Louisiana Agreement to Continue Business Between Surviving Partners and Legal Representative of Deceased Partner

Description

How to fill out Agreement To Continue Business Between Surviving Partners And Legal Representative Of Deceased Partner?

Selecting the ideal legal document template can be quite challenging. Of course, there is a wide range of templates accessible on the internet, but how can you find the legal format you need? Utilize the US Legal Forms website.

This platform provides thousands of templates, such as the Louisiana Agreement to Continue Business Between Surviving Partners and Legal Representative of Deceased Partner, suitable for both business and personal use. All templates are reviewed by professionals and comply with federal and state regulations.

If you are currently registered, sign in to your account and click on the Download button to obtain the Louisiana Agreement to Continue Business Between Surviving Partners and Legal Representative of Deceased Partner. Use your account to check the legal templates you have previously acquired. Go to the My documents section of your account to retrieve another copy of the document you need.

Complete, modify, and print, then sign the obtained Louisiana Agreement to Continue Business Between Surviving Partners and Legal Representative of Deceased Partner. US Legal Forms is the largest collection of legal templates where you can find various document formats. Utilize this service to download well-crafted documents that adhere to state requirements.

- If you are a new user of US Legal Forms, here are simple steps for you to follow.

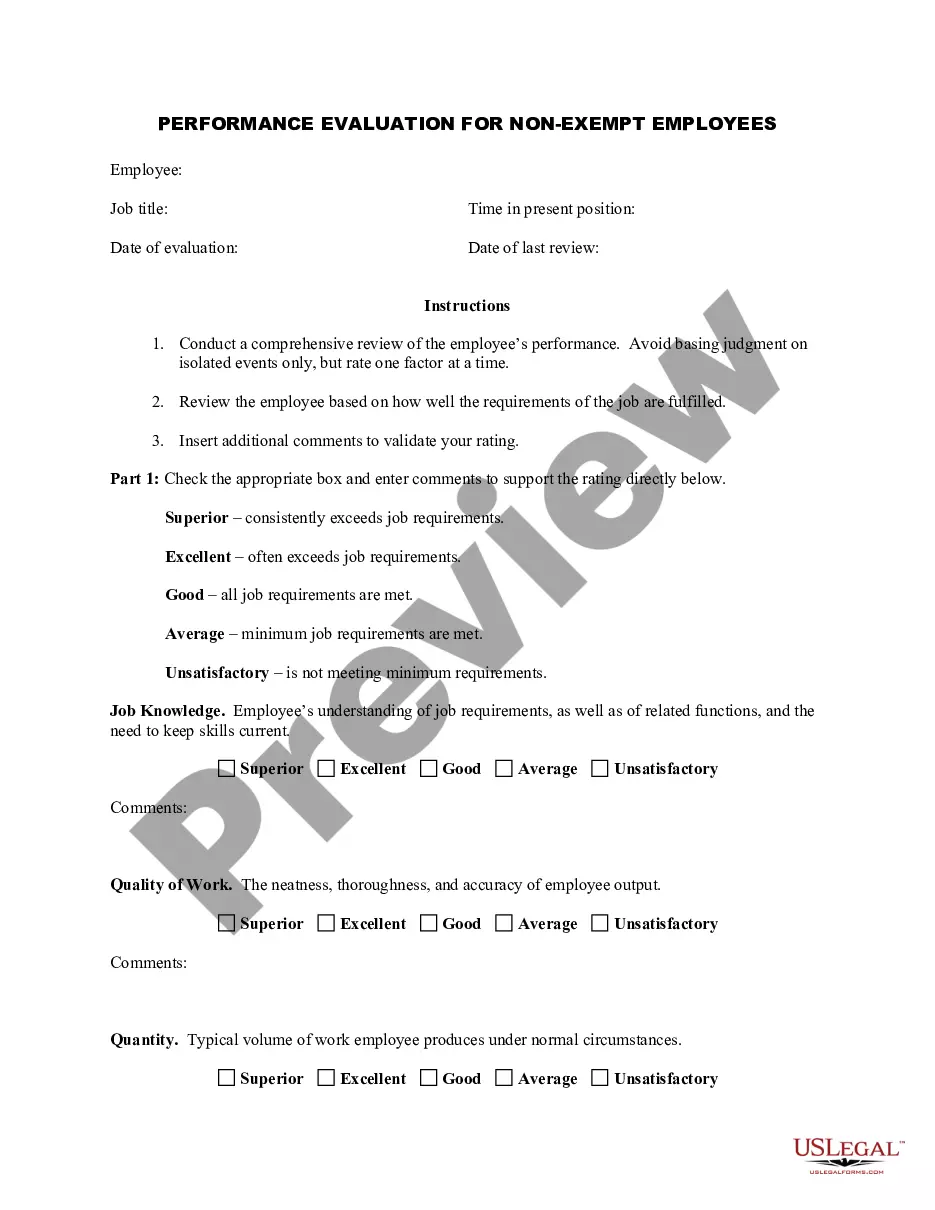

- First, ensure you have selected the correct format for your city/region. You can review the form using the Preview button and read the form description to make sure it is suitable for you.

- If the form does not meet your expectations, use the Search field to find the appropriate form.

- When you are convinced that the form is satisfactory, click the Purchase now button to buy the form.

- Choose the pricing plan you wish to select and enter the necessary information. Create your account and finalize the purchase using your PayPal account or Visa or Mastercard.

- Select the file format and download the legal document template to your device.

Form popularity

FAQ

In an unincorporated business, the death of a partner can lead to uncertainty regarding operations and ownership. Typically, the remaining partners may need to negotiate the terms under which the business will continue or be dissolved. A Louisiana Agreement to Continue Business Between Surviving Partners and Legal Representative of Deceased Partner can provide a clear framework for surviving partners to manage the transition effectively, ensuring that the business remains stable and operational.

