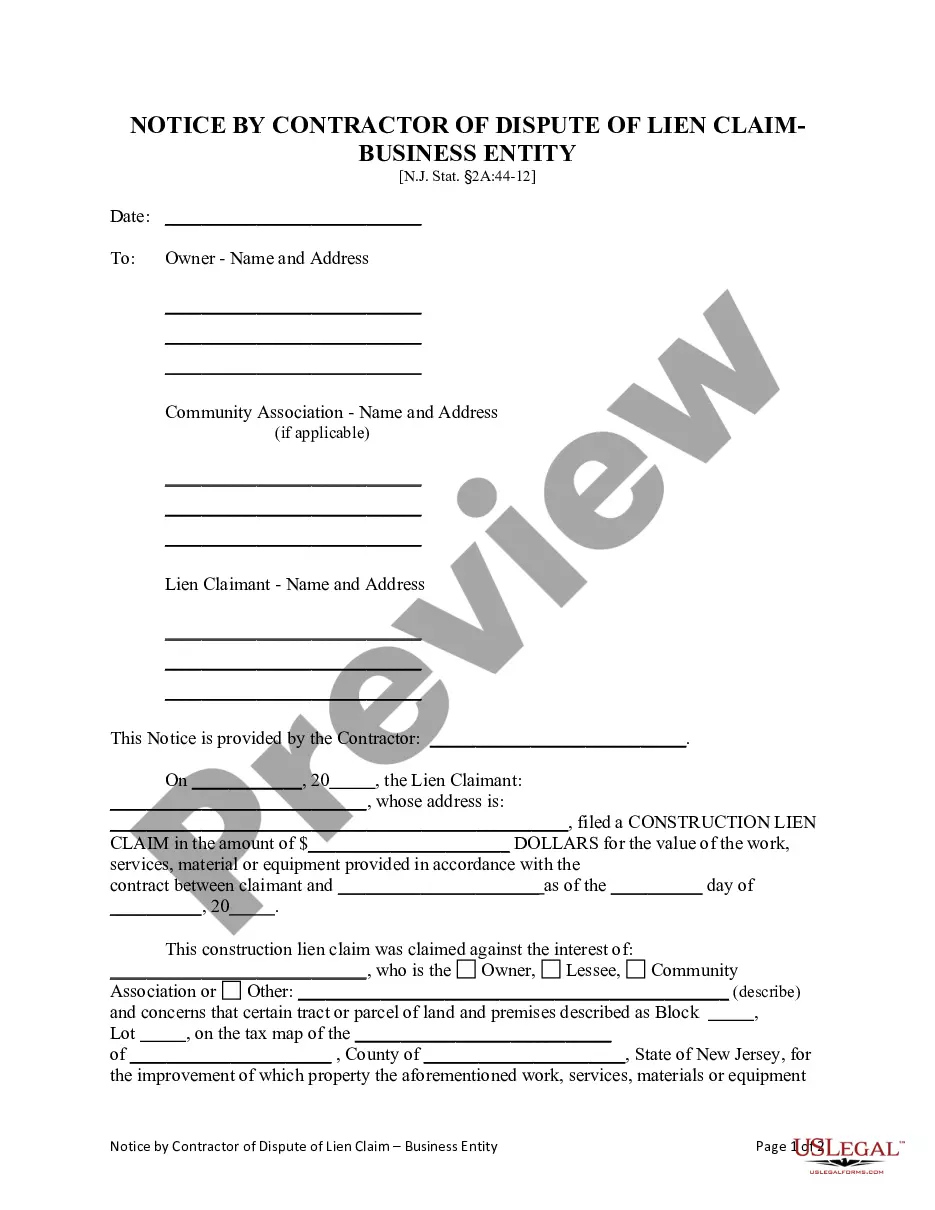

A number of states have enacted measures to facilitate greater communication between borrowers and lenders by requiring mortgage servicers to provide certain notices to defaulted borrowers prior to commencing a foreclosure action. The measures serve a dual purpose, providing more meaningful notice to borrowers of the status of their loans and slowing down the rate of foreclosures within these states. For instance, one state now requires a mortgagee to mail a homeowner a notice of intent to foreclose at least 45 days before initiating a foreclosure action on a loan. The notice must be in writing, and must detail all amounts that are past due and any itemized charges that must be paid to bring the loan current, inform the homeowner that he or she may have options as an alternative to foreclosure, and provide contact information of the servicer, HUD-approved foreclosure counseling agencies, and the state Office of Commissioner of Banks.

