Louisiana Leasehold Interest Workform

Description

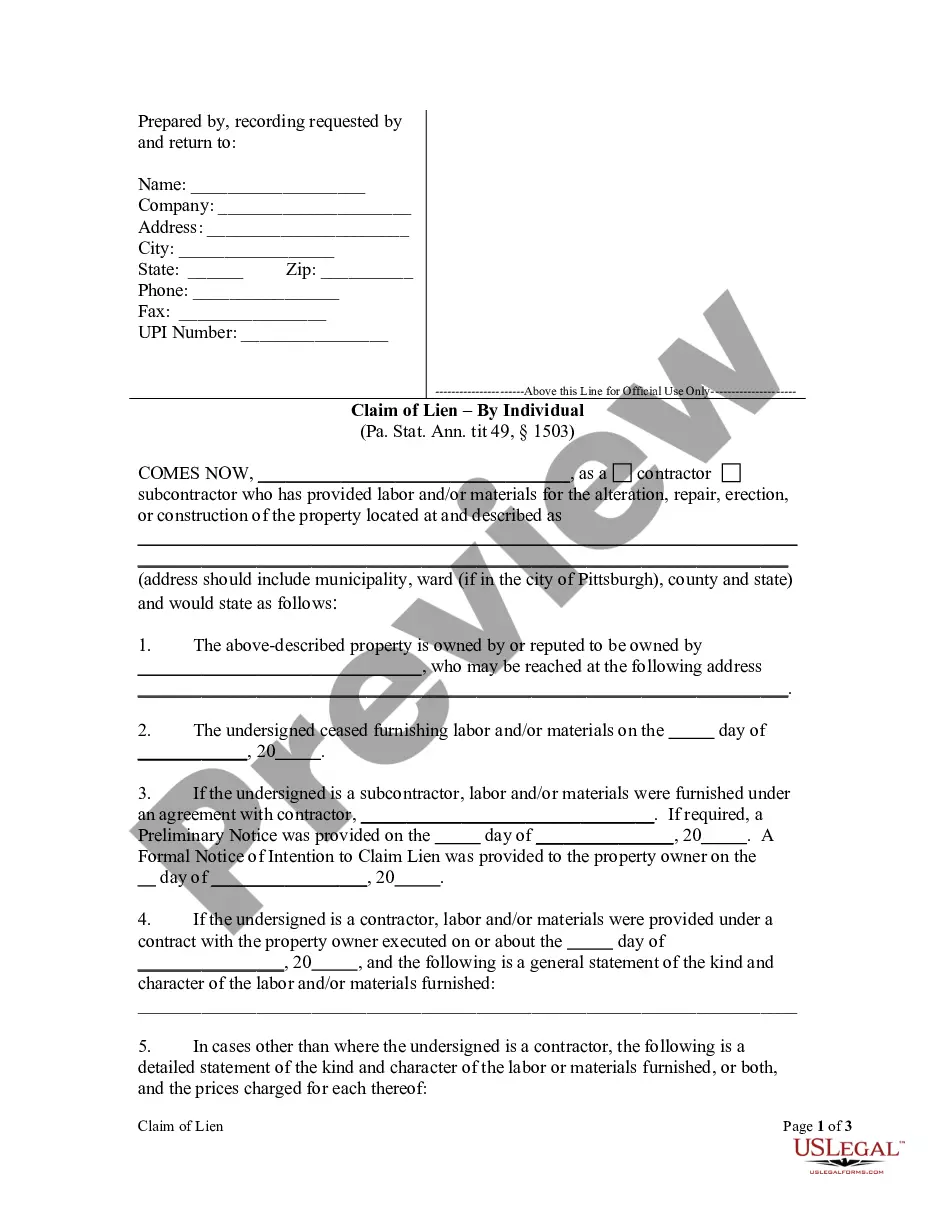

How to fill out Leasehold Interest Workform?

