Louisiana Warranty Deed to Child Reserving a Life Estate in the Parents

Description

How to fill out Louisiana Warranty Deed To Child Reserving A Life Estate In The Parents?

Searching for Louisiana Warranty Deed to Child Retaining a Life Estate in the Parent's example and completing it could present a challenge.

To conserve time, expenses, and effort, utilize US Legal Forms and select the appropriate template specifically for your state with just a few clicks.

Our legal experts draft all documents, so you merely need to fill them in. It's truly that simple.

If there’s a description, read it to comprehend the particulars. Hit Buy Now if you found what you need. Select your package on the pricing page and set up your account. Choose to pay using a credit card or PayPal. Store the form in your preferred file format. You can either print the Louisiana Warranty Deed to Child Retaining a Life Estate in the Parent's template or complete it using any online editor. Don’t fret about errors as your sample can be utilized and sent, and printed as many times as needed. Explore US Legal Forms and gain access to over 85,000 state-specific legal and tax documents.

- Log in to your account and return to the form's webpage to save the example.

- Your downloaded templates are saved in My documents and can be accessed anytime for future use.

- If you haven't registered yet, you must sign up.

- Refer to our detailed instructions on how to obtain your Louisiana Warranty Deed to Child Retaining a Life Estate in the Parent's template within minutes.

- To acquire a valid sample, verify its acceptability for your state.

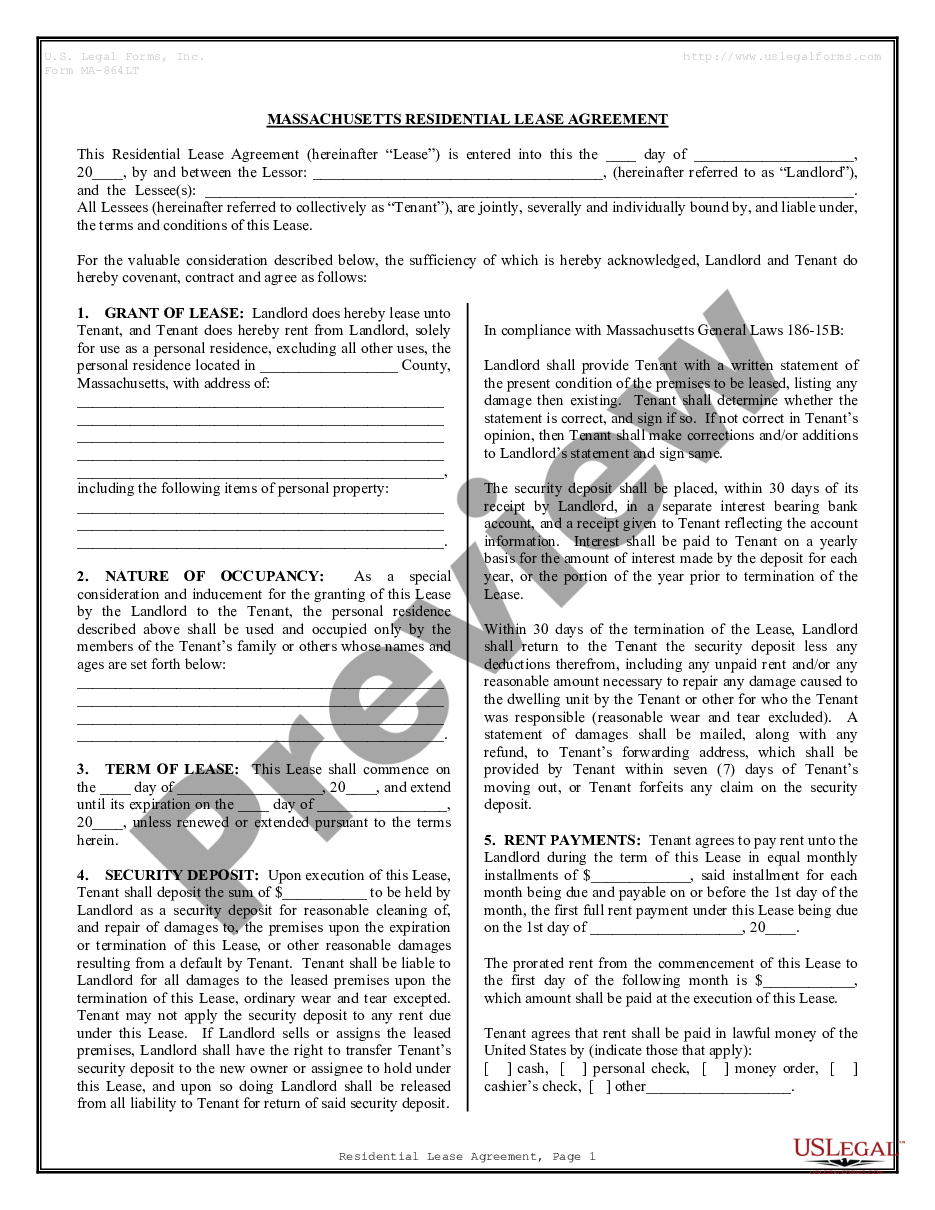

- Examine the example using the Preview feature (if available).

