Louisiana Agreement to Devise or Bequeath Property of a Business Transferred to Business Partner

Description

How to fill out Agreement To Devise Or Bequeath Property Of A Business Transferred To Business Partner?

Have you ever been in a situation where you require documents for either business or personal reasons almost every day.

There are numerous legal document templates accessible online, but finding ones you can trust is not easy.

US Legal Forms offers thousands of template forms, such as the Louisiana Agreement to Devise or Bequeath Property of a Business Transferred to Business Partner, which are designed to comply with both federal and state guidelines.

Choose the pricing plan you want, fill in the required information to create your account, and purchase your order with your PayPal or credit card.

Select a convenient document format and download your copy. You can find all the document templates you have purchased in the My documents menu. You can retrieve an additional copy of the Louisiana Agreement to Devise or Bequeath Property of a Business Transferred to Business Partner at any time if needed. Just click the appropriate form to download or print the document template. Use US Legal Forms, the most comprehensive selection of legal forms, to save time and avoid mistakes. The service provides professionally created legal document templates that can be used for various purposes. Create your account on US Legal Forms and start making your life easier.

- If you are already acquainted with the US Legal Forms site and possess an account, just sign in.

- After that, you can download the Louisiana Agreement to Devise or Bequeath Property of a Business Transferred to Business Partner template.

- If you do not have an account and wish to start using US Legal Forms, follow these steps.

- Obtain the form you need and ensure it is for the correct area/region.

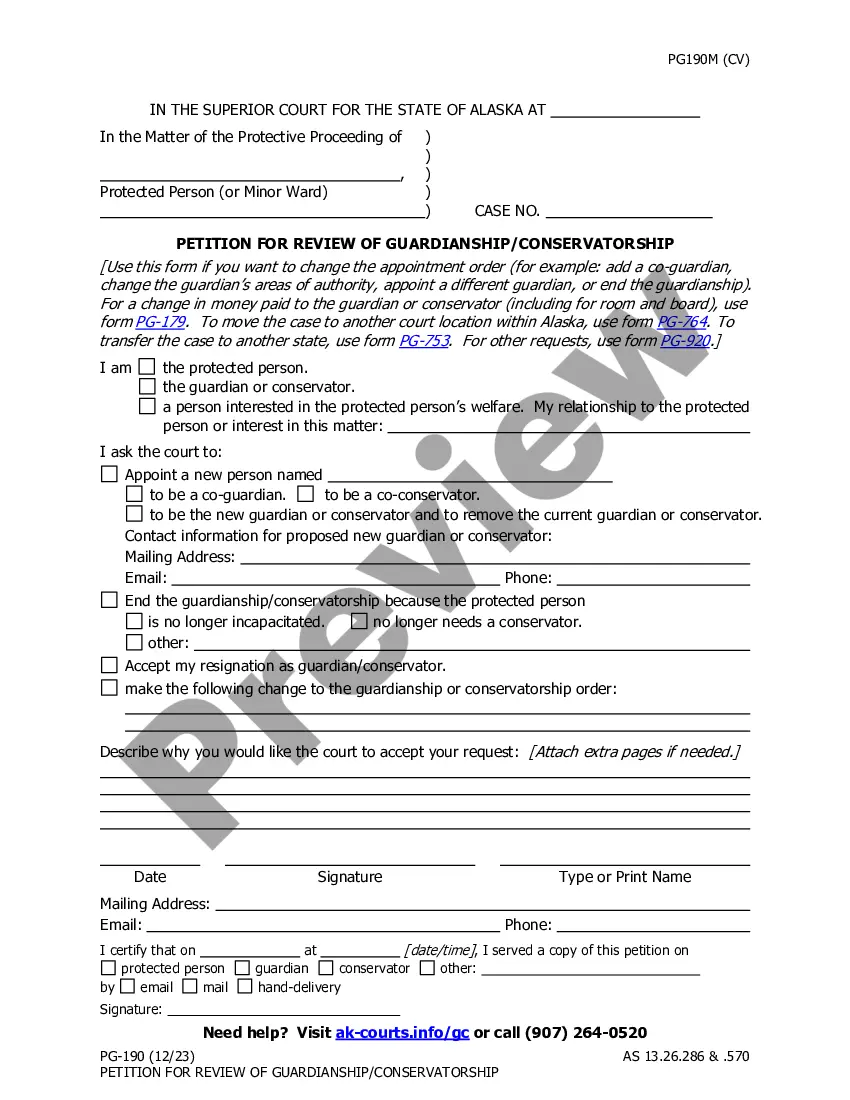

- Utilize the Preview button to review the form.

- Examine the description to confirm that you have selected the correct form.

- If the form is not what you are looking for, use the Search field to find the form that fits your needs.

- Once you find the right form, simply click Buy now.

Form popularity

FAQ

To convert a single-member LLC to a multi-member LLC in Louisiana, you will first need to amend your operating agreement to include the new members. Then, you must file an updated Articles of Organization with the Secretary of State. Utilizing a Louisiana Agreement to Devise or Bequeath Property of a Business Transferred to Business Partner may be beneficial for managing ownership interests in the future.

1 : to give or leave by will (see will entry 2 sense 1) used especially of personal property a ring bequeathed to her by her grandmother. 2 : to hand down : transmit lessons bequeathed to future generations.

What is the difference between these two phrases? Traditionally, a devise referred to a gift by will of real property. The beneficiary of a devise is called a devisee. In contrast, a bequest referred to a gift by will of personal property or any other property that is not real property.

Testamentary: Having to do with a will. For example, a trust that is set up in a will is called a testamentary trust. Testator: Someone who writes and executes (signs) a will. Testatrix: The old-fashioned term for a female will-writer. Trustee: Someone who has legal authority over the assets in a trust.

Bequests are assets given in a will or a trust. A bequest might be a specific amount of money or assets, a percentage of those assets, or what is left over after heirs and other obligations are paid from an estate.

However, you should also consider how your will dovetails with your partnership agreement. A partnership agreement takes precedence over a will so if the latter is not written with the former in mind then there is every chance that an asset you wished to gift is not actually yours it belongs to the partnership.

A gift given by means of the will of a decedent of an interest in real property.

Leaving Your Property Some Other Way Before you list those specific bequests, you will name a beneficiary or beneficiaries to get "everything else" in your estate-- that is, all of the property that is left over after the specific gifts are distributed.

The Supreme Court held as under: Section 42(c) of the Partnership Act can appropriately be applied to a' partnership where there are more than two partners. If one of them dies, the firm is dissolved; but if there is a contract to the contrary, the surviving partners will continue the firm.

It is likely, therefore, that following the death of the partner, the legal title to any non-real estate partnership assets will be held by the surviving partner and the personal representatives of the deceased partner on trust for the surviving partner and the estate.