Kentucky Stipulation Governing Payment of Nonparticipating Royalty Under Segregated Tracts Covered by one Oil and Gas Lease

Description

How to fill out Stipulation Governing Payment Of Nonparticipating Royalty Under Segregated Tracts Covered By One Oil And Gas Lease?

Choosing the right lawful papers web template can be quite a have a problem. Naturally, there are a lot of web templates available online, but how can you find the lawful form you want? Take advantage of the US Legal Forms site. The services provides a large number of web templates, such as the Kentucky Stipulation Governing Payment of Nonparticipating Royalty Under Segregated Tracts Covered by one Oil and Gas Lease, that you can use for enterprise and personal requirements. All of the varieties are examined by experts and meet up with state and federal needs.

In case you are previously authorized, log in in your account and then click the Acquire button to have the Kentucky Stipulation Governing Payment of Nonparticipating Royalty Under Segregated Tracts Covered by one Oil and Gas Lease. Utilize your account to look from the lawful varieties you might have bought earlier. Check out the My Forms tab of the account and acquire one more backup in the papers you want.

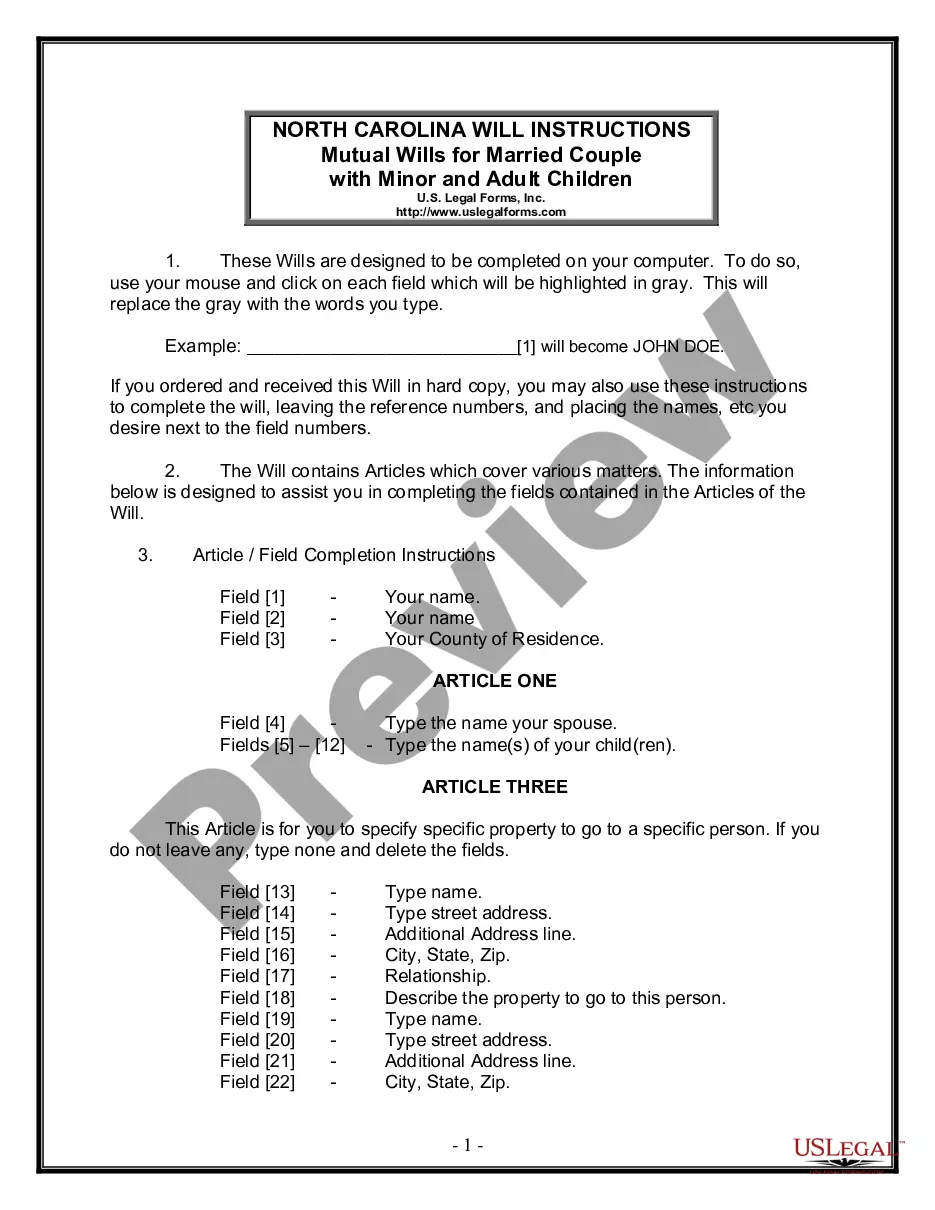

In case you are a whole new consumer of US Legal Forms, listed below are basic instructions for you to comply with:

