Louisiana Sub-Advisory Agreement of Neuberger and Berman Management, Inc.

Description

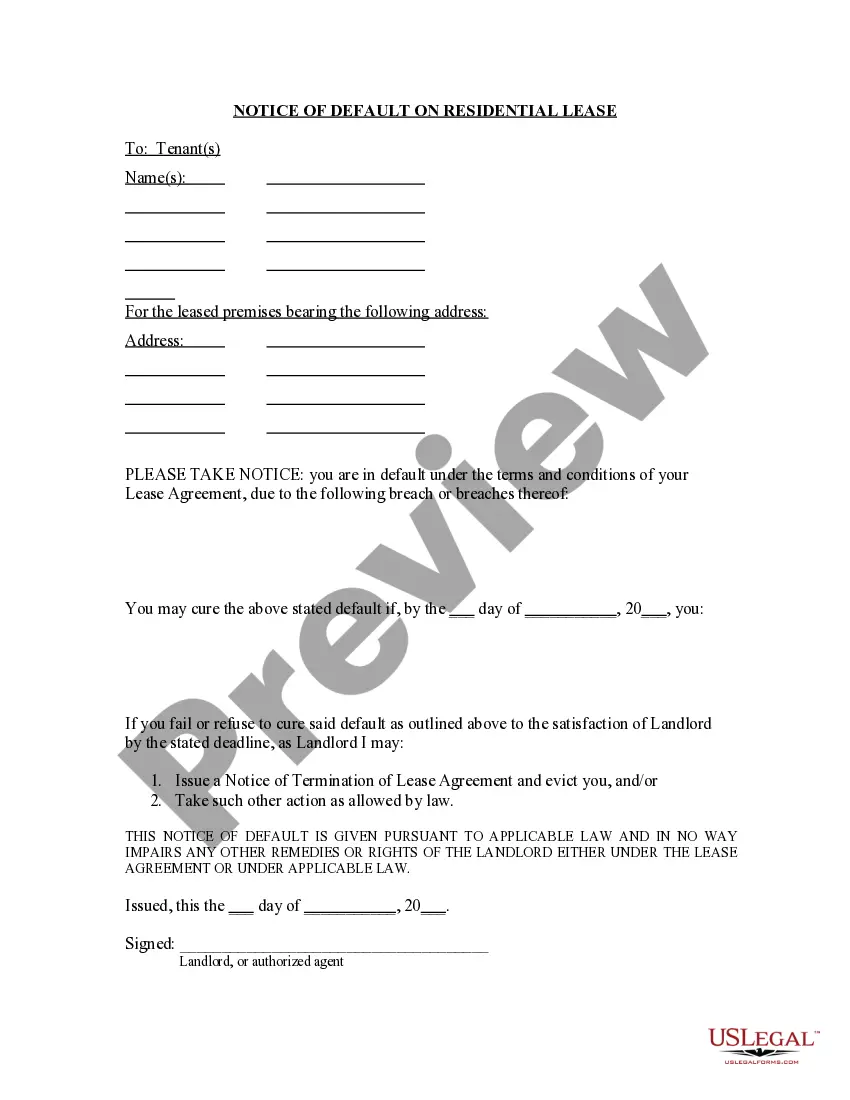

How to fill out Sub-Advisory Agreement Of Neuberger And Berman Management, Inc.?

If you want to total, download, or print authorized document themes, use US Legal Forms, the largest variety of authorized types, that can be found on-line. Use the site`s simple and practical look for to obtain the papers you need. Various themes for organization and individual uses are categorized by classes and claims, or keywords. Use US Legal Forms to obtain the Louisiana Sub-Advisory Agreement of Neuberger and Berman Management, Inc. within a few mouse clicks.

In case you are presently a US Legal Forms consumer, log in in your profile and then click the Download option to obtain the Louisiana Sub-Advisory Agreement of Neuberger and Berman Management, Inc.. You may also access types you previously delivered electronically within the My Forms tab of your respective profile.

If you use US Legal Forms the first time, refer to the instructions listed below:

- Step 1. Ensure you have selected the form for your proper metropolis/nation.

- Step 2. Utilize the Preview choice to check out the form`s content. Never overlook to see the outline.

- Step 3. In case you are not happy with all the type, take advantage of the Look for discipline towards the top of the monitor to find other types of your authorized type web template.

- Step 4. When you have discovered the form you need, select the Acquire now option. Select the pricing strategy you like and include your references to sign up to have an profile.

- Step 5. Method the financial transaction. You may use your charge card or PayPal profile to accomplish the financial transaction.

- Step 6. Find the structure of your authorized type and download it in your device.

- Step 7. Full, modify and print or indication the Louisiana Sub-Advisory Agreement of Neuberger and Berman Management, Inc..

Each and every authorized document web template you purchase is yours permanently. You possess acces to each type you delivered electronically inside your acccount. Click on the My Forms area and choose a type to print or download once more.

Contend and download, and print the Louisiana Sub-Advisory Agreement of Neuberger and Berman Management, Inc. with US Legal Forms. There are millions of skilled and status-certain types you can utilize for your personal organization or individual needs.

Form popularity

FAQ

For nine consecutive years, Neuberger Berman has been named first or second in Pensions & Investment's Best Places to Work in Money Management survey (among those with 1,000 employees or more). The firm manages $436 billion in client assets as of March 31, 2023.

NEUBERGER BERMAN BD LLC - Brokerage/Investment Adviser Firm.

With offices in 25 countries, Neuberger Berman's diverse team has over 2,400 professionals. For eight consecutive years, the company has been named first or second in Pensions & Investments Best Places to Work in Money Management survey (among those with 1,000 employees or more).

Neuberger Berman Group LLC is a private, independent, employee-owned investment management firm. The firm manages equities, fixed income, private equity and hedge fund portfolios for global institutional investors, advisors and high-net-worth individuals.

Neuberger Berman Group LLC is a private, independent, employee-owned investment management firm. The firm manages equities, fixed income, private equity and hedge fund portfolios for global institutional investors, advisors and high-net-worth individuals.

Neuberger Berman is a private, independent, employee-owned investment manager?a rare structure for a large asset management firm, almost all of which are either public or owned by other financial institutions.

Neuberger Berman is an experienced hedge fund solutions provider investing on behalf of institutional, high-net-worth and retail clients via registered liquid alternative funds, custom portfolios, and commingled products.

Neuberger Berman Group LLC is a private, independent, employee-owned investment management firm. The firm manages equities, fixed income, private equity and hedge fund portfolios for global institutional investors, advisors and high-net-worth individuals.

Neuberger Berman Group LLC has chosen J.P. Morgan Clearing Corp.

Neuberger Berman peak revenue was $2.8B in 2022. Neuberger Berman annual revenue for 2021 was 2.4B, 17.17% growth from 2020. Neuberger Berman annual revenue for 2022 was 2.8B, 17.35% growth from 2021.