"Note Form and Variations" is a American Lawyer Media form. This form is for your note payments with different variations.

Kentucky Note Form and Variations

Description

How to fill out Note Form And Variations?

Are you inside a placement the place you need documents for possibly company or specific functions almost every time? There are tons of legitimate record layouts available online, but discovering versions you can trust is not easy. US Legal Forms offers a huge number of form layouts, just like the Kentucky Note Form and Variations, which can be written to satisfy federal and state specifications.

In case you are presently familiar with US Legal Forms internet site and have your account, basically log in. After that, you are able to obtain the Kentucky Note Form and Variations web template.

Unless you offer an accounts and wish to begin using US Legal Forms, follow these steps:

- Get the form you want and make sure it is to the right metropolis/state.

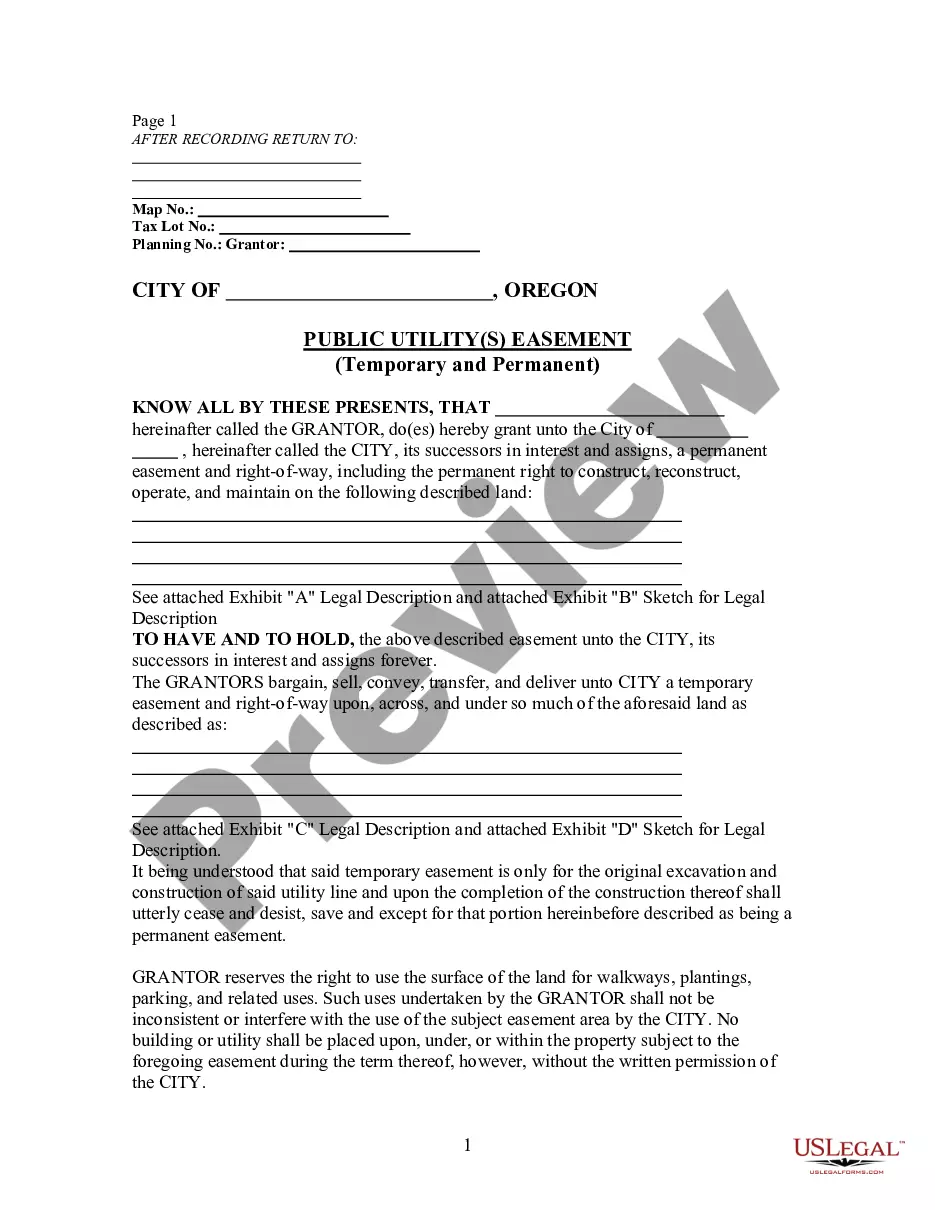

- Make use of the Review option to review the form.

- Browse the explanation to actually have chosen the appropriate form.

- In the event the form is not what you`re trying to find, utilize the Look for field to discover the form that meets your needs and specifications.

- Whenever you obtain the right form, simply click Acquire now.

- Pick the rates strategy you want, submit the required information to generate your account, and purchase your order with your PayPal or charge card.

- Select a practical data file structure and obtain your backup.

Get all of the record layouts you may have purchased in the My Forms food list. You can obtain a extra backup of Kentucky Note Form and Variations any time, if possible. Just click the needed form to obtain or produce the record web template.

Use US Legal Forms, the most considerable assortment of legitimate types, to save lots of time and avoid faults. The assistance offers appropriately produced legitimate record layouts which can be used for an array of functions. Create your account on US Legal Forms and start generating your daily life easier.

Form popularity

FAQ

Where can I get an EIN in Kentucky? All EINs are issued by the federal government through the IRS, regardless of your state. You can apply for a federal employer identification number on the IRS website. Keep in mind that you will also have to get a state tax ID number from the Kentucky Department of Revenue.

Commonwealth Business Identifier (CBI): A unique, ten-digit, number assigned to all Kentucky businesses. The CBI allows the business to be easily identified by all state agencies that utilize the Kentucky OneStop Portal. Complete the online registration via the Kentucky Business OneStop portal.

This stands for Commonwealth Business Identifier number, and is another name for your Kentucky state tax ID number. Note that this is distinct from your federal tax ID number, which is sometimes simply called a ?tax ID,? and is sometimes called an employer identification number, or EIN.

Non-residents and part-year residents must file an income tax return (Form 740-NP, Kentucky Nonresident and Part-Year Resident Individual Income Tax Return) if any gross income from Kentucky sources or other sources exceeds the modified gross income limits for their family size.

Kentucky Tax Registration (10A100) - Basic Kentucky tax registration can be completed online or via the Kentucky Tax Registration Application (10A100). Additional tax registrations may be required based on your industry, for more information visit the Kentucky Department of Revenue.

Commonwealth Business Identifier (CBI): A unique, ten-digit, number assigned to all Kentucky businesses. The CBI allows the business to be easily identified by all state agencies that utilize the Kentucky OneStop Portal. Complete the online registration via the Kentucky Business OneStop portal.

A Limited Liability Entity Tax (LLET) applies to both C corporations and Limited Liability Pass-Through Entities (LLPTEs) and is not an alternative to another tax. However, corporations paying the LLET are allowed to apply that amount as a credit towards its regular corporate income tax.

The best way to apply for your CBI is to apply online. It's faster, more convenient, and more accessible. However, be aware that it may take up to 4 to 6 weeks to receive your Kentucky CBI number, since it takes longer to process than your federal tax ID.