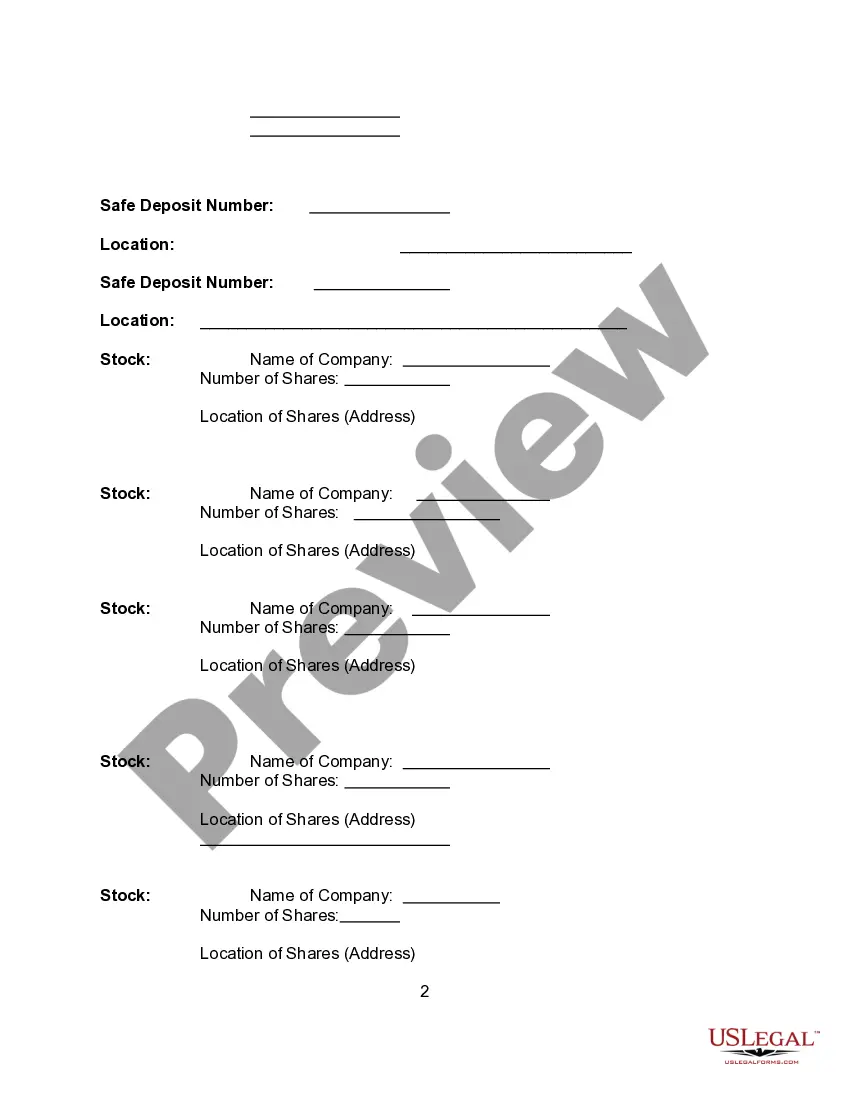

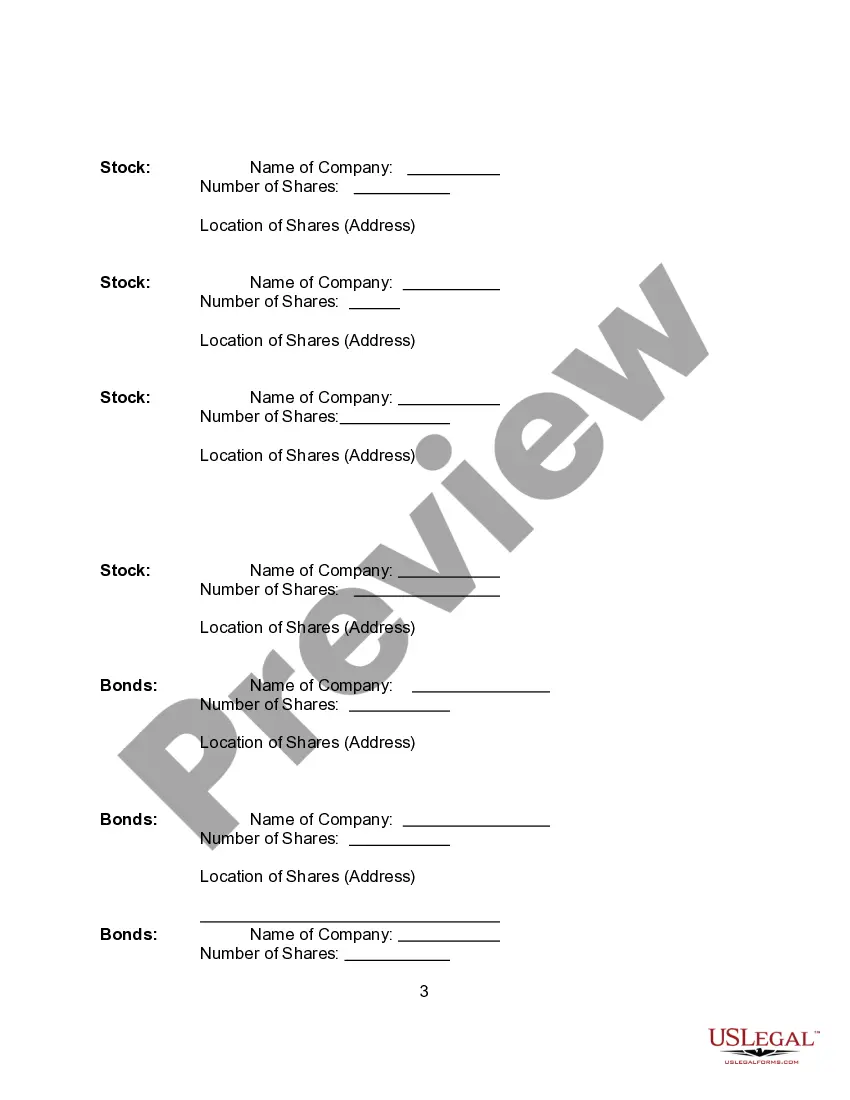

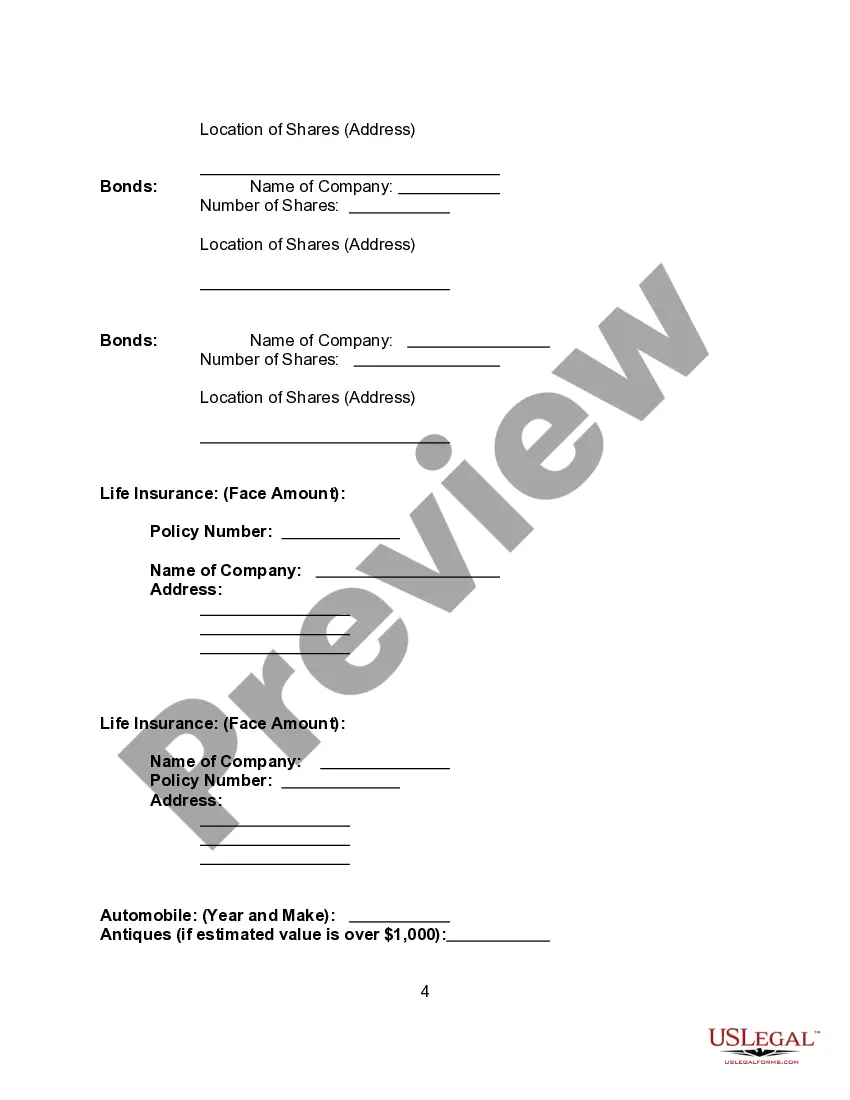

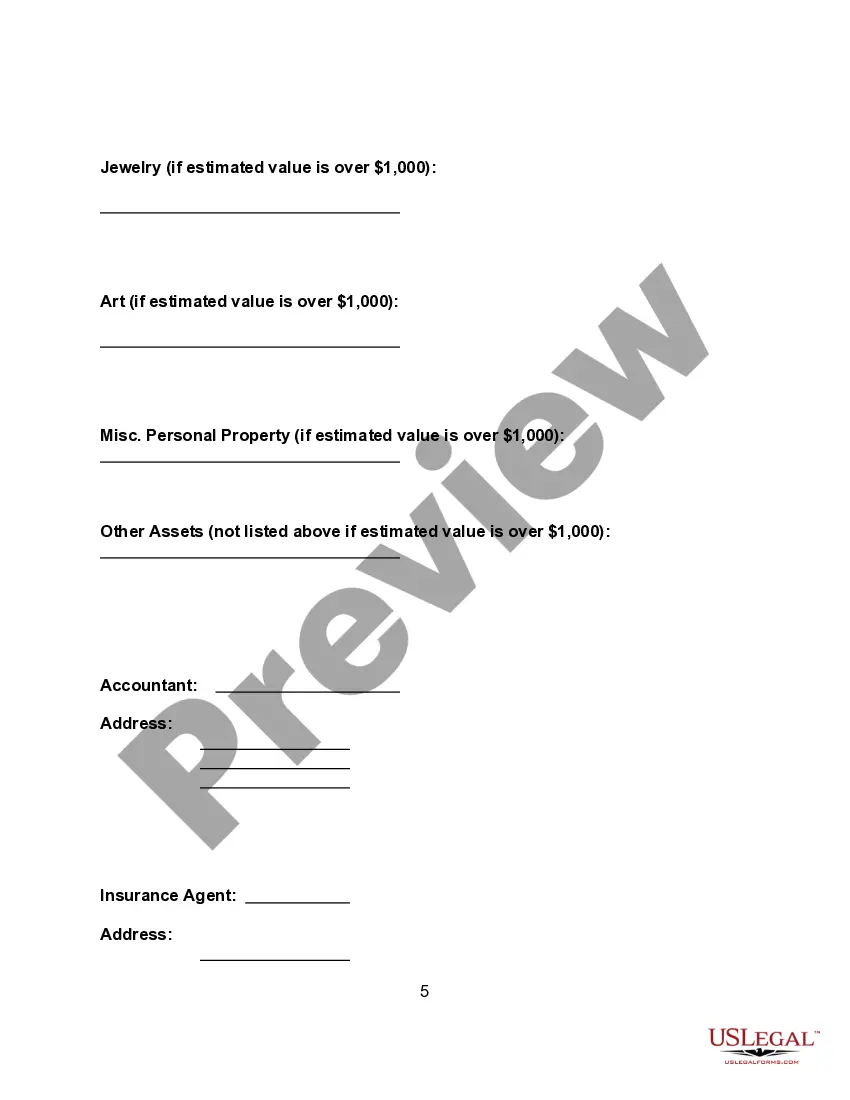

Louisiana Asset Information Sheet

Description

How to fill out Asset Information Sheet?

US Legal Forms - one of the largest repositories of valid documents in the USA - offers a variety of legal document templates that you can download or create.

Using the website, you will find thousands of forms for both business and personal purposes, organized by categories, states, or keywords. You can access the latest versions of forms such as the Louisiana Asset Information Sheet within moments.

If you have a monthly subscription, Log In and obtain the Louisiana Asset Information Sheet from your US Legal Forms library. The Download button will be present on every form you review.

When you are satisfied with the form, confirm your selection by clicking the Purchase now button. Then, select your preferred pricing plan and provide your credentials to create an account.

