Louisiana Agreement to Dissolve and Wind up Partnership with Settlement and Lump-sum Payment

Description

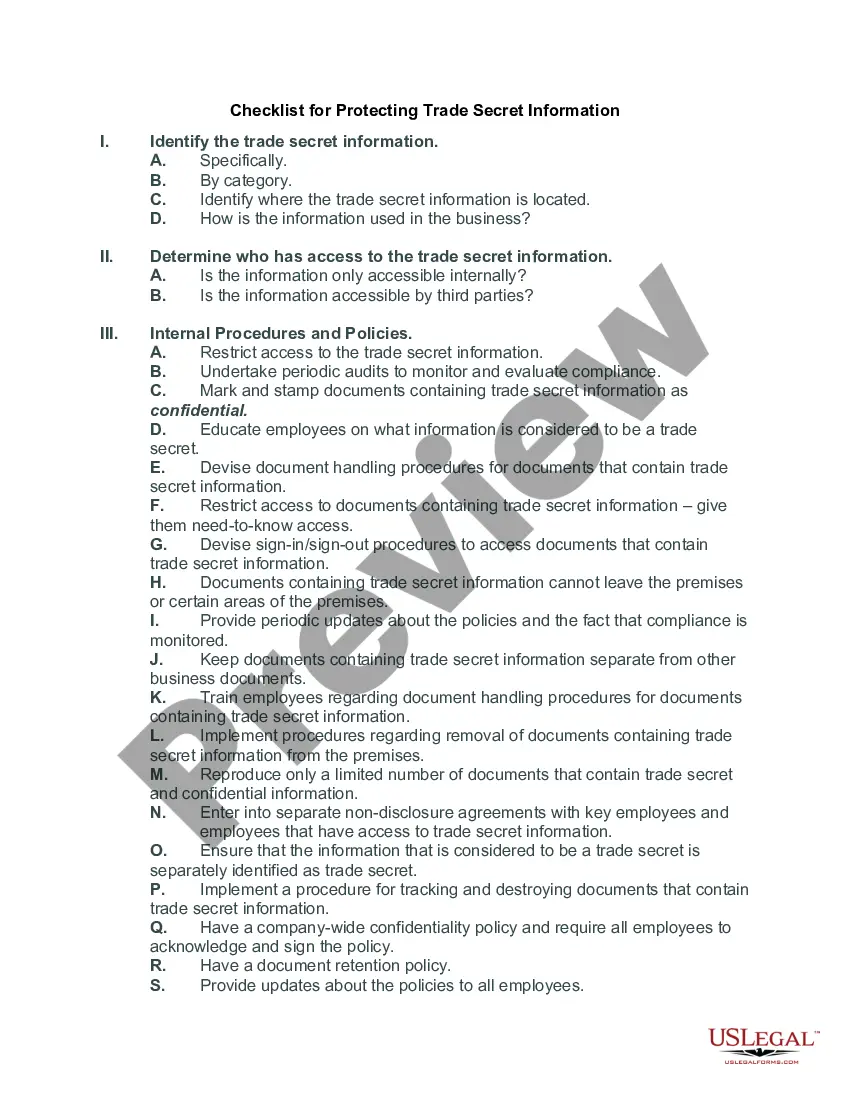

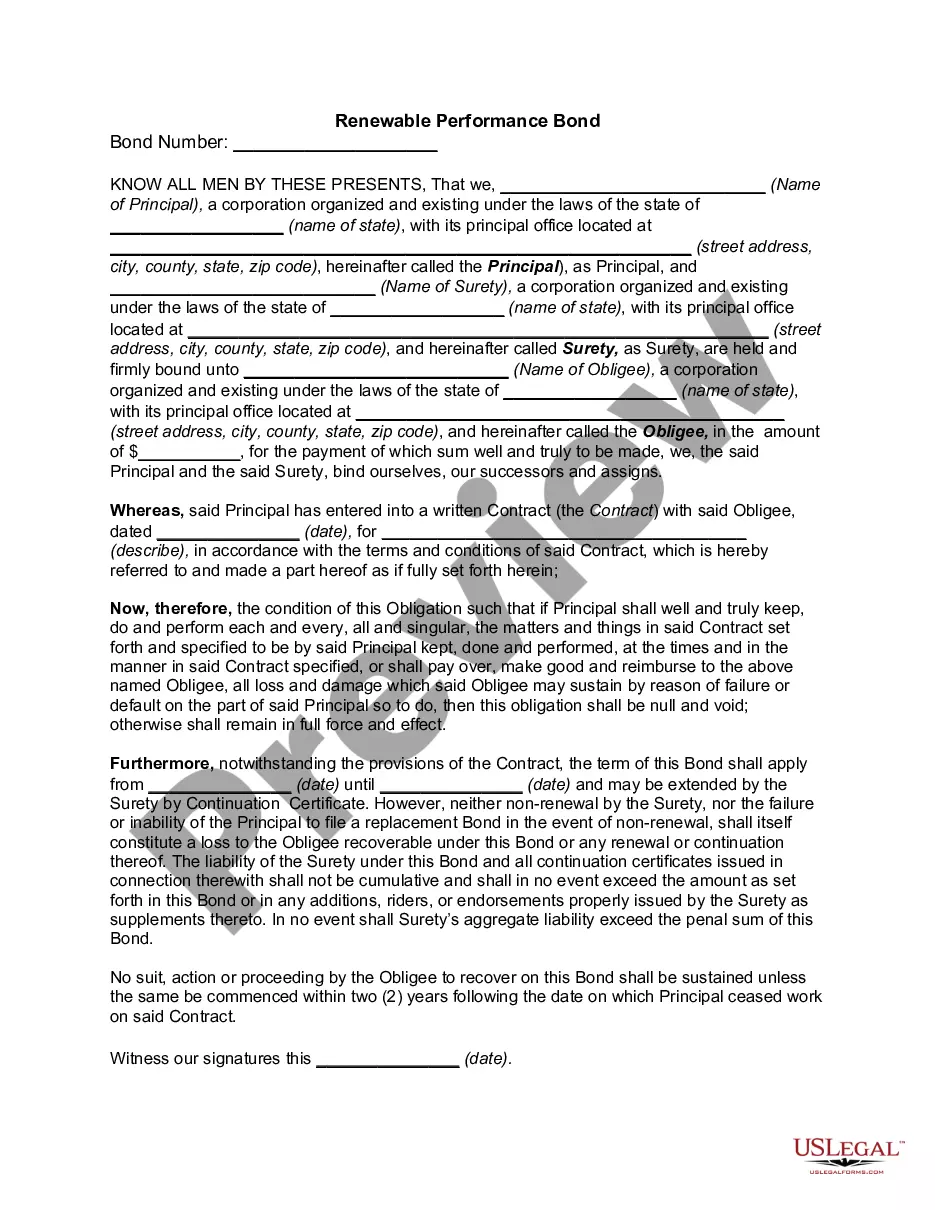

How to fill out Agreement To Dissolve And Wind Up Partnership With Settlement And Lump-sum Payment?

You can spend hours online searching for the legal document template that meets the state and federal guidelines you require.

US Legal Forms offers thousands of legal forms that can be reviewed by professionals.

You can actually download or print the Louisiana Agreement to Dissolve and Wind up Partnership with Settlement and Lump-sum Payment from the service.

If available, utilize the Preview button to view the document template as well.

- If you have a US Legal Forms account, you may Log In and click the Obtain button.

- Then, you can complete, edit, print, or sign the Louisiana Agreement to Dissolve and Wind up Partnership with Settlement and Lump-sum Payment.

- Every legal document template you purchase is yours forever.

- To obtain an additional copy of any purchased form, go to the My documents tab and click the appropriate button.

- If you are using the US Legal Forms website for the first time, follow these simple instructions.

- First, ensure that you have selected the correct document template for the county/region of your choice.

- Read the form description to confirm that you have chosen the right form.

Form popularity

FAQ

An agreement can spell out the order in which liabilities are to be paid, but if it does not, UPA Section 40(a) and RUPA Section 807(1) rank them in this order: (1) to creditors other than partners, (2) to partners for liabilities other than for capital and profits, (3) to partners for capital contributions, and

The proceeds from the sale of assets along with the contribution of the partners at the time of dissolution of the firm are first used up to pay off the external liabilities, i.e., the creditors, bank loans, bank overdrafts, bills payable etc.

