Louisiana Statement of Current Monthly Income and Disposable Income Calculation for Use in Chapter 13 - Post 2005

Description

How to fill out Statement Of Current Monthly Income And Disposable Income Calculation For Use In Chapter 13 - Post 2005?

Are you in a placement the place you need papers for either company or person functions just about every day? There are a lot of legitimate document templates available on the Internet, but discovering kinds you can trust is not straightforward. US Legal Forms gives a huge number of form templates, much like the Louisiana Statement of Current Monthly Income and Disposable Income Calculation for Use in Chapter 13 - Post 2005, which are created to satisfy state and federal requirements.

When you are presently knowledgeable about US Legal Forms website and possess a free account, merely log in. After that, you may acquire the Louisiana Statement of Current Monthly Income and Disposable Income Calculation for Use in Chapter 13 - Post 2005 template.

Unless you come with an bank account and wish to begin to use US Legal Forms, adopt these measures:

- Obtain the form you need and make sure it is for the correct town/area.

- Take advantage of the Review option to check the shape.

- Read the information to actually have chosen the appropriate form.

- If the form is not what you are trying to find, use the Search field to get the form that meets your requirements and requirements.

- Once you find the correct form, click Purchase now.

- Choose the prices plan you want, fill out the desired info to make your account, and buy the order with your PayPal or bank card.

- Choose a practical document format and acquire your copy.

Get each of the document templates you have purchased in the My Forms food list. You can get a more copy of Louisiana Statement of Current Monthly Income and Disposable Income Calculation for Use in Chapter 13 - Post 2005 anytime, if required. Just go through the needed form to acquire or print the document template.

Use US Legal Forms, by far the most considerable selection of legitimate kinds, to save lots of some time and stay away from mistakes. The services gives skillfully made legitimate document templates which you can use for a range of functions. Generate a free account on US Legal Forms and begin producing your lifestyle easier.

Form popularity

FAQ

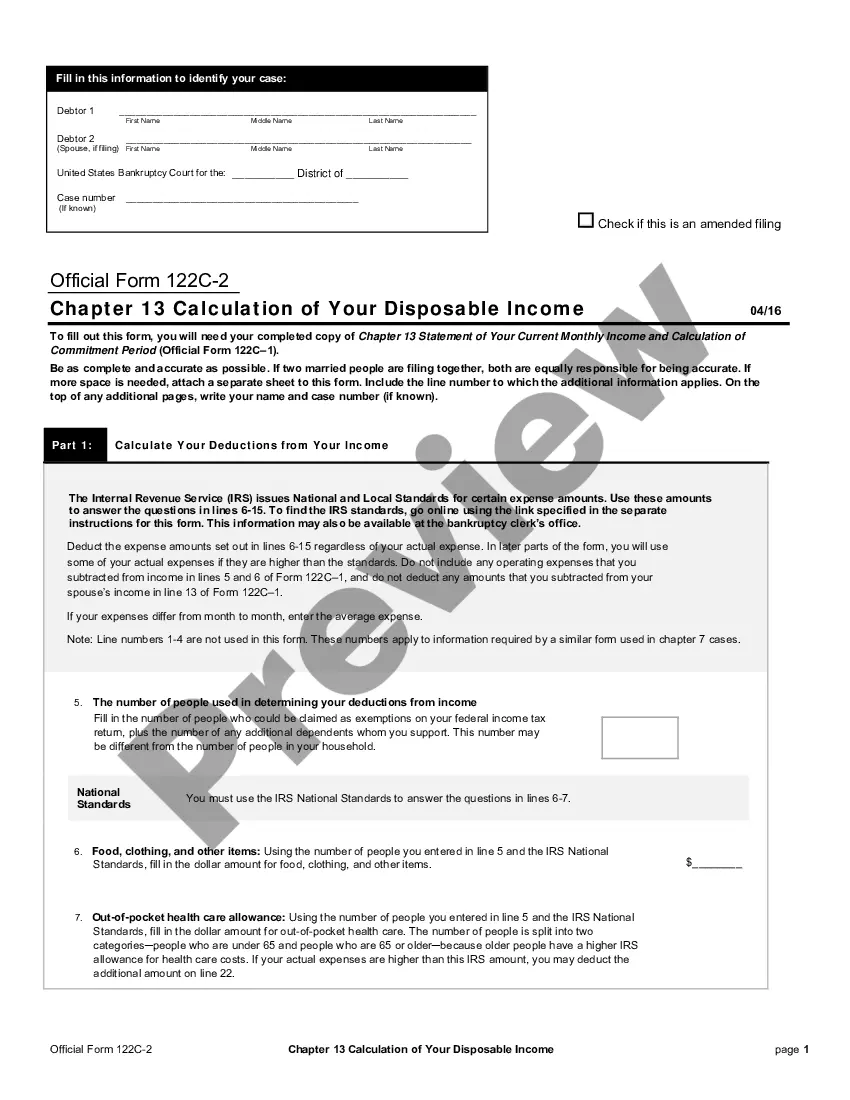

To calculate your monthly payment amount in a Chapter 13 bankruptcy, calculate your income for the six months before your bankruptcy filing. Deduct allowable expenses to determine your disposable income. Pay your priority debtors and any secured debts that you want to keep after the bankruptcy.

