A nonprofit corporation is one that is organized for charitable or benevolent purposes. These corporations include certain hospitals, universities, churches, and other religious organizations. A nonprofit entity does not have to be a nonprofit corporation, however. Nonprofit corporations do not have shareholders, but have members or a perpetual board of directors or board of trustees.

Louisiana Articles of Incorporation for Non-Profit Organization, with Tax Provisions

Description

How to fill out Articles Of Incorporation For Non-Profit Organization, With Tax Provisions?

If you intend to aggregate, obtain, or generate legal document templates, utilize US Legal Forms, the finest array of legal forms, accessible online.

Employ the site's user-friendly and convenient search to locate the documents you need.

Various templates for business and personal purposes are organized by types and states, or keywords and phrases.

Step 5. Complete the transaction. You may use your credit card or PayPal account to finalize the transaction.

Step 6. Choose the format of the legal form and download it to your device.

- Use US Legal Forms to locate the Louisiana Articles of Incorporation for Non-Profit Organization, with Tax Provisions in just a few clicks.

- If you are already a US Legal Forms user, Log In to your account and then select the Download option to find the Louisiana Articles of Incorporation for Non-Profit Organization, with Tax Provisions.

- You can also access forms you've previously obtained in the My documents section of your account.

- If you are using US Legal Forms for the first time, follow the instructions below.

- Step 1. Ensure you have chosen the form for the correct city/state.

