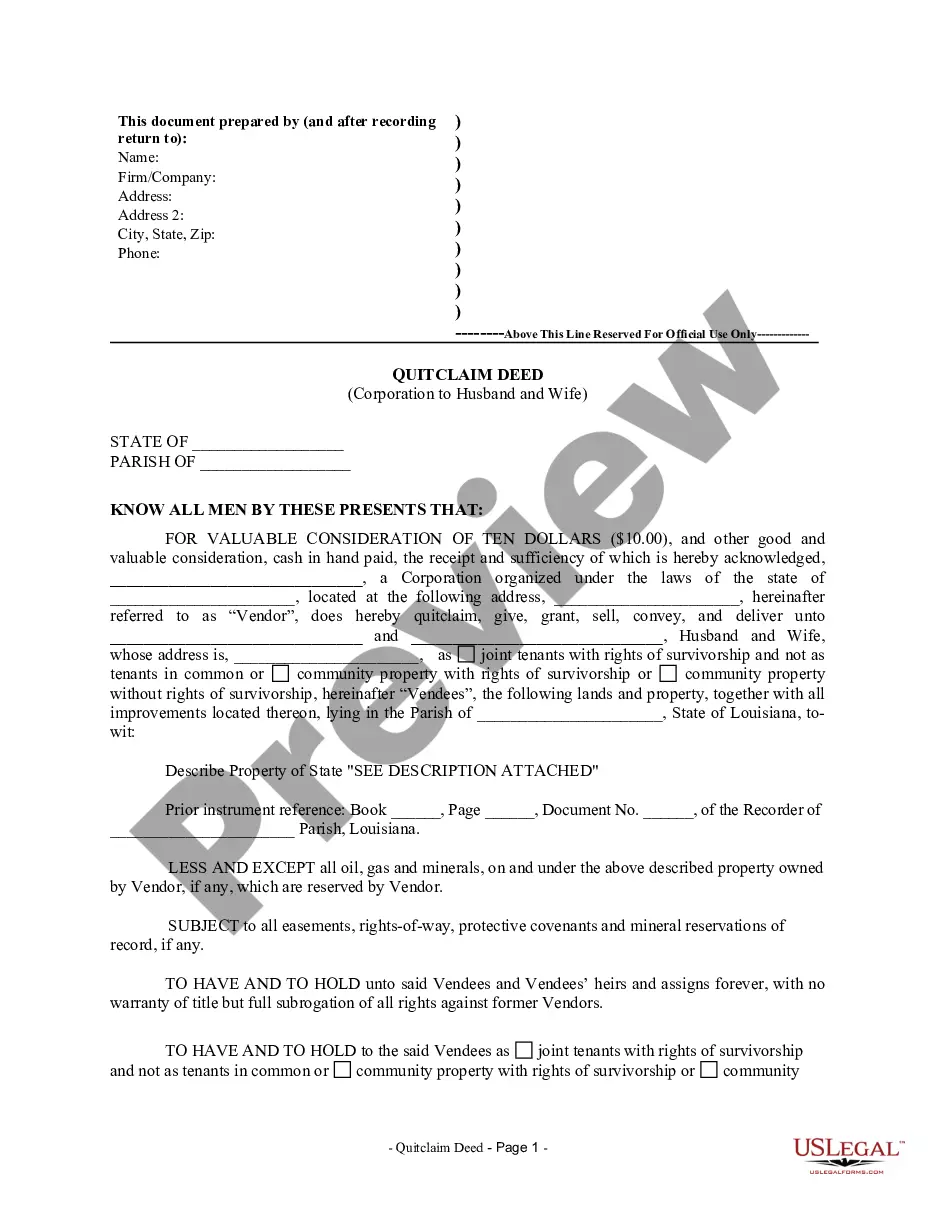

Louisiana Quitclaim Deed from Corporation to Husband and Wife

Description

How to fill out Louisiana Quitclaim Deed From Corporation To Husband And Wife?

Locating Louisiana Quitclaim Deed forms from Corporation to Husband and Wife templates and completing them can be rather challenging.

To conserve time, expenses, and effort, utilize US Legal Forms and select the appropriate template specifically for your state in just a few clicks.

Our legal experts draft every document, so you only need to complete them. It is remarkably simple.

Click on the Buy Now button if you found what you need. Select your plan on the pricing page and create an account. Indicate whether you want to pay via credit card or PayPal. Save the template in your desired format. You can now print the Louisiana Quitclaim Deed from Corporation to Husband and Wife form or edit it with any online editor. Don’t worry about errors because your template can be utilized and submitted, and printed as many times as you like. Try US Legal Forms and gain access to over 85,000 state-specific legal and tax documents.

- Log in to your account and return to the form's page to save the document.

- All your downloaded templates are kept in My documents and are accessible at all times for future use.

- If you haven't subscribed yet, you must register.

- Review our detailed instructions on how to obtain the Louisiana Quitclaim Deed from Corporation to Husband and Wife template within a few minutes.

- To acquire a valid form, check its relevance to your state.

- Examine the template using the Preview feature (if available).

- If there's a description, read it carefully to grasp the key points.

Form popularity

FAQ

A person who signs a quitclaim deed to transfer property they do not own results in no title at all being transferred since there is no actual ownership interest. The quitclaim deed only transfers the type of title you own.

It is also crucial that a spouse know about the loan, even if he or she is not on the mortgage. In general, the spouse must sign a deed of trust, the Truth in Lending and Right to Cancel documents. By signing these documents, they are simply acknowledging the existence of the mortgage.

In states like California and Florida, the spouses may use a quitclaim deed to transfer the property without warranting title. Other stateslike Texasrecognize a similar type of deed called a deed without warranty.

In order to transfer ownership of the marital home pursuant to a divorce, one spouse is going to need to sign a quitclaim deed, interspousal transfer deed, or a grant deed, in order to convey the title to the property.

A quitclaim deed affects ownership and the name on the deed, not the mortgage. Because quitclaim deeds expose the grantee to certain risks, they are most often used between family members and where there is no exchange of money.Quitclaim deeds transfer title but do not affect mortgages.

The Louisiana quitclaim deed is used to transfer real estate in Louisiana from one person to another. A quitclaim has no guarantee or warranty attached to it.Signing A quitclaim deed must be authorized with the Grantor(s) (the Sellers) in front of two (2) witnesses and a notary public.

But you might be wondering if an owner can transfer a deed to another person without a real estate lawyer. The answer is yes. Parties to a transaction are always free to prepare their own deeds.A quitclaim deed, for example, is far simpler than a warranty deed.

If you sign a quitclaim deed to release yourself from ownership of the property or a claim to the title, then that doesn't mean you are no longer held accountable for the mortgage payment.Otherwise, you may be held responsible for unpaid payments despite no longer having a claim to the title.