Kentucky Clerical Staff Agreement - Self-Employed Independent Contractor

Description

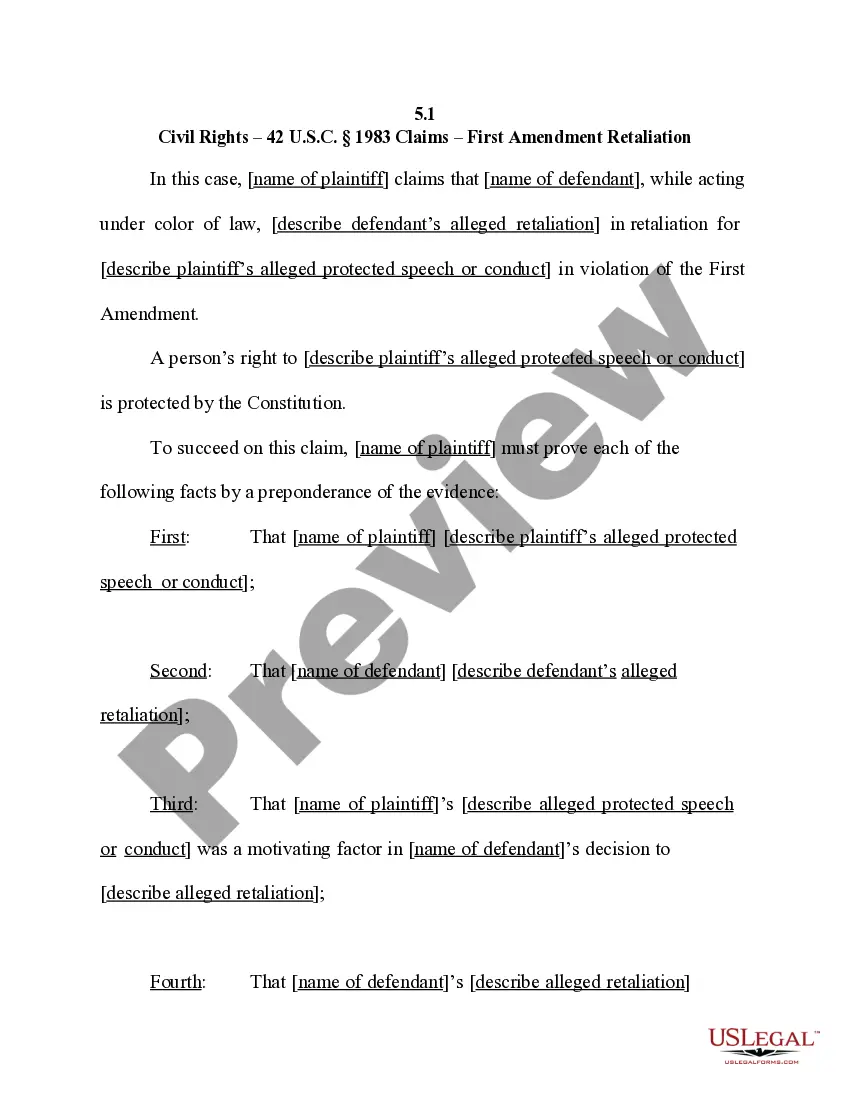

How to fill out Clerical Staff Agreement - Self-Employed Independent Contractor?

It is feasible to spend time online searching for the legal document format that meets the state and federal criteria you require.

US Legal Forms offers a vast array of legal forms that have been vetted by professionals.

You can conveniently download or print the Kentucky Clerical Staff Agreement - Self-Employed Independent Contractor from my services.

First, make sure you have selected the correct document format for the state/city you choose. Review the form description to ensure you have selected the right document. If available, use the Review button to view the document format as well.

- If you already have a US Legal Forms account, you can Log In and click the Download button.

- Afterward, you may complete, modify, print, or sign the Kentucky Clerical Staff Agreement - Self-Employed Independent Contractor.

- Any legal document format you acquire is yours permanently.

- To obtain an additional copy of the acquired form, navigate to the My documents tab and click the relevant button.

- If you are using the US Legal Forms site for the first time, follow the simple instructions below.

Form popularity

FAQ

Creating an independent contractor agreement is essential when entering into a work relationship with a self-employed individual. Start by clearly defining the services the contractor will provide and the payment terms you both agree upon. Next, include essential elements such as project timelines, confidentiality clauses, and termination conditions to protect both parties. By using the Kentucky Clerical Staff Agreement - Self-Employed Independent Contractor template from uslegalforms, you can easily customize this document to meet your specific needs and ensure compliance.

No, an independent contractor does not count as an employee. The Kentucky Clerical Staff Agreement - Self-Employed Independent Contractor clearly outlines the distinction. Independent contractors operate their own businesses and work under their own terms, while employees typically follow the employer’s specifications and guidelines. Understanding this difference can help both parties navigate legal and tax responsibilities effectively.

The independent contractor agreement in Kentucky outlines the working relationship between an employer and a self-employed individual. This document specifies the terms of work, payment, and any legal obligations both parties must uphold. A clear agreement protects both parties and helps to avoid misunderstandings. The Kentucky Clerical Staff Agreement - Self-Employed Independent Contractor offers a reliable framework for these agreements.

Filling out an independent contractor form involves providing accurate personal information, including name and address, as well as financial details like your Social Security Number or Employer Identification Number. You should also clarify the type of services offered and the payment structure. Make sure to review everything thoroughly to avoid inaccuracies. A Kentucky Clerical Staff Agreement - Self-Employed Independent Contractor can guide you through this.

To fill out an independent contractor agreement, start by entering the names and contact information of both parties. Next, detail the scope of services, payment details, and deadlines. Ensure you read through all terms before signing to understand your obligations. Utilizing a Kentucky Clerical Staff Agreement - Self-Employed Independent Contractor template can simplify this process.

An independent contractor typically fills out a W-9 form to provide their Taxpayer Identification Number to the hiring party. You may also see other documents like a contract detailing job specifics or invoices for payment. It's essential to keep accurate records of all transactions for tax purposes. Using a Kentucky Clerical Staff Agreement - Self-Employed Independent Contractor can streamline this process.

To write an independent contractor agreement, start with clear definitions of the parties involved and the scope of work. Include payment terms, deadlines, and confidentiality clauses. You may also want to specify the terms of termination and dispute resolution. A well-structured Kentucky Clerical Staff Agreement - Self-Employed Independent Contractor ensures both parties understand their responsibilities.

Yes, a 1099 employee can and should have a contract to clearly define their working relationship with clients. This contract can specify project details, payment terms, and deadlines, offering legal protection for both parties. Utilizing a Kentucky Clerical Staff Agreement - Self-Employed Independent Contractor helps formalize this arrangement, providing clarity and security in the partnership.

Independent contractors must follow specific rules to maintain their status, including handling their own taxes and adhering to the terms of any contracts. They should not be directly controlled by a client regarding how to perform their work. A Kentucky Clerical Staff Agreement - Self-Employed Independent Contractor helps clarify these rules and ensures both parties understand their rights and responsibilities.

Breaking an independent contractor agreement can lead to various consequences, such as financial penalties or legal action. The specific repercussions often depend on the terms outlined in the Kentucky Clerical Staff Agreement - Self-Employed Independent Contractor. It's important to understand your agreement thoroughly and, if possible, seek a resolution before any breaches occur.