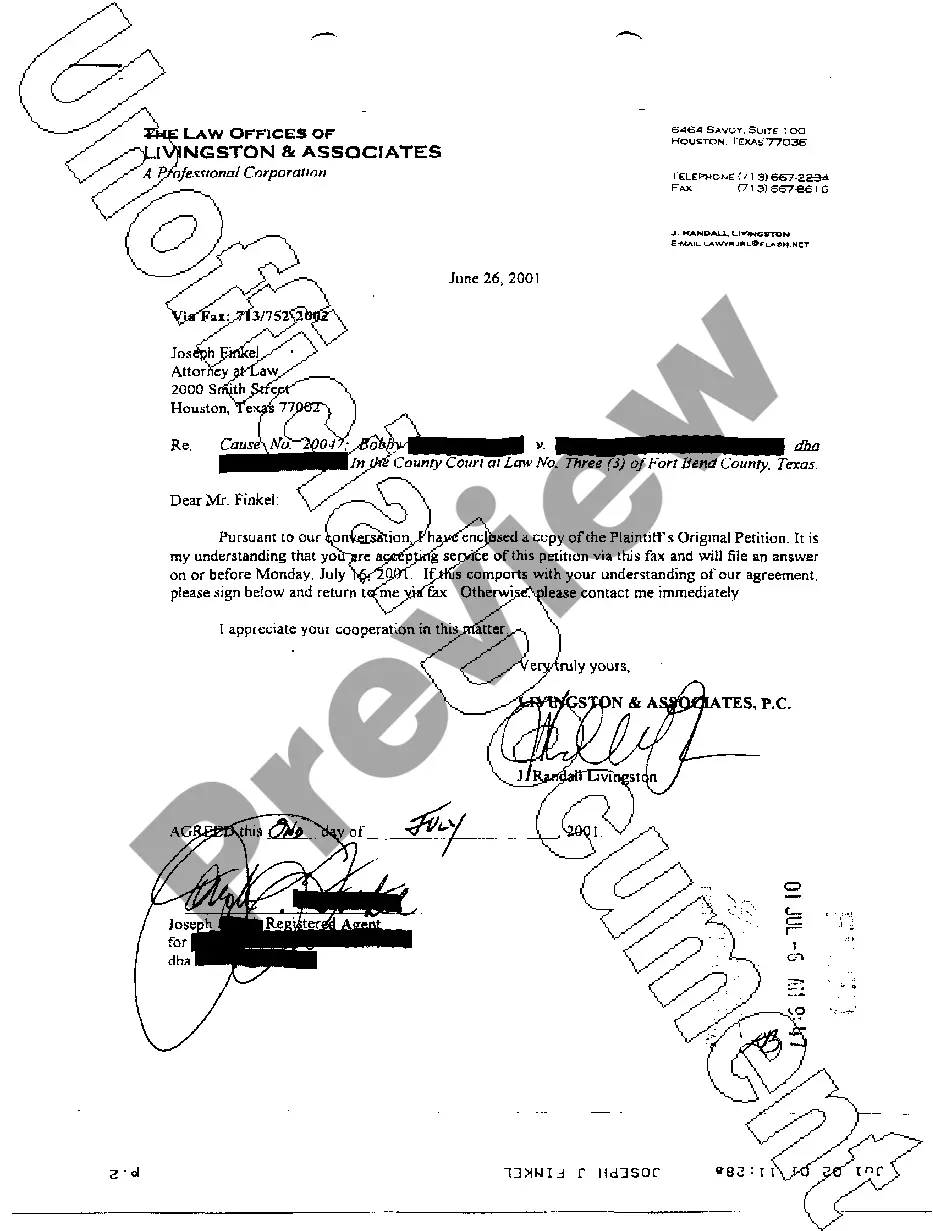

Kentucky Accounting Procedures

Description

How to fill out Accounting Procedures?

Choosing the best authorized papers web template might be a battle. Of course, there are tons of layouts available online, but how do you obtain the authorized type you require? Take advantage of the US Legal Forms website. The support gives 1000s of layouts, including the Kentucky Accounting Procedures, which you can use for business and personal requirements. All the types are checked out by pros and meet federal and state specifications.

In case you are presently authorized, log in for your account and click the Download option to have the Kentucky Accounting Procedures. Make use of your account to appear through the authorized types you may have acquired previously. Check out the My Forms tab of your respective account and obtain yet another copy of your papers you require.

In case you are a new customer of US Legal Forms, allow me to share straightforward recommendations that you should comply with:

- First, make sure you have chosen the right type for your city/area. You are able to check out the shape while using Preview option and study the shape outline to make sure this is the best for you.

- In the event the type is not going to meet your expectations, utilize the Seach industry to obtain the proper type.

- Once you are sure that the shape is acceptable, click the Get now option to have the type.

- Pick the prices prepare you need and type in the essential information and facts. Create your account and pay for your order with your PayPal account or charge card.

- Pick the file formatting and down load the authorized papers web template for your gadget.

- Full, revise and printing and indicator the obtained Kentucky Accounting Procedures.

US Legal Forms is definitely the largest collection of authorized types for which you can discover a variety of papers layouts. Take advantage of the company to down load expertly-made paperwork that comply with express specifications.

Form popularity

FAQ

There are ten steps in an accounting cycle, which include analyzing transactions, journalizing transactions, post transactions, preparing an unadjusted trial balance, preparing adjusting entries, preparing the adjusted trial balance, preparing financial statements, preparing closing entries, posting a closing trial ...

Defining the accounting cycle with steps: (1) Financial transactions, (2) Journal entries, (3) Posting to the Ledger, (4) Trial Balance Period, and (5) Reporting Period with Financial Reporting and Auditing.

The first four steps in the accounting cycle are (1) identify and analyze transactions, (2) record transactions to a journal, (3) post journal information to a ledger, and (4) prepare an unadjusted trial balance. We begin by introducing the steps and their related documentation.

The steps in the accounting cycle are identifying transactions, recording transactions in a journal, posting the transactions, preparing the unadjusted trial balance, analyzing the worksheet, adjusting journal entry discrepancies, preparing a financial statement, and closing the books.

The two main accounting methods are cash accounting and accrual accounting. Cash accounting records revenues and expenses when they are received and paid. Accrual accounting records revenues and expenses when they occur. Generally accepted accounting principles (GAAP) requires accrual accounting.

Segregation of Duties Related to Activity Funds Specifically, three critical duties should be segregated for internal control purposes: (1) signing checks, (2) maintaining fund accounting records, and (3) reconciling bank statements.