Kentucky Self-Employed Seamstress Services Contract

Description

How to fill out Self-Employed Seamstress Services Contract?

If you need to compile, acquire, or print authorized document templates, utilize US Legal Forms, the leading variety of legal forms available online.

Take advantage of the site's straightforward and user-friendly search to locate the documents you need.

Various templates for commercial and personal purposes are organized by categories and states, or keywords.

Step 4. Once you have found the form you need, click the Buy now button. Choose the pricing plan you prefer and enter your information to register for an account.

Step 5. Complete the transaction. You can use your Visa or MasterCard or PayPal account to finalize the purchase. Step 6. Select the format of the legal form and download it to your device. Step 7. Complete, edit, and print or sign the Kentucky Self-Employed Seamstress Services Contract. Each legal document template you purchase is yours forever. You have access to every form you downloaded in your account. Visit the My documents section and select a form to print or download again. Be proactive and obtain, and print the Kentucky Self-Employed Seamstress Services Contract with US Legal Forms. There are numerous professional and state-specific forms available for your business or personal needs.

- Use US Legal Forms to find the Kentucky Self-Employed Seamstress Services Contract with just a few clicks.

- If you are already a US Legal Forms customer, Log In to your account and click the Download button to obtain the Kentucky Self-Employed Seamstress Services Contract.

- You can also access forms you previously downloaded in the My documents tab of your account.

- If you are using US Legal Forms for the first time, follow the steps below.

- Step 1. Ensure you have selected the form for your correct region/state.

