Louisiana Legend on Stock Certificate Giving Notice of Restriction on Transfer due to Stock Redemption Agreement Requiring First an Offer to the Corporation and then an Offer to other Stockholders

Description

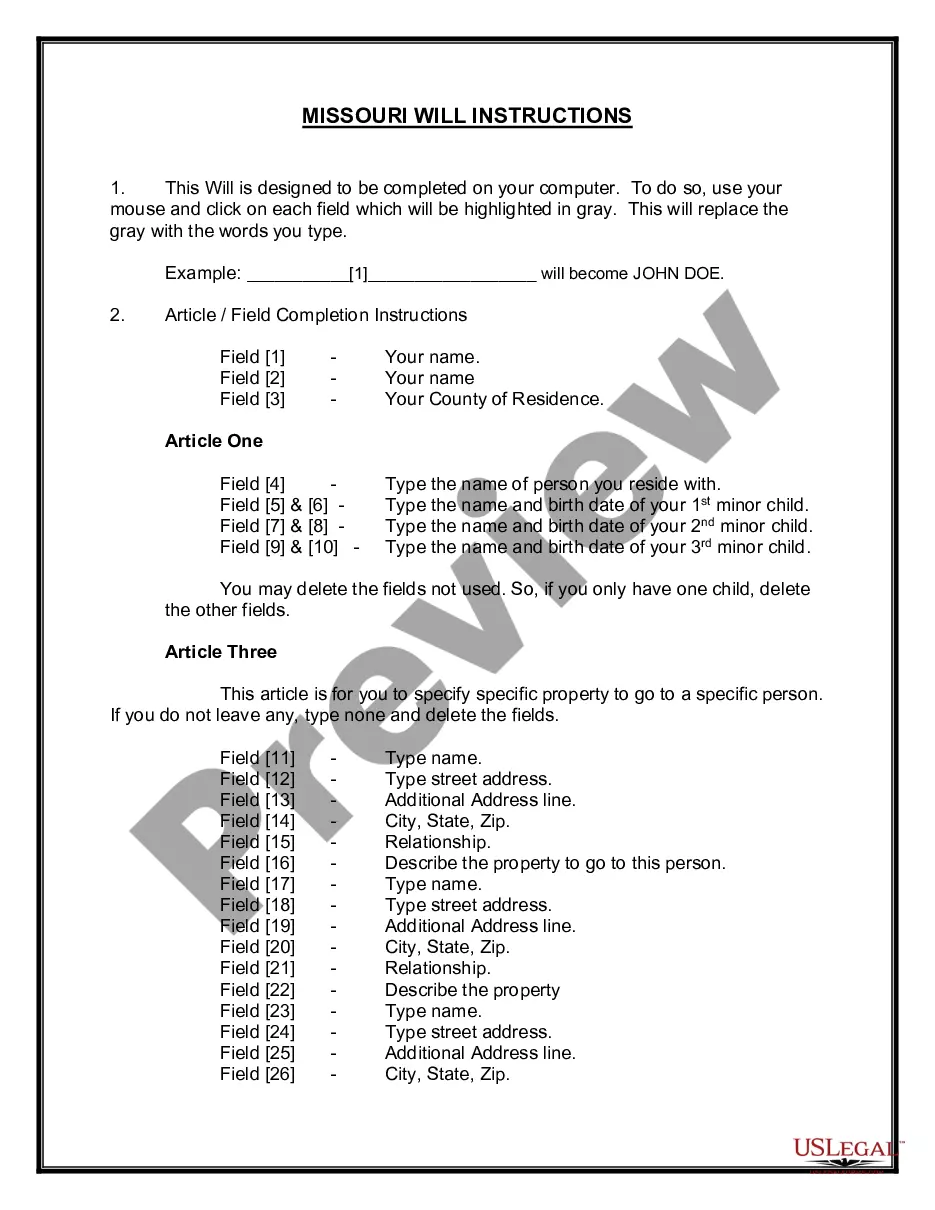

How to fill out Legend On Stock Certificate Giving Notice Of Restriction On Transfer Due To Stock Redemption Agreement Requiring First An Offer To The Corporation And Then An Offer To Other Stockholders?

