Kentucky Gutter Services Contract - Self-Employed

Description

How to fill out Gutter Services Contract - Self-Employed?

If you wish to complete, download, or create valid document templates, utilize US Legal Forms, the largest selection of legal forms available online.

Take advantage of the site's user-friendly and convenient search to locate the documents you require. Numerous templates for business and personal use are categorized by topics and states, or keywords.

Use US Legal Forms to find the Kentucky Gutter Services Agreement - Self-Employed with just a few clicks.

Step 5. Complete the transaction. You can use your credit card or PayPal account to finalize the payment.

Step 6. Select the format of the legal form and download it to your device. Step 7. Fill out, edit, and print or sign the Kentucky Gutter Services Agreement - Self-Employed. Every legal document template you acquire is yours permanently. You will have access to each form you obtained in your account. Visit the My documents section and select a form to print or download again. Be proactive and download, and print the Kentucky Gutter Services Agreement - Self-Employed with US Legal Forms. There are numerous professional and state-specific forms available for your business or personal needs.

- If you are already a US Legal Forms user, sign in to your account and click the Download button to retrieve the Kentucky Gutter Services Agreement - Self-Employed.

- You can also access forms you previously obtained in the My documents section of your account.

- If you are using US Legal Forms for the first time, follow the instructions below.

- Step 1. Ensure you have selected the form for the correct city/state.