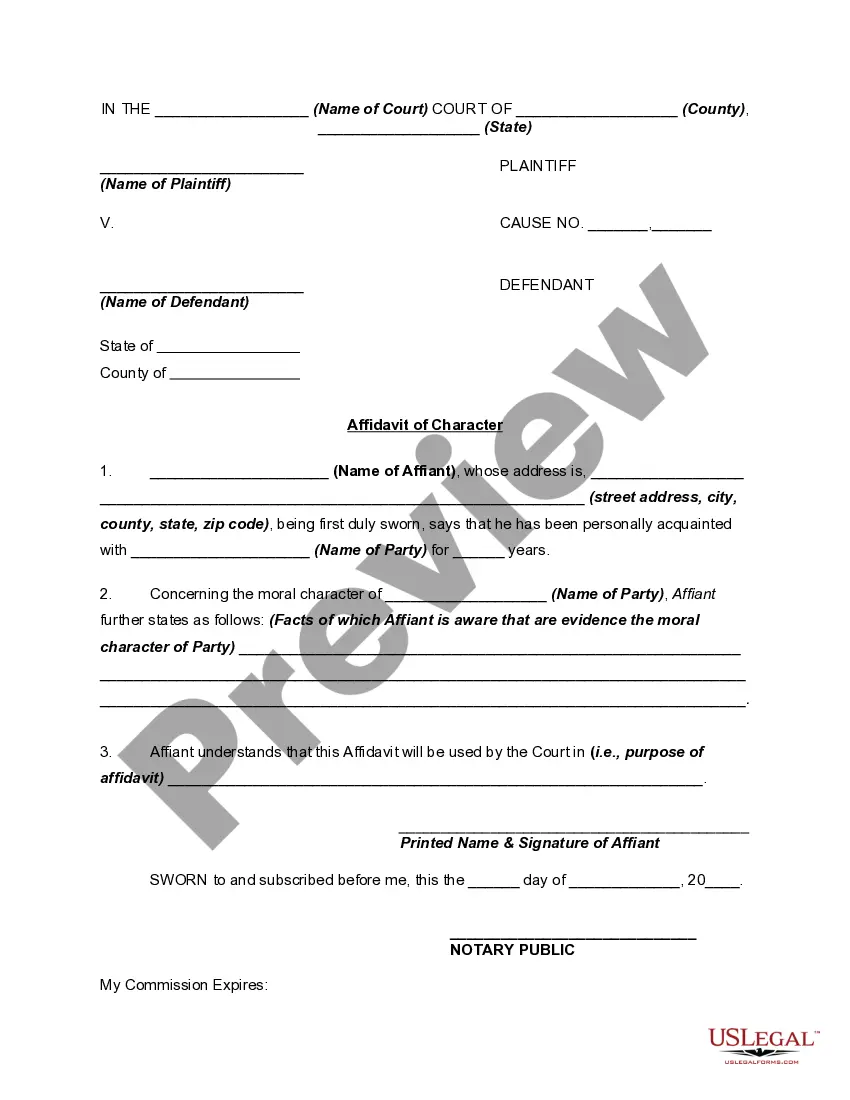

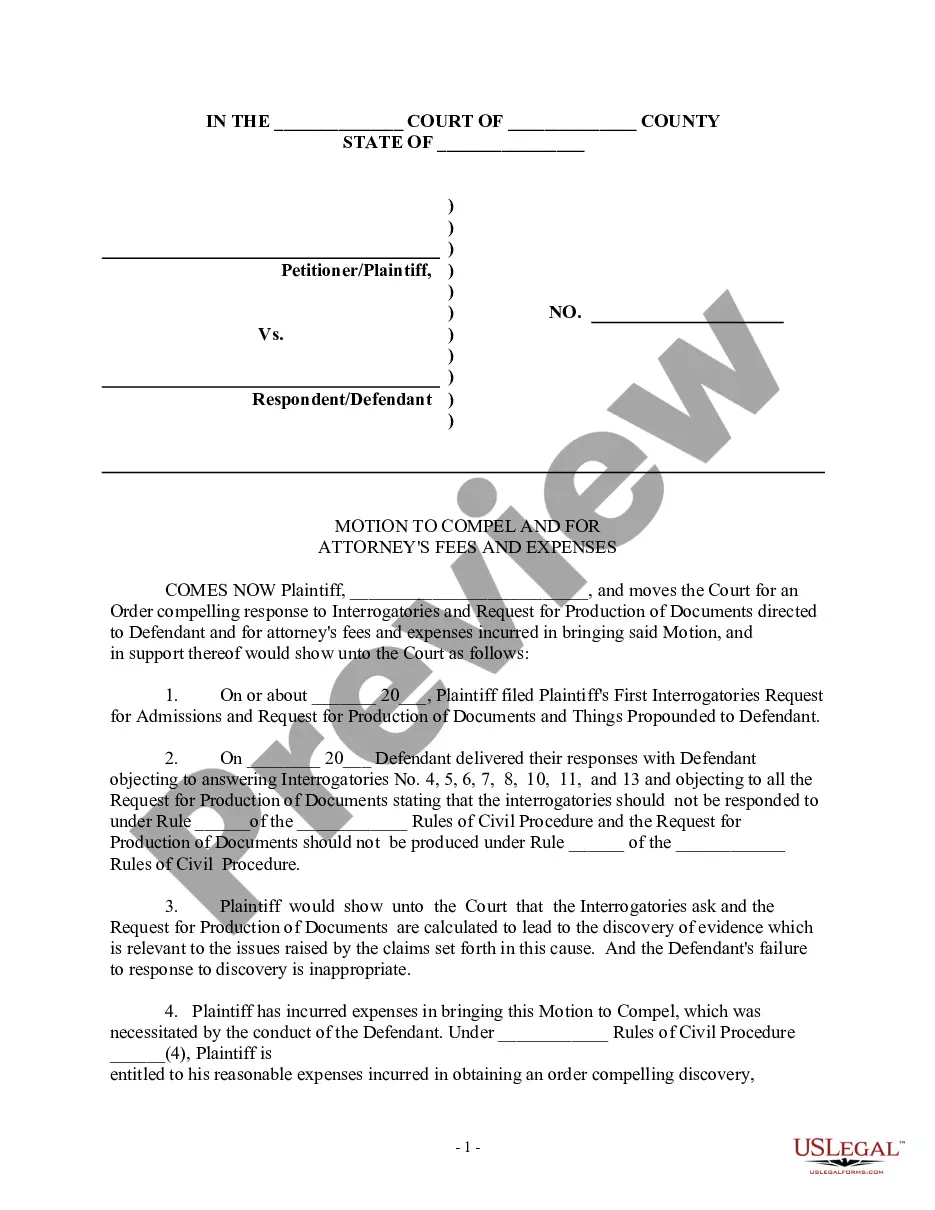

- Initial, make certain you have chosen the proper form for the metropolis/region. You are able to check out the form while using Preview button and browse the form information to make sure it will be the right one for you.

- In the event the form does not meet up with your preferences, make use of the Seach discipline to find the right form.

- When you are certain that the form is proper, go through the Get now button to have the form.

- Opt for the rates program you would like and enter in the required info. Build your account and buy the order making use of your PayPal account or bank card.

- Pick the document structure and obtain the lawful papers web template in your system.

- Comprehensive, revise and printing and signal the attained Kentucky Stipulation Governing Payment of Nonparticipating Royalty Under Segregated Tracts Covered by one Oil and Gas Lease.

US Legal Forms is definitely the largest catalogue of lawful varieties in which you can find numerous papers web templates. Take advantage of the company to obtain expertly-made documents that comply with status needs.

