Louisiana Employee Stock Option Plan of Manugistics Group, Inc.

Description

How to fill out Employee Stock Option Plan Of Manugistics Group, Inc.?

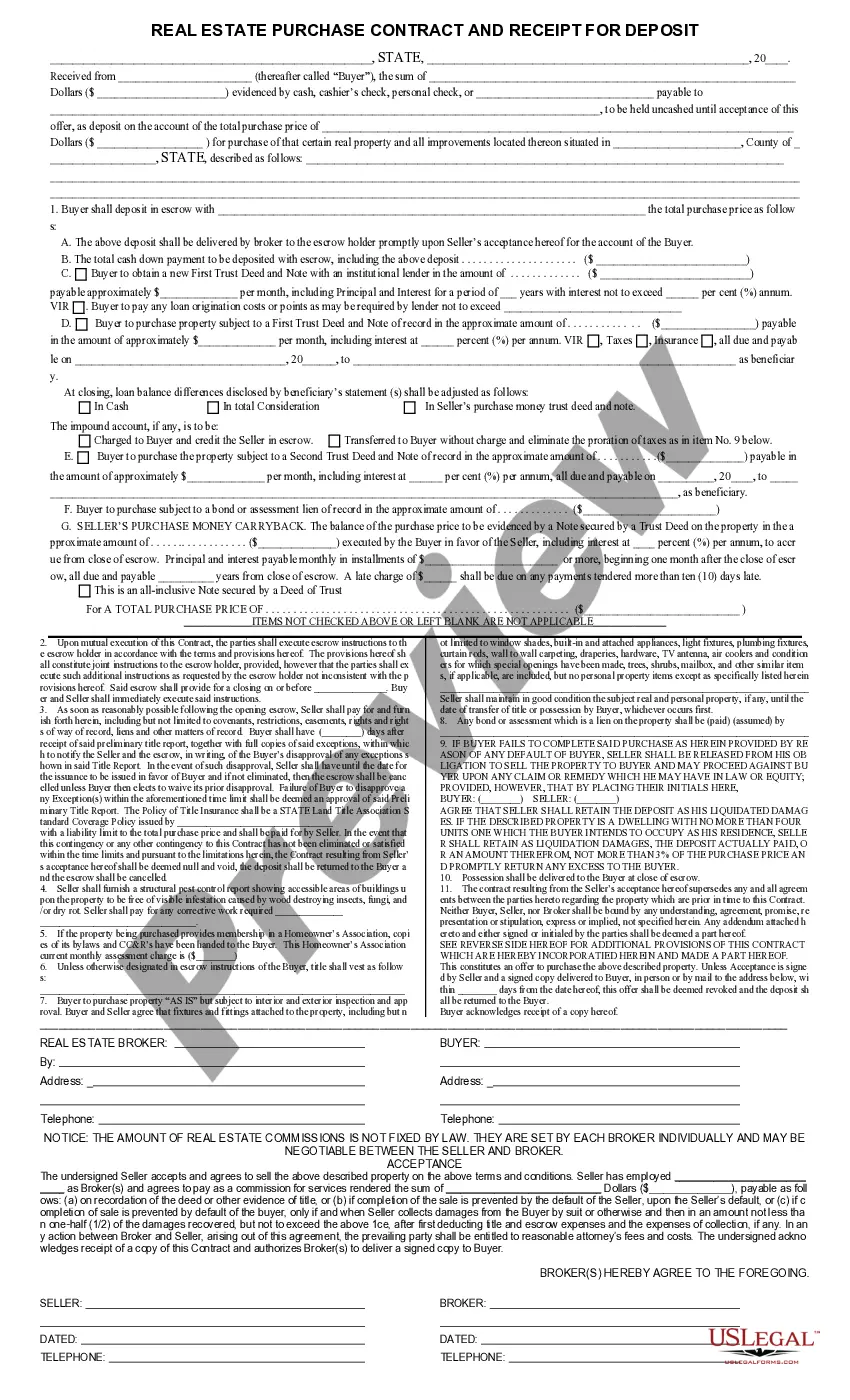

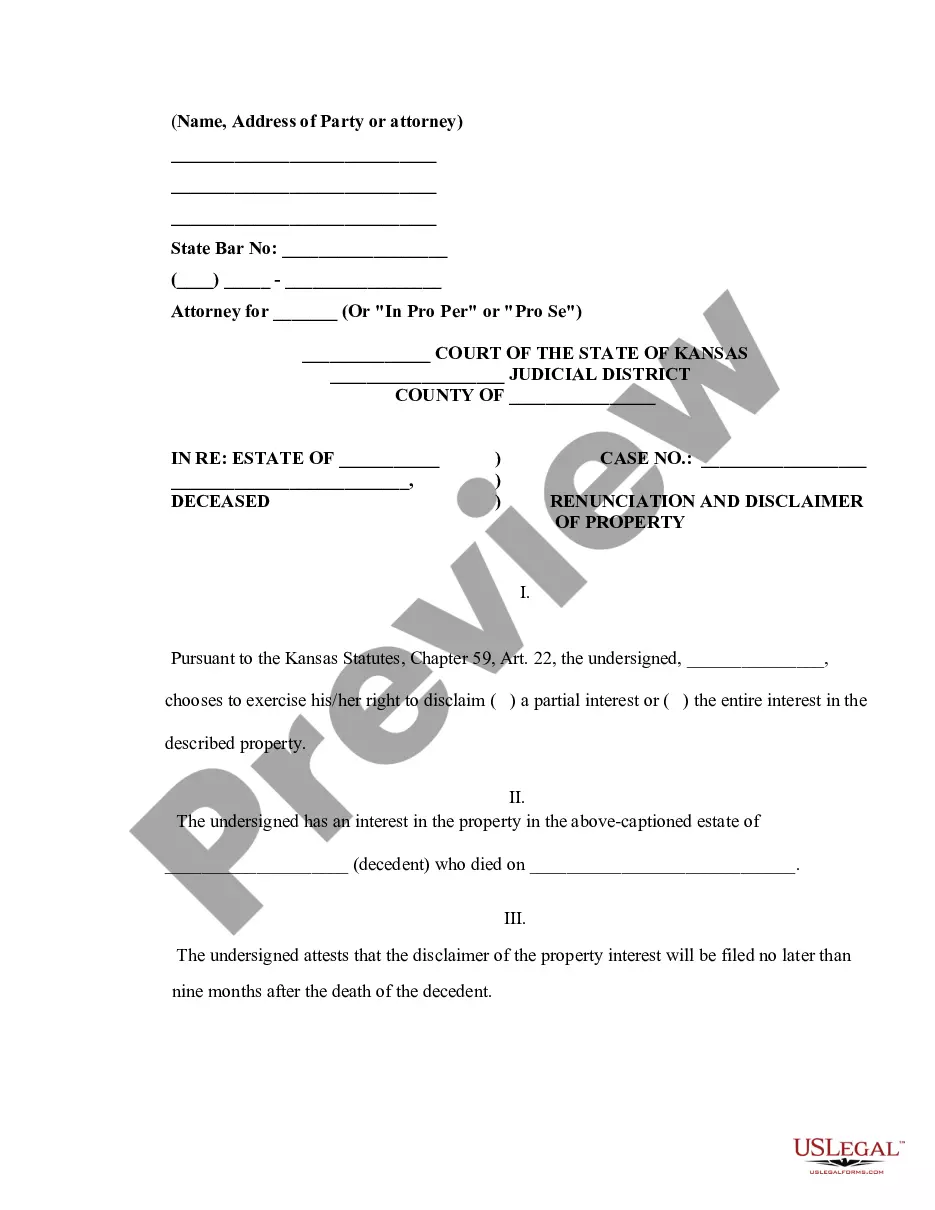

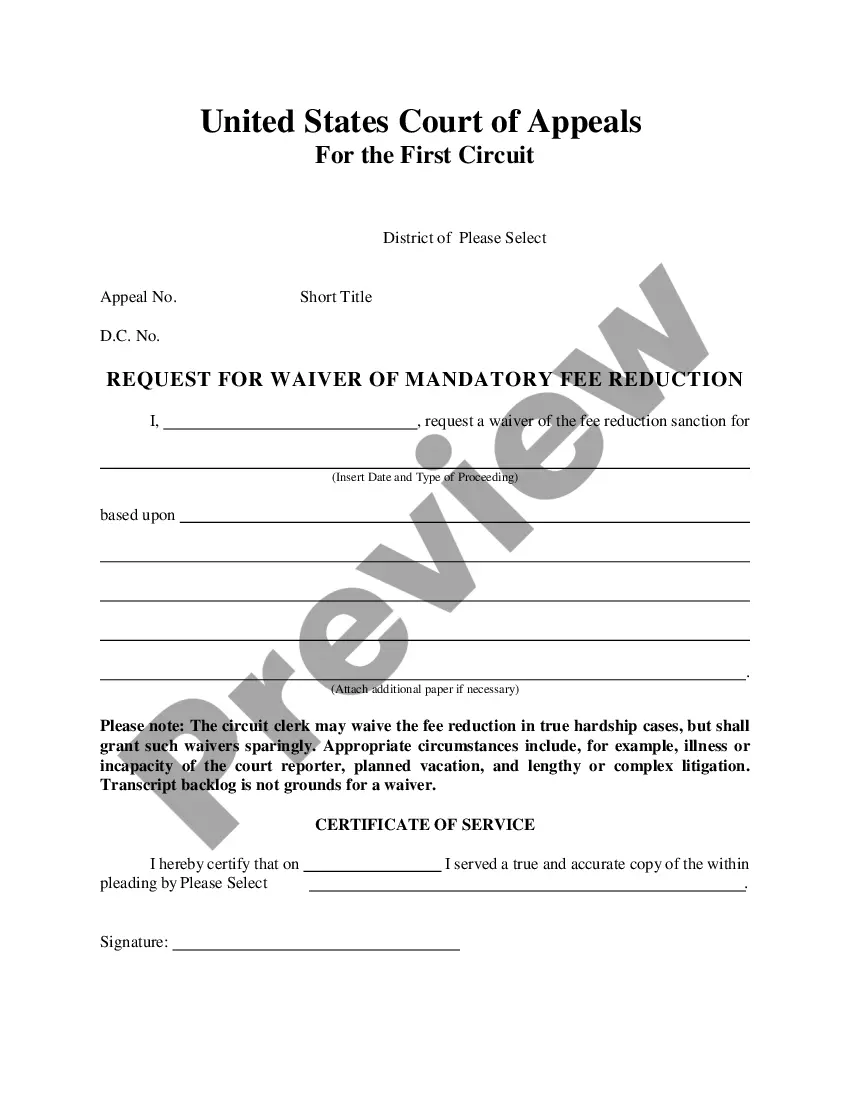

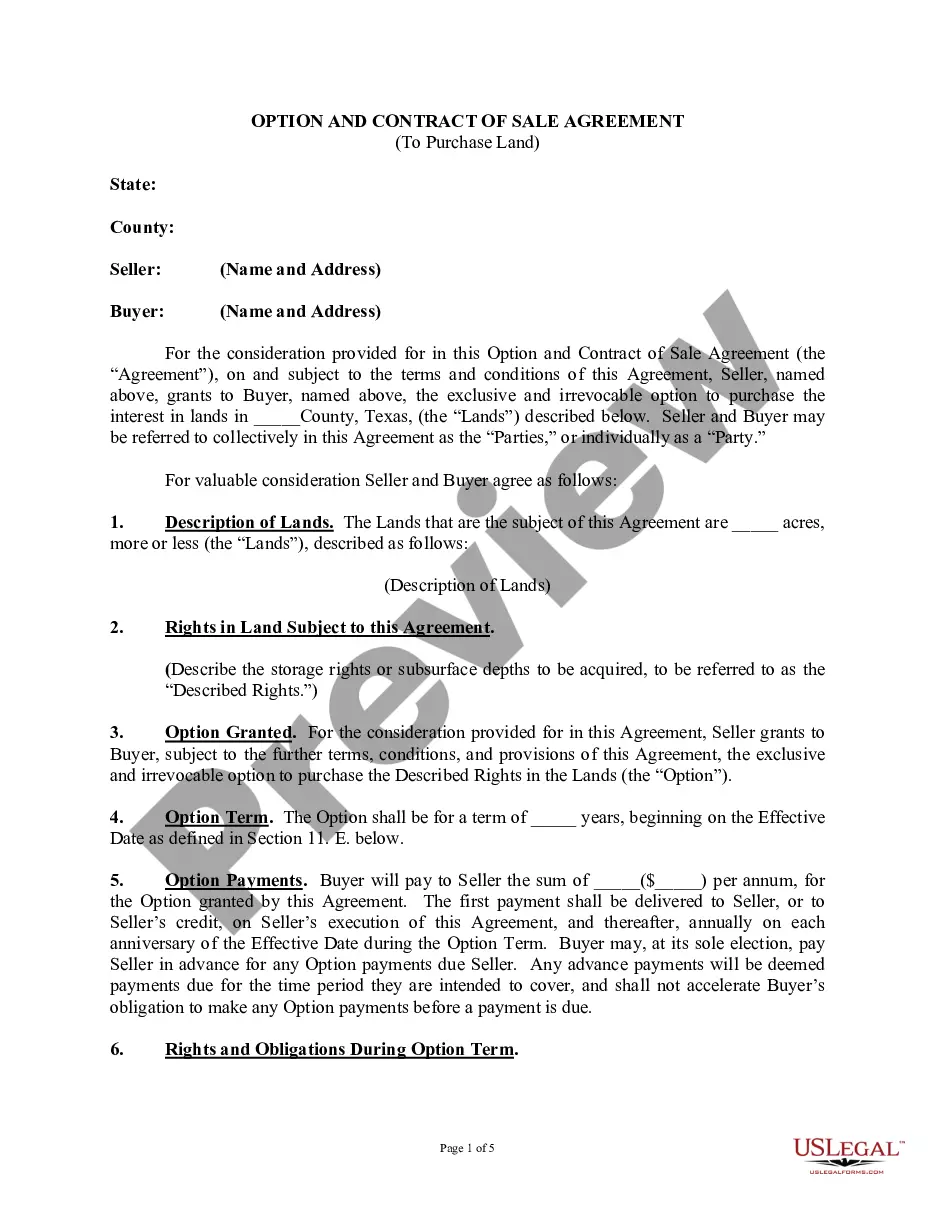

Choosing the best authorized papers web template might be a battle. Obviously, there are a lot of templates available on the net, but how would you find the authorized develop you require? Take advantage of the US Legal Forms site. The support provides 1000s of templates, including the Louisiana Employee Stock Option Plan of Manugistics Group, Inc., that can be used for company and private requires. Each of the forms are examined by specialists and meet up with state and federal needs.

In case you are currently registered, log in to the account and click the Acquire key to have the Louisiana Employee Stock Option Plan of Manugistics Group, Inc.. Make use of your account to search from the authorized forms you might have bought formerly. Go to the My Forms tab of your account and have another copy from the papers you require.

