This is a rider to the software/services master agreement order form. It provides that a related entity of the customer may use the software purchased from the vendor.

Kentucky Related Entity

Description

How to fill out Related Entity?

Choosing the best lawful papers design can be quite a battle. Obviously, there are tons of templates available online, but how can you find the lawful form you will need? Utilize the US Legal Forms site. The assistance gives thousands of templates, including the Kentucky Related Entity, which can be used for enterprise and private demands. All the kinds are checked out by specialists and fulfill federal and state demands.

In case you are already signed up, log in in your accounts and then click the Download key to have the Kentucky Related Entity. Make use of your accounts to search through the lawful kinds you may have ordered formerly. Check out the My Forms tab of your own accounts and acquire an additional copy in the papers you will need.

In case you are a new consumer of US Legal Forms, here are straightforward instructions for you to comply with:

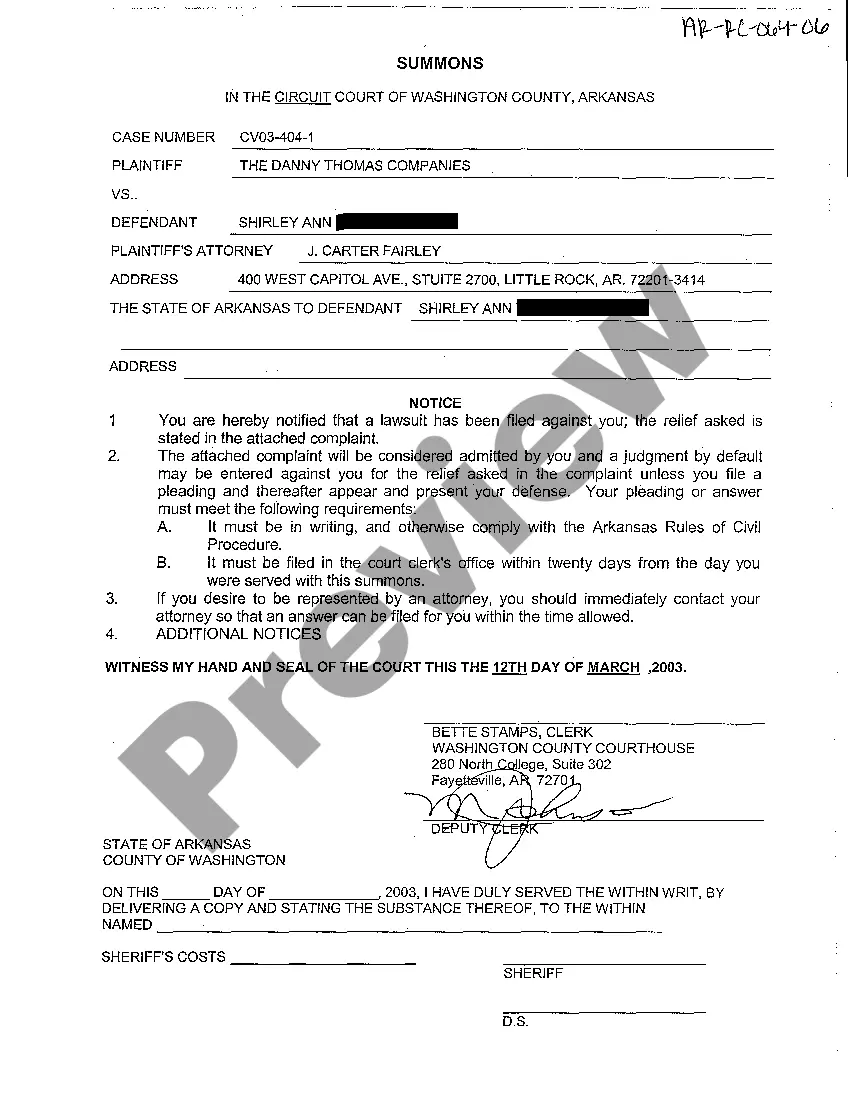

- Very first, make sure you have selected the appropriate form for your personal area/region. You are able to check out the shape making use of the Review key and study the shape explanation to ensure it will be the best for you.

- When the form fails to fulfill your requirements, utilize the Seach field to get the proper form.

- When you are positive that the shape would work, click on the Acquire now key to have the form.

- Select the rates plan you need and enter the essential details. Design your accounts and pay for your order making use of your PayPal accounts or credit card.

- Choose the file format and acquire the lawful papers design in your gadget.

- Comprehensive, change and produce and sign the obtained Kentucky Related Entity.

US Legal Forms will be the greatest catalogue of lawful kinds that you will find different papers templates. Utilize the company to acquire appropriately-made papers that comply with condition demands.

Form popularity

FAQ

A Kentucky LLC is taxed based on the number of members, which is what owners of an LLC are called. Single-member LLCs (SMLLC), where you are the only owner, file taxes as a sole proprietorship. If your LLC is owned by multiple people, it is considered a multi-member LLC and is taxed as a partnership by default.

Kentucky now joins a majority of states that have enacted PTE taxes as a workaround for the cap on the federal deduction for state and local taxes.

These instructions have been designed for pass-through entities: S-corporations, partnerships, and general partnerships , which are required by law to file a Kentucky income tax and LLET return. Form PTE is complementary to the federal forms 1120S and 1065.

The Kentucky Limited Liability Entity Tax (KY LLET) serves the same purpose. The tax is calculated using the lesser of $0.095/$100 of Kentucky gross receipts or $0.75/$100 of Kentucky gross profits. Regardless of which calculation method is used, business owners are required to pay a minimum Kentucky LLET of $175.

The state of Kentucky has many strengths that make it a good place to start a business. Generally, it has a business-friendly environment. It also offers various incentives and programs that aim to help businesses. Ideal location ? Kentucky is in the middle of multiple states.

At the tail-end of this spring's tax filing season, the Kentucky General Assembly passed House Bill (HB) 5, which included a retroactive pass-through entity (PTE) tax effective for taxable years beginning on or after January 1, 2022. The Governor signed HB 5 on March 31, making it the law effective immediately.

?Calculating KY Limited Liability Entity Tax (LLET) Kentucky imposes a tax on every business that is protected from liability by the laws of the state. This includes corporations, LLCs, S-Corporations, limited partnerships, and other types of businesses.

These changes are the result of House Bill 8 that passed in 2022. The bill lowers income taxes from 5% to 4.5% but expands sales taxes to a variety of services to offset that loss in state revenue. For example, a person making $50,000 currently pays $2,500 in state income taxes.