Louisiana Jury Instruction - 10.10.3 Employee vs. Self-Employed Independent Contractor

Description

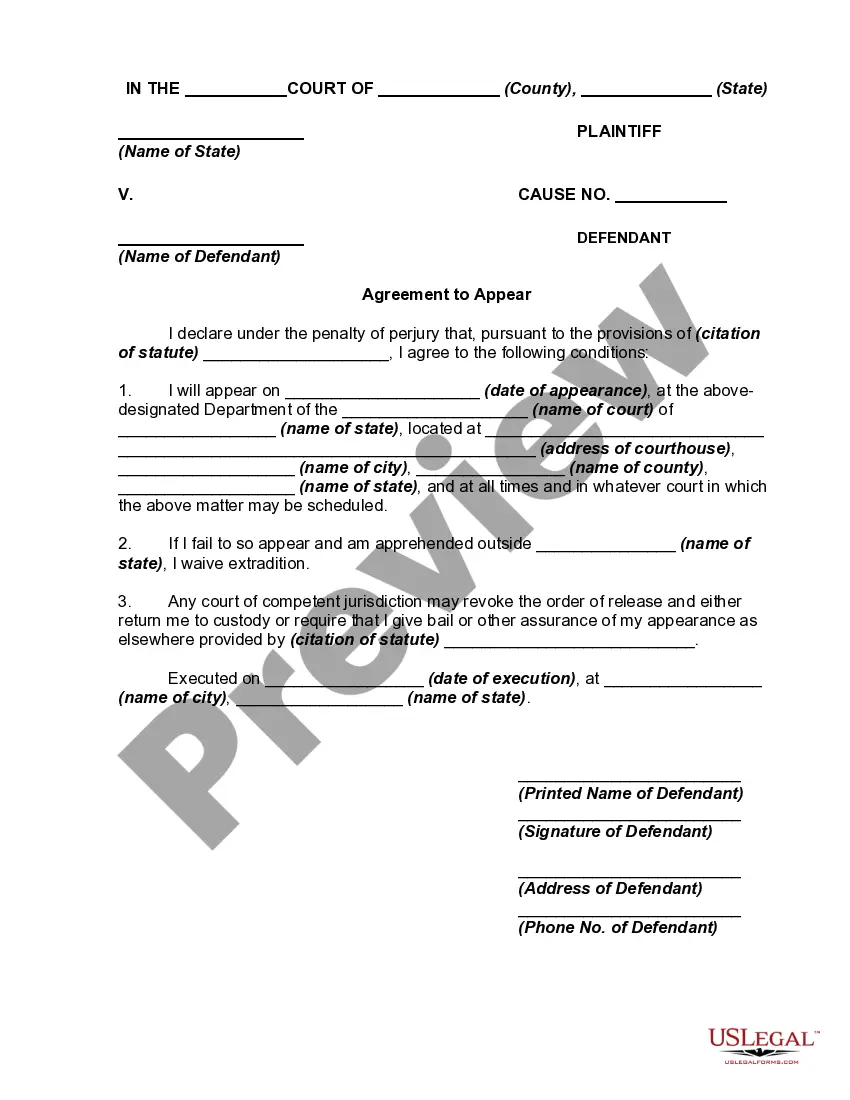

How to fill out Jury Instruction - 10.10.3 Employee Vs. Self-Employed Independent Contractor?

If you wish to complete, acquire, or print legitimate record layouts, use US Legal Forms, the most important assortment of legitimate types, that can be found on-line. Take advantage of the site`s basic and practical look for to find the paperwork you want. Numerous layouts for business and person uses are sorted by categories and says, or keywords. Use US Legal Forms to find the Louisiana Jury Instruction - 10.10.3 Employee vs. Self-Employed Independent Contractor in just a handful of mouse clicks.

When you are currently a US Legal Forms consumer, log in to your profile and click on the Obtain key to obtain the Louisiana Jury Instruction - 10.10.3 Employee vs. Self-Employed Independent Contractor. You can even entry types you in the past saved inside the My Forms tab of your profile.

If you work with US Legal Forms initially, refer to the instructions beneath:

- Step 1. Be sure you have chosen the form for that right city/region.

- Step 2. Utilize the Preview option to check out the form`s articles. Don`t neglect to learn the description.

- Step 3. When you are unhappy together with the kind, make use of the Search area on top of the display to locate other variations of the legitimate kind template.

- Step 4. After you have discovered the form you want, click on the Get now key. Select the costs prepare you prefer and put your qualifications to register on an profile.

- Step 5. Process the transaction. You can utilize your bank card or PayPal profile to complete the transaction.

- Step 6. Find the formatting of the legitimate kind and acquire it on the product.

- Step 7. Complete, modify and print or indicator the Louisiana Jury Instruction - 10.10.3 Employee vs. Self-Employed Independent Contractor.

Each and every legitimate record template you purchase is yours permanently. You have acces to each kind you saved in your acccount. Go through the My Forms section and select a kind to print or acquire yet again.

Compete and acquire, and print the Louisiana Jury Instruction - 10.10.3 Employee vs. Self-Employed Independent Contractor with US Legal Forms. There are thousands of professional and status-certain types you can use for your personal business or person requirements.

Form popularity

FAQ

If payment for services you provided is listed on Form 1099-NEC, Nonemployee Compensation, the payer is treating you as a self-employed worker, also referred to as an independent contractor.

You are probably an independent contractor if: You set your own working hours. You provide the tools and equipment needed to do your job. You work for more than one company at a time. You pay your own business and traveling expenses.

(7) "Independent contractor" means any person who renders service, other than manual labor, for a specified recompense for a specified result either as a unit or as a whole, under the control of his principal as to results of his work only, and not as to the means by which such result is accomplished, and are expressly ...

Pay basis: If you pay a worker on an hourly, weekly, or monthly basis, the IRS will consider it a sign the worker is your employee. An independent is generally paid by the job, project, assignment, etc., or receives a commission or similar fee.

The basic test for determining whether a worker is an independent contractor or an employee is whether the principal has the right to control the manner and means by which the work is performed.

If an employer has the right to control the work, it is likely a traditional employee/employer relationship. On the other hand, if the worker has more control, he or she is more likely to be considered an independent contractor.

The law further states that independent contractor status is evidenced if the worker: (1) has a substantial investment in the business other than personal services, (2) purports to be in business for himself or herself, (3) receives compensation by project rather than by time, (4) has control over the time and place ...