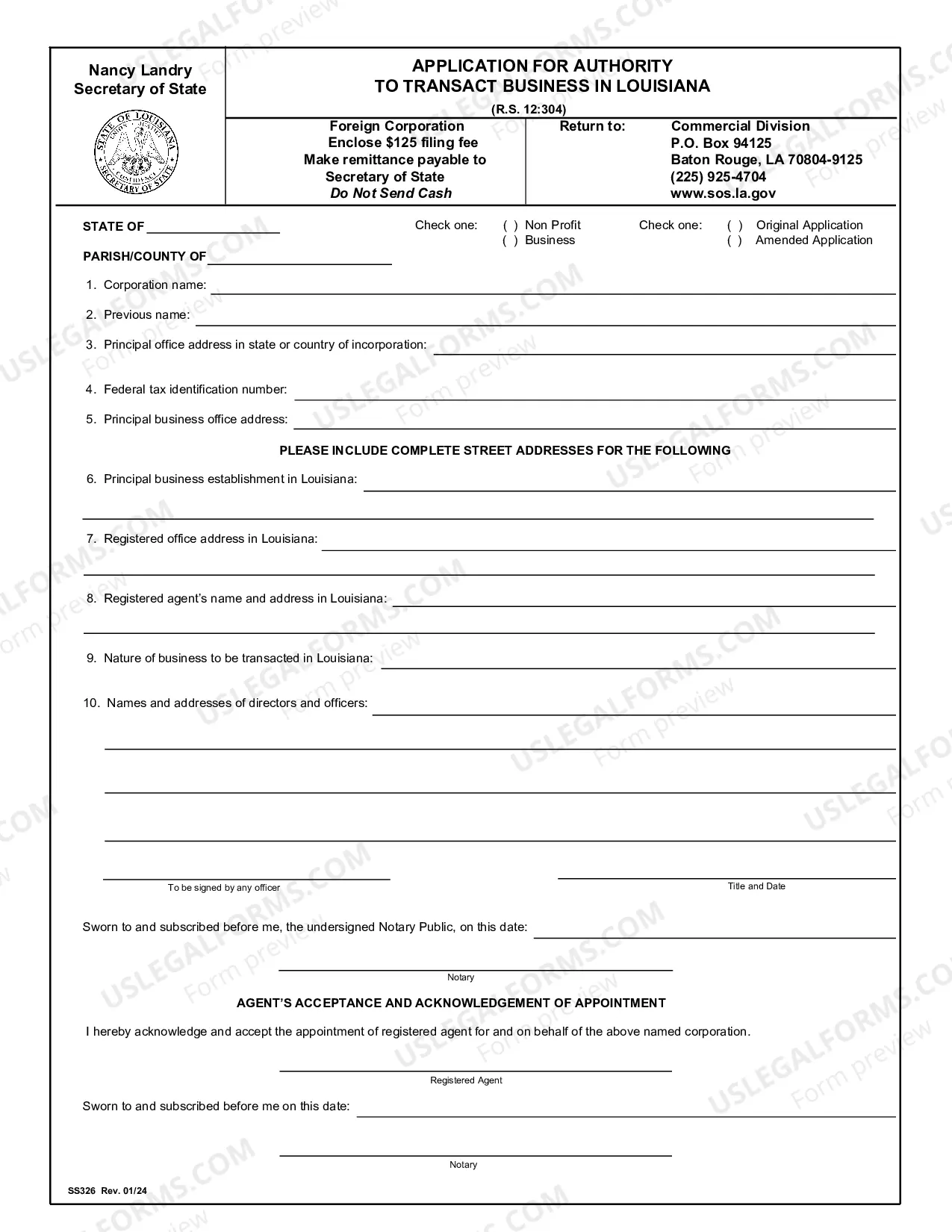

Louisiana Registration of Foreign Corporation

Description

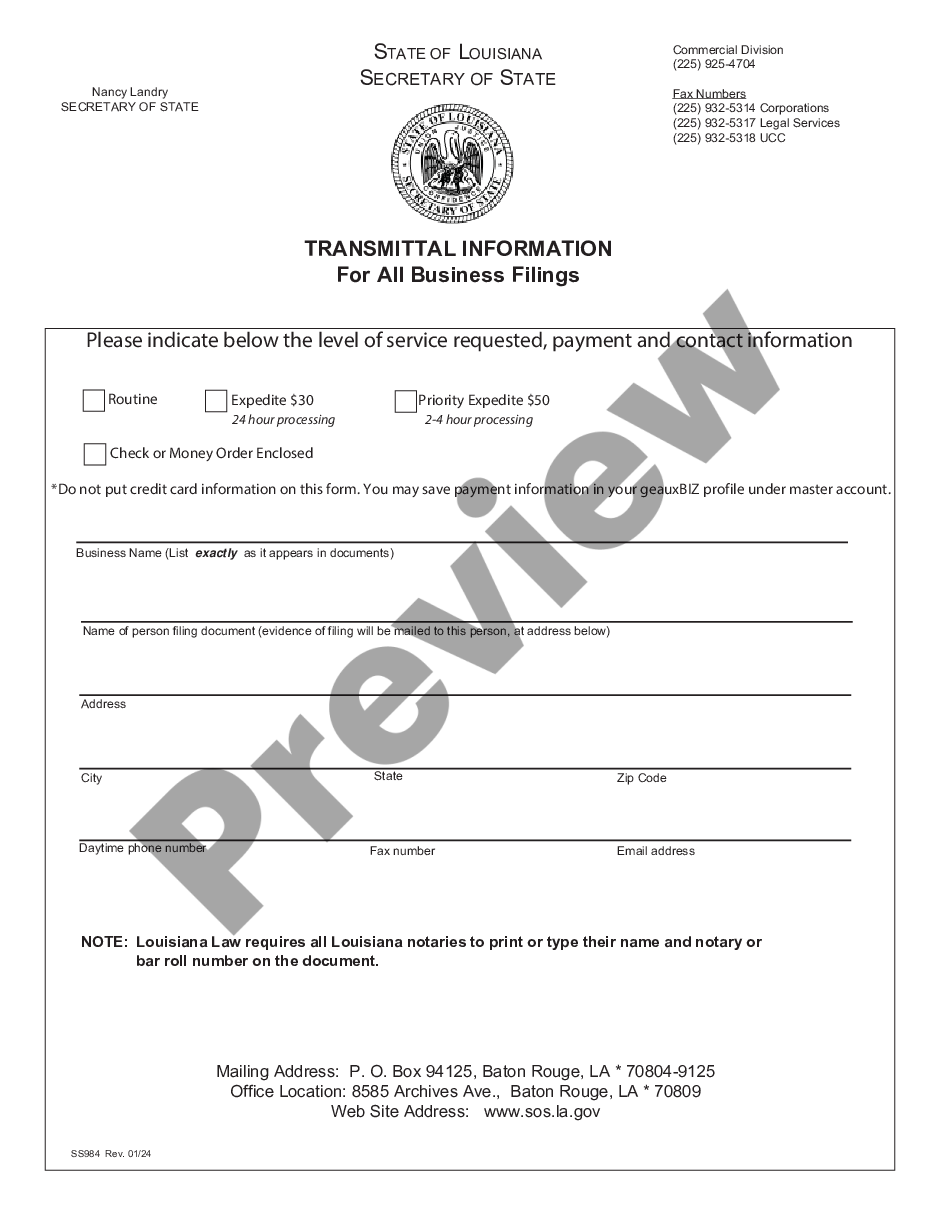

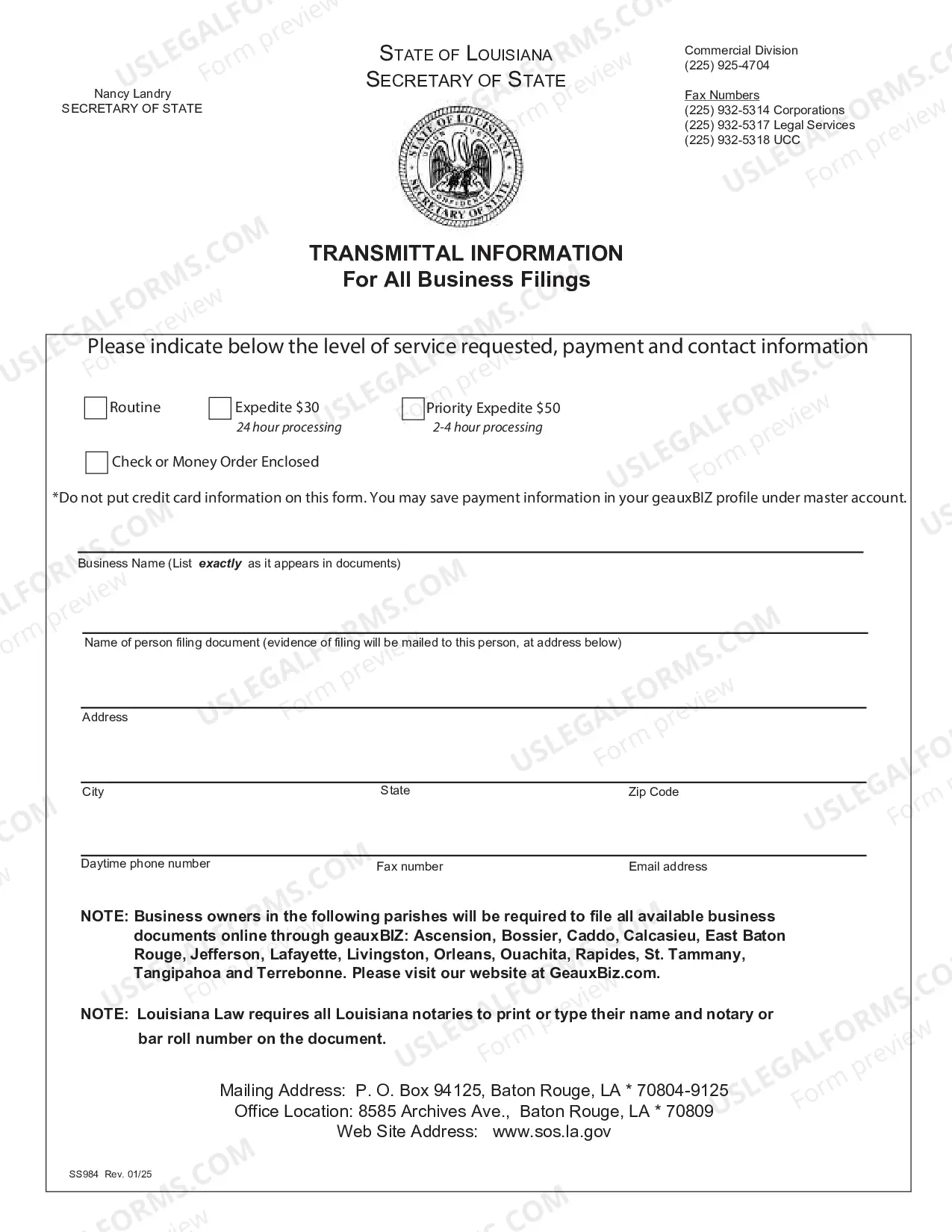

How to fill out Louisiana Registration Of Foreign Corporation?

Looking for Louisiana Registration of Foreign Corporation templates and filling out them can be a problem. To save lots of time, costs and energy, use US Legal Forms and find the correct template specifically for your state within a couple of clicks. Our legal professionals draft each and every document, so you simply need to fill them out. It truly is that simple.

Log in to your account and return to the form's web page and save the document. Your saved examples are stored in My Forms and are available all the time for further use later. If you haven’t subscribed yet, you should sign up.