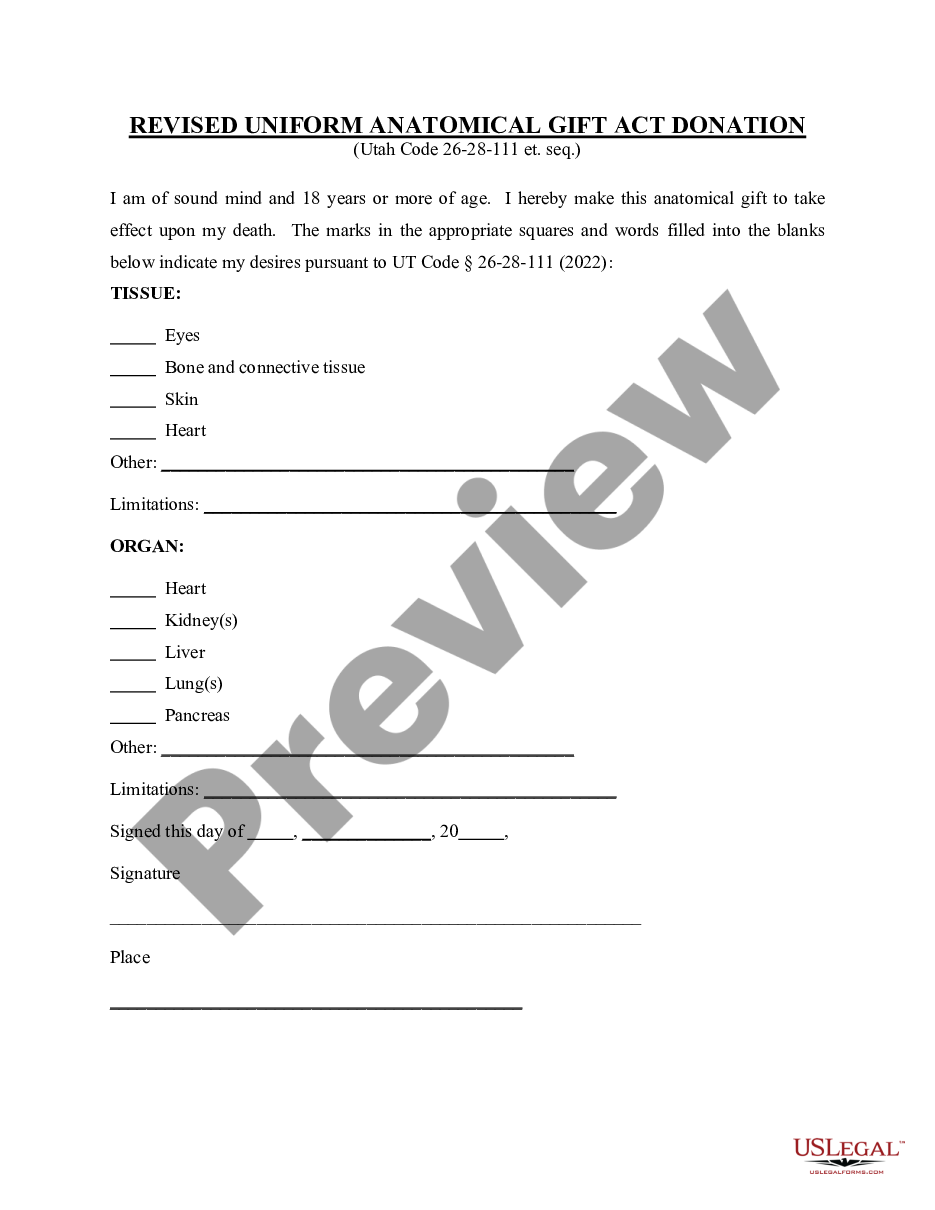

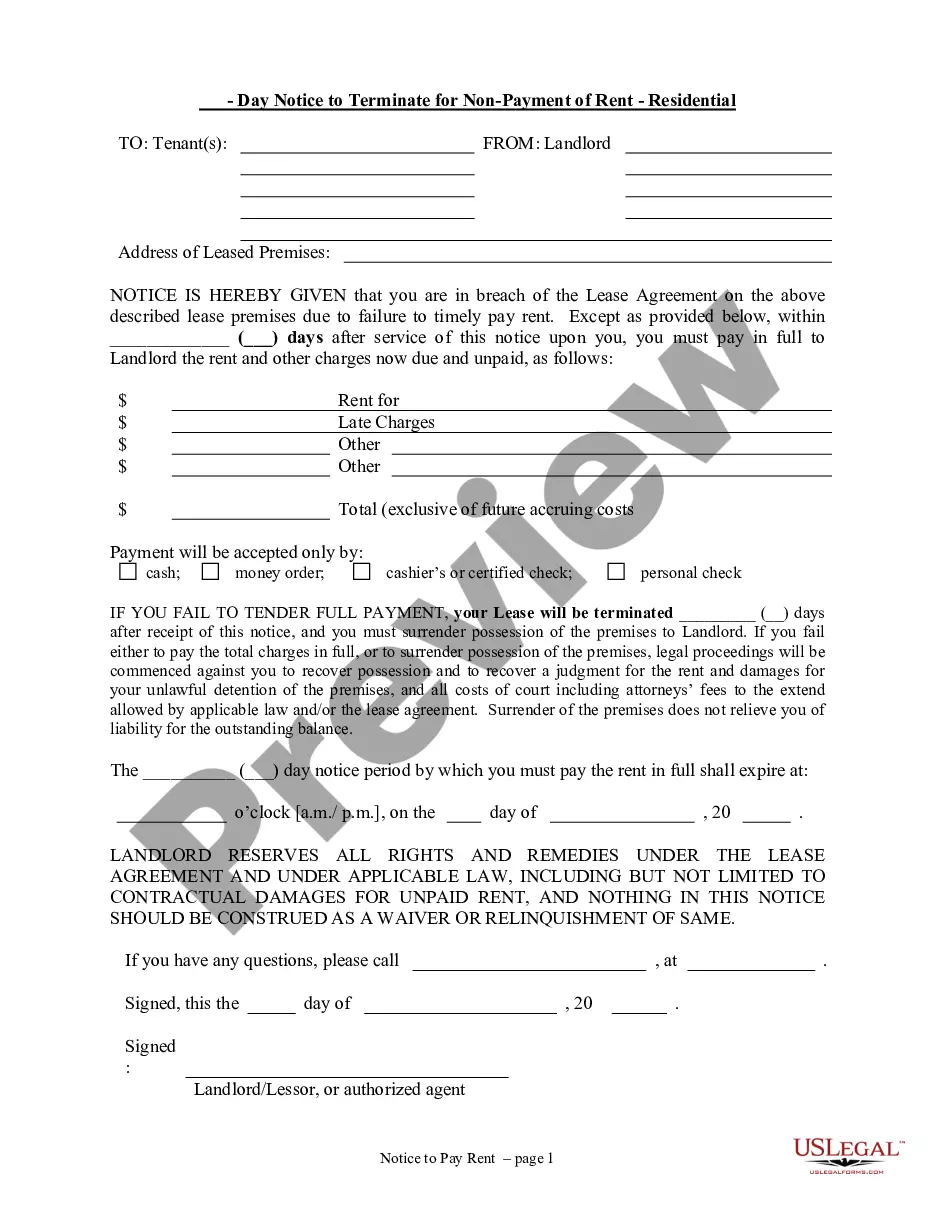

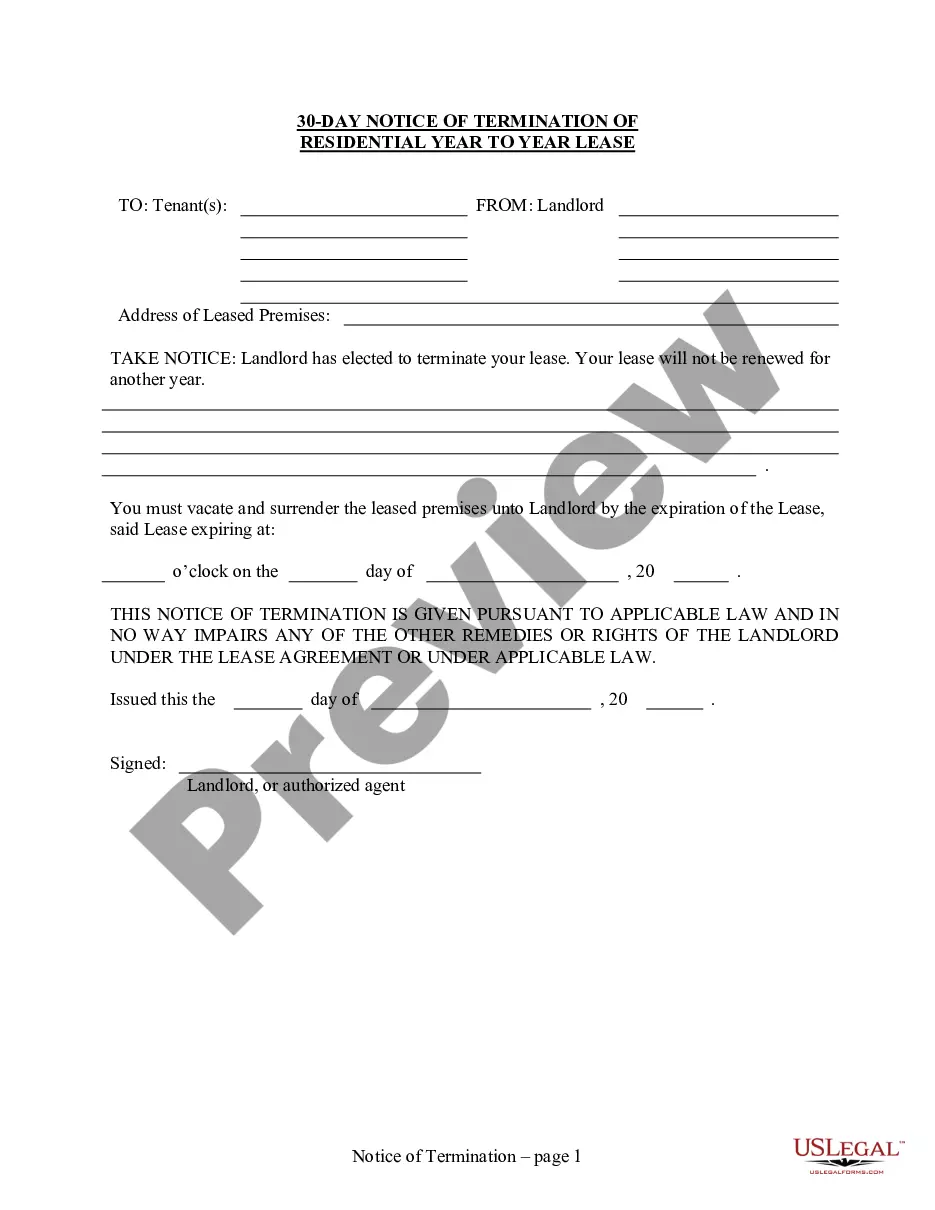

- Step 2. Utilize the Preview option to browse the form's content. Do not forget to review the information.

