Louisiana Assignment of Contract as Security for Loan

Description

How to fill out Assignment Of Contract As Security For Loan?

Are you currently in a circumstance where you need documents for business or particular reasons almost every day.

There are numerous legitimate document templates available online, but locating trusted ones is challenging.

US Legal Forms offers a wide range of form templates, such as the Louisiana Assignment of Contract as Security for Loan, that are designed to meet federal and state regulations.

Once you find the appropriate form, simply click Buy now.

Select the payment plan you prefer, complete the required information to process your payment, and finalize the purchase using your PayPal or credit card.

- If you are already familiar with the US Legal Forms website and have an account, simply Log In.

- After that, you can download the Louisiana Assignment of Contract as Security for Loan template.

- If you do not have an account and wish to start using US Legal Forms, follow these steps.

- Find the form you need and ensure it is for your specific city/county.

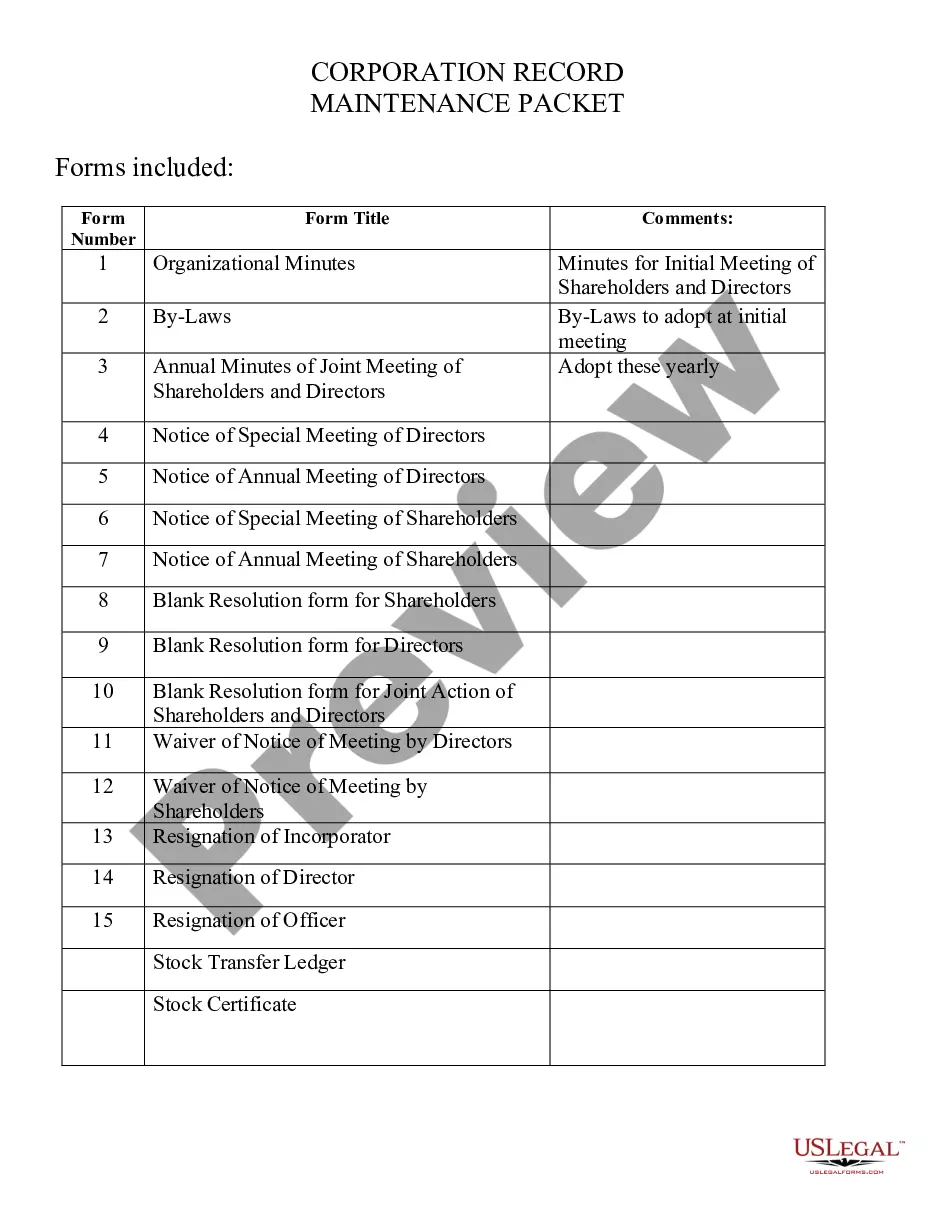

- Use the Preview feature to examine the form.

- Read the description to confirm that you have selected the correct form.

- If the form does not meet your criteria, utilize the Research field to locate the form that suits your needs.

Form popularity

FAQ

The phrase 'by way of assignment' refers to the method of transferring rights and obligations through a legal agreement. In the context of loans, this means that the borrower can assign their rights to the lender as a form of security. This is an important concept in financial contracts, and resources like US Legal Forms can help clarify these terms and assist with the necessary documentation.

WHEREAS, it is a condition precedent to the Secured Party's making any loans to Debtor under the Credit Agreement that the Debtor execute and deliver a Security Agreement in substantially the form hereof. a. Overview: A security agreement is frequently one of many loan documents executed in conjunction with a loan.

Judicial mortgage is a lien resulting from judgments passed on contested cases or by default in favor of the judgment creditor. According to the state statute of Louisiana (La. C.C. Art.

Mortgage is different from a security agreement. A mortgage is used to secure the lender's rights by placing a lien against the title of the property. Once all loan repayments have been made, the lien is removed.

Certain specific requirements are required for the security agreement to form the foundation for a valid security interest, namely 1) it must be signed, 2) it must clearly state that a security interest is intended, and 3) it must contain a sufficient description of the collateral subject to the security interest.

WHEREAS, it is a condition precedent to the Secured Party's making any loans to Debtor under the Credit Agreement that the Debtor execute and deliver a Security Agreement in substantially the form hereof. a. Overview: A security agreement is frequently one of many loan documents executed in conjunction with a loan.

A security agreement is a document that provides a lender a security interest in a specified asset or property that is pledged as collateral. Security agreements often contain covenants that outline provisions for the advancement of funds, a repayment schedule, or insurance requirements.

A security agreement, in the law of the United States, is a contract that governs the relationship between the parties to a kind of financial transaction known as a secured transaction.

Under a security deed, the lender is automatically able to foreclose or sell the property when the borrower defaults. Foreclosing on a mortgage, on the other hand, involves additional paperwork and legal requirements, thus extending the process.

Mortgage is different from a security agreement. A mortgage is used to secure the lender's rights by placing a lien against the title of the property. Once all loan repayments have been made, the lien is removed. However, the buyer doesn't own the property till all loan payments have been made.