In case you are a whole new consumer of US Legal Forms, listed here are easy guidelines for you to follow:

- First, ensure you have chosen the appropriate develop to your town/county. It is possible to look through the shape utilizing the Preview key and browse the shape explanation to guarantee this is basically the right one for you.

- In the event the develop will not meet up with your preferences, utilize the Seach field to find the proper develop.

- Once you are sure that the shape is suitable, click on the Buy now key to have the develop.

- Pick the prices prepare you desire and type in the required information and facts. Make your account and pay for the order with your PayPal account or bank card.

- Select the document formatting and acquire the authorized papers web template to the gadget.

- Full, modify and print out and indication the attained Louisiana Employee Stock Option Plan of Manugistics Group, Inc..

US Legal Forms will be the largest local library of authorized forms where you can find various papers templates. Take advantage of the company to acquire expertly-manufactured paperwork that follow state needs.

Form popularity

FAQ

An ESOP is an employee benefit plan that enables employees to own part or all of the company they work for. ESOPs are most commonly used to facilitate succession planning, allowing a company owner to sell his or her. shares and transition flexibly out of the business.

Holders of share purchase rights may or may not buy an agreed number of shares of stock at a pre-determined price, but only if they are an existing stockholder. Options, on the other hand, are the right to buy or sell stocks at a pre-set price called the strike price.

Stock options are a form of equity compensation that allows an employee to buy a specific number of shares at a pre-set price. Many startups, private companies, and corporations will include them as part of a compensation plan for prospective employees.

Disadvantages of Employee Stock Purchase Plans Ensuring the ESPP follows security and tax law guidelines can be challenging. A large amount of HR functions goes into administering the stock purchase plan. There are legal, tax, and administrative issues that go into setting up the plan.

Stock options give employees the option to buy a certain number of shares at a predetermined price within a specified period. Equity, on the other hand, gives employees actual shares of the company, either outright or subject to vesting conditions.

The difference between an ESOP and a stock option is that while ESOP allows owners of tightly held businesses to sell to an ESOP and reinvest the revenues tax-free, as long as the ESOP controls at least 30% of the business, as well as certain requirements, are met.

The most notable difference between an ESOP vs ESPP is in how the employee receives the stock and when they can sell the stock. ESOPs provide the stock or shares at no cost to employees. ESPPs require participants to contribute funds to purchase shares of stock, though at a discounted rate.

Your ESPP will have set offering and purchase periods, while a stock option grant has a set term in which you can exercise the options after they vest. The purchase price of stock under a tax-qualified Section 423 ESPP is typically discounted in some way from the market price at purchase.