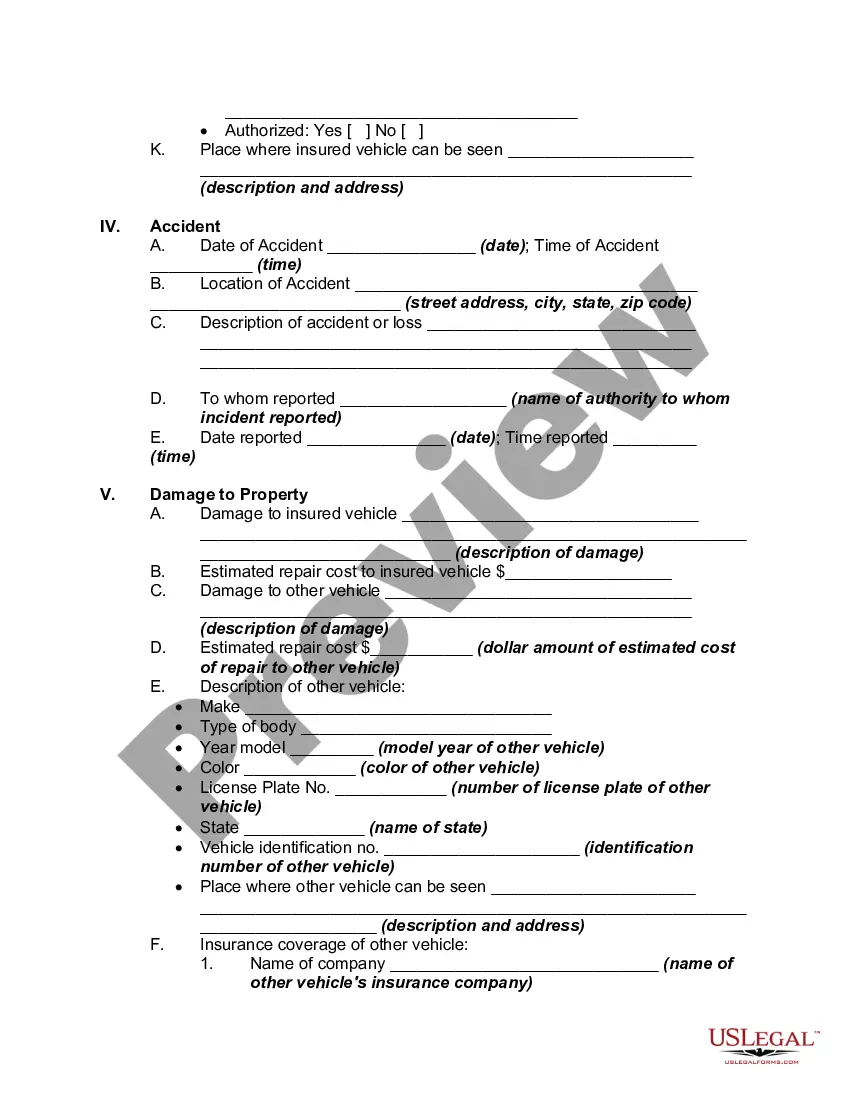

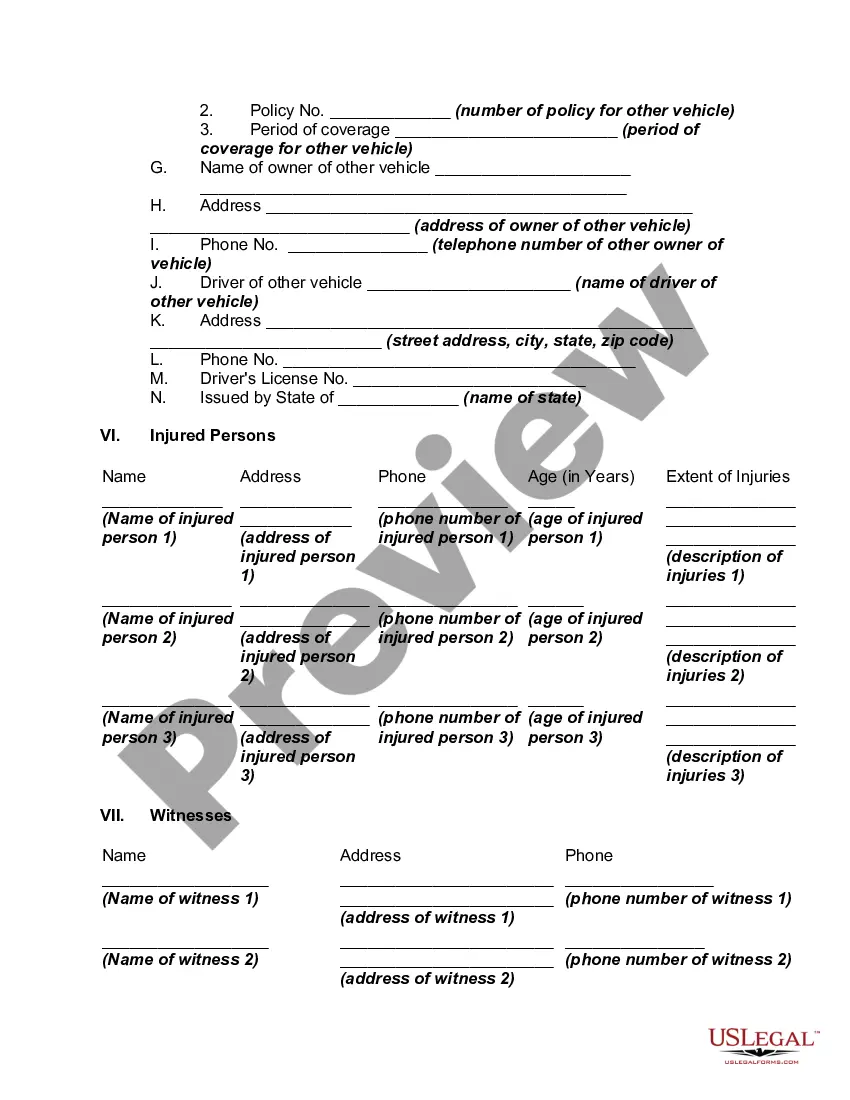

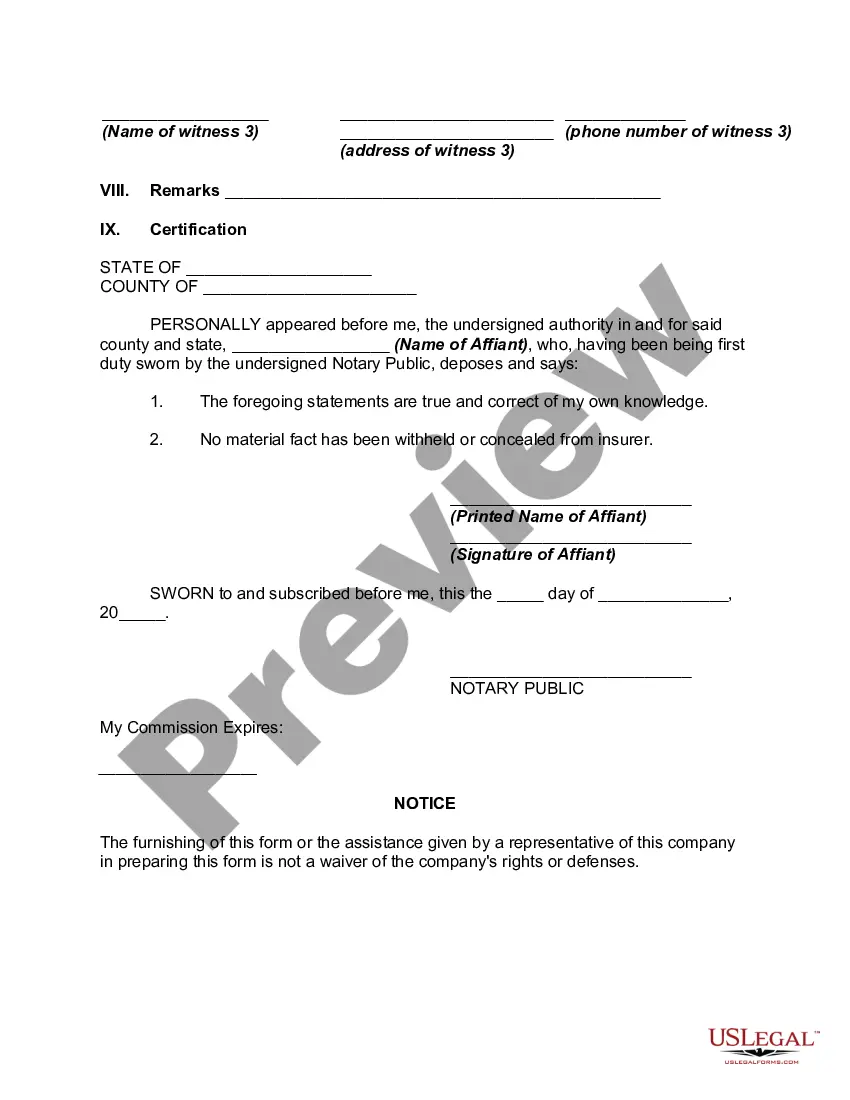

Louisiana Sworn Statement regarding Proof of Loss for Automobile Claim

Description

How to fill out Sworn Statement Regarding Proof Of Loss For Automobile Claim?

Choosing the right lawful papers format can be a battle. Obviously, there are a variety of web templates accessible on the Internet, but how can you discover the lawful form you need? Take advantage of the US Legal Forms web site. The services gives a huge number of web templates, for example the Louisiana Sworn Statement regarding Proof of Loss for Automobile Claim, which can be used for organization and personal needs. Every one of the forms are checked out by specialists and meet state and federal needs.

