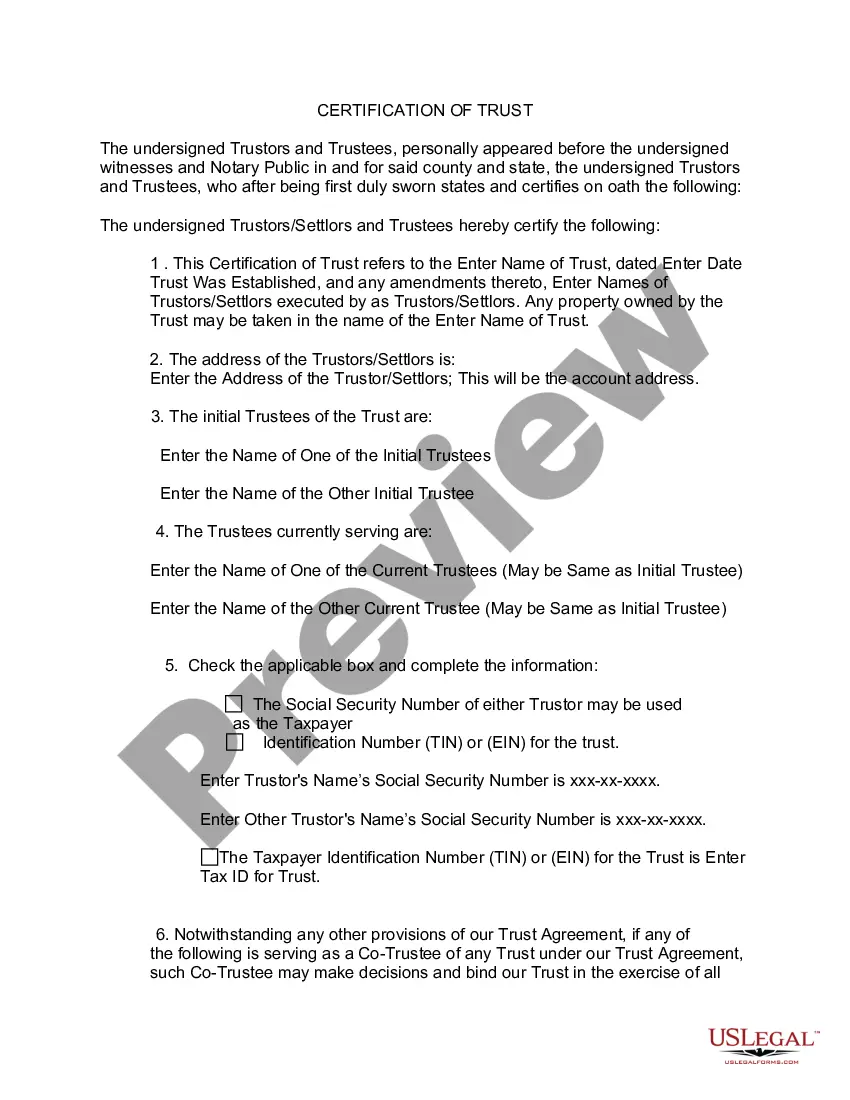

This form is a deed of trust modification. It is to be entered into by a borrower, co-grantor, and the lender. The agreement modifies the mortgage or deed of trust to secure a debt described within the agreement. Other provisions include: renewal and extension of the lien, co-grantor liability, and note payment terms.

Massachusetts Change or Modification Agreement of Deed of Trust

Description

How to fill out Change Or Modification Agreement Of Deed Of Trust?

Locating the appropriate legal document web template can be challenging.

Of course, there are numerous designs available online, but how do you locate the legal form you need.

Utilize the US Legal Forms website. This service offers thousands of templates, including the Massachusetts Change or Modification Agreement of Deed of Trust, suitable for both business and personal purposes. All forms are reviewed by experts and comply with federal and state regulations.

Once you are confident the form is suitable, click the Get now button to obtain the form. Choose the pricing plan you prefer and input the required information. Create your account and complete the transaction using your PayPal account or credit card. Select the file format and download the legal document template to your device. Fill out, edit, print, and sign the acquired Massachusetts Change or Modification Agreement of Deed of Trust. US Legal Forms is the largest repository of legal forms where you can find numerous document templates. Use this service to obtain professionally crafted documents that comply with state requirements.

- If you are already registered, Log In to your account and click the Download button to obtain the Massachusetts Change or Modification Agreement of Deed of Trust.

- Use your account to review the legal forms you have previously purchased.

- Navigate to the My documents section of your account and download another copy of the documents you need.

- If you are a new user of US Legal Forms, here are simple instructions you should follow.

- First, ensure you have selected the correct form for your city/region. You can review the form by clicking the Review button and read the form description to confirm it’s right for you.

- If the form does not meet your requirements, use the Search field to find the appropriate form.

Form popularity

FAQ

To file a complaint for modification in Massachusetts, you need to prepare the necessary legal documents and submit them to the appropriate court. Ensure that you clearly outline the reasons for the modification in your complaint. For assistance with a Massachusetts Change or Modification Agreement of Deed of Trust, platforms like USLegalForms provide templates and guidance to simplify the filing process.

In Massachusetts, you generally have 90 days to serve a complaint after filing it with the court. However, the timeline can vary based on the type of case and the specific circumstances. It is important to adhere to these timelines, especially when pursuing a Massachusetts Change or Modification Agreement of Deed of Trust, to avoid delays in your legal proceedings.

To update a trust deed, you must prepare a new deed that incorporates the changes you want to make. This new deed should be executed according to Massachusetts law and recorded in the appropriate registry of deeds. Using a Massachusetts Change or Modification Agreement of Deed of Trust can streamline this process and ensure compliance with legal requirements.

Yes, a trust agreement can be changed through a process known as amendment. To make changes, you typically need to draft a written amendment that clearly outlines the modifications. This is particularly relevant when dealing with a Massachusetts Change or Modification Agreement of Deed of Trust, as it ensures that all parties involved are aware of the new terms.

Yes, a trustee can amend a trust deed if the trust document grants them that authority. The trustee must act in the best interests of the beneficiaries and ensure that any changes comply with relevant laws. If you are looking for guidance on a Massachusetts Change or Modification Agreement of Deed of Trust, consider seeking assistance from legal resources.

To modify a trust deed, you typically need to draft a formal amendment that outlines the changes you wish to make. It is essential to follow state laws and the original trust's terms when making these modifications. Using a platform like USLegalForms can simplify the process of creating a Massachusetts Change or Modification Agreement of Deed of Trust.

Irrevocable trusts cannot be changed or modified without the consent of the beneficiaries. Once established, the terms are set in stone, and the creator cannot alter them. If you are considering a Massachusetts Change or Modification Agreement of Deed of Trust, it is crucial to ensure that you are working with a trust that allows for modifications.

A modification of a deed of trust is a legal process that alters the terms of an existing deed of trust. This might include changes to the interest rate, payment schedule, or any other significant terms. Understanding the Massachusetts Change or Modification Agreement of Deed of Trust can help you navigate these adjustments effectively.

In Massachusetts, a codicil does not necessarily need to be notarized to be valid. However, having it notarized can provide an additional layer of authenticity and help avoid disputes in the future. If you're dealing with a Massachusetts Change or Modification Agreement of Deed of Trust, it's wise to consider notarization for clarity and legal protection.