Louisiana Notice of Intent to Foreclose - Mortgage Loan Default

Description

How to fill out Notice Of Intent To Foreclose - Mortgage Loan Default?

If you need to comprehensive, acquire, or print out authorized record themes, use US Legal Forms, the largest selection of authorized kinds, which can be found on-line. Take advantage of the site`s basic and convenient lookup to obtain the files you will need. Numerous themes for business and specific functions are categorized by categories and suggests, or keywords and phrases. Use US Legal Forms to obtain the Louisiana Notice of Intent to Foreclose - Mortgage Loan Default in just a few clicks.

If you are currently a US Legal Forms buyer, log in for your bank account and click the Obtain switch to obtain the Louisiana Notice of Intent to Foreclose - Mortgage Loan Default. Also you can access kinds you formerly acquired from the My Forms tab of the bank account.

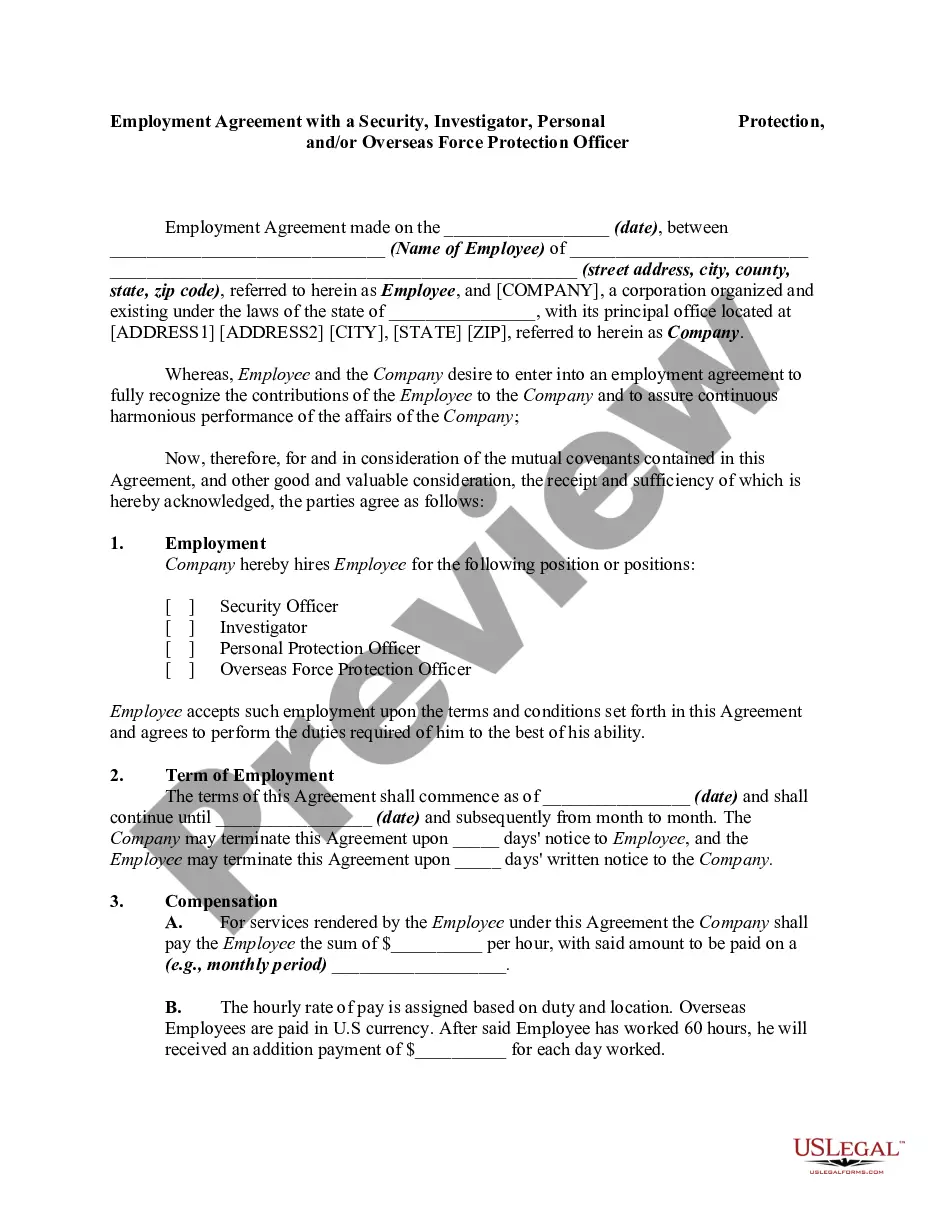

Should you use US Legal Forms initially, follow the instructions listed below:

- Step 1. Make sure you have chosen the shape to the right town/region.

- Step 2. Utilize the Review solution to look through the form`s content. Do not forget to see the explanation.

- Step 3. If you are unsatisfied with all the form, utilize the Lookup field at the top of the screen to get other types in the authorized form template.

- Step 4. Upon having discovered the shape you will need, go through the Acquire now switch. Choose the prices plan you like and add your accreditations to register to have an bank account.

- Step 5. Process the financial transaction. You can utilize your credit card or PayPal bank account to finish the financial transaction.

- Step 6. Pick the structure in the authorized form and acquire it in your device.

- Step 7. Comprehensive, edit and print out or sign the Louisiana Notice of Intent to Foreclose - Mortgage Loan Default.

Each authorized record template you get is your own forever. You may have acces to each form you acquired with your acccount. Select the My Forms section and decide on a form to print out or acquire again.

Remain competitive and acquire, and print out the Louisiana Notice of Intent to Foreclose - Mortgage Loan Default with US Legal Forms. There are thousands of professional and express-particular kinds you can utilize to your business or specific requires.

Form popularity

FAQ

