Massachusetts Addendum for Release of Liability on Assumption of FHA, VA or Conventional Loan, Restoration of Seller's Entitlement for VA Guaranteed Loan

Description

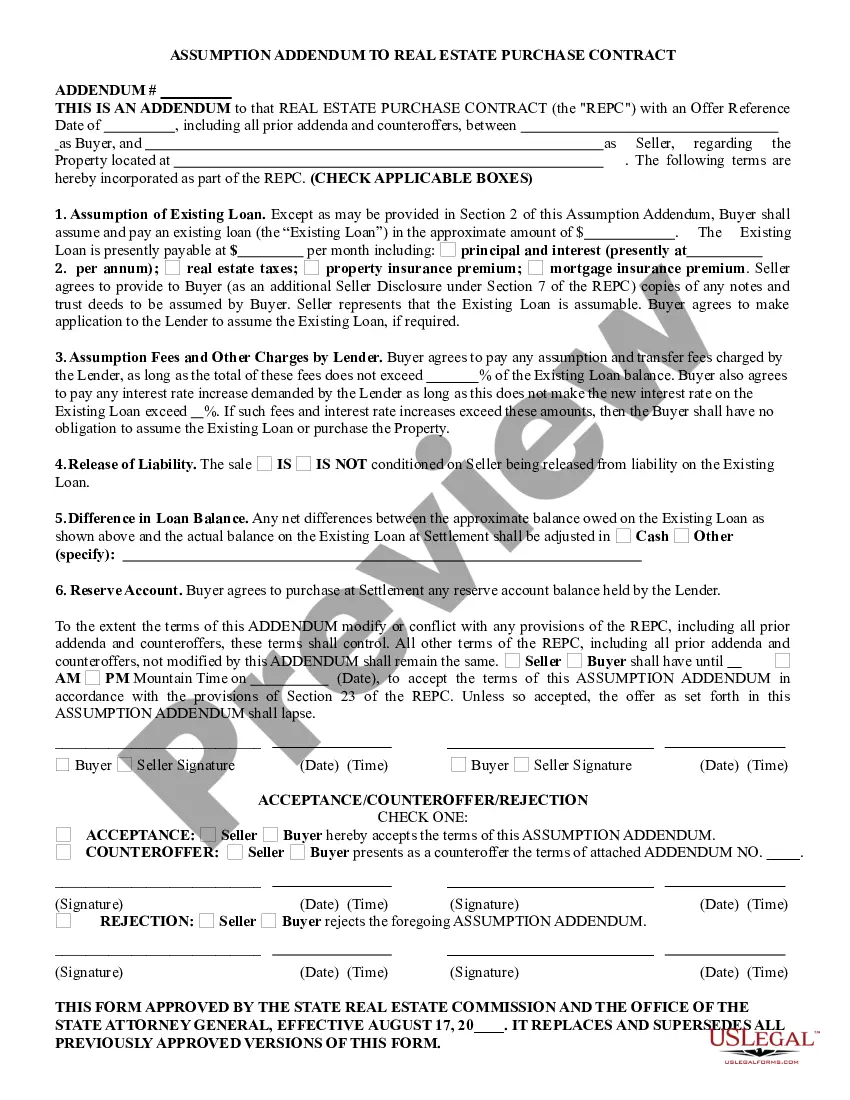

How to fill out Addendum For Release Of Liability On Assumption Of FHA, VA Or Conventional Loan, Restoration Of Seller's Entitlement For VA Guaranteed Loan?

US Legal Forms - one of the largest collections of legal documents in the United States - provides a vast selection of legal form templates that you can download or print. By using the website, you can access thousands of forms for business and personal purposes, organized by categories, states, or keywords. You can find the latest versions of forms such as the Massachusetts Addendum for Release of Liability on Assumption of FHA, VA or Conventional Loan, Restoration of Seller's Entitlement for VA Guaranteed Loan within minutes.

If you already have an account, Log In and download the Massachusetts Addendum for Release of Liability on Assumption of FHA, VA or Conventional Loan, Restoration of Seller's Entitlement for VA Guaranteed Loan from the US Legal Forms library. The Download button will appear on each form you view. You have access to all previously downloaded forms in the My documents section of your account.

If you are using US Legal Forms for the first time, here are simple steps to help you get started: Ensure you have selected the correct form for your city/state. Click the Preview button to review the form’s content. Read the form description to make sure you have chosen the right form. If the form does not meet your requirements, utilize the Search field at the top of the page to find one that does. If you are satisfied with the form, confirm your choice by clicking the Purchase now button. Then, select the pricing plan you prefer and provide your credentials to register for an account. Process the payment. Use your Visa or MasterCard or PayPal account to complete the transaction. Find the format and download the form to your device. Edit. Fill out, modify, print, and sign the downloaded Massachusetts Addendum for Release of Liability on Assumption of FHA, VA or Conventional Loan, Restoration of Seller's Entitlement for VA Guaranteed Loan. Every template you add to your account does not have an expiration date and is yours to keep forever. Therefore, to download or print another version, simply go to the My documents section and click on the form you need.

