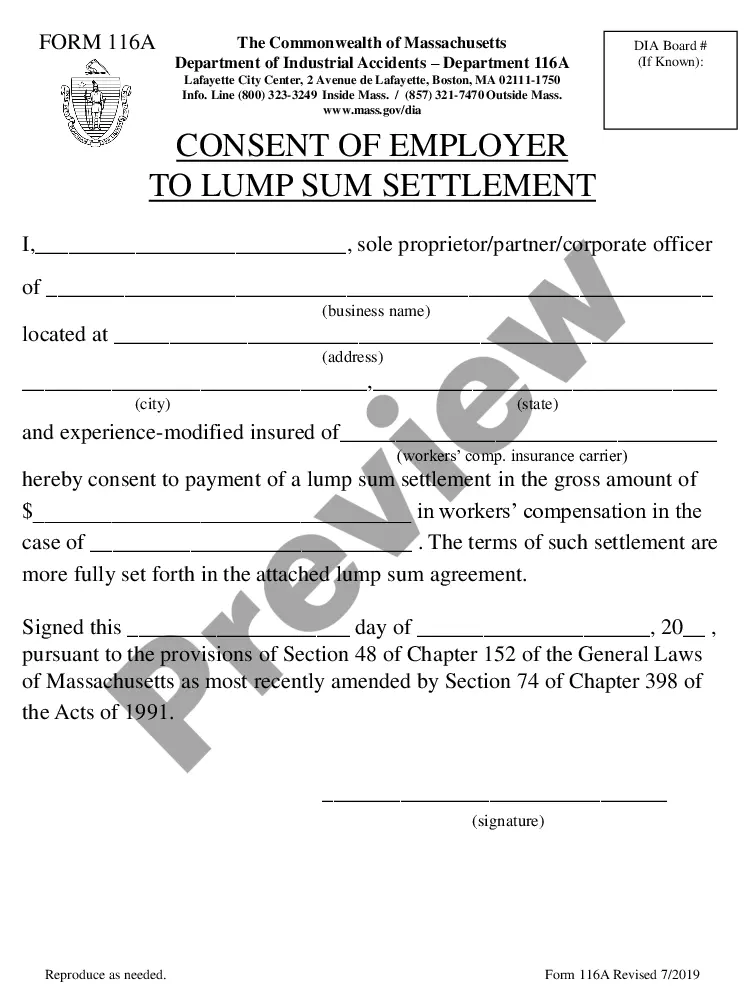

Massachusetts Consent of Employer To Lump Sum Settlement is an agreement between an employer and employee that allows the employee to receive their wages in a single lump sum payment rather than the traditional bi-weekly or monthly paycheck. This type of settlement is typically used when an employee terminates their employment or retires. There are two types of Massachusetts Consent of Employer To Lump Sum Settlement: voluntary and involuntary. Voluntary is when the employer and employee mutually agree to the settlement and the employee will receive the lump sum payment in lieu of their remaining wages. Involuntary is when the employer terminates the employee's employment and the employee is entitled to the lump sum payment in lieu of the wages they would have earned had their employment continued. Both types of Massachusetts Consent of Employer To Lump Sum Settlement require the employer to provide the employee with documentation of the agreement, including the amount of the lump sum payment, the date of payment, and the reason for the agreement.

Massachusetts Consent of Employer To Lump Sum Settlement

Description

How to fill out Massachusetts Consent Of Employer To Lump Sum Settlement?

If you are seeking a method to correctly prepare the Massachusetts Employer Consent for Lump Sum Settlement without engaging a legal advisor, then you are in the right place.

US Legal Forms has established itself as the most comprehensive and trustworthy collection of formal templates for every personal and commercial circumstance.

Another significant benefit of US Legal Forms is that you will never misplace the documents you obtained - you can locate any of your downloaded templates in the My documents section of your profile whenever needed.

- Ensure that the document you view on the page aligns with your legal circumstances and state regulations by reviewing its text description or exploring the Preview mode.

- Enter the document title in the Search tab at the top of the page and select your state from the dropdown to find an alternative template if there are any discrepancies.

- Conduct a repeat of the content verification and click Buy now when you are assured of the documents' compliance with all the stipulations.

- Log in to your account and click Download. Register for the service and choose a subscription plan if you have not done so yet.

- Utilize your credit card or the PayPal option to acquire your US Legal Forms subscription. The blank will be ready for download immediately afterward.

- Select the format in which you wish to receive your Massachusetts Employer Consent for Lump Sum Settlement and download it by clicking the corresponding button.

- Upload your template to an online editor to complete and sign it quickly or print it to prepare your physical copy manually.

Form popularity

FAQ

Companies with one or more employees are required to buy workers' compensation insurance. Even companies who employ only family members are still required to have coverage. Sole-Proprietors and Partners are excluded from coverage, but they can elect to be covered on the policy form.

The Massachusetts Workers' Compensation Act requires you to cover all workers at all times, covering: Medical care for work-related injuries or illnesses. Partial wage replacement when your employees need time off to recover.

Can I be fired while I'm out on workers' compensation? Unless your union contract, or individual contract of hire, requires it, an employer doesn't have to hold your job open while you can't work due to an on-the-job injury.

Find your actual gross earnings, including overtime, bonuses, etc. divide this number by the number of weeks you worked at your job to compute your average weekly wage. Multiply that number by 60% (. 60) to come up with your approximate weekly compensation.

Case law in Massachusetts has held, generally, that compensation for an injury arising out of and in the course of employment does not extend to cover employees going to and coming from their work. This is referred to as the ?going-and-coming? rule. This rule bars recovery of workers' compensation benefits.

You need to suffer a work-related injury or illness, or be a dependent of a worker killed on the job, to get workers' compensation benefits. Workers' compensation pays medical bills related to the injury or illness, pays for lost wages, and in some cases provides vocational rehabilitation for workers who qualify.

Generally, the injured worker should receive their lump sum settlement within fourteen (14) days of the workers' compensation insurance company's receipt of the approved lump sum agreement. This general rule comes from Section 8 of the Massachusetts Workers' Compensation Act (M.G.L. c.

Up to 260 weeks or 5 years. However, you are entitled to 7 years of benefits when combining Temporary Total and Temporary Partial Disability. For example, if you receive 3 years of temporary total disability benefits, you cannot receive an additional 5 years of partial disability benefits.