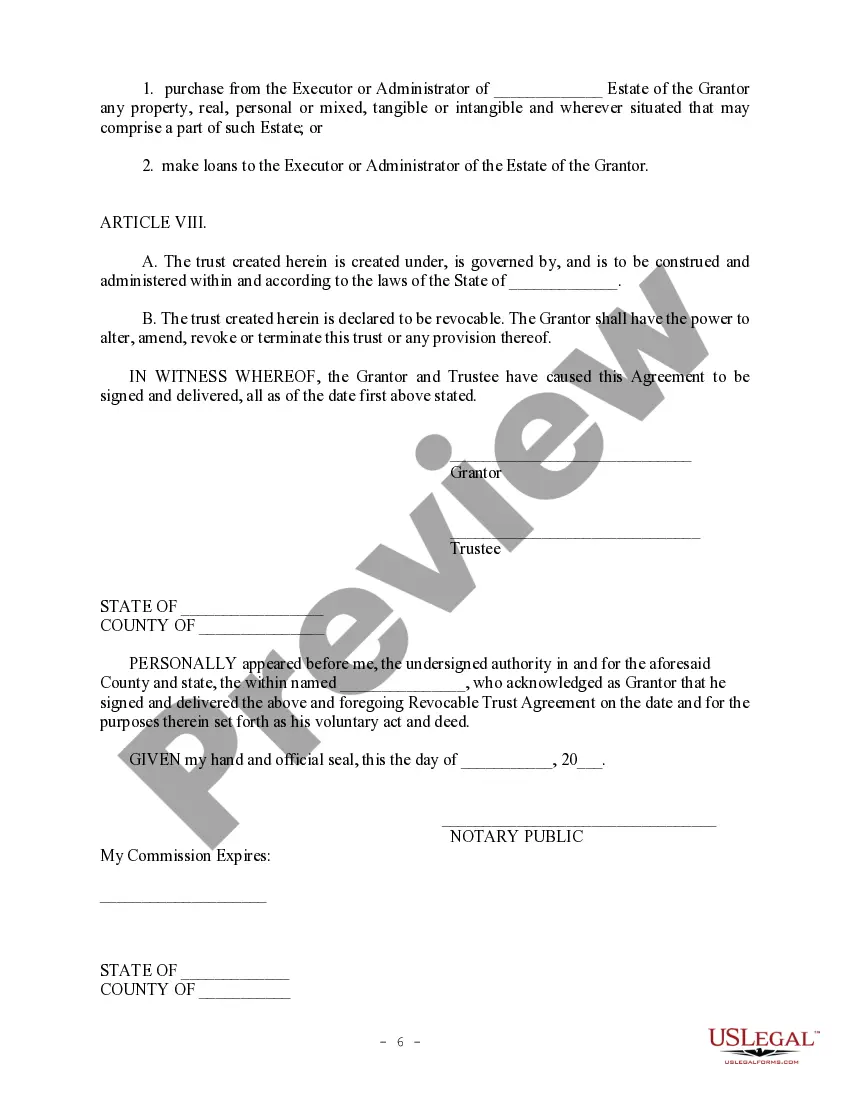

Louisiana Revocable Trust Agreement - Grantor as Beneficiary

Description

How to fill out Revocable Trust Agreement - Grantor As Beneficiary?

You can dedicate numerous hours online looking for the valid document template that fulfills the federal and state requirements you desire.

US Legal Forms offers thousands of valid forms that have been reviewed by experts.

It is easy to obtain or print the Louisiana Revocable Trust Agreement - Grantor as Beneficiary from our service.

First, ensure that you have chosen the correct document template for the area/city of your selection. Review the form description to confirm you have selected the appropriate form.

- If you already possess a US Legal Forms account, you may Log In and click the Download button.

- Afterward, you can complete, edit, print, or sign the Louisiana Revocable Trust Agreement - Grantor as Beneficiary.

- Every valid document template you purchase is yours permanently.

- To obtain another copy of a purchased form, visit the My documents tab and then click the relevant button.

- If you are using the US Legal Forms website for the first time, follow these straightforward instructions.

Form popularity

FAQ

One significant disadvantage of a family trust, like a Louisiana Revocable Trust Agreement - Grantor as Beneficiary, is the potential for increased administrative burdens and costs. Setting up and maintaining the trust requires time and financial resources, which may not be feasible for everyone. Furthermore, family dynamics can complicate trust management, leading to disputes among beneficiaries. It is essential to consider these factors and have open conversations about family expectations.

While this question pertains to the UK, one common mistake parents often make, which can apply broadly, includes failing to clearly outline their intentions in the trust document. In a Louisiana Revocable Trust Agreement - Grantor as Beneficiary, clarity is vital to prevent confusion among beneficiaries. Parents must consider all aspects, such as distribution terms and trustee duties, to ensure their wishes are honored. Engaging a legal expert can significantly help in avoiding such pitfalls.

Trust funds offer many benefits, but they also come with some dangers, especially within a Louisiana Revocable Trust Agreement - Grantor as Beneficiary. Mismanagement or lack of oversight may lead to unintended financial consequences. Additionally, beneficiaries might make poor decisions if they do not fully understand the trust's provisions. It is advisable to regularly review trust structures and seek professional guidance to mitigate these risks.

Yes, an individual trustee can also be a beneficiary in a Louisiana Revocable Trust Agreement - Grantor as Beneficiary. This arrangement can simplify trust management and provide the trustee with a vested interest in the trust's success. However, it is crucial to establish clear guidelines to avoid potential conflicts of interest. Ultimately, ensure that your trust document reflects your intentions clearly.

Yes, in a Louisiana Revocable Trust Agreement - Grantor as Beneficiary, the grantor can also be a beneficiary of the trust. This arrangement allows the grantor to benefit from the trust assets during their lifetime while ensuring a clear plan for asset distribution after their death. This dual role offers flexibility and control over one's estate planning needs.

Transferring assets to a trust after the grantor's death involves a few critical steps. First, identify the assets you wish to place into the trust. Then, follow the provisions laid out in the Louisiana Revocable Trust Agreement - Grantor as Beneficiary, which may specify how assets should be retitled or transferred. It is often a good idea to seek professional guidance during this process to ensure compliance with legal requirements.

Yes, a trust usually becomes irrevocable upon the death of the grantor, specifically in a Louisiana Revocable Trust Agreement - Grantor as Beneficiary. This change means that the terms of the trust can no longer be altered, ensuring that the trust assets are distributed according to the grantor's wishes. An irrevocable trust offers greater protection for the assets and can provide benefits for estate planning.

To transfer property held in a living trust after the grantor's death, the successor trustee should first locate the trust document and identify the beneficiaries. Next, the trustee will need to follow the instructions set forth in the Louisiana Revocable Trust Agreement - Grantor as Beneficiary for asset distribution. This process generally involves updating titles, deeds, or accounts to reflect the new ownership for beneficiaries.

When the grantor of a Louisiana Revocable Trust Agreement - Grantor as Beneficiary passes away, the trust typically becomes irrevocable. The successor trustee takes over management of the trust and distributes the assets according to the terms outlined in the trust document. This process helps avoid lengthy probate proceedings, providing a smoother transition for the beneficiaries.

To add a beneficiary to your Louisiana Revocable Trust Agreement - Grantor as Beneficiary, you will need to amend the trust document. This involves creating a formal amendment that specifies the new beneficiary's name and any relevant details regarding their inheritance. It's crucial to follow the procedures outlined in your original trust document to ensure compliance. If you require assistance, our platform, USLegalForms, provides valuable resources to help you navigate this process efficiently.