Louisiana Self-Employed Seamstress Services Contract

Description

How to fill out Self-Employed Seamstress Services Contract?

Are you currently in a situation where you require documentation for either business or personal reasons almost constantly.

There are numerous legitimate document templates available online, but finding versions you can trust is not simple.

US Legal Forms offers thousands of form templates, such as the Louisiana Self-Employed Seamstress Services Contract, that are designed to comply with federal and state regulations.

Once you find the right form, click Get now.

Select the pricing plan you need, fill out the required information to create your account, and complete the transaction using your PayPal or credit card. Choose a convenient document format and download your copy. Access all the document templates you have purchased in the My documents section. You can obtain another copy of the Louisiana Self-Employed Seamstress Services Contract at any time if needed. Just click the required form to download or print the document template. Utilize US Legal Forms, the most comprehensive collection of legal forms, to save time and avoid mistakes. The service provides professionally crafted legal document templates that you can use for various purposes. Create an account on US Legal Forms and start simplifying your life.

- If you are already familiar with the US Legal Forms website and have an account, simply Log In.

- After that, you can download the Louisiana Self-Employed Seamstress Services Contract template.

- If you do not have an account and wish to start using US Legal Forms, follow these steps.

- Obtain the form you need and ensure it is for the correct city/area.

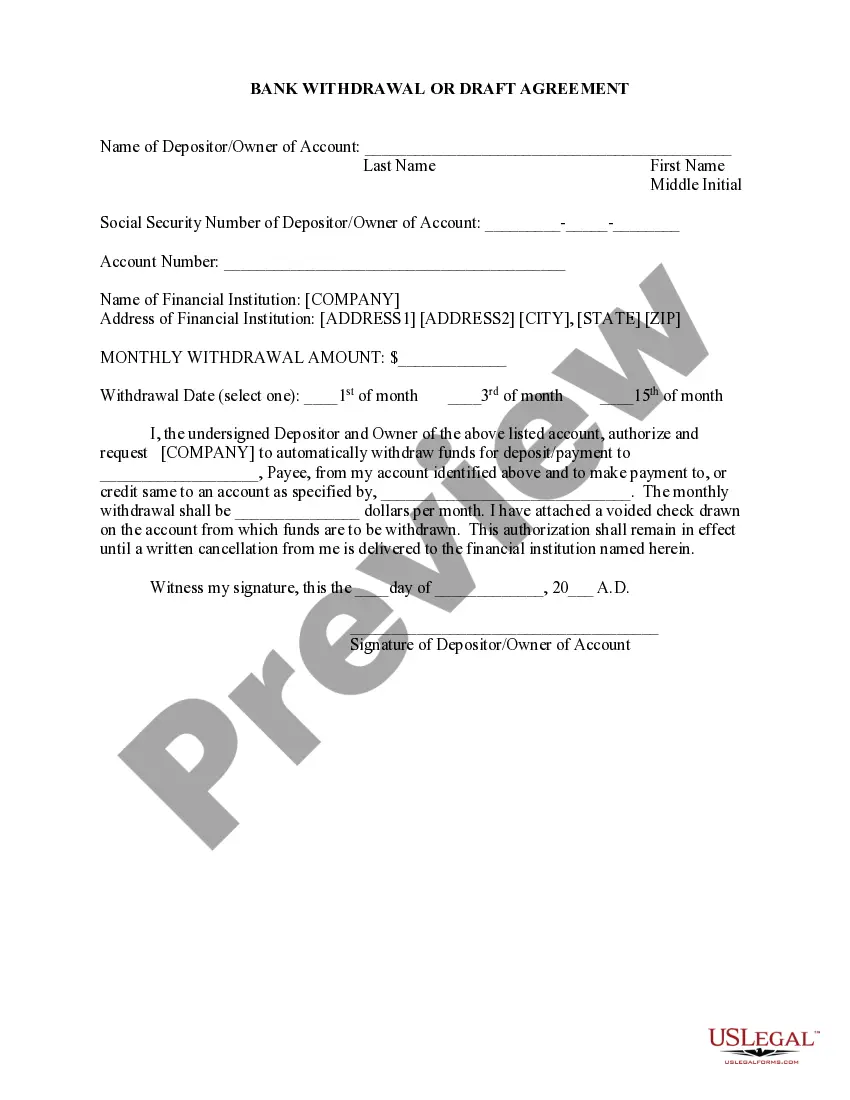

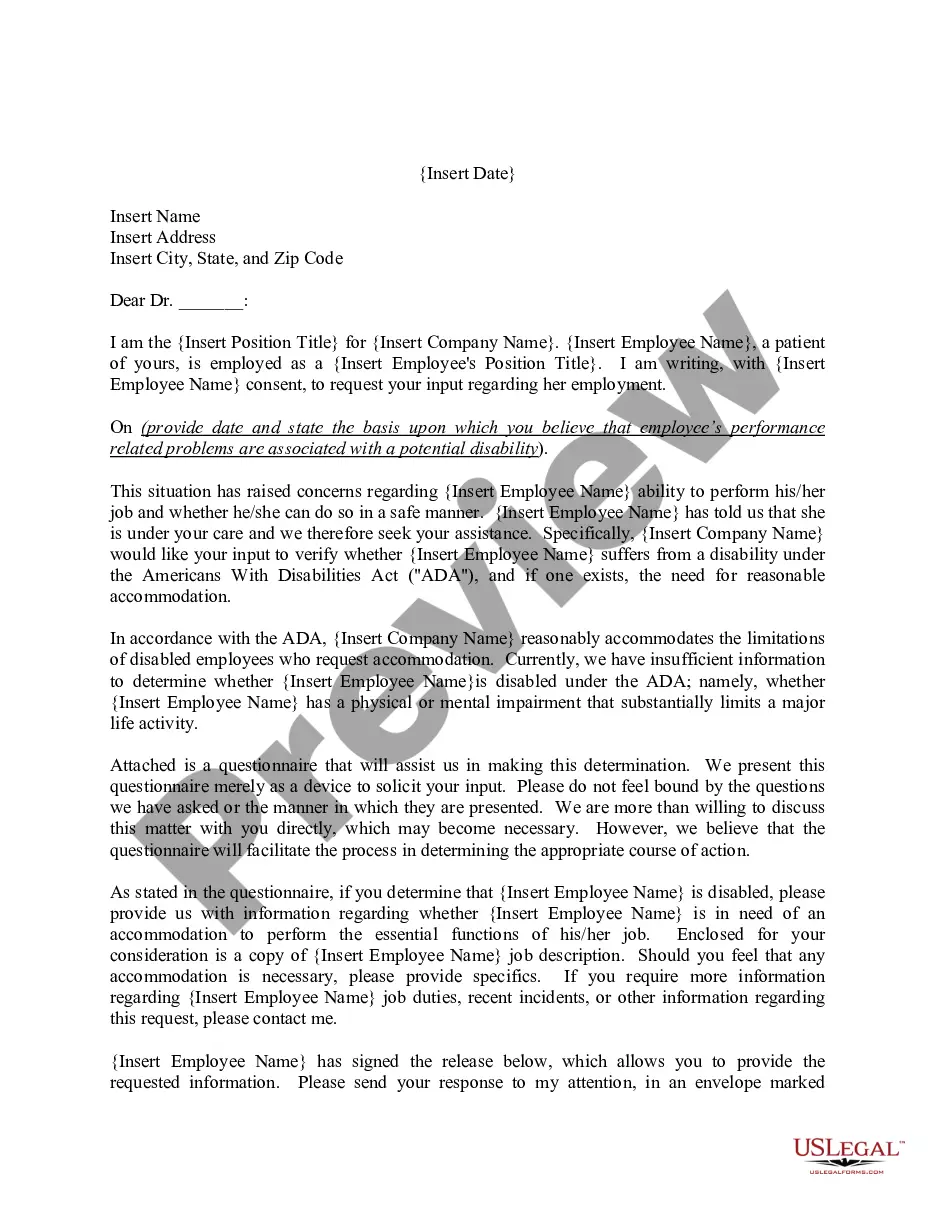

- Utilize the Review button to examine the form.

