Louisiana Notice of Adverse Action - Non-Employment - Due to Consumer Investigative Report

Description

How to fill out Notice Of Adverse Action - Non-Employment - Due To Consumer Investigative Report?

Have you ever entered a location where you require documents for occasional business or specific purposes almost daily.

There is a multitude of legal document templates accessible online, but finding forms you can rely on is challenging.

US Legal Forms offers a plethora of template designs, including the Louisiana Notice of Adverse Action - Non-Employment - Due to Consumer Investigative Report, which is crafted to comply with state and federal regulations.

Select a convenient file format and download your copy.

Access all the document templates you have purchased in the My documents section. You can obtain another copy of the Louisiana Notice of Adverse Action - Non-Employment - Due to Consumer Investigative Report at any time if required. Simply click on the desired form to download or print the document template.

- If you are already familiar with the US Legal Forms site and possess an account, just Log In.

- Subsequently, you can download the Louisiana Notice of Adverse Action - Non-Employment - Due to Consumer Investigative Report template.

- If you do not have an account and wish to start using US Legal Forms, follow these instructions.

- Locate the form you need and ensure it is for the correct city/county.

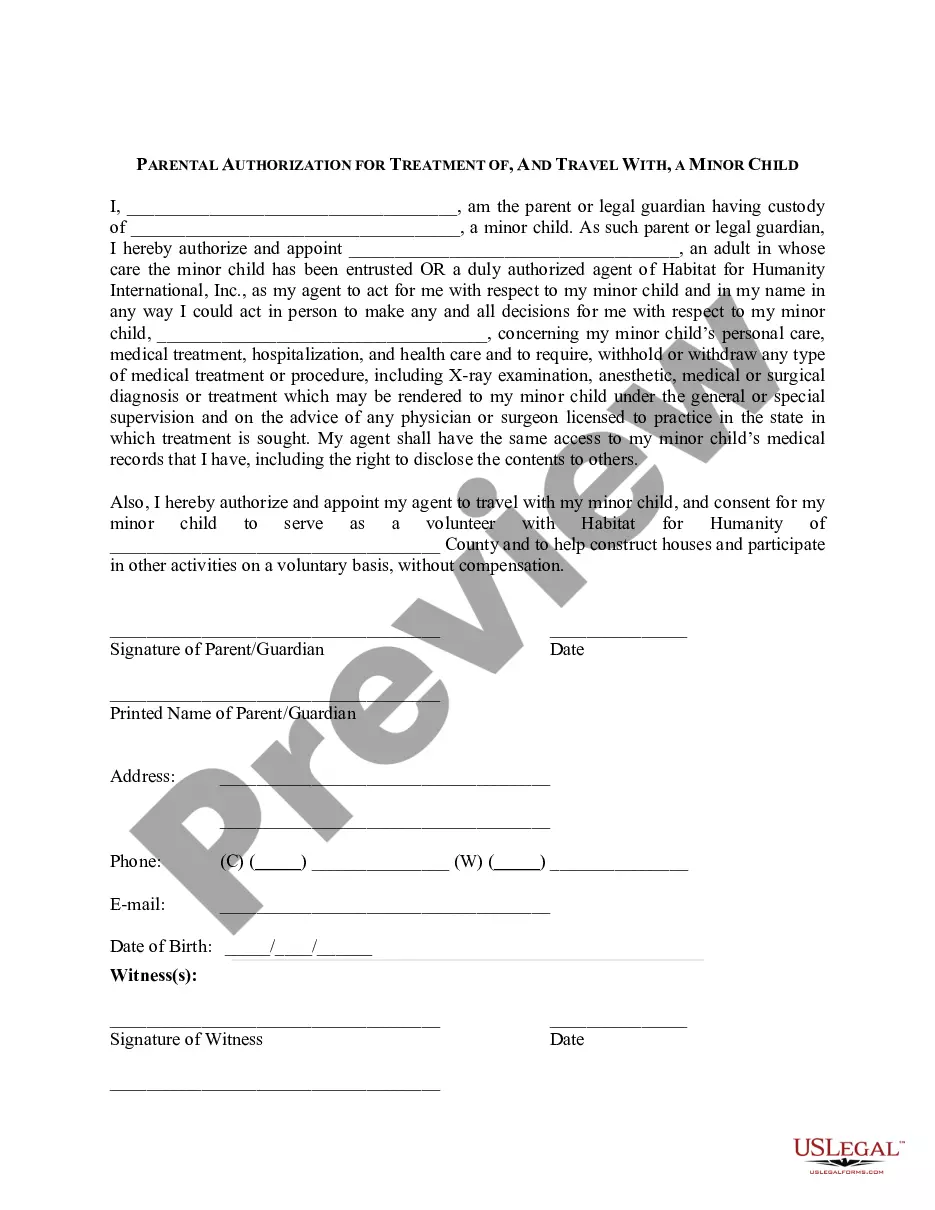

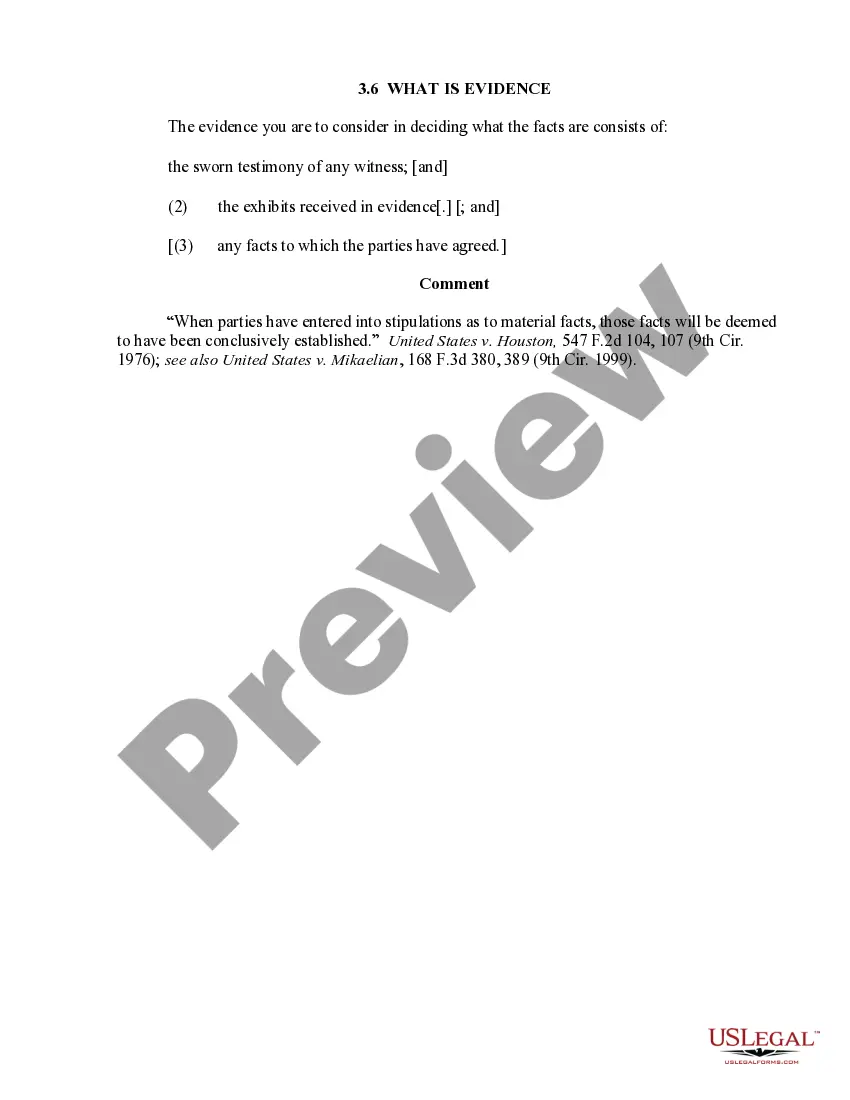

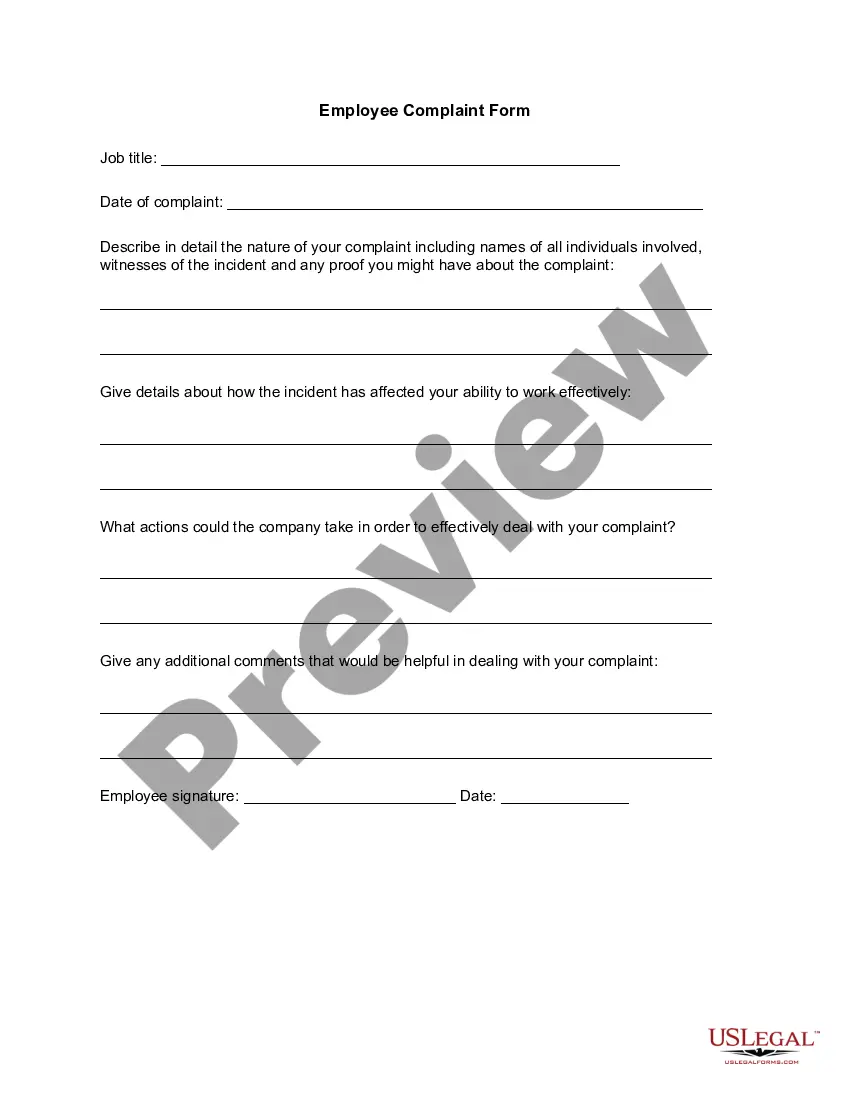

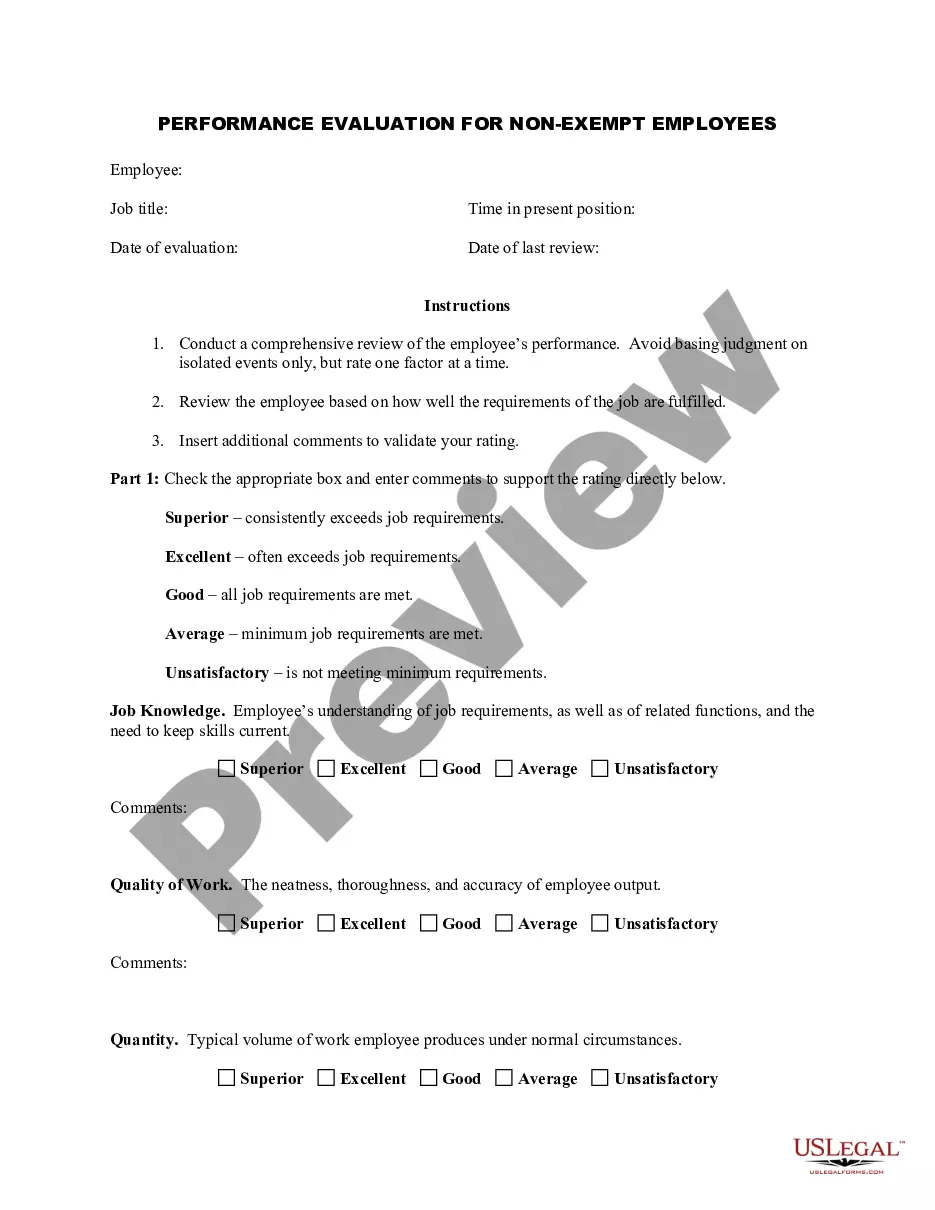

- Utilize the Review button to examine the form.

- Read the description to confirm that you have selected the correct form.

- If the form does not align with what you are searching for, use the Lookup field to find the form that matches your needs and specifications.

- Once you find the appropriate form, click Get now.

- Choose the pricing plan you desire, fill in the necessary information to create your account, and make a purchase using your PayPal or Visa or Mastercard.

Form popularity

FAQ

As a rule of thumb, the distinction between the two types of investigations can be thought of as simply verifying the specific facts about education, employment or other information the applicant has provided to the employer ("consumer report") versus obtaining more general character or personal information through

