Louisiana Self-Employed Independent Welder Services Contract

Description

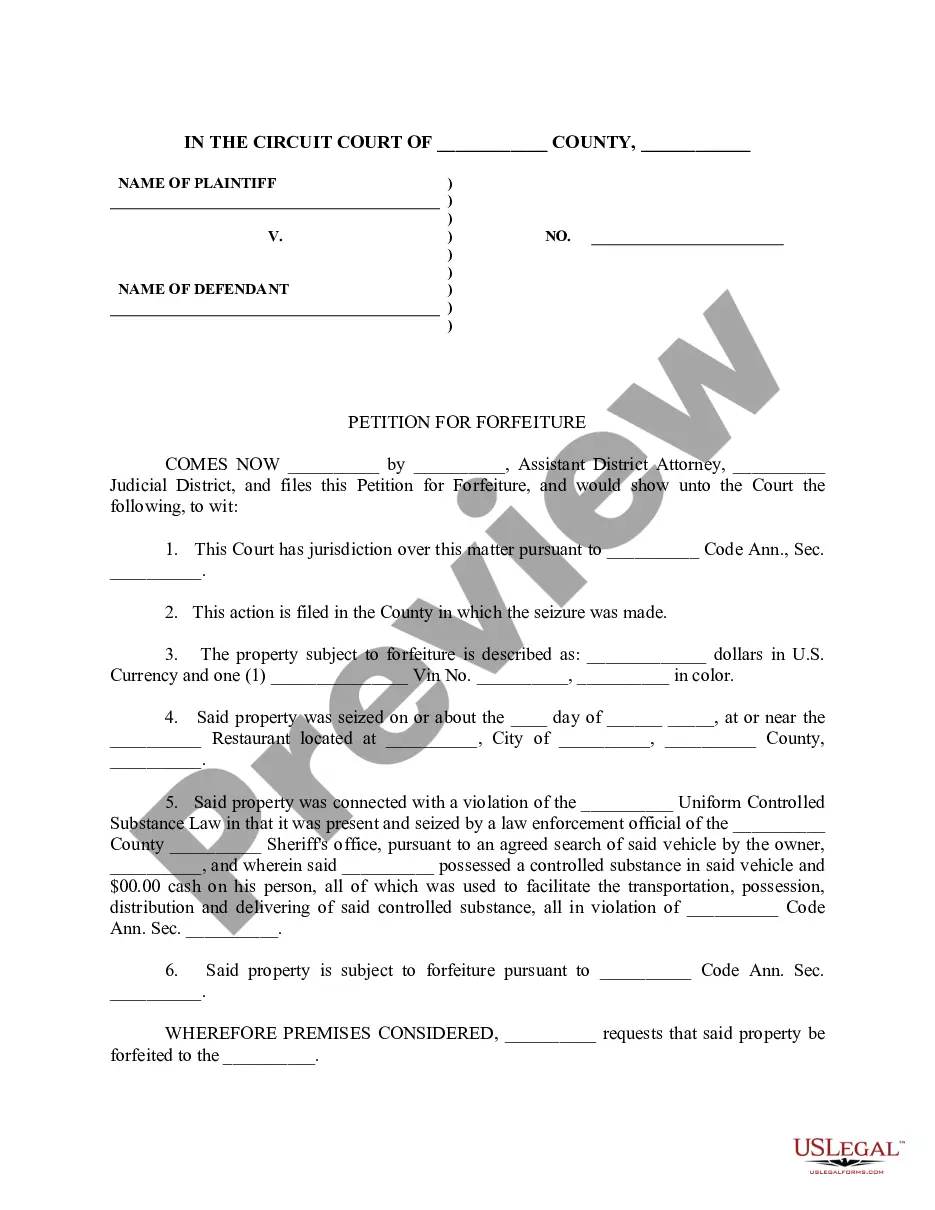

How to fill out Self-Employed Independent Welder Services Contract?

If you need to obtain, acquire or print valid document templates, utilize US Legal Forms, the largest collection of legal forms available online.

