Kentucky Attorney Agreement - Self-Employed Independent Contractor

Description

How to fill out Attorney Agreement - Self-Employed Independent Contractor?

Finding the right legitimate papers web template might be a struggle. Naturally, there are a variety of web templates available on the net, but how will you discover the legitimate form you require? Take advantage of the US Legal Forms internet site. The support offers thousands of web templates, like the Kentucky Attorney Agreement - Self-Employed Independent Contractor, which can be used for enterprise and private requires. Every one of the varieties are checked by specialists and fulfill federal and state demands.

In case you are previously registered, log in to your profile and click on the Acquire key to find the Kentucky Attorney Agreement - Self-Employed Independent Contractor. Make use of your profile to appear with the legitimate varieties you may have purchased previously. Proceed to the My Forms tab of your respective profile and get one more copy of the papers you require.

In case you are a brand new user of US Legal Forms, listed below are straightforward guidelines that you should comply with:

- Very first, make certain you have chosen the proper form for your personal metropolis/county. It is possible to look through the shape using the Preview key and read the shape explanation to make sure it will be the right one for you.

- In the event the form is not going to fulfill your expectations, utilize the Seach area to discover the right form.

- Once you are certain that the shape is acceptable, click the Get now key to find the form.

- Opt for the costs prepare you need and enter in the needed details. Create your profile and pay money for an order with your PayPal profile or charge card.

- Select the submit format and down load the legitimate papers web template to your system.

- Comprehensive, change and produce and indication the received Kentucky Attorney Agreement - Self-Employed Independent Contractor.

US Legal Forms will be the biggest library of legitimate varieties for which you can see numerous papers web templates. Take advantage of the service to down load skillfully-manufactured paperwork that comply with state demands.

