Kentucky Modeling Services Contract - Self-Employed

Description

How to fill out Modeling Services Contract - Self-Employed?

Are you currently in a position where you require documents for either organization or specific tasks nearly every day.

There are numerous legal document templates accessible online, but finding ones you can trust isn't easy.

US Legal Forms offers thousands of form templates, including the Kentucky Modeling Services Contract - Self-Employed, which are designed to comply with federal and state regulations.

Utilize US Legal Forms, the most extensive selection of legal forms, to save time and avoid mistakes.

The service provides professionally crafted legal document templates that you can use for various purposes. Create your account on US Legal Forms and start making your life a bit easier.

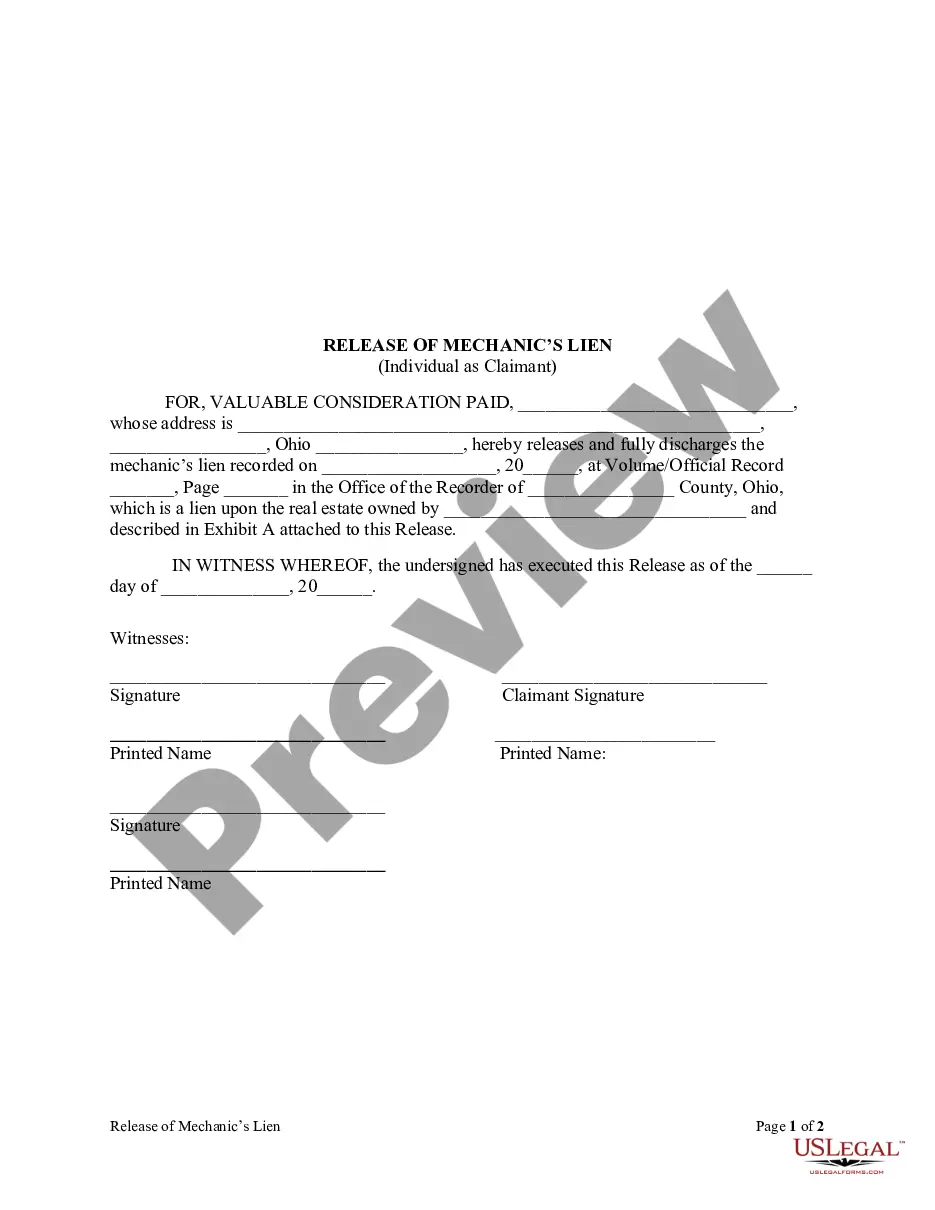

- If you are already familiar with the US Legal Forms website and have an account, simply Log In.

- Then, you can download the Kentucky Modeling Services Contract - Self-Employed template.

- If you do not have an account and want to start using US Legal Forms, follow these steps.

- Obtain the form you need and ensure it is for your correct area/state.

- Use the Review button to examine the form.

- Check the description to ensure you have selected the correct form.

- If the form isn't what you're looking for, utilize the Search field to find the form that meets your needs.

- When you locate the appropriate form, click Buy now.

- Choose the pricing plan you prefer, fill out the required information to create your account, and purchase the order using your PayPal or credit card.

- Select a convenient document format and download your copy.

- Find all the document templates you have purchased in the My documents section. You can obtain an additional copy of the Kentucky Modeling Services Contract - Self-Employed at any time if needed. Simply click the required form to download or print the document template.

Form popularity

FAQ

The five elements required for a legally binding contract in Kentucky are an offer, acceptance, consideration, legal purpose, and mutual consent. Ensure that your Kentucky Modeling Services Contract - Self-Employed includes these essential components to avoid any disputes. Consulting with a legal expert can provide additional security for your agreements.

For a contract to be legally binding in Kentucky, it must involve an offer, acceptance, consideration, legal purpose, and parties with the capacity to contract. A Kentucky Modeling Services Contract - Self-Employed should clearly outline these elements for validity. Crafting your agreement carefully can help protect your interests.

In Kentucky, the self-employment tax rate generally mirrors the federal rate of 15.3%. This tax applies to income earned from a Kentucky Modeling Services Contract - Self-Employed. Understanding these tax obligations helps prepare you for accurate financial planning and compliance.

Doing business in Kentucky can include various activities such as operating a physical office, hiring employees, or entering into contracts like a Kentucky Modeling Services Contract - Self-Employed. If you generate revenue within the state, you likely qualify as doing business. It's essential to understand these guidelines to maintain compliance with state laws.

In Kentucky, contractors typically need a license if they perform work costing $2,500 or more. This requirement includes those entering into a Kentucky Modeling Services Contract - Self-Employed. Make sure to check local regulations as well, as some cities may have additional licensing requirements.

The general rule is that an individual is an independent contractor if the payer has the right to control or direct only the result of the work and not what will be done and how it will be done. If you are an independent contractor, then you are self-employed.

Becoming an independent contractor is one of the many ways to be classified as self-employed. By definition, an independent contractor provides work or services on a contractual basis, whereas, self-employment is simply the act of earning money without operating within an employee-employer relationship.

How do I create an Independent Contractor Agreement?State the location.Describe the type of service required.Provide the contractor's and client's details.Outline compensation details.State the agreement's terms.Include any additional clauses.State the signing details.

There are many benefits to a career as a model. You learn skills that can give you poise and confidence. You could have the opportunity to travel to interesting places and meet fascinating people and the salary can also be good, depending on your experience and reputation. Modeling is a very competitive career choice.

If you're modelling freelance, you'll be part of the self-employed workforce. Whilst this is liberating in many ways, many people dread having to do their own taxes.