Are you inside a placement in which you need files for both business or personal uses nearly every working day? There are a variety of lawful file layouts available on the Internet, but getting ones you can rely on isn`t easy. US Legal Forms provides a huge number of form layouts, much like the Louisiana Legend on Stock Certificate Giving Notice of Restriction on Transfer due to Stock Redemption Agreement Requiring First an Offer to the Corporation and then an Offer to other Stockholders, that happen to be composed in order to meet state and federal demands.

In case you are presently acquainted with US Legal Forms site and also have an account, basically log in. Afterward, you are able to obtain the Louisiana Legend on Stock Certificate Giving Notice of Restriction on Transfer due to Stock Redemption Agreement Requiring First an Offer to the Corporation and then an Offer to other Stockholders template.

Unless you offer an account and wish to start using US Legal Forms, adopt these measures:

- Obtain the form you will need and ensure it is for that right metropolis/region.

- Take advantage of the Review key to review the form.

- Read the outline to ensure that you have selected the appropriate form.

- When the form isn`t what you are trying to find, make use of the Research area to find the form that suits you and demands.

- Once you obtain the right form, click on Purchase now.

- Choose the prices prepare you need, fill in the necessary info to make your account, and buy the order using your PayPal or Visa or Mastercard.

- Select a handy file file format and obtain your copy.

Get every one of the file layouts you have purchased in the My Forms menu. You can obtain a extra copy of Louisiana Legend on Stock Certificate Giving Notice of Restriction on Transfer due to Stock Redemption Agreement Requiring First an Offer to the Corporation and then an Offer to other Stockholders at any time, if possible. Just click on the essential form to obtain or print the file template.

Use US Legal Forms, the most extensive selection of lawful varieties, to save lots of time and prevent errors. The services provides professionally manufactured lawful file layouts which you can use for an array of uses. Produce an account on US Legal Forms and begin making your lifestyle a little easier.

Form popularity

FAQ

Restricted stock refers to unregistered shares of ownership in a corporation that are issued to corporate affiliates, such as executives and directors. Restricted stock is non-transferable and must be traded in compliance with special Securities and Exchange Commission (SEC) regulations.

In order to have the legend on a stock certificate removed, investors should contact the company's shareholder relations department to find out the details of the removal process. Following that, the company will send a confirmation authorizing its transfer agent to remove the legend.

Also ing to Section 22A of the Securities Contract and Regulation Act, 1956 if the recognised stock exchange acting in pursuance to the bye laws made by it, refuses to list the securities of any public company, the company shall be given appropriate reasons for the refusal and has an option to appeal to the ...

In order to have the legend on a stock certificate removed, investors should contact the company's shareholder relations department to find out the details of the removal process. Following that, the company will send a confirmation authorizing its transfer agent to remove the legend.

Only a transfer agent can complete the task of removing a restrictive stock legend. The transfer agent will require an opinion letter from the issuer's counsel or from his or her own lawyer plus 144 papers completed by a broker?stating that the restricted legend can be removed.

The purpose of the restrictive legend or notation is to protect the issuing company from loosing its private placement exemption for the initial sale of the securities and to notify the investor that the restricted securities cannot be resold into the public securities market without satisfying certain requirements.

The basic rights of each stockholder (unless otherwise restricted) are to share proportionately: (1) in profits, (2) in management (the right to vote for directors), (3) in corporate assets upon liquidation, and (4) in any new issues of stock of the same class (preemptive right).

In general, restricted securities are acquired in a nonpublic transaction (private placement). Such securities are unregistered, can only be resold under certain conditions and usually bear a legend to that effect.