Form popularity

FAQ

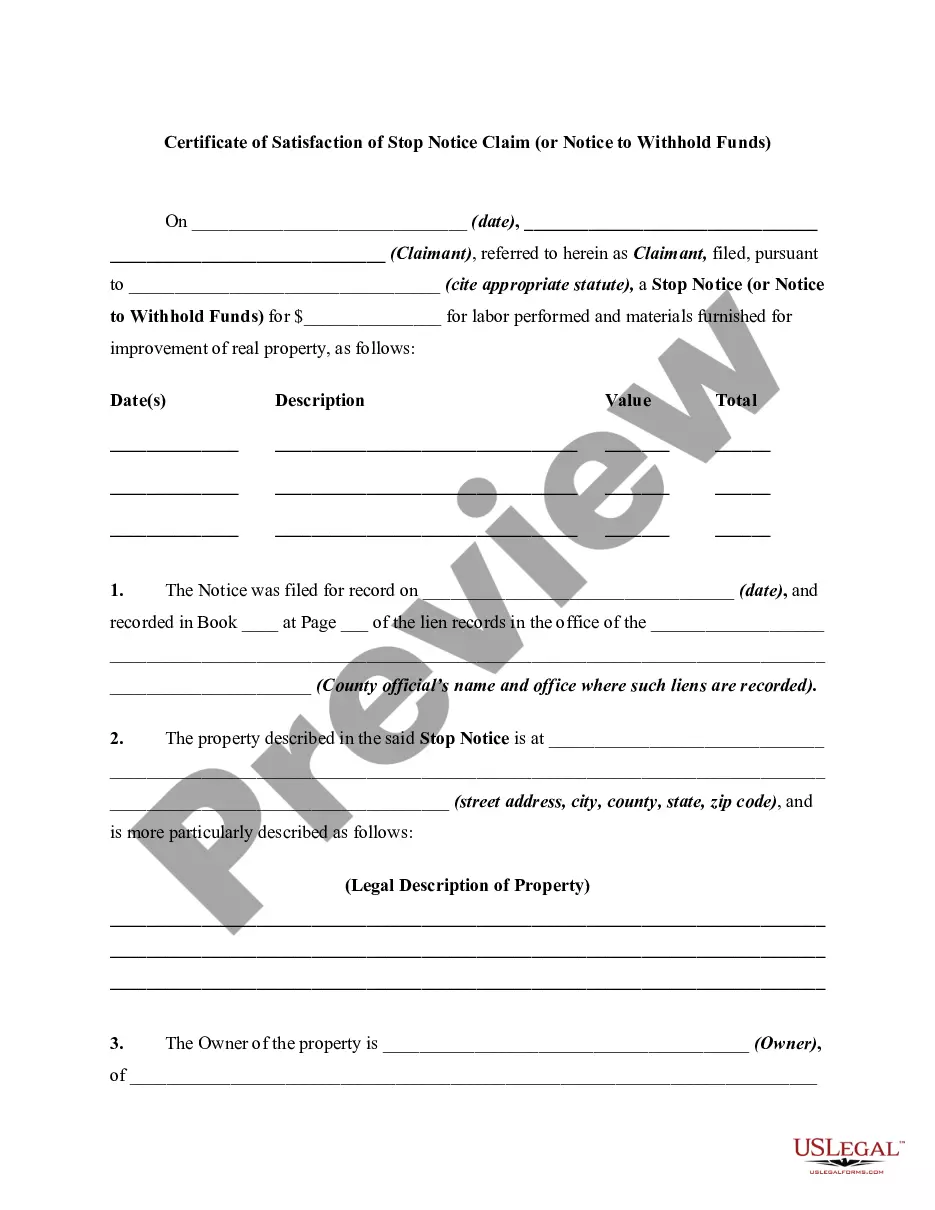

Royalty Payment Clauses A royalty is agreed upon as a percentage of the lease, minus what was reasonably used in the lessee's production costs. This is stipulated in a Royalty Clause. The royalty is paid by the lessee to the owner of the mineral rights, the lessor in the lease.

Ownership in a share of production, paid to an owner who does not share in the right to explore or develop a lease, or receive bonus or rental payments. It is free of the cost of production, and is deducted from the royalty interest.

The royalty rate is negotiated between the owner of the mineral rights and the company extracting the oil and gas, and can range from 12.5% to 25% of the production value. Royalties are an important source of income for landowners who have mineral rights.

Participating Royalty Interest (NPRI) is an interest in oil and gas production which is created from the mineral estate. Like the plain ?royalty interest? it is expensefree, bearing no operational costs of production.

Royalty interest in the oil and gas industry refers to ownership of a portion of a resource or the revenue it produces. A company or person that owns a royalty interest does not bear any operational costs needed to produce the resource, yet they still own a portion of the resource or revenue it produces.

The formula to calculate NPRI without proportionate share reduction is LRR ? RI = NPRI. As an example, reducing your revenue interest from 25% LRR results in 1/16 NPRI, leaving 75% NRI for working interest owners.

Non-operating working interests include overriding royalty interests, production payments, and net profit interests. Unlike royalty interests, non-operating working interest must include a portion of the costs associated with the day-to-day operation of the well.

Calculating Overriding Royalty Interest An ORRI is a straight percentage. For example, a 2% override would appear on the royalty statement as 0.02 interest in the proceeds from the sale of the leased hydrocarbons.