On the death of a partner, subject to any contract to the contrary, the partnership ceases to exist. Here, the contract on the contrary means the partnership need not be dissolved if it is expressly mentioned in the partnership deed that the remaining partners (not a partner) can continue the firm's business.

Explanation: The person who represents the deceased partner is his legal heir or executor.

The Supreme Court held as under: Section 42(c) of the Partnership Act can appropriately be applied to a' partnership where there are more than two partners. If one of them dies, the firm is dissolved; but if there is a contract to the contrary, the surviving partners will continue the firm.

Step By step explanation:Deceased partner's share of Goodwill of the firm.Deceased partner's share in the undistributed profits or the reserves.The amount standing in the deceased partner's Capital A/c.The amount of Interest on the Capital up to the date of death of the deceased partner.More items...?

In case of death of a partner, his or her legal representative receives the amount payable to him or her by the firm. The legal representative of the deceased partner is eligible for the following amounts: The amount standing in the deceased partner's Capital A/c.

On the death of a partner, subject to any contract to the contrary, the partnership ceases to exist. Here, the contract on the contrary means the partnership need not be dissolved if it is expressly mentioned in the partnership deed that the remaining partners (not a partner) can continue the firm's business.

The death of a partner in a two-person partnership will terminate the partnership for federal tax purposes if it results in the partnership's immediately winding up its business (Sec. 708(b)(1)(A)). If this occurs, the partnership's tax year closes on the partner's date of death.

For the aforesaid proposition, the Court relied upon Section 42(c) of Indian Partnership Act, 1932 which provided for dissolution of a partnership upon the death of a partner and noting that in this case, once the partnership comes to an end, by virtue of death of one of the partners, there would not be any partnership

When a partner in a partnership dies, the basic position under the Partnership Act 1890 is that the partnership is dissolved: 'Subject to any agreement between the partners, every partnership is dissolved as regards all the partners by the death2026 of any partner.