Kentucky Window Contractor Agreement - Self-Employed

Description

How to fill out Window Contractor Agreement - Self-Employed?

US Legal Forms - one of the largest collections of legal documents in the United States - provides a variety of legal document templates that you can download or print.

On the website, you can find thousands of forms for business and personal purposes, categorized by type, state, or keywords. You can obtain the most recent versions of documents like the Kentucky Window Contractor Agreement - Self-Employed in just a few minutes.

If you have a monthly subscription, Log In and download the Kentucky Window Contractor Agreement - Self-Employed from the US Legal Forms library. The Download button will appear on every document you view. You can access all previously downloaded forms in the My documents tab of your account.

Complete the transaction. Use your credit card or PayPal account to finalize the purchase.

Choose the format and download the document to your device. Edit. Fill out, modify, print, and sign the downloaded Kentucky Window Contractor Agreement - Self-Employed. Every template you add to your account has no expiration date and is yours permanently. So, if you want to download or print another copy, just go to the My documents section and click on the form you need. Access the Kentucky Window Contractor Agreement - Self-Employed with US Legal Forms, the most extensive collection of legal document templates. Utilize a vast array of professional and state-specific templates that meet your business or personal needs and requirements.

- If you are using US Legal Forms for the first time, here are simple steps to get started.