In Louisiana, you must file an Affadavit to Dissolve Limited Liability Company with the Secretary of State. The state will then send you a Certificate of Dissolution. Louisiana requires business owners to submit their Certificate of Dissolution by mail, fax, in person, or online.

How to Dissolve a PartnershipReview and Follow Your Partnership Agreement.Vote on Dissolution and Document Your Decision.Send Notifications and Cancel Business Registrations.Pay Outstanding Debts, Liquidate, and Distribute Assets.File Final Tax Return and Cancel Tax Accounts.Limiting Your Future Liability.

An agreement can spell out the order in which liabilities are to be paid, but if it does not, UPA Section 40(a) and RUPA Section 807(1) rank them in this order: (1) to creditors other than partners, (2) to partners for liabilities other than for capital and profits, (3) to partners for capital contributions, and

Just keep in mind these five key steps when dissolving a partnership:Review your partnership agreement.Discuss with other partners.File dissolution papers.Notify others.Settle and close out all accounts.

Dissolution of a limited partnership is the first step toward termination (but termination does not necessarily follow dissolution). The limited partners have no power to dissolve the firm except on court order, and the death or bankruptcy of a limited partner does not dissolve the firm.

You and your partner need to discuss obligations, such as the business's debts and future liabilities, and how you plan to wind down the business. File a Dissolution Form. You'll need to file a dissolution of partnership form with the state your business is based in to formally announce the end of the partnership.

The liabilities of the partnership shall rank in order of payment, as follows:Those owing to creditors other than partners,Those owing to partners other than for capital and profits,Those owing to partners in respect of capital,Those owing to partners in respect of profits.

Dissolution occurs when any partner discontinues his or her involvement in the partnership business or when there is any change in the partnership relationship. The second step is known as winding up. This is when partnership accounts are settled and assets are liquidated.