Louisiana Warranty Agreement as to Web Site Software

Description

How to fill out Warranty Agreement As To Web Site Software?

Are you in the position where you require documentation for either business or personal purposes almost every day.

There are numerous legitimate document templates accessible online, but finding versions you can trust isn’t easy.

US Legal Forms provides thousands of form templates, including the Louisiana Warranty Agreement regarding Web Site Software, that are crafted to meet federal and state requirements.

Once you locate the correct form, click on Purchase now.

Choose the payment plan you desire, enter the required details to create your account, and settle the transaction using your PayPal or credit card.

- If you are already acquainted with the US Legal Forms site and have your account, simply Log In.

- Then, you can download the Louisiana Warranty Agreement regarding Web Site Software template.

- If you do not have an account and wish to start using US Legal Forms, follow these steps.

- Obtain the form you need and ensure it is for the correct city/state.

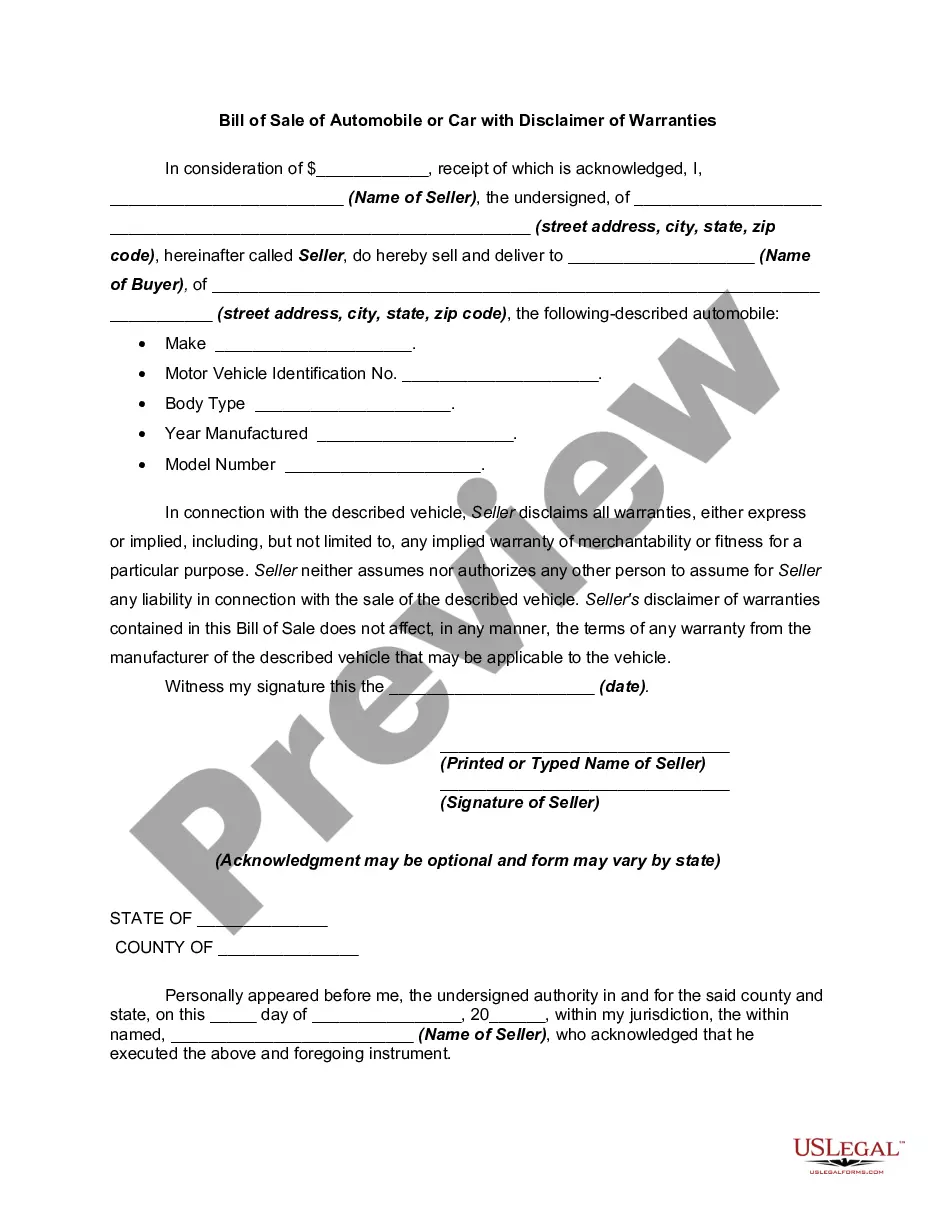

- Utilize the Review button to inspect the form.

- Read the description to confirm that you have selected the accurate form.

- If the form isn’t what you’re looking for, use the Lookup field to find the form that fits your needs and criteria.

Form popularity

FAQ

Sales of custom software - downloaded are exempt from the sales tax in Louisiana. In the state of Louisiana, any transactions where the customer is required to pay a subscription or access fee to obtain the use, although not the ownership of a website or software are not taxable.

GeauxBIZ allows you to file your Louisiana business (i.e. corporation, LLC, partnership, etc.), register for a Louisiana tax account number, apply for a Louisiana unemployment insurance account number, and also file amendments, such as annual reports.

Here are the 8 steps to forming an LLC in Louisiana:Choose a name for your LLC and making sure it's available for use.Designate a Registered Agent for your LLC.File your Articles of Organization with the Louisiana Secretary of State.Draft your LLC's Operating Agreement.Get a Federal Tax ID Number (EIN) for your LLC.More items...?

GeauxBIZ can help you find resources to help plan, make key financial decisions, and complete legal activities necessary to start your business.

According to the proposed regulation, consolidated filers are taxpayers who are approved, according to LAC 61:I. 4351(A)(1)(a), to file consolidated sales tax returns to report sales from multiple locations on one consolidated monthly return.

In most states, where services aren't taxable, SaaS also isn't taxable. Other states, like Washington, consider SaaS to be an example of tangible software and thus taxable. Just like with anything tax related, each state has made their own rules and laws.

GeauxBIZ is your one-stop site for launching your new business in the state of Louisiana. You can: Create a checklist to help plan, make key financial decisions and complete legal activities prior to launching your new business. Reserve a business name for your new business.

All sales, use, consumption, distribution, storage for use or consumption, leases, and rentals of tangible personal property are taxable, unless an exemption or exclusion is provided by law for a particular transaction.

Goods that are subject to sales tax in Louisiana include physical property, like furniture, home appliances, and motor vehicles. The purchase of groceries, prescription medicine, and gasoline are tax-exempt.

Louisiana imposes sales and use tax on retail sales of tangible personal property in Louisiana or on the use of tangible personal property in Louisiana. Software located on a server, instate or out-of-state, and made available to users (as discussed above) is taxable by this State.