28 U.S.C.A. § 1961 provides in part that interest shall be allowed on any money judgment in a civil case recovered in a district court. Such interest would continue to accrue throughout an appeal that was later affirmed.

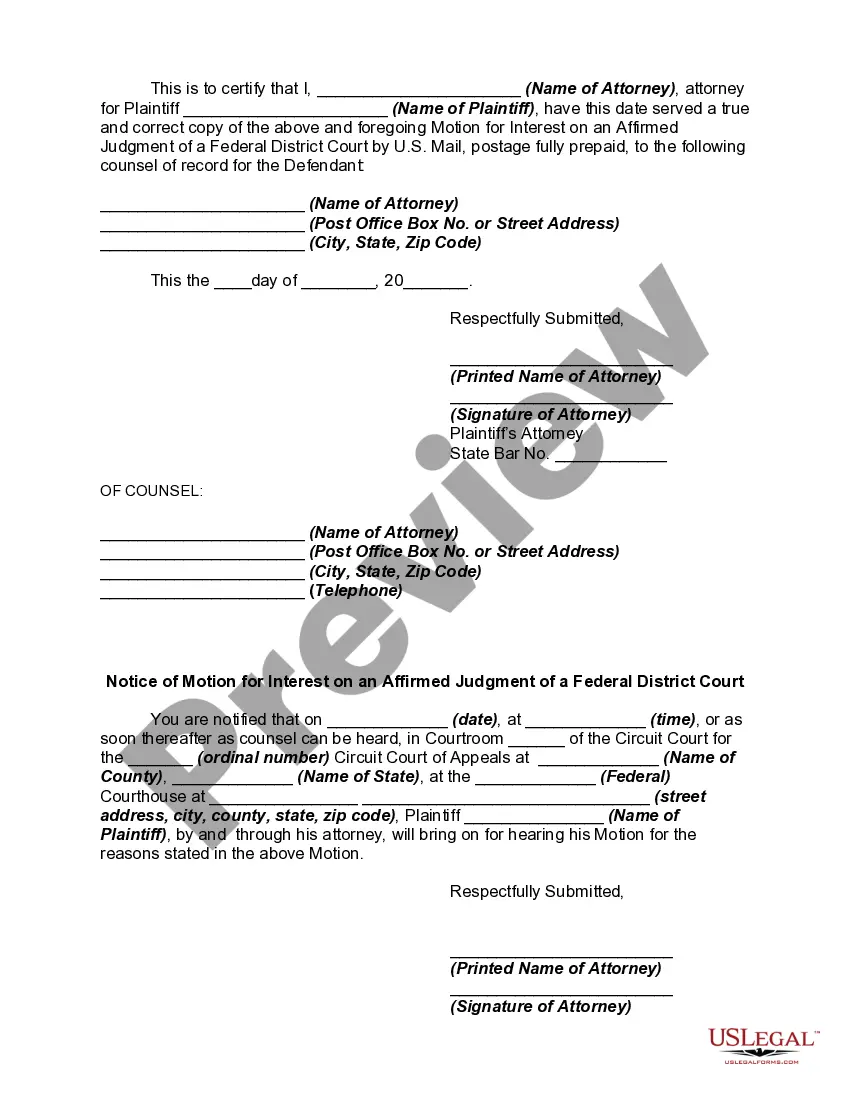

Louisiana Motion for Interest on an Affirmed Judgment of a Federal District Court

Description

How to fill out Motion For Interest On An Affirmed Judgment Of A Federal District Court?

Are you presently in the placement where you require documents for possibly organization or personal uses just about every working day? There are a lot of legitimate document themes accessible on the Internet, but discovering versions you can rely on isn`t straightforward. US Legal Forms offers thousands of kind themes, like the Louisiana Motion for Interest on an Affirmed Judgment of a Federal District Court, that are composed to fulfill federal and state specifications.

Should you be previously familiar with US Legal Forms web site and get an account, basically log in. After that, it is possible to acquire the Louisiana Motion for Interest on an Affirmed Judgment of a Federal District Court format.

If you do not offer an profile and need to begin to use US Legal Forms, adopt these measures:

- Find the kind you require and ensure it is for that appropriate area/area.

- Utilize the Review option to check the shape.

- See the outline to ensure that you have chosen the proper kind.

- In case the kind isn`t what you are trying to find, take advantage of the Search industry to get the kind that fits your needs and specifications.

- When you obtain the appropriate kind, click Buy now.

- Select the costs strategy you need, fill in the specified information to produce your account, and purchase an order making use of your PayPal or Visa or Mastercard.

- Select a handy paper format and acquire your copy.

Discover all of the document themes you might have bought in the My Forms menu. You may get a more copy of Louisiana Motion for Interest on an Affirmed Judgment of a Federal District Court at any time, if necessary. Just select the needed kind to acquire or produce the document format.

Use US Legal Forms, the most considerable variety of legitimate kinds, in order to save time as well as stay away from blunders. The services offers expertly made legitimate document themes which you can use for a variety of uses. Generate an account on US Legal Forms and begin making your way of life a little easier.

Form popularity

FAQ

To calculate your own pre-judgment interest, count the number of days between the 180th day after you notified your defendant of a pending lawsuit or the date you filed the lawsuit, and multiply the number of days by the appropriate rate.

Post-judgment interest rate: 10.10% (the amount of post judgment interest is set by Rule 36.7 of the Uniform Civil Procedure Rules 2005).

You can add interest at any time while the judgment is active. Generally, any unpaid principal balance collects interest at 10%, or 7% if the debtor is a government agency. This general rule applies to any judgment against a business or government agency, or when the debtor owes $200,000 or more.

The rate of interest used in calculating the amount of post-judgment interest is the weekly average 1-year constant maturity (nominal) Treasury yield, as published by the Federal Reserve System each Monday for the preceding week (unless that day is a holiday in which case the rate is published on the next business day) ...

When and at what rate do judgment debts attract interest? Judgment debts accrue simple interest at a rate of 8% a year until payment, unless rules of court provide otherwise, pursuant to section 17 of the Judgments Act 1838 (JA 1838) and the Judgment Debts (Rate of Interest) Order 1993, SI 1993/564.

Rule 50(a) provides for a motion for judgment as a matter of law (JMOL) which may be made at any time before submission of the case to the jury. This was previously known as a motion for a directed verdict.

(d) The court may allow an attorney to withdraw by ex parte motion if: (1) The attorney has been terminated by the client; or (2) The attorney has secured the written consent of the client and of all parties or their respective counsel; or (3) A limited appearance, as authorized by Rule 1.2(c) of the Rules of ...

Post-Judgment Interest Rates - 2023 Week EndingRate (%)8/11/20235.348/18/20235.368/25/20235.399/1/20235.3911 more rows