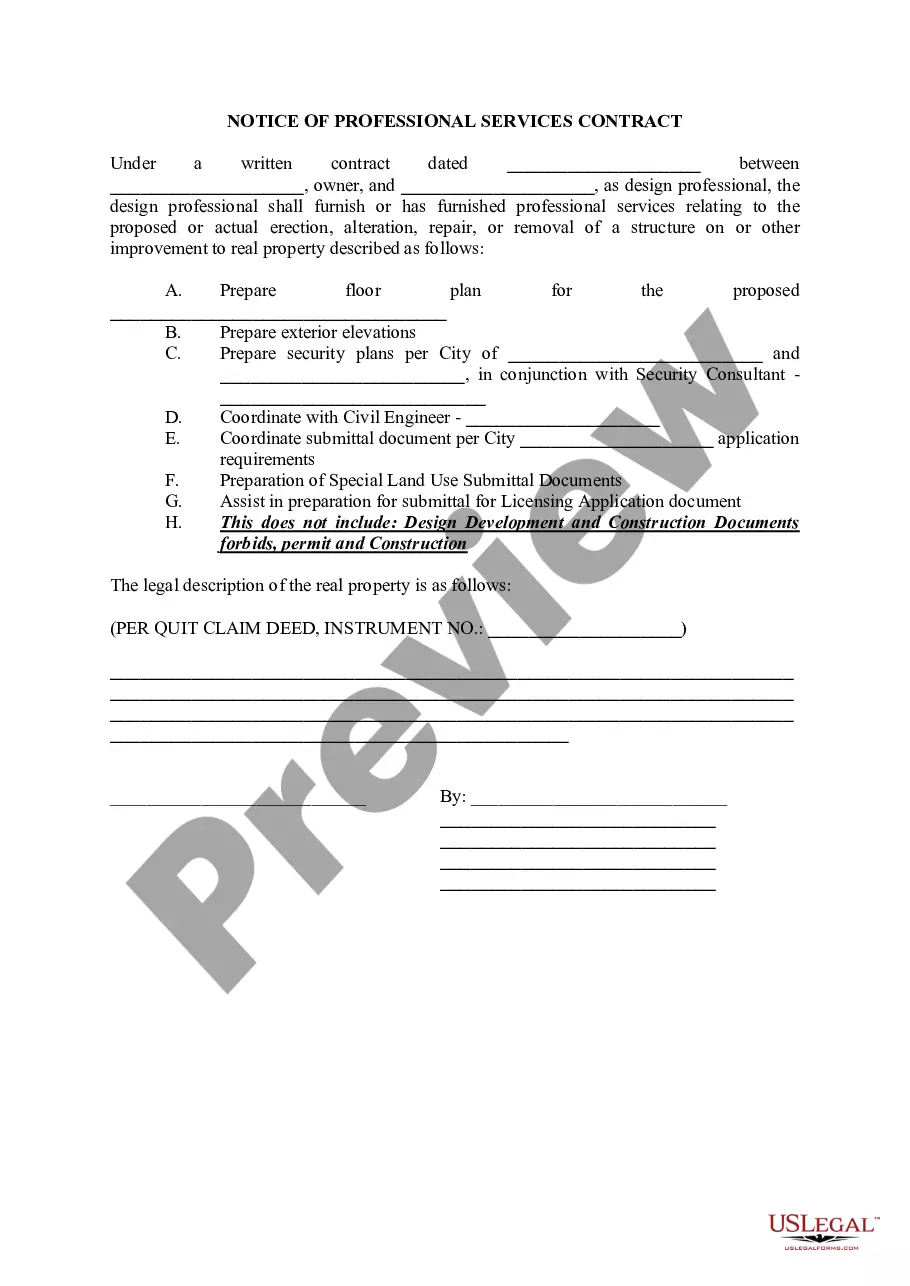

Kentucky Release of Judgment Lien - Full Release

Description

How to fill out Release Of Judgment Lien - Full Release?

US Legal Forms - one of many largest libraries of legitimate varieties in America - delivers a variety of legitimate document web templates it is possible to obtain or print out. Utilizing the internet site, you may get thousands of varieties for organization and personal purposes, sorted by categories, suggests, or keywords and phrases.You can find the latest versions of varieties much like the Kentucky Release of Judgment Lien - Full Release within minutes.

If you already have a subscription, log in and obtain Kentucky Release of Judgment Lien - Full Release through the US Legal Forms collection. The Acquire switch will show up on every kind you perspective. You get access to all earlier downloaded varieties from the My Forms tab of your respective accounts.

If you wish to use US Legal Forms for the first time, here are easy directions to obtain began:

- Ensure you have chosen the correct kind for the town/county. Click on the Preview switch to analyze the form`s articles. Look at the kind description to actually have chosen the proper kind.

- In the event the kind doesn`t fit your demands, use the Lookup field on top of the display screen to discover the one which does.

- In case you are pleased with the shape, affirm your choice by clicking the Buy now switch. Then, pick the prices strategy you prefer and offer your credentials to sign up for the accounts.

- Process the deal. Use your bank card or PayPal accounts to finish the deal.

- Choose the formatting and obtain the shape on your own system.

- Make adjustments. Fill out, modify and print out and sign the downloaded Kentucky Release of Judgment Lien - Full Release.

Each and every template you put into your account lacks an expiration date and is yours for a long time. So, if you would like obtain or print out an additional duplicate, just visit the My Forms segment and click on about the kind you want.

Get access to the Kentucky Release of Judgment Lien - Full Release with US Legal Forms, probably the most extensive collection of legitimate document web templates. Use thousands of expert and express-distinct web templates that meet up with your company or personal requirements and demands.

Form popularity

FAQ

For both open account and written contracts, the statute begins to run from the date of default. Kentucky Judgments (both domestic and foreign judgments domesticated in Kentucky) are valid for fifteen (15) years and can be renewed.

Statute of Limitations by State Statute of Limitations by State (in years)Kentucky515Louisiana1010Maine66Maryland36**50 more rows ?

The judge may give the losing party additional time to satisfy the judgment. If the losing party fails to pay the judgment ordered by the court within 10 days of the due date, additional action may be necessary. First, the winning party should contact the losing party and attempt to collect the judgment.

The circumstances in which the Department of Revenue will consider a Specific Lien Release are as follows: The taxpayer owns other property, subject to the lien, that is worth at least two times the total of the tax owed, plus any additions to the tax owed, and any other debts owed on the property, such as a mortgage.

Releasing a Vehicle Lien To release a lien, the following documents may be mailed, e-mailed or delivered in person: Original Kentucky Title. Completed Release/Termination Statement (TC 96-187) ? we are only able to provide this form to the lien holder.

There are three things you can try to do to deal with a judgement if you can't pay: Try to negotiate a voluntary payment plan with the creditor. File to have the judgment vacated. File bankruptcy to discharge the debt.

How long does a judgment lien last in Kentucky? A judgment lien in Kentucky will remain attached to the debtor's property (even if the property changes hands) for 15 years.

If they decide to do so, they have the permission to put a lien on any property you have and sell it to pay back the money owed. To attach a lien, the creditor will need to record the judgment with the county clerk for the Kentucky county where the debtor has property.