If you wish to finalize, acquire, or generate legal documentation templates, utilize US Legal Forms, the most extensive compilation of legal documents available online.

Take advantage of the website's user-friendly and convenient search feature to find the documents you need.

A range of templates for business and personal purposes are organized by categories and states, or keywords.

Step 4. Once you have found the form you desire, click the Get now button. Select the pricing plan you prefer and enter your details to register for the account.

Step 5. Complete the payment. You can use your credit card or PayPal account to finalize the transaction.

- Use US Legal Forms to find the Louisiana Leasehold Interest Workform in just a few clicks.

- If you are already a US Legal Forms member, Log In to your account and click the Download button to access the Louisiana Leasehold Interest Workform.

- You can also retrieve forms you have previously downloaded from the My documents section of your account.

- If you are using US Legal Forms for the first time, adhere to the following instructions.

- Step 1. Confirm that you have chosen the appropriate form for your specific city/state.

- Step 2. Utilize the Preview option to review the form’s details. Remember to verify the information.

- Step 3. If you are not satisfied with the form, make use of the Search box at the top of the page to locate other versions of the legal document format.

Form popularity

FAQ

An owner grants a leasehold interest on the land when they retain ownership of the property while allowing a tenant to use it. This arrangement typically occurs in commercial settings or residential developments. The Louisiana Leasehold Interest Workform facilitates this process, outlining the responsibilities and rights of both parties. Always review your lease agreement carefully to understand the terms involved.

Yes, you can mortgage a leasehold interest, but it comes with specific regulations. When using the Louisiana Leasehold Interest Workform, lenders may require additional documentation to secure the mortgage. It's crucial to ensure that the terms of your lease agreement allow for refinancing or mortgaging the leasehold interest. Make sure to consult with a property attorney for clarity on your particular situation.

An example of a leasehold interest is when a business rents commercial space for a specified time under a lease agreement. The business has the right to operate within that space and benefit from it during the lease term. Utilizing the Louisiana Leasehold Interest Workform helps document this arrangement, ensuring that both the landlord and tenant understand their rights and obligations.

A tenant's leasehold interest coverage describes the protection of the tenant's legal rights during the lease term. This coverage allows tenants to retain their rights to use the property, even if the property changes hands. Implementing the Louisiana Leasehold Interest Workform can help define this coverage explicitly, providing peace of mind for all parties involved.

Transferring a leasehold interest typically involves a formal agreement between the current tenant and the new tenant. This process usually requires notifying the property owner and may involve submitting the Louisiana Leasehold Interest Workform to document the transfer. Following these steps ensures a smooth transition and maintains legal clarity.

The tenant's interest in the leased property is often referred to as a leasehold interest. This designation signifies the legal rights a tenant has to possess and use the property for an agreed period. By using the Louisiana Leasehold Interest Workform, tenants can accurately outline and protect these interests.

A leasehold tenant typically holds a temporary interest in real property. This interest allows tenants to occupy and use the property as specified in their lease agreement. Utilizing the Louisiana Leasehold Interest Workform helps clarify this interest, ensuring all parties understand their rights.

Leasehold interest coverage refers to the rights and benefits a tenant enjoys under a rental agreement. It specifically protects the tenant's stake in the property for the duration of the lease. Understanding this concept is crucial when using the Louisiana Leasehold Interest Workform, as it outlines your entitlements and responsibilities.

In Louisiana, the minimum income threshold to file taxes depends on your filing status and age. Generally, if your gross income exceeds a set limit, you need to file a return. The Louisiana Leasehold Interest Workform can guide you through the filing process, helping you determine whether you meet the filing requirement based on your income.

Louisiana Administrative Code 61 III 1519 addresses valuation standards for property tax assessments. Understanding these standards is vital for anyone managing leasehold interests in Louisiana. By leveraging the Louisiana Leasehold Interest Workform, you can more easily comply with these valuation requirements and ensure accurate tax filings.