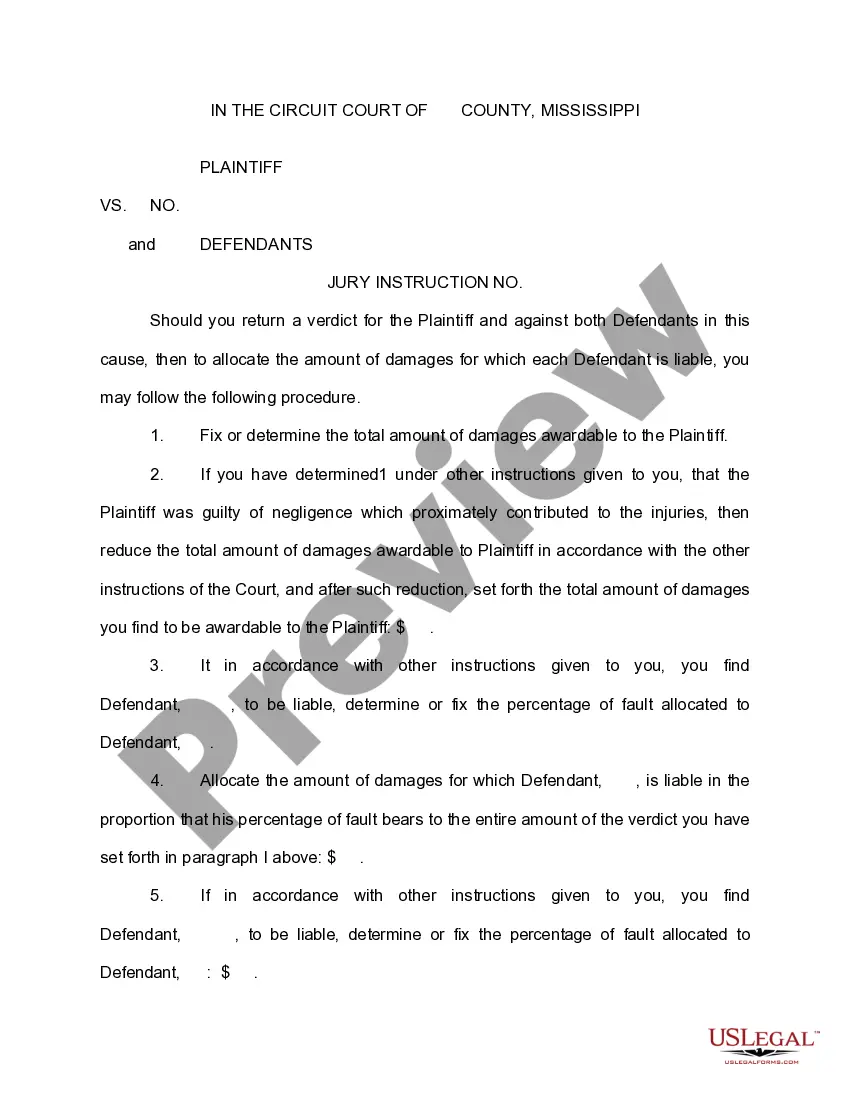

- Step 2. Utilize the Preview option to review the form's content. Be sure to read the description.

- Step 3. If you are not satisfied with the form, use the Search field at the top of the screen to find other versions of the legal form template.

Form popularity

FAQ

Writing a self-employed contract involves outlining the scope of work, payment terms, and deadlines. Start with a clear introduction that specifies the parties involved and the services provided. Including a Kentucky Self-Employed Seamstress Services Contract template from a reliable source like uslegalforms can simplify this process. This can ensure you cover all necessary legal aspects, protecting both you and your clients.

To set up as an independent contractor in Kentucky, start by defining your services and identifying your target market. Next, consider registering your business name and obtaining any necessary licenses. Establishing a Kentucky Self-Employed Seamstress Services Contract is crucial for outlining your terms and protecting your business interests. This contract will provide clarity to both you and your clients regarding expectations.

In Kentucky, a sole proprietor may need to obtain a business license depending on the type of services offered. While some localities require a general business license, others may have specific regulations for seamstress services. It is essential to check with your local government to ensure compliance. Additionally, having a Kentucky Self-Employed Seamstress Services Contract can help clarify your business operations.

The five elements required for a legally binding contract in Kentucky are offer, acceptance, consideration, legal purpose, and capacity. Each element plays a crucial role in defining the agreement between parties. For Kentucky Self-Employed Seamstress Services Contracts, ensuring all five elements are present protects both the seamstress and the client. You can streamline this process by using resources like uslegalforms to create a comprehensive contract that meets all legal requirements.

A contract becomes legally binding in Kentucky when it includes essential elements such as an offer, acceptance, consideration, legal purpose, and the capacity of the parties to contract. For Kentucky Self-Employed Seamstress Services Contracts, including these elements ensures that both parties understand their rights and responsibilities. Furthermore, having a written agreement can help clarify the terms and reduce misunderstandings. Utilizing platforms like uslegalforms can simplify the process of creating such contracts.

In Kentucky, a verbal contract can be legally binding if it meets specific criteria. However, it is often challenging to prove the terms of a verbal agreement if a dispute arises. For Kentucky Self-Employed Seamstress Services Contracts, written agreements are generally preferred to ensure clarity and enforceability. Using a documented contract can help protect both parties and provide clear terms for the services rendered.

Generally, a service contract does not need to be notarized to be valid. However, having a Kentucky Self-Employed Seamstress Services Contract notarized can add an extra layer of authenticity and may be required for certain transactions. It is a good practice to understand the specific requirements in your state to ensure your contract is fully enforceable.

Yes, you can write your own terms of service. Crafting a Kentucky Self-Employed Seamstress Services Contract that includes your terms of service can help clarify expectations for you and your clients. Just remember to cover all essential points, such as scope of work, payment terms, and dispute resolution, to protect both parties.

Self-written contracts are legal as long as they meet the necessary legal requirements. A Kentucky Self-Employed Seamstress Services Contract created by you can be enforceable if it includes clear terms, is signed by both parties, and complies with state laws. Always review your contract to ensure it effectively serves its purpose.

Yes, you can write an agreement without a lawyer. Many people successfully draft their own contracts, including a Kentucky Self-Employed Seamstress Services Contract. However, using a reliable resource like USLegalForms can help ensure that your contract meets legal standards and covers all necessary aspects.