- Step 3. If you are dissatisfied with the form, use the Search area at the top of the screen to find alternative varieties of the legal document template.

- Step 4. After identifying the form you need, select the Purchase now option. Choose the pricing plan you prefer and enter your details to register for an account.

Form popularity

FAQ

To create articles of incorporation for a non-profit organization in Louisiana, start by drafting documents that include your organization's name, purpose, and the names of your initial board of directors. You must meet state guidelines to ensure proper application for tax provisions as well. Services like US Legal Forms can provide comprehensive templates and resources to make this process efficient and straightforward.

Creating Louisiana Articles of Incorporation for a Non-Profit Organization, with Tax Provisions, involves several steps. First, you need to outline your nonprofit's purpose, structure, and governance. Using a reliable service like US Legal Forms can help you quickly generate accurate documents that meet state requirements, ensuring a smooth formation process.

To obtain Louisiana Articles of Incorporation for a Non-Profit Organization, with Tax Provisions, you can start by visiting the Louisiana Secretary of State’s website. There, you will find the necessary forms and instructions to guide you through the application process. Additionally, you can leverage resources like US Legal Forms to access pre-made templates that simplify your filing experience.

Yes, you can write your own Louisiana Articles of Incorporation for Non-Profit Organization, with Tax Provisions, but it is essential to follow state guidelines closely. Ensure that your document includes all necessary information to avoid complications during the filing process. For added assurance, consider using templates and services from USLegalForms to streamline your efforts and ensure compliance.

No, Louisiana Articles of Incorporation for Non-Profit Organization, with Tax Provisions, serve as the initial legal document to establish your nonprofit. In contrast, a 501(c)(3) status refers specifically to tax exemption granted by the IRS. While both are crucial for nonprofits, they fulfill different roles in the creation and operation of your organization.

Yes, many nonprofits can achieve tax-exempt status in Louisiana, but they must apply and meet specific criteria set by the IRS. The status generally allows organizations to avoid federal income tax, and, in some cases, state taxes as well. It's important to file the Louisiana Articles of Incorporation for Non-Profit Organization, with Tax Provisions, to lay the groundwork for obtaining this status.

To form an LLC in Louisiana, you need to file Articles of Organization with the Secretary of State. This document includes vital details about your business, including its name, address, and management structure. Additionally, if you are considering a non-profit, you’ll need the Louisiana Articles of Incorporation for Non-Profit Organization, with Tax Provisions. Ensuring proper documentation is vital for legal compliance and operational success.

Yes, Louisiana requires Articles of Organization to legally form entities such as LLCs and non-profits. This filing is a crucial step in formalizing your organization under state law. For non-profit organizations specifically, you’ll need to prepare the Louisiana Articles of Incorporation for Non-Profit Organization, with Tax Provisions. This ensures compliance and eligibility for tax-exempt status.

In Louisiana, Articles of Organization are official documents that establish a legal entity such as an LLC or non-profit organization. They include crucial information like the organization's name, address, and purpose. If you're planning to start a non-profit, filing the Louisiana Articles of Incorporation for Non-Profit Organization, with Tax Provisions is necessary. These articles protect your organization and help in tax compliance.

Yes, an LLC always needs Articles of Organization to be officially recognized. These articles outline the essential details of the business and comply with state laws. Similarly, if you are forming a non-profit organization, you will need to file the Louisiana Articles of Incorporation for Non-Profit Organization, with Tax Provisions. Failure to file these documents can lead to penalties or loss of business status.