When you are currently registered, log in to the accounts and click on the Acquire button to get the Louisiana Sworn Statement regarding Proof of Loss for Automobile Claim. Make use of your accounts to check through the lawful forms you may have purchased formerly. Visit the My Forms tab of your respective accounts and acquire an additional version from the papers you need.

When you are a fresh consumer of US Legal Forms, here are simple recommendations that you can adhere to:

- Initial, make certain you have selected the correct form to your metropolis/county. It is possible to look through the form using the Preview button and browse the form outline to ensure this is the best for you.

- When the form fails to meet your expectations, take advantage of the Seach industry to find the correct form.

- Once you are sure that the form would work, click on the Buy now button to get the form.

- Select the costs program you need and type in the necessary information and facts. Design your accounts and buy the transaction using your PayPal accounts or charge card.

- Pick the document structure and down load the lawful papers format to the product.

- Comprehensive, revise and produce and indication the attained Louisiana Sworn Statement regarding Proof of Loss for Automobile Claim.

US Legal Forms is definitely the largest library of lawful forms for which you can discover different papers web templates. Take advantage of the service to down load skillfully-manufactured papers that adhere to state needs.

Form popularity

FAQ

Under precedent from the Louisiana Supreme Court, satisfactory proof of loss is any evidence ?sufficient to fully apprise the insurer of the insured's claims? and no formal proof of loss is required.

