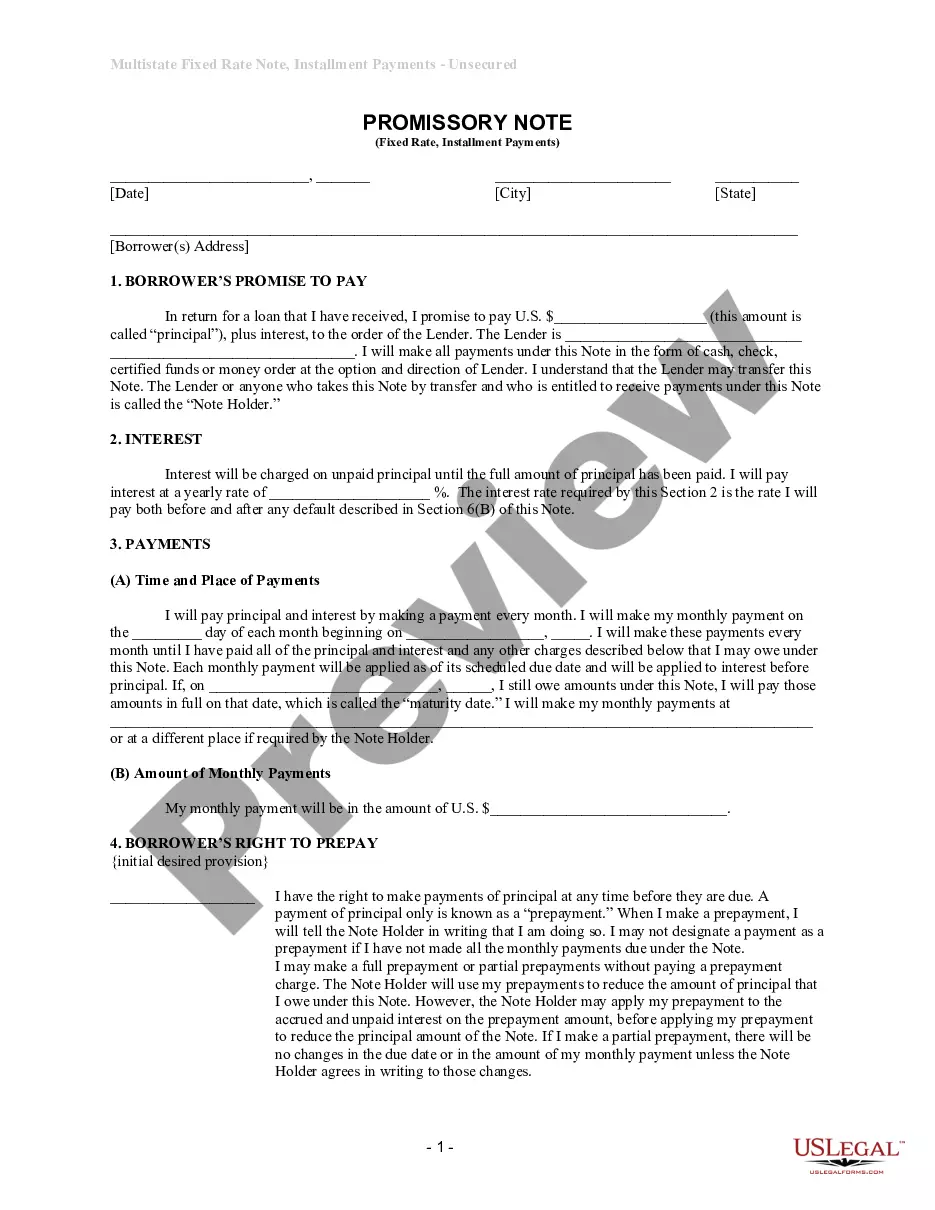

This form provides boilerplate contract clauses that disclaim or limit warranties under the contract. Several different language options are included to suit individual needs and circumstances.

Kentucky Warranty Provisions

Description

How to fill out Warranty Provisions?

Discovering the right legitimate document web template could be a struggle. Of course, there are plenty of layouts available on the net, but how would you obtain the legitimate develop you will need? Take advantage of the US Legal Forms website. The services delivers a large number of layouts, such as the Kentucky Warranty Provisions, which you can use for enterprise and private needs. Each of the forms are examined by pros and fulfill federal and state needs.

When you are presently signed up, log in to the bank account and then click the Obtain button to get the Kentucky Warranty Provisions. Make use of bank account to look with the legitimate forms you might have bought formerly. Proceed to the My Forms tab of your own bank account and acquire yet another duplicate of the document you will need.

When you are a new customer of US Legal Forms, listed here are basic guidelines so that you can stick to:

- Initially, ensure you have chosen the correct develop for your personal city/state. You can look over the shape making use of the Review button and read the shape explanation to make sure it will be the best for you.

- If the develop does not fulfill your needs, make use of the Seach area to get the appropriate develop.

- When you are positive that the shape would work, click the Purchase now button to get the develop.

- Opt for the prices plan you desire and enter in the required info. Build your bank account and buy your order utilizing your PayPal bank account or charge card.

- Select the document format and download the legitimate document web template to the product.

- Complete, revise and printing and sign the obtained Kentucky Warranty Provisions.

US Legal Forms will be the largest collection of legitimate forms that you can find different document layouts. Take advantage of the service to download expertly-made papers that stick to condition needs.

Form popularity

FAQ

?The 6% Kentucky sales tax on extended warranty services is charged on the initial sale of the extended warranty contract itself. Extended Warranty Services - TAXANSWERS - Kentucky.gov Kentucky.gov ? Pages ? Extended-Warrant... Kentucky.gov ? Pages ? Extended-Warrant...

Many sellers believe there is a general exemption from sales tax for labor charges. However, in California many types of labor charges are subject to tax. Tax applies to charges for producing, fabricating, or processing tangible personal property for your customers.

For routine service that does not include any parts (such as wheel alignment, tire rotation, paintless dent repair, etc.), should dealers charge sales tax on the labor? ?No, if there are no parts sold in the transaction, then there is no sales tax on a service job that only requires labor.

Tax-exempt goods Some goods are exempt from sales tax under Kentucky law. Examples include groceries, prescription drugs, and some manufacturing equipment.

Tax-exempt customers Some customers are exempt from paying sales tax under Kentucky law. Examples include government agencies, some nonprofit organizations, and merchants purchasing goods for resale. Sellers are required to collect a valid exemption or resale certificate from buyers to validate each exempt transaction. Kentucky Sales & Use Tax Guide - Avalara avalara.com ? taxrates ? state-rates ? kentuc... avalara.com ? taxrates ? state-rates ? kentuc...

Businesses providing these services must charge and remit a 6% sales tax on the total sales price of the service effective last Jan. 1. Businesses without a sales and use tax account must apply for one.

Does a plumbing or HVAC contractor need to charge sales tax for services? ?No, contractors are making improvements or repairs to real property, and improvements or repairs to real property are not services that are subject to sales tax. Labor Charges for Installation - TAXANSWERS - Kentucky.gov ky.gov ? Pages ? Labor-Charges-for-I... ky.gov ? Pages ? Labor-Charges-for-I...

A 6% motor vehicle usage tax is levied upon the "retail price" of vehicles transferred in Kentucky. On used vehicles, the usage tax is 6% of the current average retail as listed in the NDA Used Car Guide or 6% of the total consideration paid. Usage Tax | Boyle County, KY boylecountyky.gov ? Usage-Tax boylecountyky.gov ? Usage-Tax