Here are our top 5 tips for buying foreclosures You need to work with a REALTOR® ... You must be preapproved for a mortgage or have proof of funds if you're paying cash. ... Properties are sold as-is, with no repairs. ... Properties may or may not have utilities for inspections. ... You may be bidding against other buyers.

Which state has the longest foreclosure process? The state with the longest foreclosure process is Hawaii, followed by Louisiana, Kentucky, Nevada, and Connecticut.

In many cases, a loan in default may be sent to the lender's collections department or sold to a third-party collections agency. Going into default may also result in your wages or tax refund being garnished if the creditor seeks a judgment against you.

Another option is a deed in lieu of foreclosure. This involves transferring the title of a property from the debtor to the lender in exchange for forgiveness of the remaining debt. It's essentially a sale of the property directly to the lender for the remaining loan balance.

Under federal law, in most cases, a mortgage servicer can't start a foreclosure until a homeowner is more than 120 days overdue on payments.

While the entire foreclosure usually takes 60 to 180 days, the borrower has to move quickly to stop the foreclosure. Once the writ of seizure and sale is ordered, the borrower can't remedy the mortgage to remain in the home. In most cases, lenders can seek deficiency judgments in Louisiana.

A ?default? occurs when a borrower does not make his or her mortgage loan payment and falls behind. When this happens, he or she risks the home heading into the foreclosure process. Usually, the foreclosure process is started within thirty days after the due date is not met.

A notice of default is a formal public notice that is filed with the state court and states that the borrower is in arrears. It is used when a borrower delays in making mortgage repayments, and the mortgage lender files the notice of default as the first step of a foreclosure process.

Options include paying back the past-due amount over time, loan modification or refinance, or deed in lieu of foreclosure. Housing counselors can help you understand the law and your options, organize your finances and represent you in negotiations with your lender, if you need this assistance.

Technically speaking, a notice of default is not a foreclosure. Instead, it serves as notice that you are behind in your payments and that your property may be sold as a result of foreclosure if you don't act soon.