Kentucky Direction For Payment of Royalty to Trustee by Royalty Owners

Description

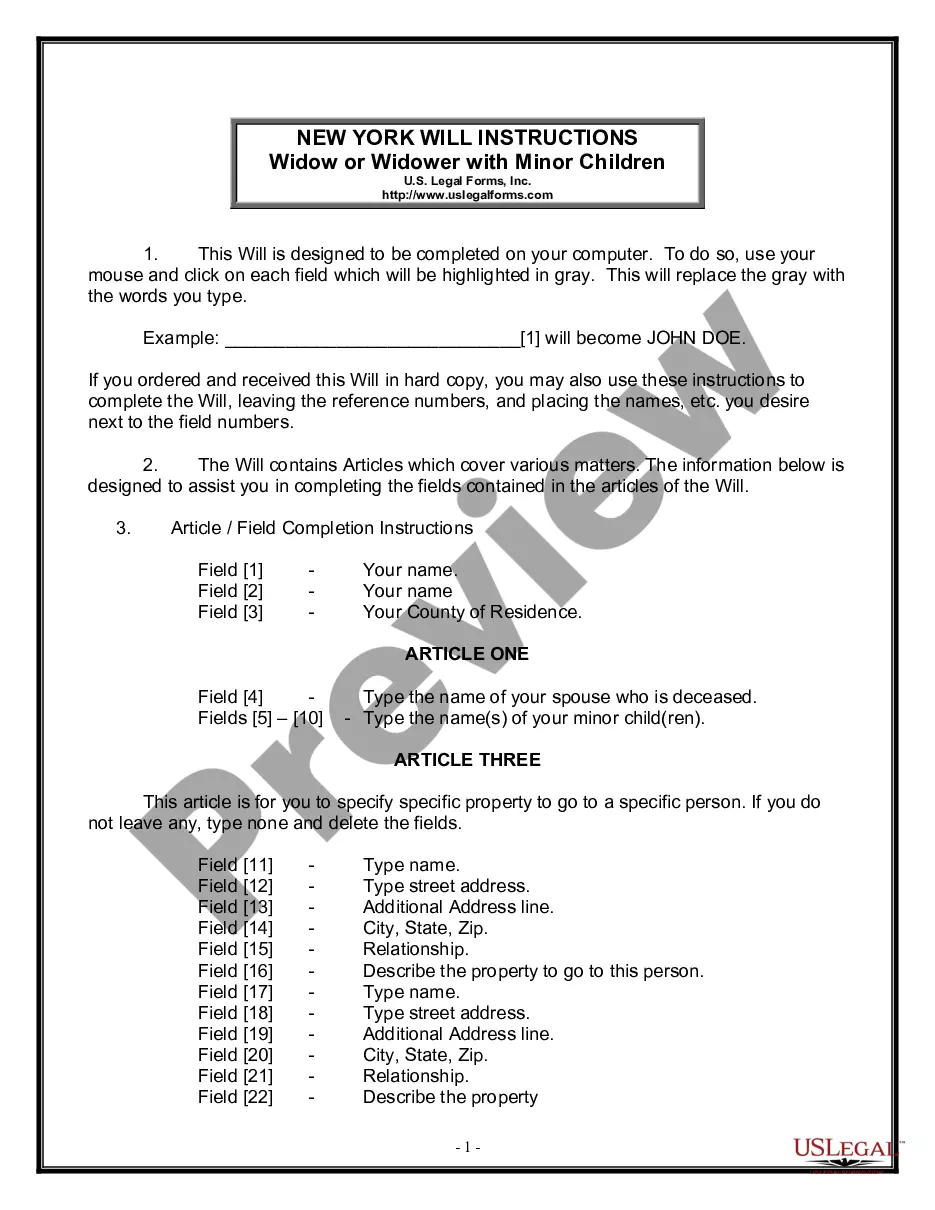

How to fill out Direction For Payment Of Royalty To Trustee By Royalty Owners?

Finding the right legal file format can be quite a struggle. Obviously, there are a lot of templates available on the net, but how will you discover the legal develop you need? Utilize the US Legal Forms internet site. The support provides a huge number of templates, such as the Kentucky Direction For Payment of Royalty to Trustee by Royalty Owners, that you can use for company and personal needs. All the types are inspected by professionals and fulfill federal and state requirements.

When you are already listed, log in to your accounts and then click the Obtain button to get the Kentucky Direction For Payment of Royalty to Trustee by Royalty Owners. Make use of your accounts to search from the legal types you might have bought in the past. Go to the My Forms tab of your own accounts and acquire another backup in the file you need.

When you are a brand new user of US Legal Forms, listed below are basic guidelines for you to comply with:

- First, be sure you have selected the right develop for your city/region. You are able to check out the form utilizing the Preview button and study the form outline to ensure this is the right one for you.

- When the develop does not fulfill your needs, take advantage of the Seach area to get the appropriate develop.

- Once you are positive that the form is acceptable, select the Get now button to get the develop.

- Select the prices strategy you want and enter in the essential information and facts. Design your accounts and pay money for the order with your PayPal accounts or charge card.

- Pick the data file formatting and down load the legal file format to your product.

- Full, modify and print out and signal the acquired Kentucky Direction For Payment of Royalty to Trustee by Royalty Owners.

US Legal Forms may be the biggest local library of legal types that you will find numerous file templates. Utilize the service to down load expertly-created files that comply with state requirements.

Form popularity

FAQ

Commonwealth Business Identifier (CBI): A unique, ten-digit, number assigned to all Kentucky businesses. The CBI allows the business to be easily identified by all state agencies that utilize the Kentucky OneStop Portal. Complete the online registration via the Kentucky Business OneStop portal.

Register for income tax with the KY Department of Revenue (DOR) You should receive your account number and tax deposit schedule within 1?2 days after registering online. If you need help with registration, call the agency directly at (502) 564-3306. Register online with the Kentucky Department of Revenue.

???????Kentucky Revised Statute Chapter 141 requires employers to withhold income tax for both residents and nonresidents employees (unless exempted by law).

??????Register or Reinstate a Business Step 1: Legally Establish Your Business. ... Step 2: Obtain Your Federal Employer Identification Number (FEIN) from the IRS. ... Step 3: Register for Tax Accounts and the Commonwealth Business Identifier (CBI). ... Step 4: If necessary, complete the specialty applications below:

Register online with the KY Dept of Revenue to receive a Withholding Account Number. Registration may also be completed via the Kentucky Registration Application (10A100).

Kentucky Tax Account Numbers If you already have a KY Withholding Tax Account Number and an assigned deposit frequency, you can find this online, or on any previous Form K-1 or K-3, or on correspondence from the KY Department of Revenue.

Kentucky Tax Registration (10A100) - Basic Kentucky tax registration can be completed online or via the Kentucky Tax Registration Application (10A100). Additional tax registrations may be required based on your industry, for more information visit the Kentucky Department of Revenue.

Register online with the KY Dept of Revenue to receive a Withholding Account Number. Registration may also be completed via the Kentucky Registration Application (10A100). Please visit the Kentucky DOR Tax Registration Information page or additional resources or call the KY DOR at (502) 564-4581.