Form popularity

FAQ

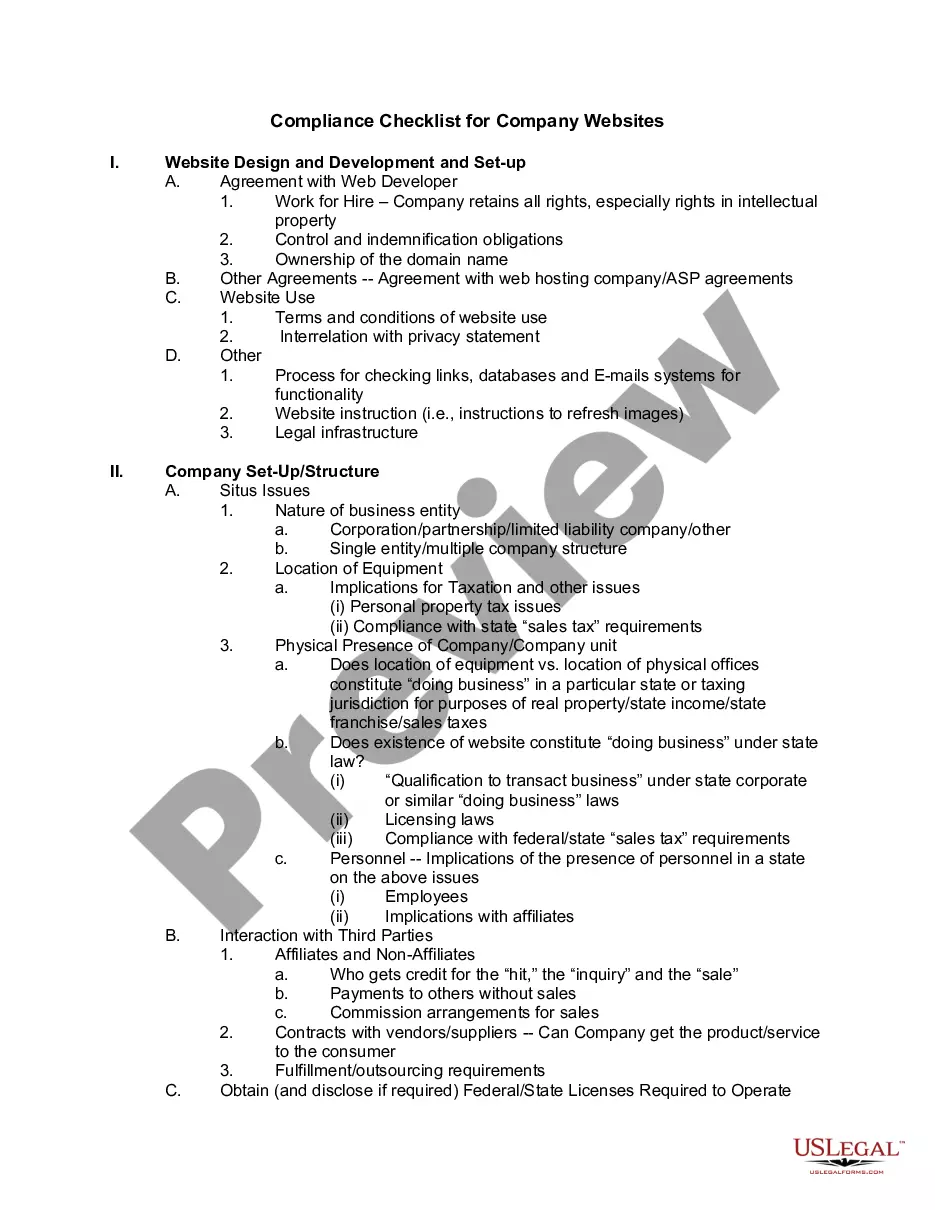

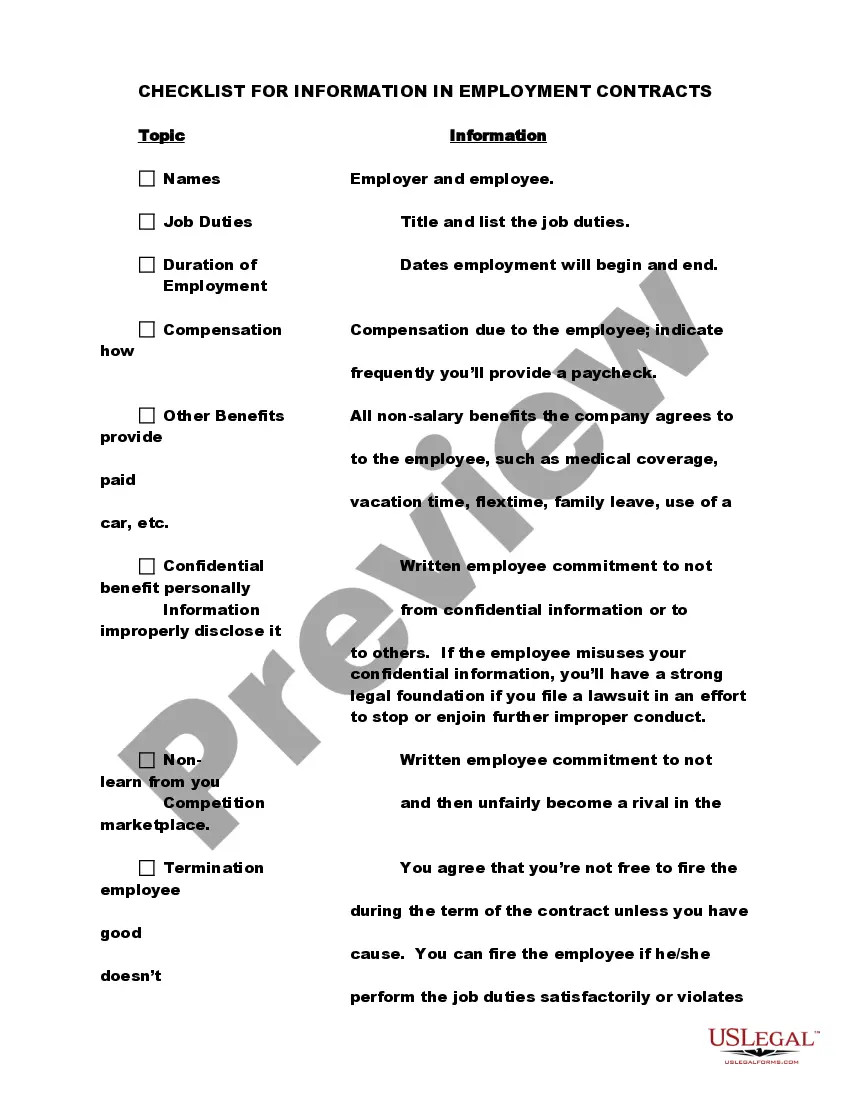

Terms to include in an independent contractor agreement General information about the parties. ... Scope of work and deliverables. ... Equipment and facilities. ... Compensation. ... Reimbursement policies. ... Benefits and liability exclusion. ... Termination. ... Indemnification clause.

Self-employed income is calculated by adding up all the income recorded on your. This includes 1099-NEC, 1099-MISC and 1099-K forms. The total earned income is then subject to the independent contractor tax rate of 15.3%.

Essential elements of a contract an offer. an acceptance. an intention to create a legal relationship. a consideration (usually money).

Yes, you can deduct self-employment tax as a business expense. It's actually one of the most common self-employment tax deductions. The self-employment tax rate is 15.3% of net earnings. That rate is the sum of a 12.4% Social Security tax and a 2.9% Medicare tax on net earnings.

If you are an independent contractor, then you are self-employed. The earnings of a person who is working as an independent contractor are subject to self-employment tax. To find out what your tax obligations are, visit the Self-Employed Individuals Tax Center.

Here are five of the most important terms that should be a part of every construction contract. Scope of Work. Clients need to be clear about what a company is going to do for them. ... Payment Obligations. ... Insurance Information. ... Parties to the Agreement and Notice. ... Authority to Make Decisions.

A contract should contain everything agreed upon by you and your licensed contractor. It should detail the work, price, when payments will be made, who gets the necessary building permits, and when the job will be finished. The contract also must identify the contractor, and give their address and license number.

As a self-employed individual, you're required to report all income. If your net earnings are over $400, then you'll have to pay self-employment taxes using Schedule SE . You'll need to submit the 1099-NEC when you file your taxes, but remember, estimated tax payments are usually required throughout the year.

The basic elements required for the agreement to be a legally enforceable contract are: mutual assent, expressed by a valid offer and acceptance; adequate consideration; capacity; and legality. In some states, elements of consideration can be satisfied by a valid substitute.

If you are a business owner or contractor who provides services to other businesses, then you are generally considered self-employed. For more information on your tax obligations if you are self-employed (an independent contractor), see our Self-Employed Individuals Tax Center.