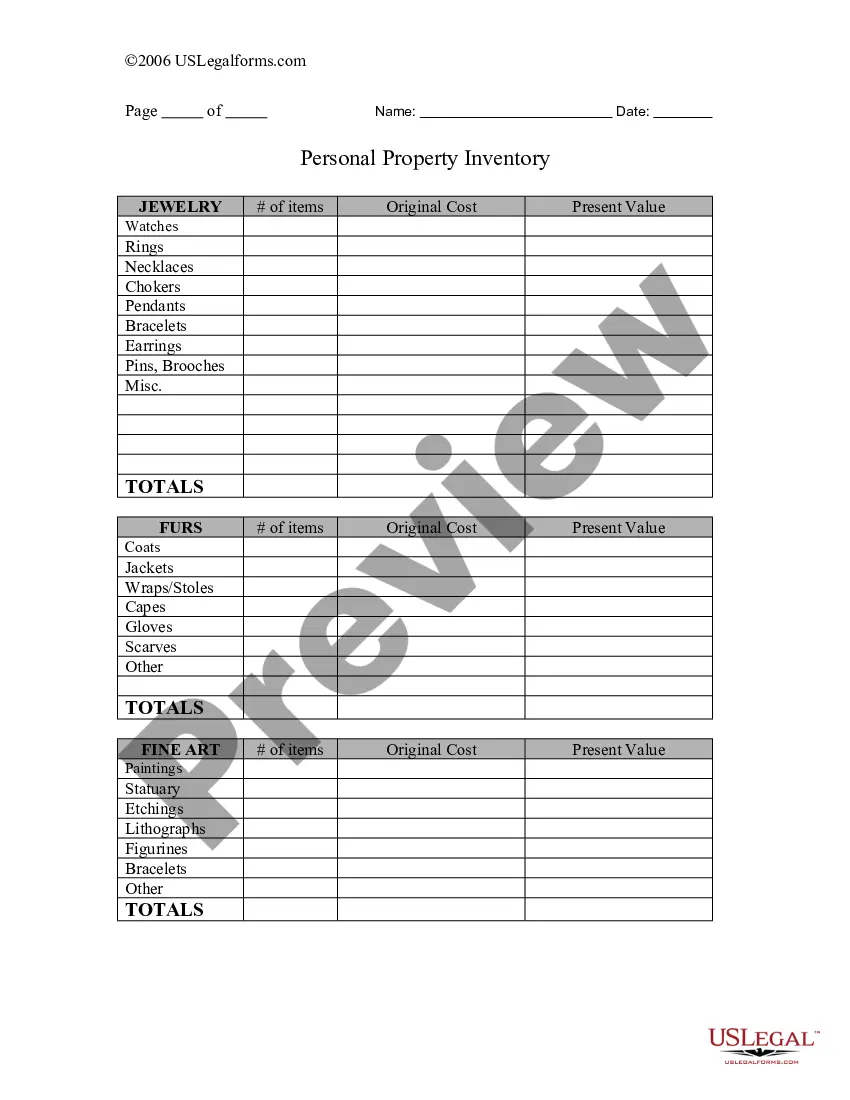

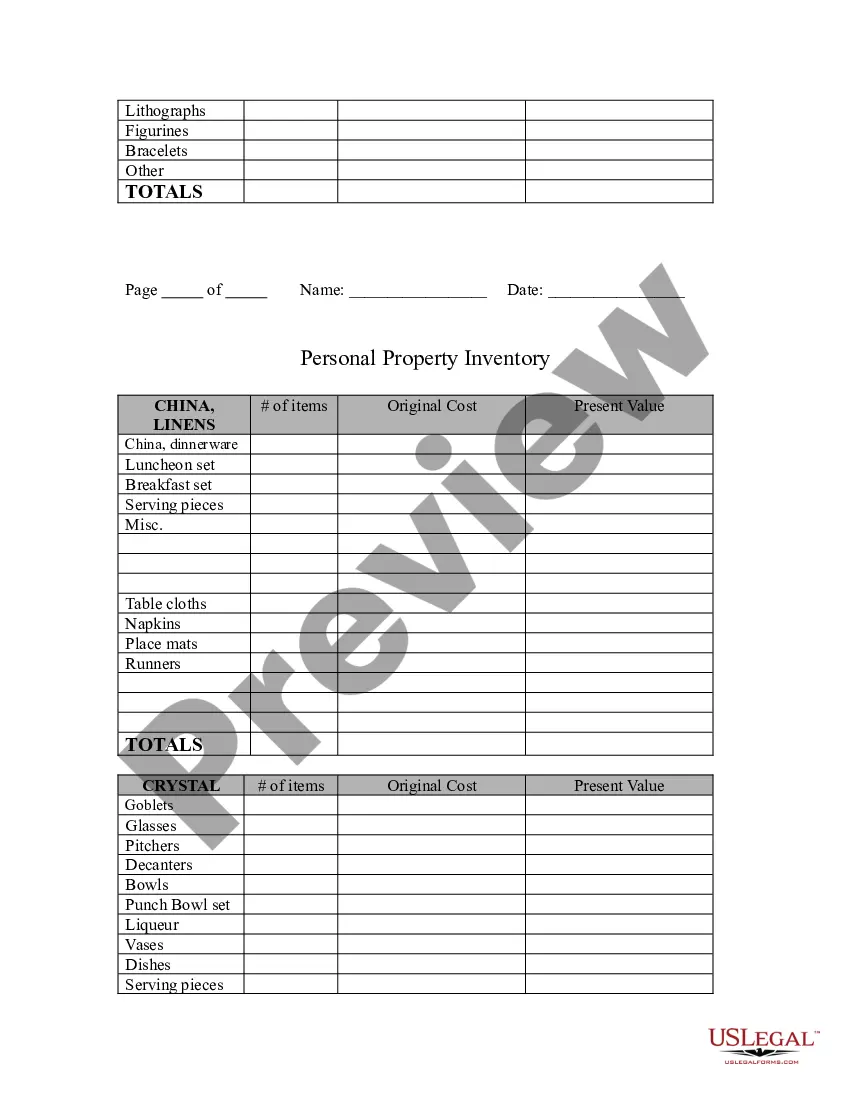

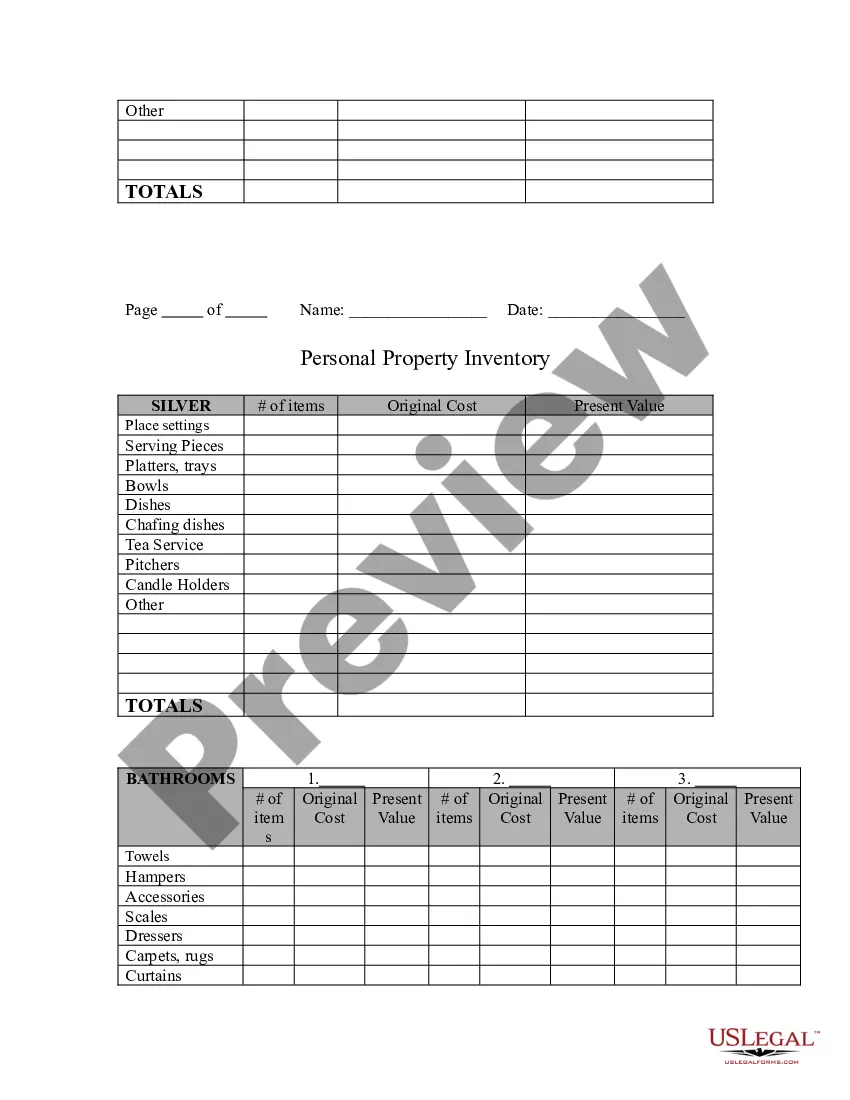

To write an inventory of your personal belongings, begin by going through each room and listing out your possessions. Group similar items and note their values and conditions to create a Massachusetts Personal Property Inventory that reflects your assets accurately. Be as detailed as possible, as this helps in various situations, such as insurance claims or estate management. Consider utilizing platforms like US Legal Forms for guidance in creating your inventory.