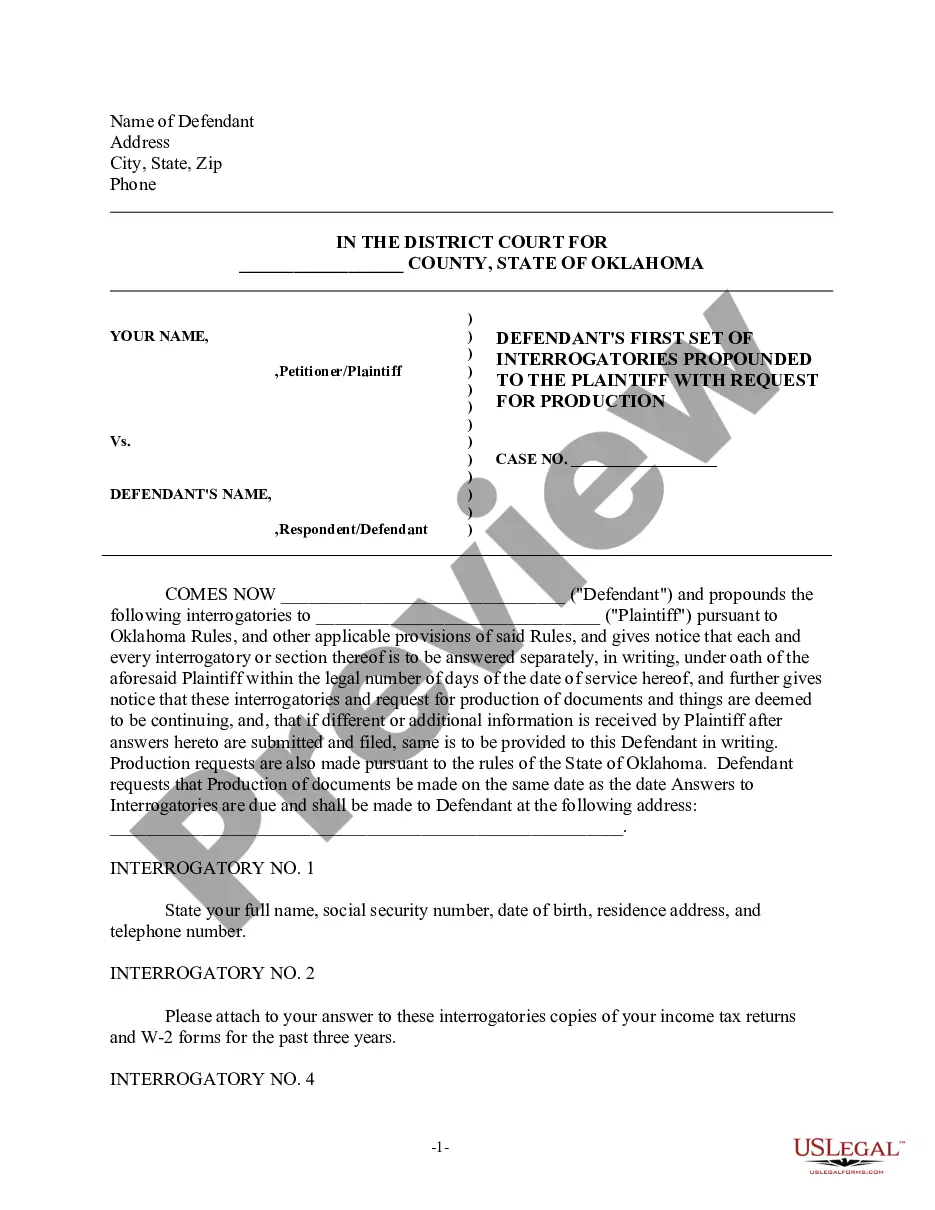

This form is a Complaint For Declaratory Judgment To Determine Credit Life Policy Coverage. Adapt to your specific circumstances. Don't reinvent the wheel, save time and money.