An investigative consumer report is more like a detailed background check. Facts that create a picture of who you are as a person are included in this kind of report, and the gathering of that information might even include interviews with your neighbors, friends and associates.

The first part of the 30-day rule requires creditors to provide notification of their credit decision within 30 days after receiving a completed application concerning the creditor's approval of, or counteroffer to, or adverse action on the application. While this is a mouthful to say, it really isn't that difficult.

California Civil Code Section 1786.2 defines an investigative consumer report as a consumer report in which information on a consumer's character, general reputation, personal characteristics, or mode of living is obtained through any means.

A creditor must notify the applicant of adverse action within: 30 days after receiving a complete credit application. 30 days after receiving an incomplete credit application. 30 days after taking action on an existing credit account.

A consumer applies to the credit card issuer for a credit card. The card issuer obtains a credit score for the consumer. The consumer's credit score is 700. Since the consumer's 700 credit score falls below the 720 cutoff score, the credit card issuer must provide a risk-based pricing notice to the consumer.

An adverse action notice is to inform you that you have been denied credit, employment, insurance, or other benefits based on information in a credit report. The notice should indicate which credit reporting agency was used, and how to contact them.

An investigative consumer report offers insight employers use to gain a better understanding of a person's character through interviews. These are often in the form of personal and/or professional references. When deciding which might be best, ask what information are you trying to gain.

If you deny a consumer credit based on information in a consumer report, you must provide an adverse action notice to the consumer. if you grant credit, but on less favorable terms based on information in a consumer report, you must provide a risk-based pricing notice.

When you apply for a job, your prospective employer may use a consumer report to evaluate you as a potential employee. A consumer report is a collection of documents that may include credit reports, criminal and other public records such as bankruptcy filings, and records of civil court procedures and judgments.