Take a look at our comprehensive guidelines on how to get your Louisiana Registration of Foreign Corporation form in a couple of minutes:

- To get an qualified form, check its validity for your state.

- Check out the example utilizing the Preview function (if it’s offered).

- If there's a description, read it to understand the specifics.

- Click on Buy Now button if you found what you're trying to find.

- Pick your plan on the pricing page and make an account.

- Choose you wish to pay out by a credit card or by PayPal.

- Save the file in the favored file format.

You can print the Louisiana Registration of Foreign Corporation template or fill it out making use of any online editor. Don’t concern yourself with making typos because your form may be utilized and sent away, and printed as often as you want. Try out US Legal Forms and access to over 85,000 state-specific legal and tax files.

Form popularity

FAQ

Choose a business name. File an application to register a trade name with the Parish Clerk of Court. Obtain licenses, permits, and zoning clearance. Obtain an Employer Identification Number.

Essentially, a foreign legal entity is similar to a foreign corporation. In America, it refers to an established corporation that is legally registered to operate in a state or jurisdiction outside of its original location.

Yes, a US LLC can be owned entirely by foreign persons.United States Tax laws require that foreigners pay taxes on any earnings made in the United States. Regardless of immigration status, the United States will allow foreigners to form a company as long as they have registered for a Taxpayer Identification Number.