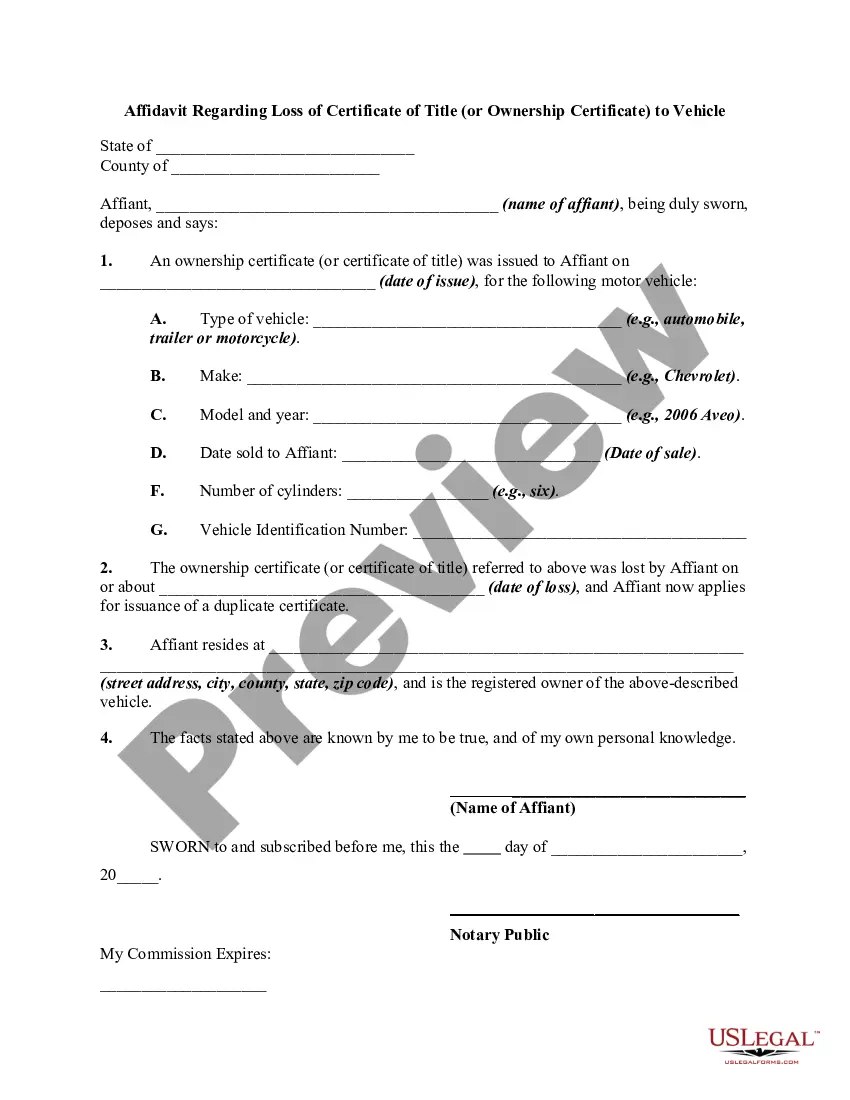

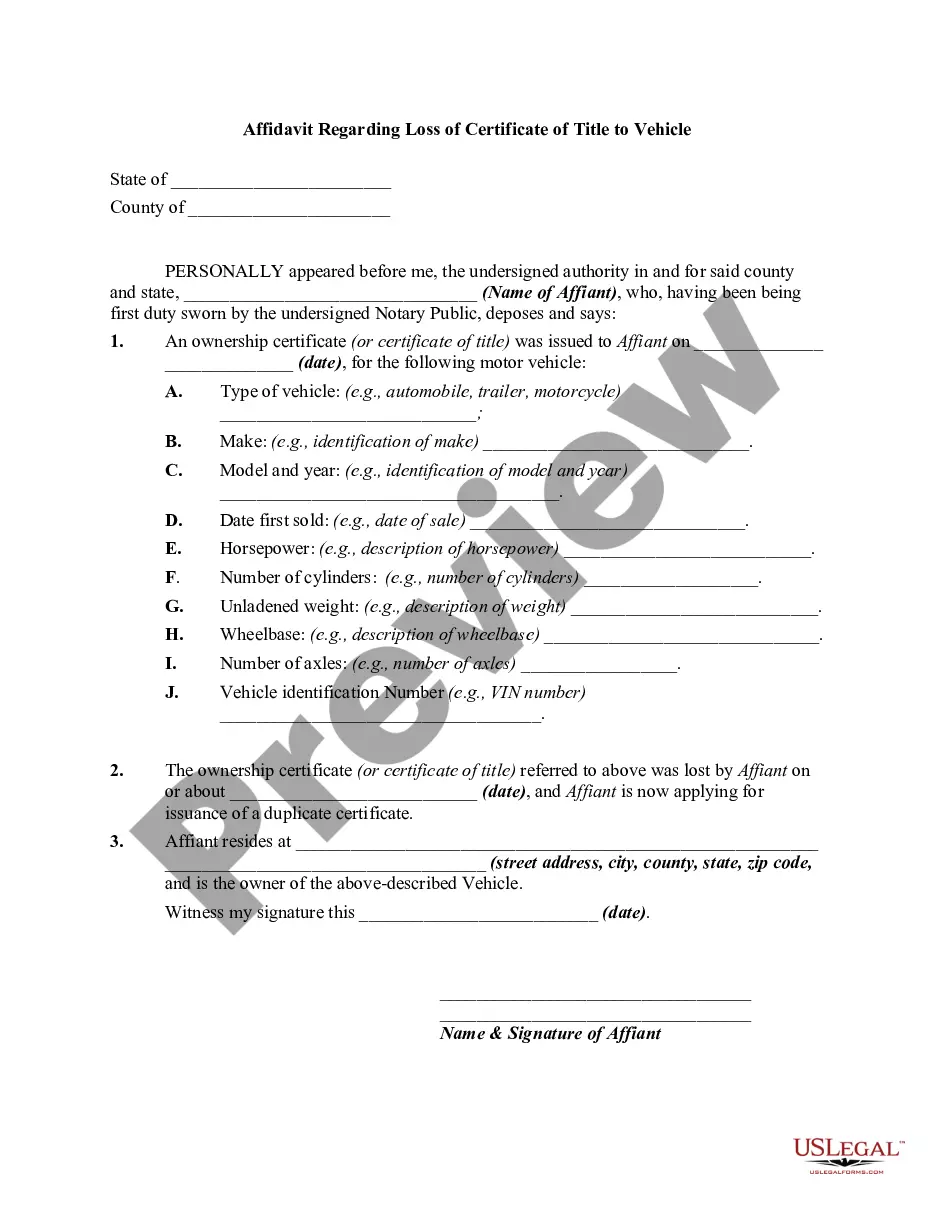

What is a proof of loss? Proof of loss is a legal document that explains what's been damaged or stolen and how much money you're claiming. Your insurer may have you fill one out, depending on the loss. Homeowners, condo and renters insurance can typically help cover personal property.

In most cases, the Proof of Loss must include the following: Amount of loss that the policyholder is claiming. Documentation that supports the amount of claimed loss. Date that the loss occurred.

Payment and adjustment of claims, policies other than life and health and accident; personal vehicle damage claims; extension of time to respond to claims during emergency or disaster; penalties; arson-related claims suspension.

What is a Proof of Loss? A Sworn Statement in Proof of Loss outlines the basic details of your property damage claim and serves as a cover document for your supporting claim materials and documentation.

Filing a Proof of Loss is required under most insurance policies, including homeowners insurance, life insurance, and car insurance. Most insurance policies require that the policyholder provide a signed Proof of Loss within 60 days of the insurance company's request.

Once the proof of loss has been received, the insurer has 30 days to accept or deny the claim as submitted. Once the claim has been accepted, and while the claim is being investigated, the insurer must notify you about the investigation's status.

A proof of loss form is evidence of any damages from an accident. Without this form, your insurer would not be able to process your claim. This would put repairs on hold, and prevent you from receiving accident benefits.