This form is used when an Assignor transfers, assigns and conveys to Assignee an overriding royalty interest in all of the oil, gas, and other minerals produced, saved, and marketed from all of the Lands and Leases equal to a determined amount (the Override ), reserving the right to pool the assigned interest.

Kentucky Assignment of Overriding Royalty Interest when Assignor Reserves the Right to Pool the Assigned Interest - Short Form

Description

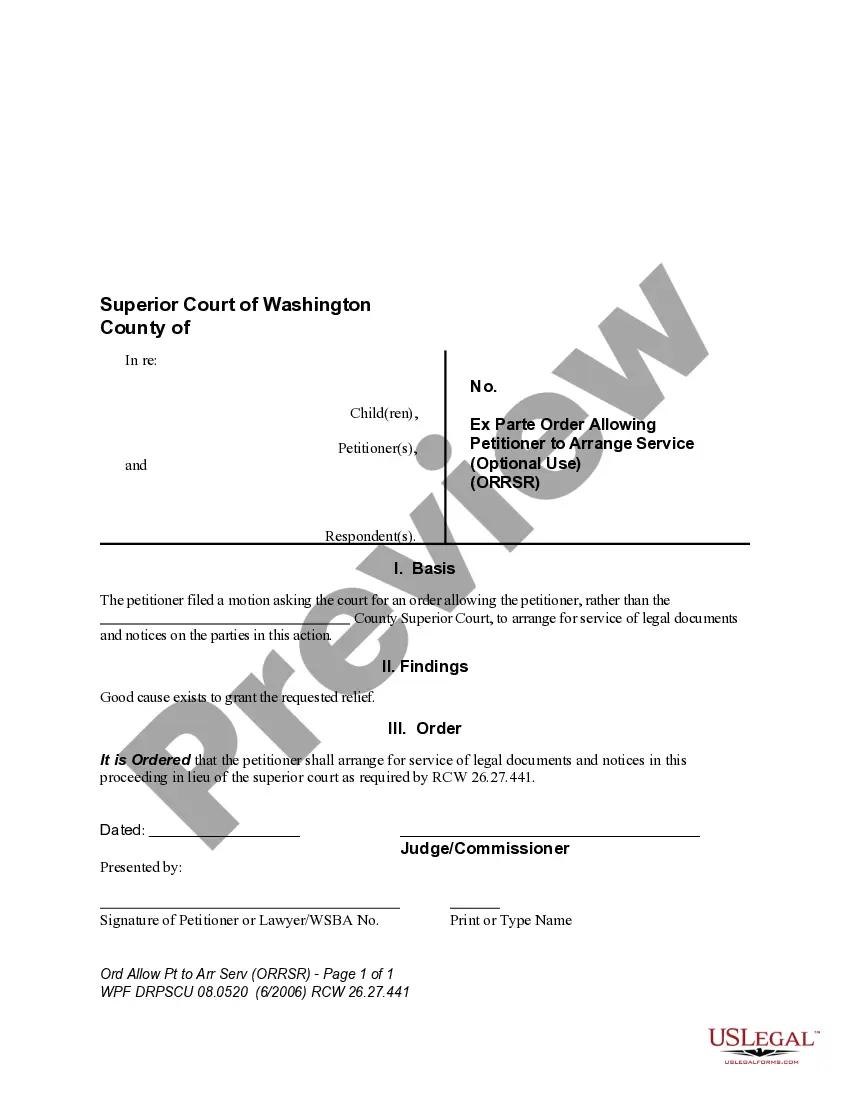

How to fill out Assignment Of Overriding Royalty Interest When Assignor Reserves The Right To Pool The Assigned Interest - Short Form?

US Legal Forms - among the greatest libraries of legitimate types in the States - delivers a variety of legitimate record templates you are able to obtain or print. Using the website, you will get thousands of types for company and individual reasons, sorted by classes, says, or key phrases.You can get the most recent types of types like the Kentucky Assignment of Overriding Royalty Interest when Assignor Reserves the Right to Pool the Assigned Interest - Short Form within minutes.

If you currently have a monthly subscription, log in and obtain Kentucky Assignment of Overriding Royalty Interest when Assignor Reserves the Right to Pool the Assigned Interest - Short Form in the US Legal Forms library. The Obtain option can look on each type you see. You gain access to all formerly downloaded types from the My Forms tab of your accounts.

In order to use US Legal Forms for the first time, allow me to share easy instructions to help you get started out:

- Ensure you have chosen the correct type for the town/state. Click on the Review option to check the form`s articles. Read the type explanation to actually have chosen the right type.

- If the type doesn`t fit your needs, use the Research area towards the top of the display to find the one who does.

- If you are happy with the form, confirm your choice by clicking the Purchase now option. Then, pick the rates strategy you favor and supply your accreditations to register for an accounts.

- Procedure the transaction. Make use of Visa or Mastercard or PayPal accounts to accomplish the transaction.

- Choose the formatting and obtain the form on the gadget.

- Make alterations. Complete, change and print and indicator the downloaded Kentucky Assignment of Overriding Royalty Interest when Assignor Reserves the Right to Pool the Assigned Interest - Short Form.

Every single design you included in your bank account lacks an expiration time and is your own property permanently. So, if you want to obtain or print one more copy, just visit the My Forms section and click in the type you will need.

Get access to the Kentucky Assignment of Overriding Royalty Interest when Assignor Reserves the Right to Pool the Assigned Interest - Short Form with US Legal Forms, probably the most extensive library of legitimate record templates. Use thousands of skilled and state-particular templates that meet up with your business or individual requirements and needs.

Form popularity

FAQ

ORRIs are created out of the working interest in a property and do not affect mineral owners. An overriding royalty interest (ORRI) is often kept or assigned to a geologist, landman, brokerage, or any entity that was able to reserve an interest in the properties.

An overriding royalty interest (ORRI) is an undivided interest in a mineral lease giving the holder the right to a proportional share (receive revenue) of the sale of oil and gas produced. The ORRI is carved out of the working interest or lease.

Calculating Overriding Royalty Interest An ORRI is a straight percentage. For example, a 2% override would appear on the royalty statement as 0.02 interest in the proceeds from the sale of the leased hydrocarbons.

You may convey overriding royalty interest on either an Assignment of Record Title Interest (Form 3000-3), a Transfer of Operating Rights (Form 3000-3a), or on a private assignment. We only require filing of one signed copy per assignment plus a nonrefundable filing fee found at 43 CFR 3000.12.

An overriding royalty interest (ORRI) is an undivided interest in a mineral lease giving the holder the right to a proportional share (receive revenue) of the sale of oil and gas produced. The ORRI is carved out of the working interest or lease.

A gross overriding royalty entitles the owner to a share of the market price of the mined product as at the time they are available to be taken less any costs incurred by the operator to bring the product to the point of sale.

An overriding royalty interest (ORRI) is an interest carved out of a working interest. It is: A percentage of gross production that is not charged with any expenses of exploring, developing, producing, and operating a well.