- Access the Massachusetts Addendum for Release of Liability on Assumption of FHA, VA or Conventional Loan, Restoration of Seller's Entitlement for VA Guaranteed Loan with US Legal Forms, the most comprehensive library of legal document templates.

- Utilize a multitude of professional and state-specific templates that cater to your business or personal needs and requirements.

Form popularity

FAQ

Yes. A VA guaranteed loan is not a gift. It must be repaid, just as you must repay any money you borrow. The VA guaranty, which protects the lender against loss, encourages the lender to make a loan with terms favorable to the veteran.

A conventional loan is any mortgage loan that is not insured or guaranteed by the government (such as under Federal Housing Administration, Department of Veterans Affairs, or Department of Agriculture loan programs). Conventional loans can be conforming or non-conforming.

Because conventional loans don't have government insurance, these loans pose a higher risk for lenders. So, credit and income requirements are stricter for conventional conforming mortgage loans than FHA-insured and VA-guaranteed mortgages.

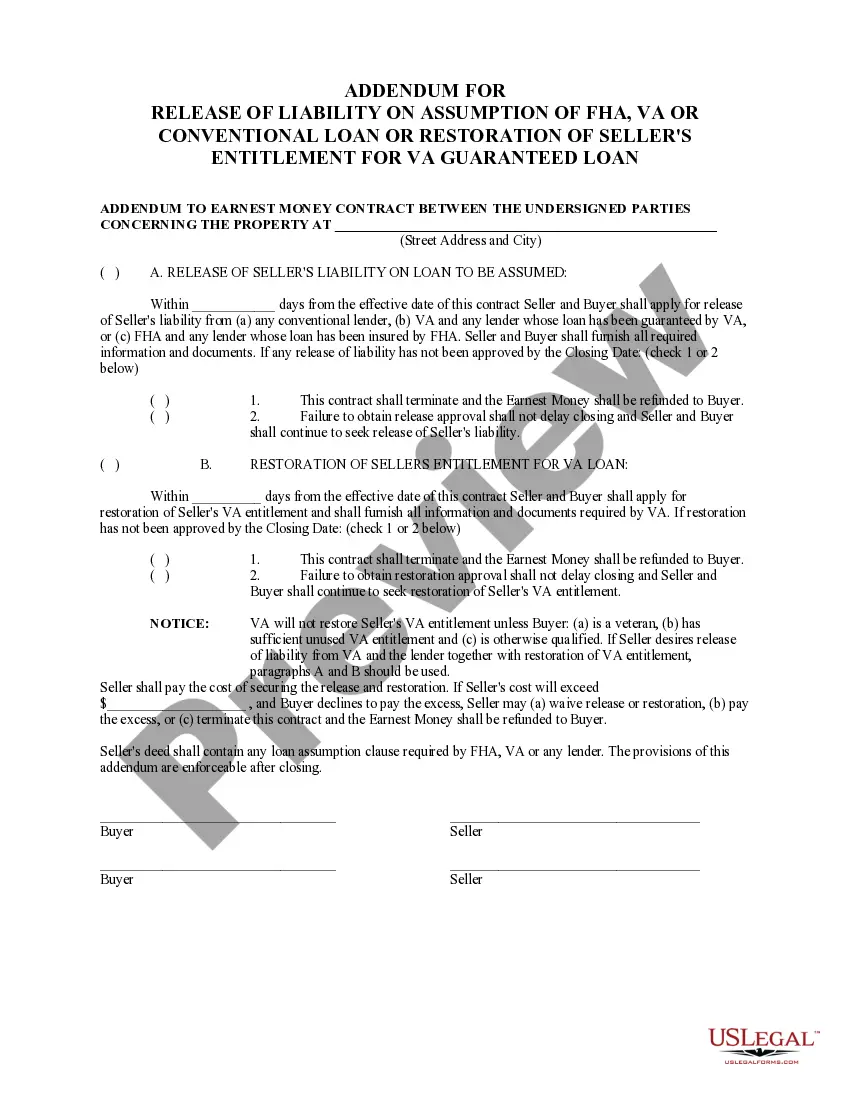

An FHA/VA financing addendum is attached to a purchase contract to state that a buyer with FHA/VA financing can back out of the sale if the appraised property value is less than the asking price.

FHA loans allow lower credit scores than conventional mortgages do, and are easier to qualify for. Conventional loans allow slightly lower down payments. VA loans are reserved for those with VA eligibility and allow lower credit scores, zero down payment options.

Like the FHA loan program, the VA loan program is a government-insured mortgage program. Also, like FHA loans, VA loans are made by private lenders and banks. However, in the case of VA loans, The Department of Veterans Affairs backs or insures the loans.