- Read the description to make sure you have selected the correct form.

- If the form is not what you are looking for, use the Search section to find the form that fits your needs.

Form popularity

FAQ

The two contract theory in Louisiana refers to the idea that a contractor may enter into two distinct agreements: one for labor and another for materials. This theory can affect how contracts, such as the Louisiana Self-Employed Seamstress Services Contract, are enforced. Understanding this theory helps ensure clarity in your agreements and protects your rights as a self-employed professional. For comprehensive guidance, consider using resources like uslegalforms to create your contracts effectively.

Yes, if you plan to engage in contracting work that exceeds $75,000, a license is required in Louisiana. This applies regardless of the type of contract you are working under, including a Louisiana Self-Employed Seamstress Services Contract. It is important to be well-informed about the licensing requirements to avoid any legal complications while running your business.

In Louisiana, you can complete projects worth up to $75,000 without needing a contractor's license. However, if your work exceeds this amount, you'll need to obtain the appropriate licensing. For self-employed seamstresses, understanding the limits of your work is essential when drafting your Louisiana Self-Employed Seamstress Services Contract. This ensures you remain compliant while providing valuable services.

While an operating agreement is not legally required for an LLC in Louisiana, it is highly recommended. An operating agreement outlines the management structure and operational procedures of the LLC, providing clarity and preventing disputes among members. For those offering Louisiana Self-Employed Seamstress Services, having a well-drafted operating agreement can enhance professionalism and establish clear expectations.

For a Louisiana Self-Employed Seamstress Services Contract to be legally binding, three crucial requirements must be satisfied. First, there must be mutual agreement on the terms, known as offer and acceptance. Second, both parties must have the legal capacity to enter into the contract. Lastly, there must be consideration, demonstrating that something of value is exchanged between the parties involved.

The 3 P's of a Louisiana Self-Employed Seamstress Services Contract stand for Parties, Purpose, and Payment. The Parties refer to the individuals or entities entering into the contract. The Purpose outlines the specific obligations and services to be provided, clearly defining what each party is agreeing to. Lastly, Payment details the consideration exchanged, ensuring both parties understand their financial responsibilities.

In order for a Louisiana Self-Employed Seamstress Services Contract to be valid, three basic requirements must be met. First, there must be an offer made by one party. Second, this offer must be accepted by the other party without any modifications. Finally, both parties must exchange something of value, known as consideration, which solidifies the agreement and makes it enforceable.

The three primary elements of a legally binding Louisiana Self-Employed Seamstress Services Contract include offer, acceptance, and consideration. The first element involves one party proposing terms to another. The second element is the acceptance of those terms by the other party, indicating their agreement. Lastly, consideration refers to the value exchanged between the parties, which is crucial for the contract's validity.

A legally binding Louisiana Self-Employed Seamstress Services Contract requires several key components. Both parties must agree to the terms, which involves mutual consent. Additionally, the subject matter of the contract must be legal and clearly defined. It is also essential that both parties have the legal capacity to enter into the agreement and that the contract includes consideration, making it enforceable in court.

To create a Louisiana Self-Employed Seamstress Services Contract, you need six essential elements. First, there must be an offer made by one party. Next, the other party must accept that offer. Then, both parties need to provide consideration, which is something of value exchanged between them. Additionally, the parties must have the legal capacity to contract, and the contract must have a lawful purpose. Finally, the agreement should be in a clear and concise written format.