Louisiana Complaint For Declaratory Judgment To Determine Credit Life Policy Coverage

Description

How to fill out Complaint For Declaratory Judgment To Determine Credit Life Policy Coverage?

Have you ever found yourself in a position where you require documents for either professional or personal use almost every day.

There are numerous legitimate document templates available online, but finding reliable versions can be challenging.

US Legal Forms offers thousands of form templates, including the Louisiana Complaint For Declaratory Judgment To Determine Credit Life Policy Coverage, which are designed to meet state and federal requirements.

Once you find the right form, simply click Get now.

Choose the pricing plan you want, fill in the required information to create your account, and pay for the order using your PayPal or credit card.

- If you are already familiar with the US Legal Forms website and have an account, simply Log In.

- Afterward, you can download the Louisiana Complaint For Declaratory Judgment To Determine Credit Life Policy Coverage template.

- If you do not have an account and wish to start using US Legal Forms, follow these steps.

- Find the form you need and ensure it is for the correct city/county.

- Use the Review button to examine the form.

- Check the description to confirm that you have selected the right form.

- If the form is not what you are looking for, use the Lookup field to find the form that fits your needs.

Form popularity

FAQ

In Louisiana, an insurance company generally has 30 days to acknowledge receipt of a claim and 60 days to settle the claim after it is filed. However, specific timeframes can vary based on the type of insurance and the complexity of the claim. If you experience delays or disputes, especially regarding the Louisiana Complaint For Declaratory Judgment To Determine Credit Life Policy Coverage, consider seeking legal advice or assistance.

A dec action, or declaratory judgment action, is a legal procedure that allows policyholders to seek a court's determination on their rights under an insurance policy. This can be particularly relevant for those dealing with complex issues like the Louisiana Complaint For Declaratory Judgment To Determine Credit Life Policy Coverage. By initiating a dec action, you can obtain a clear ruling that may help resolve disputes with your insurance provider.

Filing a complaint against an insurance company in Louisiana involves gathering relevant documents and clearly stating your grievances. You can file your complaint through the Louisiana Department of Insurance’s website, or you can contact them directly for assistance. If your complaint pertains to the Louisiana Complaint For Declaratory Judgment To Determine Credit Life Policy Coverage, make sure to include that in your description for better guidance.

To file a complaint with the Louisiana Department of Insurance, you need to provide detailed information about your issue, including your policy details. You can submit your complaint online, by mail, or via phone. If your concern involves the Louisiana Complaint For Declaratory Judgment To Determine Credit Life Policy Coverage, it's important to outline how your coverage is being affected.

The Louisiana Department of Insurance is overseen by the Commissioner of Insurance, who is an elected official. This department plays a crucial role in regulating the insurance industry, including matters related to the Louisiana Complaint For Declaratory Judgment To Determine Credit Life Policy Coverage. The commissioner ensures that insurance companies comply with state laws and protects consumers' interests.

In Louisiana, key insurance issues include the regulation of policy coverage, particularly concerning life insurance and credit life policies. The Louisiana Complaint For Declaratory Judgment To Determine Credit Life Policy Coverage has gained attention as consumers seek clarity on their rights. Additionally, the state is focusing on consumer protection measures and enhancing transparency within the insurance market.

A declaratory judgment is a binding judgment from a court defining the legal relationship between parties and their rights in a matter before the court. When there is uncertainty as to the legal obligations or rights between two parties, a declaratory judgment offers an immediate means to resolve this uncertainty.

Declaratory relief allows a party who is not certain of his rights to prevent the accrual of avoidable damages and to obtain an adjudication before the parties bring a coercive lawsuit.

Examples: a party to a contract may seek the legal interpretation of a contract to determine the parties' rights, or a corporation may ask a court to decide whether a new tax is truly applicable to that business before it pays it.

To establish federal jurisdiction in a declaratory judgment action, two conditions must be satisfied. First, is the constitutional inquiry - the case must be a 'case or controversy' pursuant to Article III of the US Constitution. Second is the prudential inquiry ? declaratory relief must be appropriate.