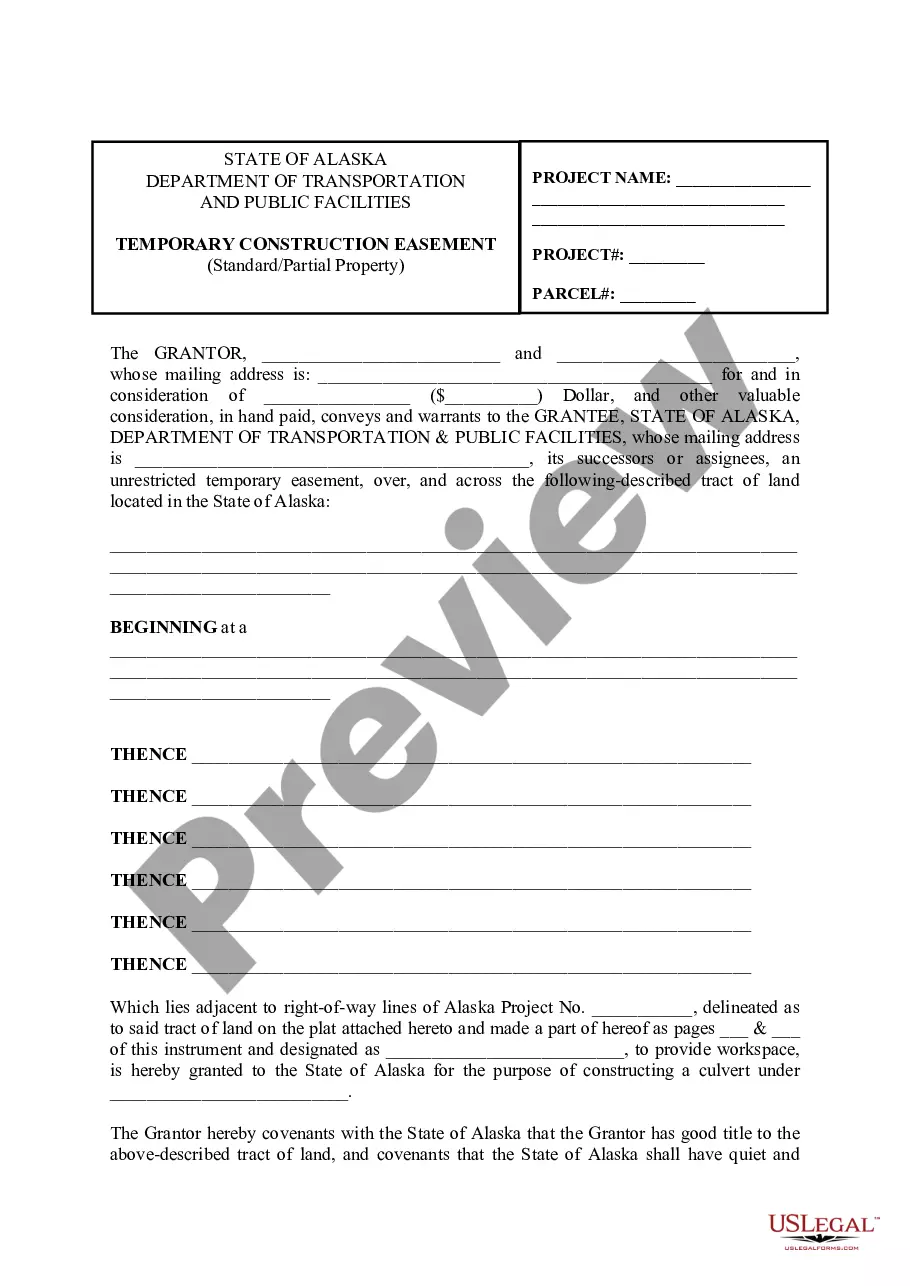

- Step 2. Use the Preview feature to review the form's details. Remember to read the description.

- Step 3. If you are not satisfied with the form, utilize the Search field at the top of the screen to find other versions of the legal form template.

- Step 4. Once you have found the form you need, click the Buy now button. Choose the payment plan you prefer and provide your details to register for an account.

Form popularity

FAQ

To fill out an independent contractor form for a Kentucky Gutter Services Contract - Self-Employed, start by providing your personal and business information at the top. Follow this by detailing the nature of the work, payment arrangements, and any applicable terms and conditions. Completing this form accurately helps protect both parties while fostering a successful working relationship. For additional guidance, explore the resources available at USLegalForms to make the process even easier.

When writing an independent contractor agreement for a Kentucky Gutter Services Contract - Self-Employed, begin by outlining the purpose of the agreement. Include key elements such as the services provided, compensation details, and the duration of the contract. Be clear and concise, as this reduces potential misunderstandings in the future. Using a reliable platform like USLegalForms can provide you with customizable templates to ensure you cover all essential aspects.

To fill out an independent contractor agreement for Kentucky Gutter Services Contract - Self-Employed, start by accurately entering your name and contact information along with the contractor's details. Next, specify the scope of work, payment terms, and deadlines. This ensures both parties understand their responsibilities clearly, maximizing the benefits of the agreement. Additionally, consider using a template from USLegalForms to streamline the process.

While forming an LLC is not mandatory to operate as a contractor in Kentucky, it does offer benefits such as liability protection and tax advantages. Establishing an LLC can enhance your credibility and provide security in your business dealings. Consider documenting your work with a Kentucky Gutter Services Contract - Self-Employed to further protect your interests.

Yes, Kentucky does require certain contractors to have a license, depending on the type of work performed. If your services involve home improvements or similar projects, you must obtain the appropriate licensing. Acquiring the necessary licensure strengthens your position in the market and is essential when completing a Kentucky Gutter Services Contract - Self-Employed.

In Kentucky, independent contractors must adhere to specific rules regarding tax obligations and payment structures. You are responsible for paying your own taxes, which includes self-employment tax. Understanding these rules ensures compliance and maintains a professional reputation, especially when executing a Kentucky Gutter Services Contract - Self-Employed.

An independent contractor agreement in Kentucky outlines the terms and conditions under which you provide services, such as Kentucky Gutter Services Contract - Self-Employed. This document defines the relationship between you and the client, detailing payment terms, project scope, and liability issues. Using a well-structured agreement helps protect both parties and clarifies expectations.

To become a gutter cleaner, you need basic tools, safety gear, and knowledge of safe cleaning practices. Additionally, having a valid business license and a Kentucky Gutter Services Contract - Self-Employed is crucial. This contract will detail the services you offer, your responsibilities, and the terms under which you operate. Consider utilizing platforms like uslegalforms to obtain all your documentation efficiently.

Yes, a business license is required to clean gutters in Kentucky. This applies whether you are self-employed or part of a larger organization. Having a Kentucky Gutter Services Contract - Self-Employed can streamline your business operations and ensure you meet all local regulations. It's a proactive step to help you focus on providing quality service while staying compliant.

Yes, you need a business license to clean gutters in Kentucky. Operating without the necessary license can lead to penalties and fines. Securing a Kentucky Gutter Services Contract - Self-Employed is a smart choice that outlines your services and legal responsibilities. This contract can guide you through the licensing process and safeguard your business interests.