Use the site's intuitive and user-friendly search feature to locate the documents you require.

Numerous templates for business and personal purposes are organized by categories and states, or keywords.

Step 3. If you are dissatisfied with the type, utilize the Search area at the top of the screen to find other variations of the legal form template.

Step 4. Once you have found the form you desire, select the Get Now option. Choose your preferred pricing plan and enter your information to sign up for an account.

- Employ US Legal Forms to find the Louisiana Self-Employed Independent Welder Services Contract with just a few clicks.

- If you are already a US Legal Forms customer, Log In to your account and click the Download option to access the Louisiana Self-Employed Independent Welder Services Contract.

- You can also retrieve forms you previously downloaded from the My documents tab of your account.

- If this is your first time using US Legal Forms, please follow the instructions below.

- Step 1. Ensure you have chosen the form for the correct city/state.

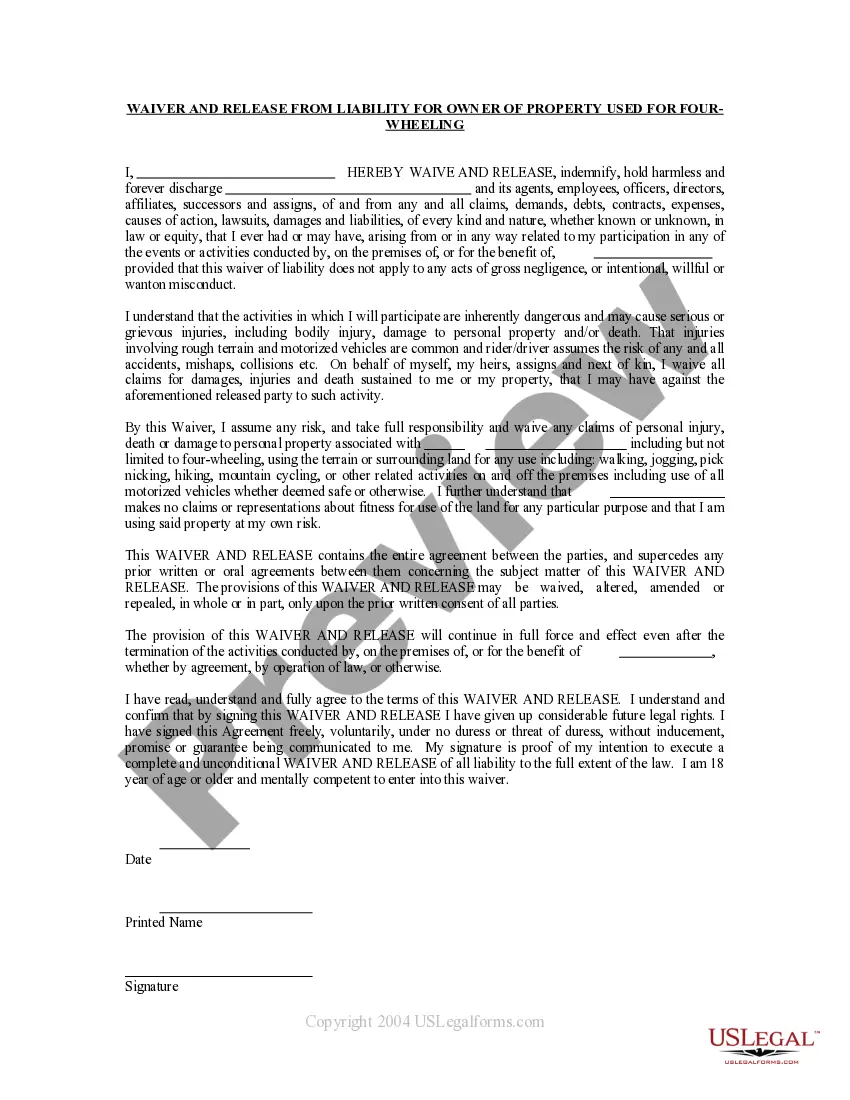

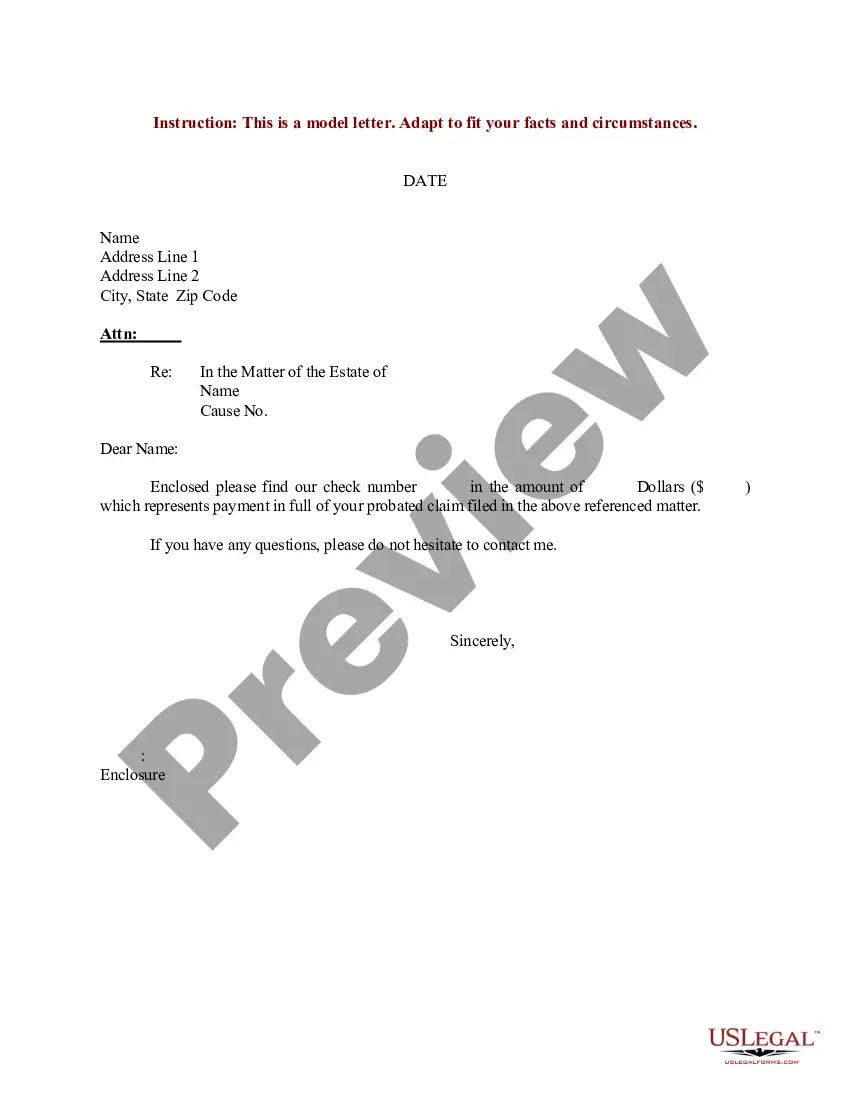

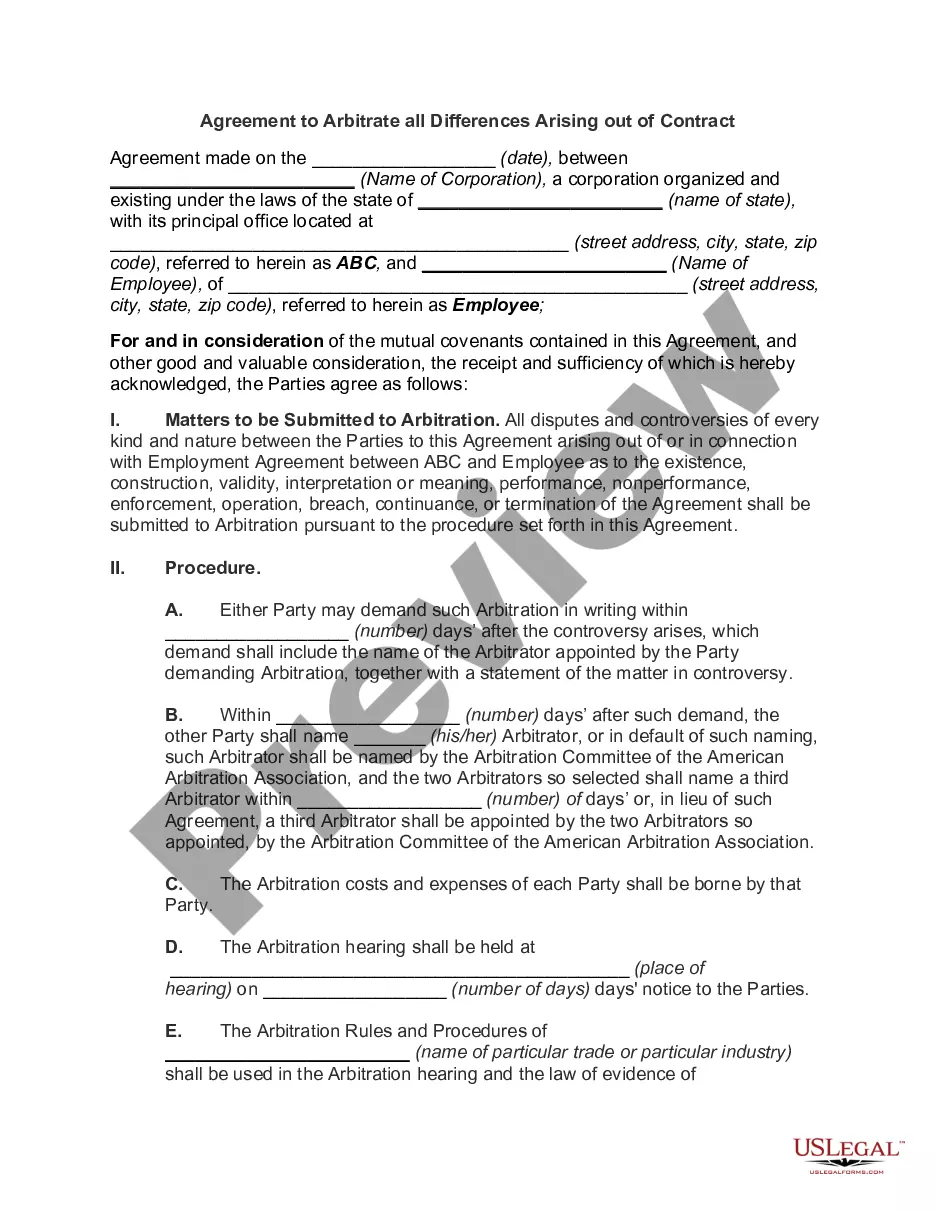

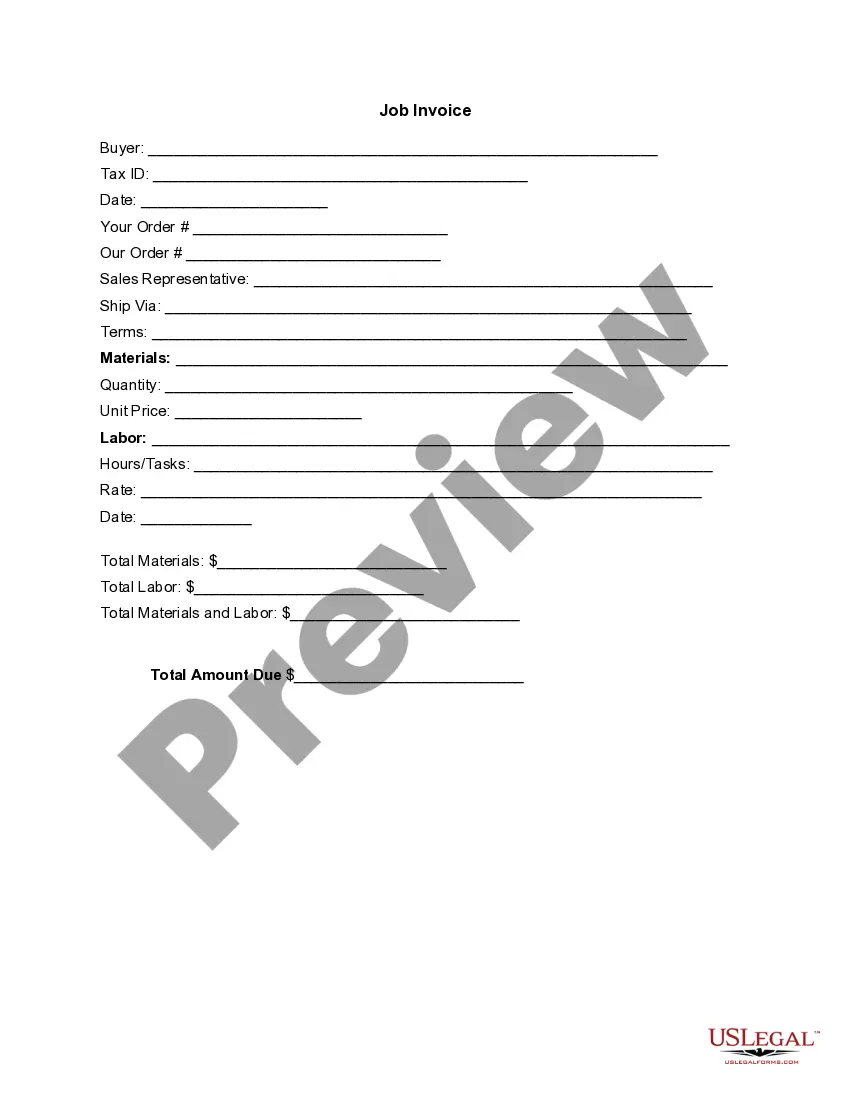

- Step 2. Use the Preview feature to review the form’s content. Don't forget to read the description.

Form popularity

FAQ

Self-employment income is income that arises from the performance of personal services, but which cannot be classified as wages because an employer-employee relationship does not exist between the payer and the payee.

Independent contractors report their income on Schedule C (Form 1040), Profit or Loss from Business (Sole Proprietorship). Also file Schedule SE (Form 1040), Self-Employment Tax if net earnings from self-employment are $400 or more.

Remember that an independent contractor is considered to be self-employed, so in effect, you are running your own one-person business. Any income that you earn as an independent contractor must be reported on Schedule C. You'll then pay income taxes on the total profit.