If you earn $1,500 every two weeks, and your employer deducts $230 for taxes, your disposable income would be $1,270. Your withholdings might differ for state or local taxes withheld.

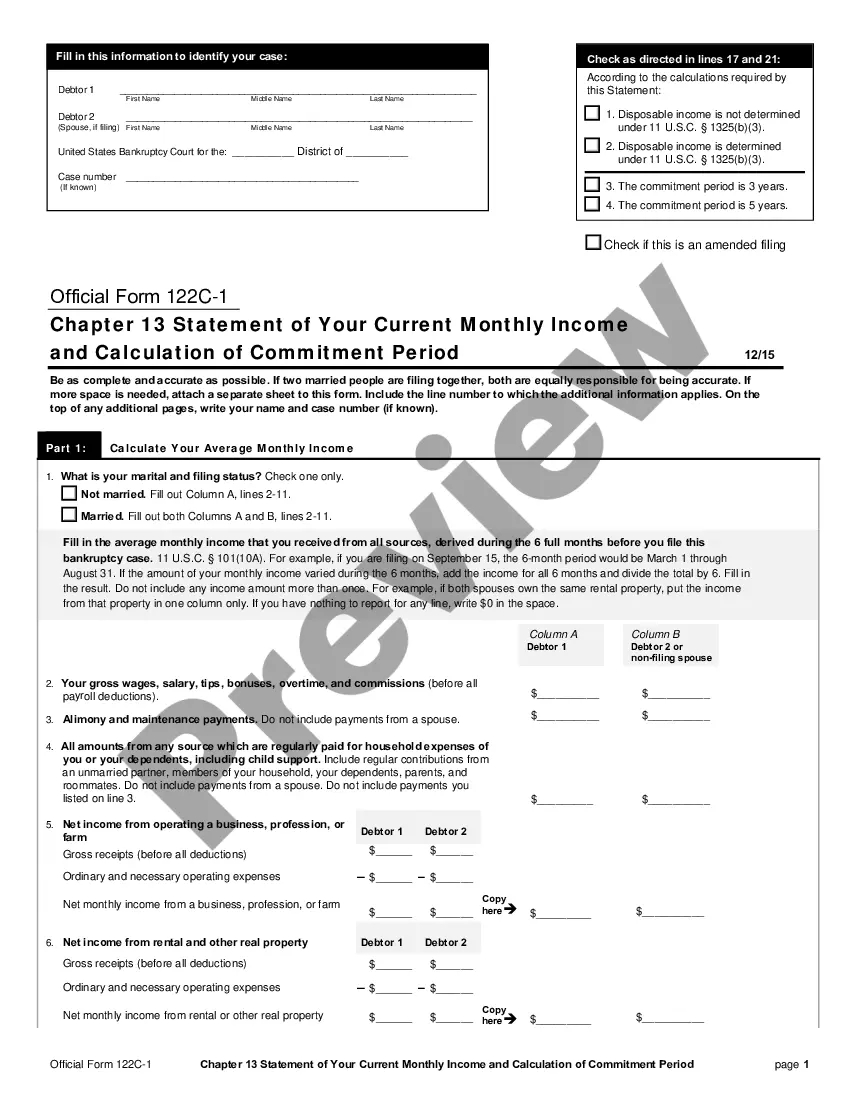

For a Chapter 13, the ?Chapter 13 Statement of Your Current Monthly Income and Calculation of Commitment Period? (Form 122C-1) tells the court your average monthly income. Your income is compared to the median income for your state, which will assist in calculating your disposable income.

Gross (or net) national disposable income equals gross (or net) national income (at market prices) minus current transfers (current taxes on income, wealth etc., social contributions, social benefits and other current transfers) payable to non-resident units, plus current transfers receivable by resident units from the ...

Disposable Income = Personal Income ? Personal Income Taxes.

What is Disposable Personal Income? After-tax income. The amount that U.S. residents have left to spend or save after paying taxes is important not just to individuals but to the whole economy. The formula is simple: personal income minus personal current taxes.

Take your monthly income and deduct living expenses, priority debt payments, and secured payments. The remaining amount is your disposable income. You'd are responsible to pay this amount to creditors each month.

An employee's disposable earnings are considered to be your gross income minus any legally required deductions such as taxes and Social Security. The remaining income is eligible for wage garnishments and is considered disposable earnings.