Complete the transaction. Use your credit card or PayPal account to finalize the process. Download the form to your device in your desired format. Edit. Fill out, modify, print, and sign the saved Louisiana Asset Information Sheet.

- Access all previously saved forms in the My documents section of your account.

- Ensure you have selected the correct form for your region/county.

- Click on the Review option to examine the form’s details.

- Check the form’s description to confirm you have chosen the right one.

- If the form doesn't meet your needs, use the Search field at the top of the page to find one that fits.

Form popularity

FAQ

10606 (1/21) Supplemental Worksheet for. Credit for Taxes Paid to Other States for Forms.

Taxpayers can register for the Louisiana Taxpayer Access Point (LaTAP) system which provides the ability to view your tax filing and payment history for all taxes. Taxpayers can also call the LDR Call Center at (855) 307-3893. Individual income taxpayers may also inquire by email to collection.inquiries@la.gov.

Assessed Value = Market Value x (Assessment Rate / 100) The first calculation is based on the market value of the property and the determined assessment rate. The market value is multiplied by the assessment rate, in decimal form, to get the assessed value.

For residential property in Louisiana, assessed value is equal to 10% of market value. So if your home has a market value of $100,000, your assessed value would be $10,000. Homeowners in Louisiana are eligible for the homestead exemption, which can significantly reduce property taxes owed.

Homeowners who are 65 years or older, or who have a permanent disability, or are the surviving spouse of a member of the armed forces or Louisiana National Guard killed in action, missing in action, or a prisoner of war may be able to "freeze" the assessed value at which their home is assessed if they meet certain

Use value is determined by the productivity of the land. The Louisiana Tax Commission provides assessors with a per acre assessed value to use in the assessment of lands taxed based upon use value.

Things permanently affixed to a building or other construction so that they cannot be removed without substantially damaging them or the immovable to which they are attached (La. Civil Code Article 466), and, (f).

The Louisiana Constitution mandates that all property subject to taxation be reappraised and valued at least every four years. Our last reassessment year was 2016. The year 2020 is a reassessment year.

Louisiana Resident Income Tax Return We last updated Louisiana Form IT-540 in January 2022 from the Louisiana Department of Revenue. This form is for income earned in tax year 2021, with tax returns due in April 2022.

Form R-10606 "Supplemental Worksheet for Credit for Taxes Paid to Other States for Forms It-540 and It-541" - Louisiana.