Louisiana Required Governmental Forms of Assignment

Description

How to fill out Required Governmental Forms Of Assignment?

Are you presently in a place that you need to have papers for possibly company or individual purposes almost every working day? There are a lot of legal file layouts available on the net, but locating ones you can trust is not easy. US Legal Forms gives a huge number of develop layouts, like the Louisiana Required Governmental Forms of Assignment, which can be published in order to meet federal and state needs.

In case you are previously familiar with US Legal Forms web site and get a free account, basically log in. Afterward, you are able to obtain the Louisiana Required Governmental Forms of Assignment format.

Should you not provide an bank account and wish to begin to use US Legal Forms, follow these steps:

- Find the develop you need and make sure it is for the right metropolis/state.

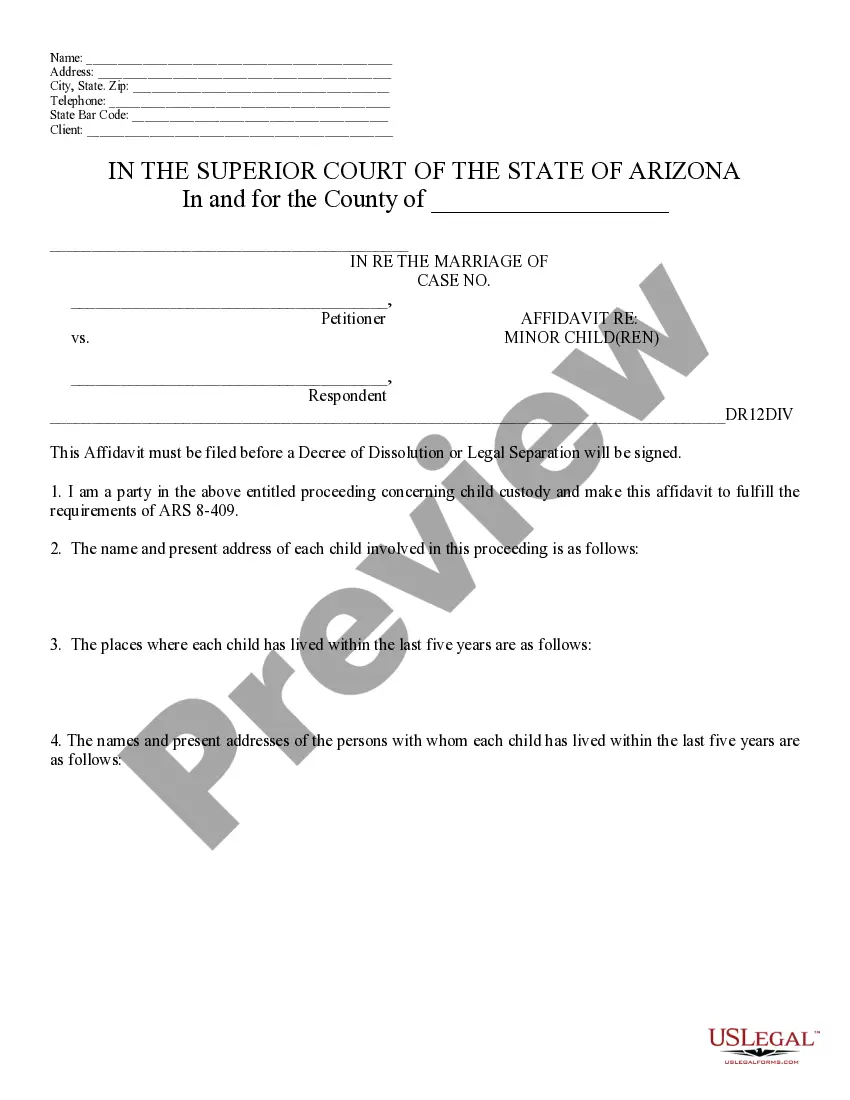

- Use the Preview option to analyze the form.

- See the information to actually have selected the correct develop.

- When the develop is not what you`re trying to find, take advantage of the Search area to get the develop that meets your requirements and needs.

- Once you get the right develop, simply click Acquire now.

- Opt for the rates strategy you want, submit the desired information and facts to produce your account, and purchase your order with your PayPal or Visa or Mastercard.

- Choose a handy file format and obtain your version.

Get each of the file layouts you have purchased in the My Forms food list. You can get a more version of Louisiana Required Governmental Forms of Assignment whenever, if needed. Just select the necessary develop to obtain or produce the file format.

Use US Legal Forms, one of the most substantial assortment of legal forms, to save lots of efforts and stay away from faults. The assistance gives expertly created legal file layouts that you can use for an array of purposes. Produce a free account on US Legal Forms and initiate producing your daily life a little easier.

Form popularity

FAQ

State government in Louisiana is comprised of three coordinate and coequal branches, namely the executive, legislative, and judicial branches. The constitution and laws of the state distribute the powers of state government among the three branches.

"The executive branch shall consist of the governor, lieutenant governor, secretary of state, attorney general, treasurer, commissioner of agriculture, commissioner of insurance, superintendent of education, commissioner of elections, and all other executive offices...of the state."

There are a lot of things Louisiana is known for: its delicious food, the party atmosphere, its French influence, and oddly enough, its legal system. While every other state uses Common Law, derived from English law, Louisiana uses French Civil Law, which is derived from the Napoleonic Code.

Forms of City and Town Government The powers of city government are distributed among three separate branches: legislative, executive, and judicial, as shown in the table below, along with state and federal equivalents.

State government in Louisiana is comprised of three coordinate and coequal branches, namely the executive, legislative, and judicial branches. The constitution and laws of the state distribute the powers of state government among the three branches.

Louisiana has three branches of government: legislative, executive and judicial. Louisiana's Legislature is composed of a Senate with 39 members and a House of Representatives with 105 members. Members of both houses are elected to four-year terms.

To ensure a separation of powers, the U.S. Federal Government is made up of three branches: legislative, executive and judicial. To ensure the government is effective and citizens' rights are protected, each branch has its own powers and responsibilities, including working with the other branches.

You can easily change your Louisiana LLC name. The first step is to file a form called the Name Change Amendment with the Secretary of State and wait for it to be approved. This is how you officially change your LLC name in Louisiana. The filing fee for a Name Change Amendment in Louisiana is $100.