Yes, a US LLC can be owned entirely by foreign persons.United States Tax laws require that foreigners pay taxes on any earnings made in the United States. Regardless of immigration status, the United States will allow foreigners to form a company as long as they have registered for a Taxpayer Identification Number.

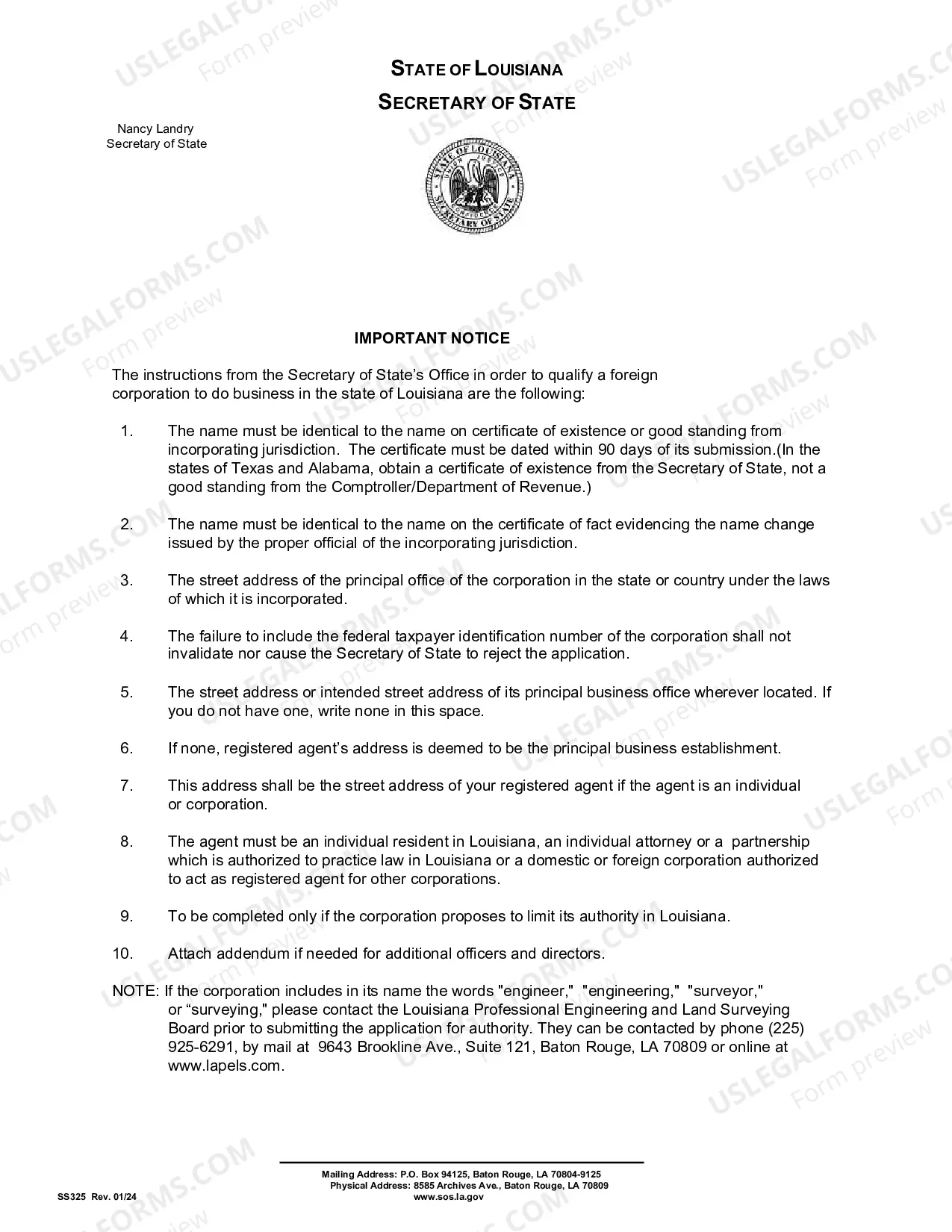

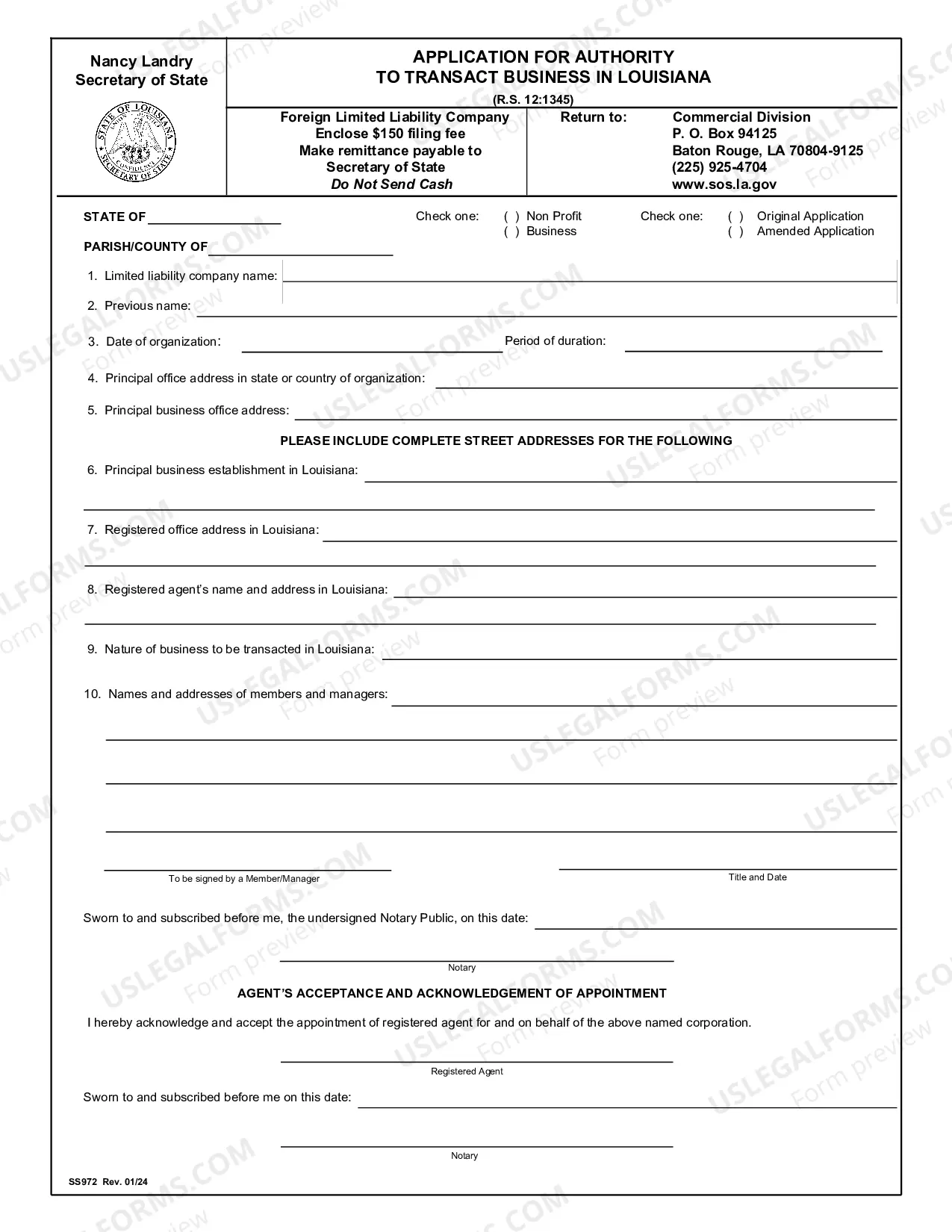

To register the foreign LLC, you will need the information from the Articles of Organization and you will need a copy of the official LLC document from the state. Next, determine if you are "doing business" in another state and are thus required to register as a foreign LLC in that state.

Most businesses are required to register with the Louisiana Secretary of State Office.However, if your business is a sole proprietorship, you do not need to register your business with the state, or formally file any assumed names with the county or state.

A domestic corporation is one formed in the state in which it is doing business. A foreign corporation is one incorporated in another state or country and does business across state lines. The process of setting up a company in a foreign state is called foreign qualification.

Foreign entity registration is the process of registering your business in one state to do business in another state. The only state that your business is not foreign to is the original state you registered your business in.

When you formed your business, you had to do so in a specific state.Foreign entity registration is the process of registering your business in one state to do business in another state. The only state that your business is not foreign to is the original state you registered your business in.