How Do You Become Self-Employed?Think of a Name for Your Self-Employed Business. Consider what services you will offer, and then pick a name that describes what you do.Choose a Self-Employed Business Structure and Get a Proper License.Open a Business Bank Account.Advertise Your Independent Contractor Services.

If you choose to pay yourself as a contractor, you need to file IRS Form W-9 with the LLC and the LLC will file an IRS Form 1099-MISC at the end of the year. You will be responsible for paying self-employment taxes on the amount earned.

Simply put, being an independent contractor is one way to be self-employed. Being self-employed means that you earn money but don't work as an employee for someone else.

Independent contractors are self-employed workers who provide services for an organisation under a contract for services. Independent contractors are not employees and are typically highly skilled, providing their clients with specialist skills or additional capacity on an as needed basis.

Becoming an independent contractor is one of the many ways to be classified as self-employed. By definition, an independent contractor provides work or services on a contractual basis, whereas, self-employment is simply the act of earning money without operating within an employee-employer relationship.

If you are an independent contractor, then you are self-employed. The earnings of a person who is working as an independent contractor are subject to self-employment tax. To find out what your tax obligations are, visit the Self-Employed Individuals Tax Center.

A 1099 employee is a US self-employed worker that reports their income to the IRS on a 1099 tax form. Freelancers, gig workers, and independent contractors are all considered 1099 employees. In contrast, actual company employees are considered W-2 employees.