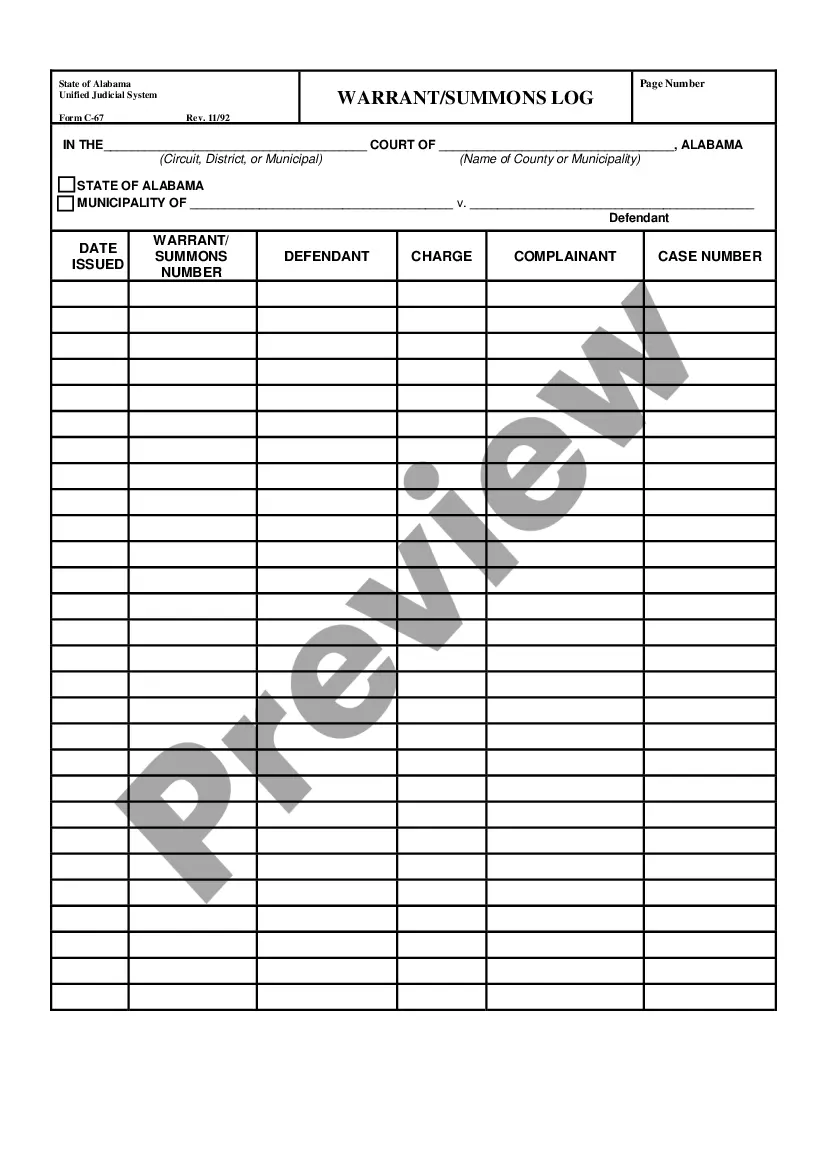

- Make sure you have selected the correct form for your city/state. Click the Preview button to review the document's content.

- Read the form description to confirm that you have selected the right form.

- If the form does not meet your needs, use the Search box at the top of the screen to find the suitable one.

- If you are satisfied with the form, confirm your selection by clicking the Get now button.

- Then, choose the payment plan you prefer and provide your details to register for an account.

Form popularity

FAQ

Writing an independent contractor agreement is a straightforward process that requires careful consideration of essential elements. Start by clearly defining the scope of work, payment terms, and the expected timeline for the Kentucky Window Contractor Agreement - Self-Employed. It is also vital to include both parties' rights and responsibilities, ensuring mutual understanding. Utilizing resources like US Legal Forms can simplify the process, providing you with templates and guidance specific to your needs.

Typically, the hiring party drafts the independent contractor agreement. They must ensure the document outlines all terms clearly, including job specifications and payment details. However, it can be beneficial for both parties to review and contribute to the agreement. Using the Kentucky Window Contractor Agreement - Self-Employed available on uslegalforms can provide a solid foundation for this critical document.

To create an independent contractor agreement, begin by defining the scope of work clearly. Include critical details such as payment terms, deadlines, and expectations. It's essential to ensure that the agreement also addresses confidentiality and termination procedures. Using a resource like the Kentucky Window Contractor Agreement - Self-Employed template from uslegalforms can simplify this process.

Filling out an independent contractor form starts with providing your personal details, such as your name and contact information. Next, include specifics about the services you'll provide, as well as payment rates and schedules. Ensure you reference your Kentucky Window Contractor Agreement - Self-Employed when discussing terms to maintain consistency. For convenience, consider using platforms like US Legal Forms to access standardized forms and templates designed for your needs.

Writing an independent contractor agreement involves several key elements. First, outline the scope of work, payment terms, and timeline for project completion. Be sure to include a section on confidentiality and non-disclosure, which is crucial for protecting sensitive information. Utilizing a Kentucky Window Contractor Agreement - Self-Employed template can streamline this process, ensuring you cover all necessary aspects and set clear expectations.

To set up as a self-employed contractor, start by obtaining the necessary licenses and permits for your trade in Kentucky. Next, choose a suitable business structure, such as a sole proprietorship or LLC, to formalize your operations. Additionally, consider creating a Kentucky Window Contractor Agreement - Self-Employed to define your responsibilities and expectations clearly. This agreement will help you establish a professional relationship with clients and protect your interests.

Yes, independent contractors file as self-employed individuals when it comes to tax reporting. They typically report their income on Schedule C of their tax return, detailing earnings and expenses. Understanding the tax implications is vital to ensure compliance and benefit from available deductions. Utilizing a Kentucky Window Contractor Agreement - Self-Employed can help streamline your business processes and clarify your status.

To complete an independent contractor agreement, start by providing contact information for both parties. Next, describe the project specifics, including timelines, payment structures, and any pertinent terms. It is essential to review the agreement thoroughly, ensuring it meets your needs. You can create a tailored Kentucky Window Contractor Agreement - Self-Employed with tools available on UsLegalForms.

The independent contractor agreement in Kentucky outlines the terms of work between a business owner and a self-employed contractor. This document defines the scope of work, payment terms, and responsibilities of each party. It is crucial for establishing clear expectations and avoiding misunderstandings. Using the Kentucky Window Contractor Agreement - Self-Employed can protect both parties involved.