Form popularity

FAQ

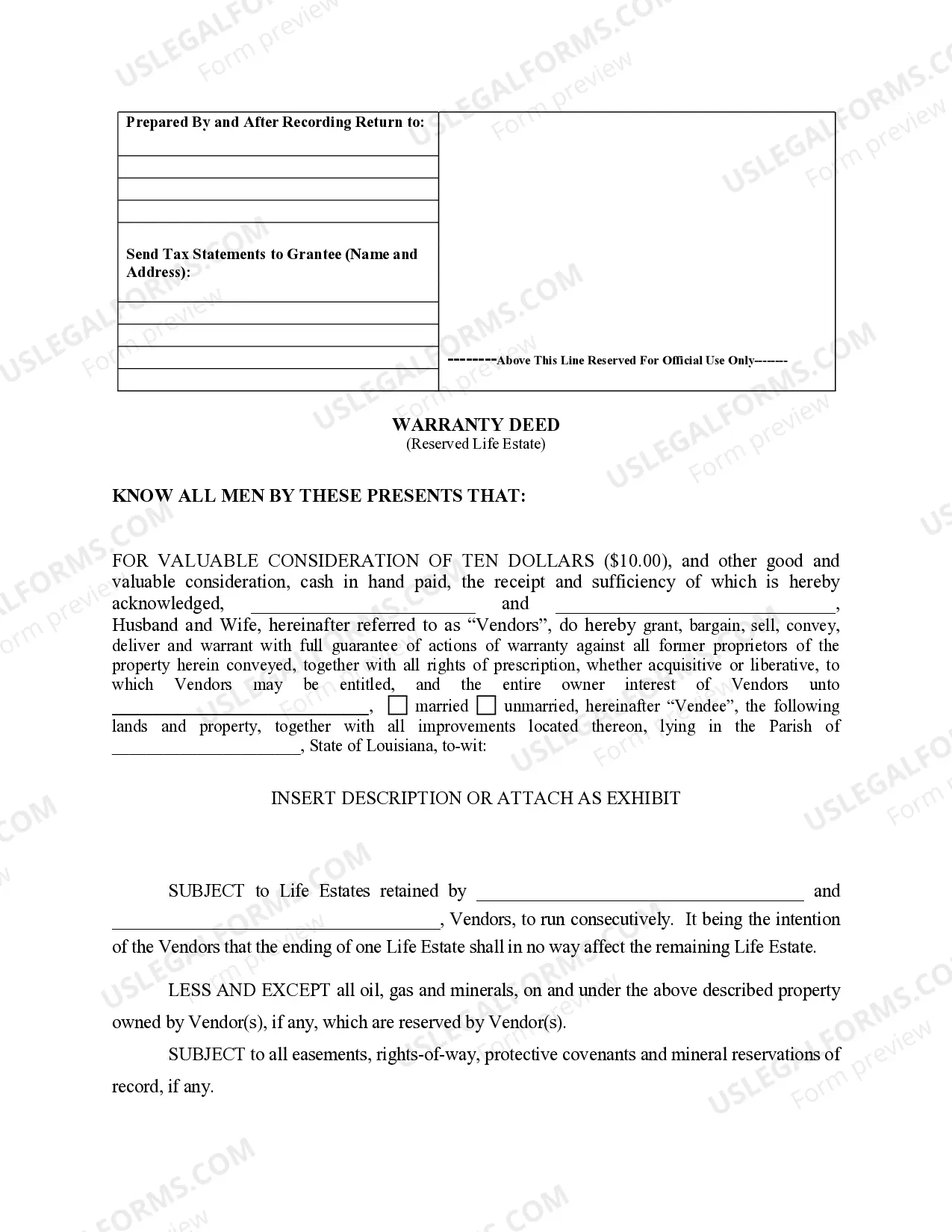

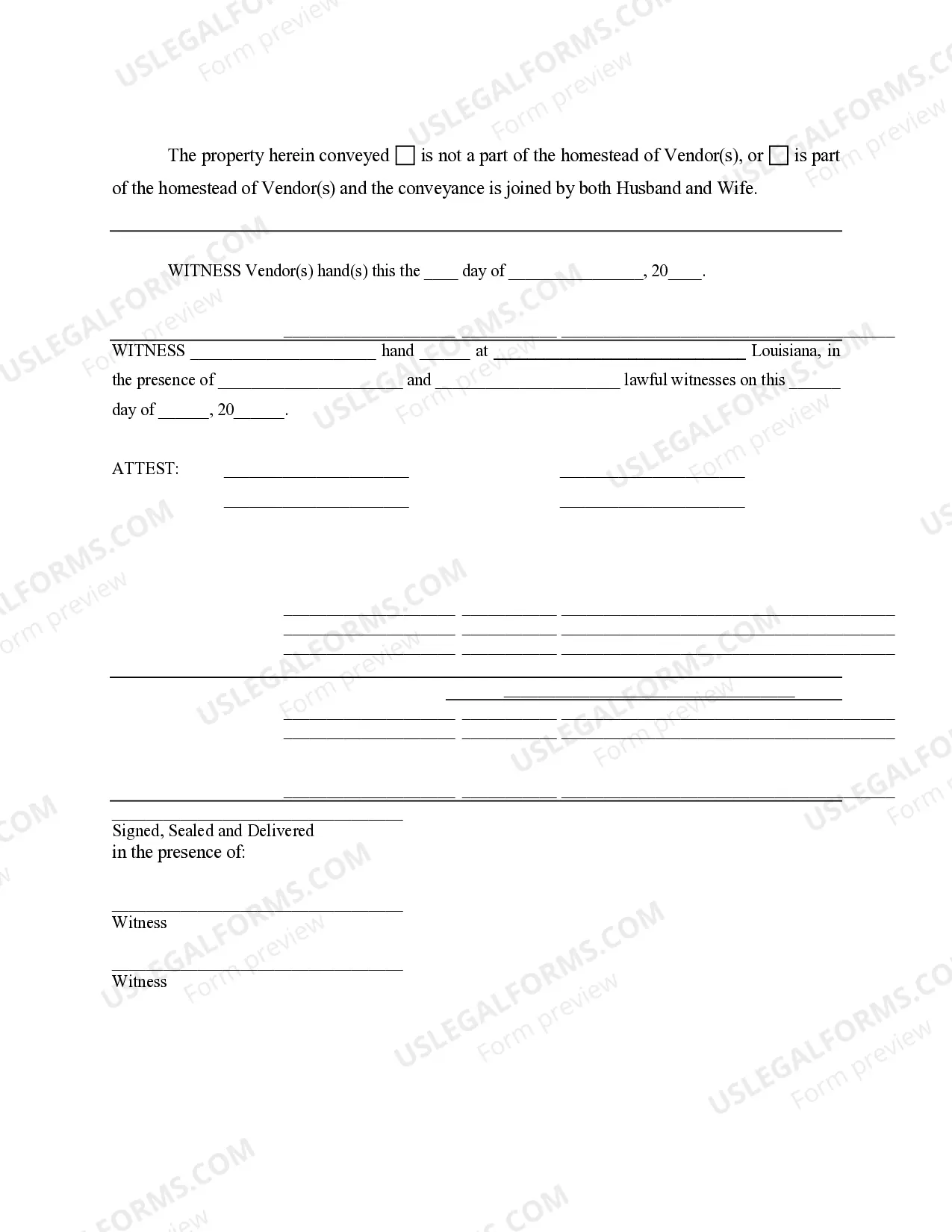

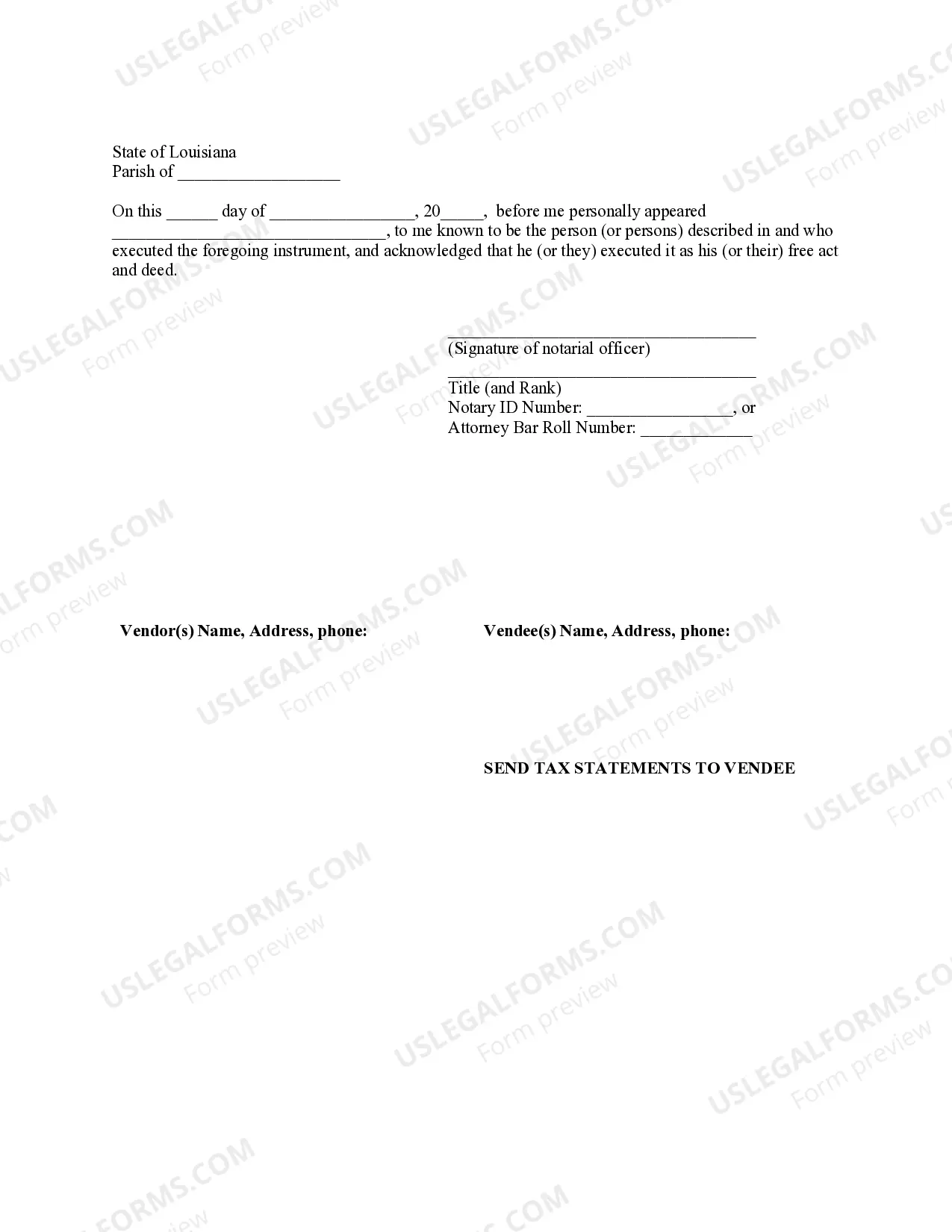

This life estate deed is a document that transfers ownership of real property, while reserving access and use of the property for the duration of the grantor's life. It allows the original owner (grantor) to remain on the premises with full access to and benefits from the property.

A warranty deed is a document often used in real estate that provides the greatest amount of protection to the purchaser of a property. It pledges or warrants that the owner owns the property free and clear of any outstanding liens, mortgages, or other encumbrances against it.

A warranty deed guarantees that: The grantor is the rightful owner of the property and has the legal right to transfer the title.The title would withstand third-party claims to ownership of the property. The grantor will do anything to ensure the grantee's title to the property.

A special warranty deed is common when a house has been foreclosed on by a bank because the previous owner did not pay their mortgage.The special warranty deed that the bank provides to the new buyer provides no protection for the period of time before the bank took ownership of the property.

Discuss property ownership interests. Access a copy of your title deed. Complete, review and sign the quitclaim or warranty form. Submit the quitclaim or warranty form. Request a certified copy of your quitclaim or warranty deed.

A special warranty deed is one in which the grantor is only guaranteeing that there are no outstanding claims or liens against the property arising from their ownership.

This life estate deed is a document that transfers ownership of real property, while reserving access and use of the property for the duration of the grantor's life. It allows the original owner (grantor) to remain on the premises with full access to and benefits from the property.

Quitclaim Deeds are used when the transfer of ownership in the property does not occur as the result of a traditional sale.Under a warranty deed, if it turns out that the property is not what the seller promised or there's an uncleared lien or other block to the title, the buyer can sue the seller and recover damages.

Unlike a warranty deed or special warranty deed, a quitclaim deed makes no assurances whatsoever about the property.For example, in a divorce situation where one spouse deeds the house to the other spouse. Quitclaim deeds are commonly used to transfer real property to an LLC or a living trust.