This is a form for return of merchandise by a customer.

Louisiana Merchandise Return

Description

How to fill out Merchandise Return?

US Legal Forms - one of the largest collections of legal documents in the country - offers a variety of legal form templates that you can download or print.

By using the website, you can discover numerous forms for business and personal needs, categorized by type, state, or keywords. You can find the latest forms such as the Louisiana Merchandise Return in just moments.

If you hold a subscription, Log In to access the Louisiana Merchandise Return within the US Legal Forms library. The Download button will appear on every form you review. You can access all previously downloaded forms in the My documents section of your account.

Select the format and download the form onto your device.

Make modifications. Fill out, edit, and print, then sign the downloaded Louisiana Merchandise Return. Each template you add to your account has no expiration date and belongs to you indefinitely. Therefore, if you wish to download or print another copy, simply go to the My documents section and click on the form you need. Gain access to the Louisiana Merchandise Return with US Legal Forms, the most comprehensive library of legal document templates. Utilize numerous professional and state-specific templates that fulfill your business or personal requirements.

- If you are accessing US Legal Forms for the first time, here are straightforward instructions to help you start.

- Ensure you have selected the correct form for your city/state.

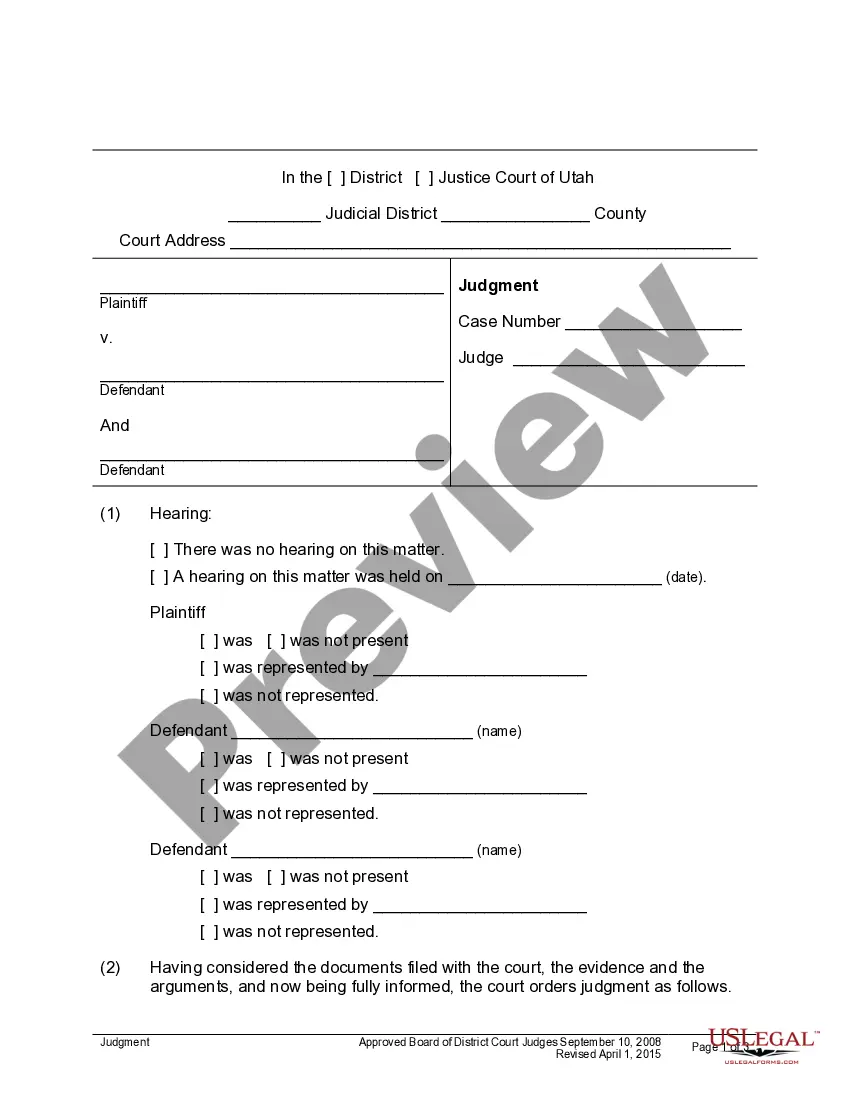

- Click the Preview button to check the form's details.

- Review the description to ensure you've selected the right form.

- If the form does not meet your needs, use the Search field at the top of the screen to find one that does.

- If you are satisfied with the form, confirm your choice by clicking the Buy now button. Then, select your preferred payment plan and provide your details to register for an account.

- Process the payment. Use your credit card or PayPal account to complete the transaction.

Form popularity

FAQ

The timeframe to receive your Louisiana state refund generally ranges from four to six weeks post-filing. Various elements, such as errors or incomplete information, can delay this process. Ensure that your Louisiana Merchandise Return is accurately completed to help expedite the receipt of your refund.

You can track your Louisiana state tax return online through the Louisiana Department of Revenue's website. They provide a tool where you can enter your personal information to check your refund status. For a smooth experience, consider using the services of US Legal Forms, which can aid you in your Louisiana Merchandise Return tracking.

A direct deposit for your Louisiana state tax refund usually takes about two to three weeks. This method often speeds up the refund process compared to receiving a check in the mail. For those concerned about tracking their Louisiana Merchandise Return, opting for direct deposit is a smart choice.

To amend your Louisiana sales tax return, you need to fill out a corrected return form, available on the Louisiana Department of Revenue website. Make sure to include any adjustments that reflect your actual sales. If you face challenges, using a platform like US Legal Forms can simplify the amendment process for your Louisiana Merchandise Return.

Generally, many individuals receive their federal tax refund before their state refund. While it may vary, the federal refund might arrive in about three weeks for e-filed submissions, while state refunds, such as for Louisiana Merchandise Return, may take a bit longer. To maximize your efficiency, consider filing both returns simultaneously.

Typically, a Louisiana state tax refund can take around four to six weeks to process after you file your return. However, this timeframe might vary based on factors like the volume of applications and any discrepancies in your submission. To ensure a smooth Louisiana Merchandise Return process, it's essential to ensure all your information is correct and complete.

A merchandise return refers to the process of sending back goods to the seller. In the context of Louisiana merchandise return policies, it often involves returning purchased items within a specified period for a refund or exchange. Many businesses in Louisiana have specific guidelines detailing how returns should be handled, including conditions for eligibility. Utilizing US Legal Forms can help you understand and document the process correctly, ensuring a smooth transaction.

In Louisiana, the statute of limitations for claiming a state refund typically lasts for three years from the date you submitted your tax return. Missing this window may result in the loss of your right to receive that refund. It’s essential to stay informed about deadlines and ensure your Louisiana merchandise return is filed within the appropriate timeframe. Consulting platforms like US Legal Forms can guide you through the filing process to avoid issues.

To track your state refund in Louisiana, you can visit the Louisiana Department of Revenue's website. Simply enter your Social Security number, the amount of your refund, and the year you filed. If you filed your return through a tax preparation service, they may also provide your refund status. Using resources like US Legal Forms can help ensure your Louisiana merchandise return is filed correctly, speeding up the refund process.

Louisiana offers tax exemption programs aimed at specific groups, such as veterans or active military personnel. These programs can provide substantial savings and help reduce the tax burden. Utilizing information about these programs can be beneficial when filing your Louisiana Merchandise Return.